This policy brief is based Bank of Italy, Working Paper Nr. 1477. The policy brief should not be reported as representing the views of the Bank of Italy. The views expressed are those of the authors and do not necessarily reflect those of the Bank of Italy.

Abstract

How do business loan characteristics, such as interest rate type and maturity, influence the transmission of supply-driven inflation shocks? Michelangeli and Piersanti (2025) explore this question through both theoretical and empirical lenses. Exploiting a DSGE model with a banking sector, they show that a larger share of long-term loans stabilizes business cycles by mitigating inflation-induced fluctuations, whereas a larger share of adjustable-rate loans amplifies recessions. A local projection model using inflation surprises in euro area countries supports these findings. The results suggest that countries with a higher share of adjustable-rate loans would benefit from a less reactive monetary policy and a less procyclical fiscal stance, highlighting the effectiveness of fiscal policy in narrowing the welfare gap between fixed- and adjustable-rate economies.

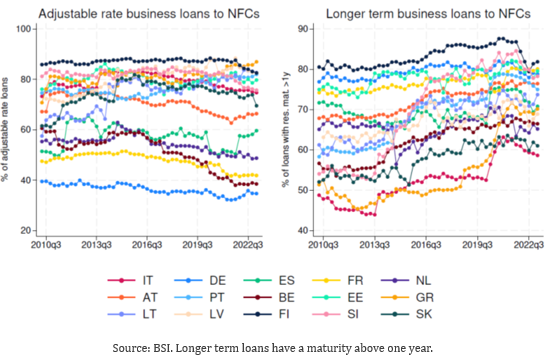

After nearly a decade of subdued inflation in much of the developed world, in the wake of the COVID-19, pandemic price pressures surged to levels last seen in the 1980s (ECB, 2022; BIS, 2022; IMF, 2022; Bank of Italy, 2022). This upsurge was largely driven by energy inflation, but other supply chain problems, as captured by backlogs of goods and services, also played a significant role (Ball et al., 2022). In this changing environment, the vast literature studying the impact of inflation shocks has experienced a deep revival (Del Negro et al., 2015; Christiano et al., 2018; Reis, 2022; Candia et al., 2021; Ascari et al., 2023; Harding et al., 2023). Nevertheless, the evidence on how loan characteristics mediate the transmission of inflationary pressures remains scant. The euro area is a highly integrated economic system where member countries share many similarities, driven, at least to some extent, by a common monetary policy and exposure towards common exogenous macroeconomic shocks. However, the structure of their economies also differs from many perspectives concerning both the real and financial side. Michelangeli and Piersanti (2025) focus on the euro area as case-study to investigate how business loan characteristics, such as interest rate type and maturity, have affected the transmission of supply-driven inflation shocks across euro area countries.1 The region’s diverse mix of long-term and adjustable-rate loans provides a unique opportunity to fit the purpose. Indeed, Figure 1 shows a great extent of cross-country heterogeneity in both business loan rate type and recourse to long-term loans.

Figure 1. Business loan characteristics across countries

In a first step, Michelangeli and Piersanti (2025) develop a DSGE model that features a frictional banking sector (Gertler and Kiyotaki, 2010; Gertler and Karadi, 2011) and allows for different possible configurations of business loan characteristics. In the model, firms borrow from banks to fully finance their acquisition of capital input. In this respect, long-term loans imply that the capital stock remains fixed for the whole loan contract duration as in Andreasen et al. (2013). The framework is extended by allowing long-term loans to be also at adjustable rate, a peculiar loan arrangement fitting the working of credit relationships in several European countries. Six alternative economies are simulated, each defined by a specific combination of loan maturity (for the sake of illustration, one, six, or twelve quarters average maturity) and interest rate type (fixed or adjustable). For example, one economy consists entirely of fixed-rate loans with a one-quarter maturity, while another features fixed-rate loans with a six-quarter maturity, and so on. For computational simplicity, firms cannot alter the length of their loans or switch between fixed and adjustable rates. As actual economies typically fall somewhere in between these six cases, this approach allows to clearly identify the main drivers of inflation shock transmission across different financial structures, providing valuable insights into real-world economies. Monetary policy is conducted by means of a standard Taylor rule targeting both inflation and marginal cost dynamics, and also with some degree of interest rate persistence. Finally, fiscal policy is implemented by imposing a distortionary labor tax on households with the aim of stabilizing the public debt-to-GDP ratio. The labor tax contributes to fund public expenditure together with net public debt emissions.

The inflation shock is modeled as a cost push shock affecting the intertemporal Phillips curve (Smets and Wouters, 2007, 2005), capturing the unexpected rise in prices due to supply-side factors like rising production costs and/or higher raw material prices. The shock transmission is mediated by business loan characteristics.

