The opinions expressed in this article are those of the authors and do not necessarily coincide with those of the Federal Reserve, Banco de Portugal or Eurosystem. Any errors and omissions are the sole responsibility of the authors.

We investigate the pass-through of a temporary value-added tax (VAT) cut on selected food products to consumer prices. Exploiting a novel dataset of daily online prices, we find that the VAT cut was fully transmitted to consumer prices, persisted throughout the policy duration, and prices returned to the pre-implementation trend after reversal. We provide evidence for two mechanisms driving this result: the policy’s salience to consumers in a high inflation environment and the decline of producer prices when implemented. We estimate that the policy reduced the inflation rate by 0.68 percentage points on impact.

Following the recent surge in inflation, several countries used temporary value-added tax (VAT) reductions on food products to alleviate the adverse effects of the rising living cost. However, the effectiveness of these measures remains contentious among economists and policymakers. Previous studies indicate that VAT cuts are not fully transmitted to consumer prices, their effects are short-lived, and prices often rebound to higher levels than before.

In our recent study (Bernardino, Gabriel, Quelhas, and Silva-Pereira, 2024), we demonstrate that temporary VAT cuts can be a fiscal tool to manage inflationary pressures on consumers. We leverage on a unique policy setting in Portugal where the government unexpectedly announced a temporary VAT zero policy on 46 food products that were previously taxed at the rate of 6%. Using a novel dataset with daily online prices from the main retailers in Portugal, we estimate the pass-through of this temporary VAT cut to consumer prices. We employ an event-study approach, comparing the price evolution of the goods affected by the policy (the treatment group) to other food products (the control group). Other food products are a suitable comparison group as their prices followed the same trend before the announcement of the policy.

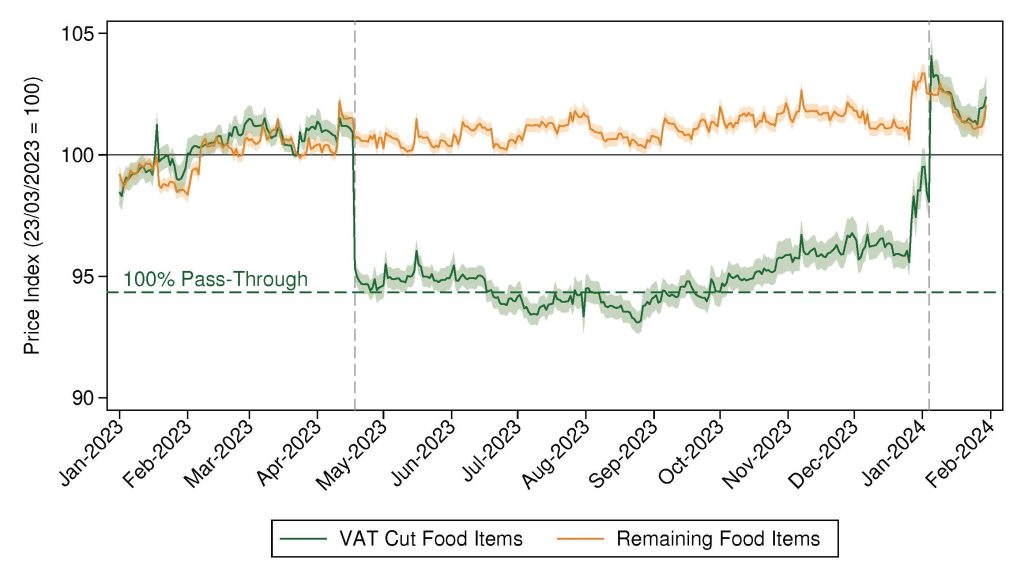

Figure 1 shows the prices of the products included in the VAT cut basket with those of other food products that kept their VAT rate unchanged.

Our findings reveal a sharp and substantial drop in the relative price between treated and control items on the day of the policy implementation (first vertical dashed line). On impact, prices were, on average, 5.65% lower than on the pre-announcement day, corresponding to an almost complete pass-through of 99.8%. Moreover, this effect persisted over time. For most of the policy duration, the price gap between VAT cut food items and other food items remained constant, with only a slight narrowing observed in the final days of the policy.

On the reversal day (second vertical dashed line), the average price index of VAT-reduced products returned to the same level as other food products. Prices of the goods in the VAT cut basket increased by 6.07%, compared to the price level at the official announcement. These observations indicate a full, persistent, and symmetric transmission of the VAT cut policy into consumer prices, which is confirmed by the formal tests performed.

Furthermore, the estimated pass-through to consumer prices on the introduction of the VAT cut was homogeneous across various dimensions. There was no significant difference across food categories, brands (trademark vs. white label), source (domestic vs. imported), supermarket size or price levels before the VAT change.

Figure 1: Food Prices during the Temporary VAT Cut in Portugal

Notes: The figure represents an average of the daily price index for each item from January 1, 2023, to January 31, 2024, normalized to 100 on the day before the unexpected announcement of the policy, March 23, 2024. It also includes a band defined by two times the standard deviation around the average. The vertical dashed lines correspond to the start and end of the policy, respectively.

To evaluate the effectiveness of the policy in reducing inflation, we approximate the policy’s direct impact on aggregate inflation by combining the estimated price changes with each category’s weight in the representative consumption basket. The introduction of this policy led to a mechanical decrease in the headline inflation rate by 0.68 percentage points.

We also discuss two features of the VAT cut’s setting that could be relevant drivers of the result that departs from existing literature. First, the timing of its implementation coincided with a decrease in the prices of producer prices related to food products. Using weekly product-level price data in agricultural wholesale markets, we observe a clear deflationary trend. This fall in supermarkets’ input costs may have facilitated the complete pass-through observed at the retail level, allowing supermarkets to keep their margins or even increase them. Second, the policy was highly salient to consumers: it received extensive media coverage over a long period, garnering significant public attention, and it was highly advertised through intensive labeling in stores. Its implementation was continuously monitored by the Portuguese Association for Consumer Protection and major newspapers. These mechanisms suggest that the effective policy communication and the timing of the intervention relative to input price dynamics shaped the policy’s success.

These findings shed light on the direct impact of VAT adjustments on prices, showing that a temporary change in the VAT rate on a set of products can be effective under certain conditions. It highlights the critical importance of timing, communication, market expectations, and institutional setting in maximizing the efficacy of public policies aimed at managing inflation.

Bernadino, T., Duque Gabriel, R., Quelhas, J., and Silva-Pereira, M. (2024), “A Full, Persistent, and Symmetric Pass-Through of a Temporary VAT Cut”, Banco de Portugal Working Paper 04/2024.