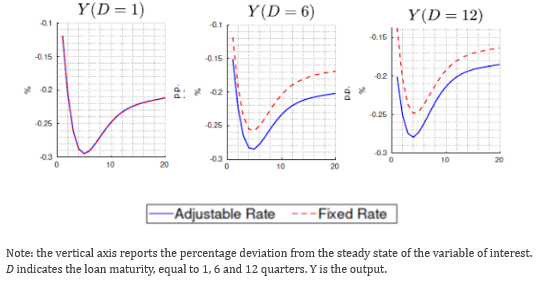

Results indicate that longer loan maturity dampens business cycle fluctuations triggered by inflation shocks (Figure 2). Loan maturity affects banks’ asset structure, particularly by limiting changes in leverage. After an inflation shock, only a fraction of all loans is reset to reflect the lower price of capital. Intermediate producers modify their credit demand to a lesser extent compared with the case of one-period contracts. This, in turn, implies that also the responses of investment, consumption and other real variables are weaker and the overall impact on the business cycle turns out to be more muted.

Moreover, with longer maturity, the impact of business cycle fluctuations in response to an inflation shock also depends on loan interest rate type. Firms with a fixed-rate long-term loan maintain the same rate until capital is re-optimized: both total loan amount and loan installments remain constant over time (the capital share is reimbursed at the end of the contract, while interests are paid periodically), cushioning the decline in GDP. In contrast, firms with adjustable-rate loans face a state contingent interest rate that rises with monetary policy rates following an inflation shock. Such a spike in the cost of loans, along with a quantity of capital to be held fixed for many periods, forces firms to balance their budget by hiring less and reducing capital demand. This induces a more severe slump in consumption and investment, and the recession turns out to be deeper as a result.

Figure 2. Impulse response functions to a recessionary cost-push shock, comparison between interest rate types for loans of different maturities

To validate the theoretical findings, aggregate bank data at the country level, focusing on the euro area, are used. The cross-sectional impact of inflation surprises on GDP across euro area countries, that differ in their share of fixed- vs adjustable-rate loans and maturity, is evaluated using local projections à la Jordà (2005).

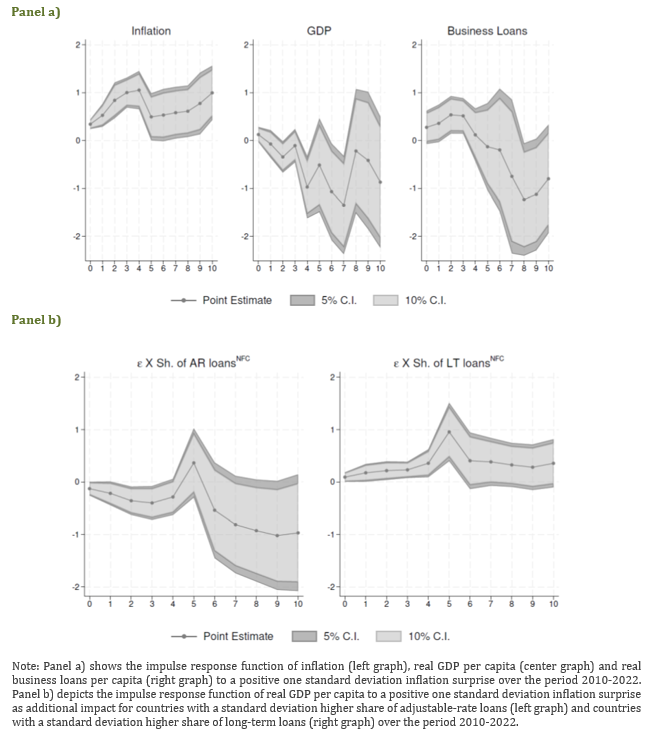

Drawing on Fabiani and Piersanti (2024), inflation shock measured as inflation surprise is constructed. The measure is defined as the difference between the realized value of the inflation rate (measured by the annual growth of the HICP) and the median forecast for the euro area from a survey of professional forecasters compiled by Thomson Reuters. First, GDP and inflation are regressed on the inflation surprise, showing that surprises proxy supply shocks by triggering both a persistent recession and a prices increase (Figure 3, panel a). Then, the inflation surprise is interacted with the share of loans with adjustable-rate and long-term maturity. The empirical results qualitatively confirm the theoretical findings: longer-term loans are associated with milder recessions, while a high share of adjustable-rate loans exacerbates declines in GDP (Figure 3, panel b).

The theoretical model is again used to assess how monetary and fiscal policies should be tailored in response to an inflationary supply shock, considering the varying characteristics of business loans. In particular, given that adjustable rates are less effective than fixed rates in smoothing business cycle fluctuations at all loan maturities, monetary and fiscal policies are fine tuned to narrow as much as possible the welfare gap between the two rate type models at each maturity profile.

The findings indicate that in adjustable-rate economies the response to inflation should be less aggressive, especially for longer maturities. Indeed, the monetary policy rate should be changed more gradually than it is done in an economy where long-term loans are priced at fixed rate.

Moreover, the analysis highlights the potential effectiveness of fiscal policy in mitigating the negative effects of recessions that follow the rise in inflation. In particular, still in the context of a restrictive monetary policy, countries with business loans mostly priced at adjustable-rates could benefit from a less procyclical labor tax policy. Ultimately the results suggest that when loans are long-term, a less procyclical fiscal policy might be a more effective tool than a less restrictive monetary policy for reducing the welfare gap between fixed and adjustable rate economies.

This result should however be interpreted cautiously for at least three reasons. First, the feasibility of such a shift in fiscal policy depends heavily on each country’s debt-to-GDP ratio. In practice, allowing public debt to grow beyond typical levels in response to shocks may be undesirable. Second, we assume that both fixed and adjustable-rate economies follow the same fiscal policy rule ex-ante, though they may differ in their fiscal capacity to implement such a policy. More generally, halving labor tax revenues can be extremely challenging, making the significant fiscal policy adjustments suggested here potentially unfeasible. Lastly, for simplicity, we have not considered alternative fiscal measures, such as public investment or fiscal transfers, which could lead to different outcomes that are beyond the scope of this analysis. However, this experiment shows that, when accounting for heterogeneity across countries in business loans characteristics, fiscal policy might be, at least in principle, more capable of improving welfare and limiting the costs associated to the recession as, differently than the monetary policy, it does not affect the policy rate feedback from the inflation shock.

Figure 3. Empirical impulse response function to a standardized positive inflation surprise

Andreasen, M. M., M. Ferman, and P. Zabczyk (2013). The business cycle implications of banks’ maturity transformation. Review of Economic Dynamics 16 (4), 581–600.

Ascari, G., S. Fasani, J. Grazzini, and L. Rossi (2023). Endogenous uncertainty and the macroeconomicimpact of shocks to inflation expectations. Journal of Monetary Economics.

Ball, L. M., D. Leigh, and P. Mishra (2022). Understanding us inflation during the covid era. Technical report, National Bureau of Economic Research.

Bank of International Settlement (2022). Annual Economic Report.

Bank of Italy (2022). Annual Report on 2021.

Candia, B., O. Coibion, and Y. Gorodnichenko (2021). The inflation expectations of us firms: Evidence from a new survey. Technical report, National Bureau of Economic Research.

Christiano, L. J., M. S. Eichenbaum, and M. Trabandt (2018). On dsge models. Journal of Economic Perspectives 32 (3), 113–140.

Del Negro, M., M. P. Giannoni, and F. Schorfheide (2015). Inflation in the great recession and new keynesian models. American Economic Journal: Macroeconomics 7 (1), 168–196.

European Central Bank (2022). Economic Bulletin, No. 4.

Fabiani, A. and F. M. Piersanti (2024). Inflation, capital structure and firm value. Bank of Italy Temi di Discussione (Working Paper) No 1434.

Gertler, M. and P. Karadi (2011). A model of unconventional monetary policy. Journal of monetary Economics 58 (1), 17–34.

Gertler, M. and P. Karadi (2015). Monetary policy surprises, credit costs, and economic activity. American Economic Journal: Macroeconomics 7 (1), 44–76.

Gertler, M. and N. Kiyotaki (2010). Financial intermediation and credit policy in business cycle analysis. In Handbook of monetary economics, Volume 3, pp. 547–599. Elsevier.

Harding, M., J. Lind´e, and M. Trabandt (2023). Understanding post-covid inflation dynamics. Journal of Monetary Economics.

Jordà, ` O. (2005). Estimation and inference of impulse responses by local projections. American economic review 95 (1), 161–182.

International Monetary Fund (2022). World Economic Outlook.

Michelangeli, V., and F. M. Piersanti (2025). Business loan characteristics and inflation shocks transmission in the euro area. Bank of Italy Working Papers (Temi di discussione), No. 1477.

Reis, R. (2022). Losing the inflation anchor. Brookings Papers on Economic Activity 2021 (2), 307–379.

Smets, F. and R. Wouters (2005). Comparing shocks and frictions in us and euro area business cycles: a bayesian dsge approach. Journal of Applied Econometrics 20 (2), 161–183.

Smets, F. and R. Wouters (2007). Shocks and frictions in us business cycles: A bayesian dsge approach. American economic review 97 (3), 586–606.

Michelangeli and Piersanti (2025) focused on inflationary shocks driven by supply-side factors, and the results may differ if shocks driven primarily by demand-side factors are considered.