This policy brief is based on the paper entitled “Firm ownership and the macroeconomics of incentive leakages“ ECB Working Paper (No 3033, February 2025). The views expressed are those of the authors and do not necessarily reflect those of the ECB.

Abstract

Market power of firms and consequent aggregate welfare distortions have become an important topic of discussion in macroeconomics. The standard policy response consists of attempts to introduce more competition. However, such attempts are not often very successful. We take a different approach to the problem. Taking monopoly power as given, we ask if altering the internal structure of firms can reduce the welfare distortions. We put the question within a standard dynamic general equilibrium model. In standard macroeconomics analysis, profits are distributed as a lump-sum, precluding any interesting incentive effects. We study internal structures that eliminate this incentive leakage. Such forms include shareholder-operated or worker-owned-and-operated firms that make certain internal decisions in a decentralised manner. We show that such firms effectively exploit their monopoly power less. When all firms do this, an aggregate demand externality arises which improves steady state welfare. Some forms not only eliminate welfare distortion from monopoly, but improve welfare even beyond perfect competition in the steady state by achieving welfare closer to the Golden Rule level.

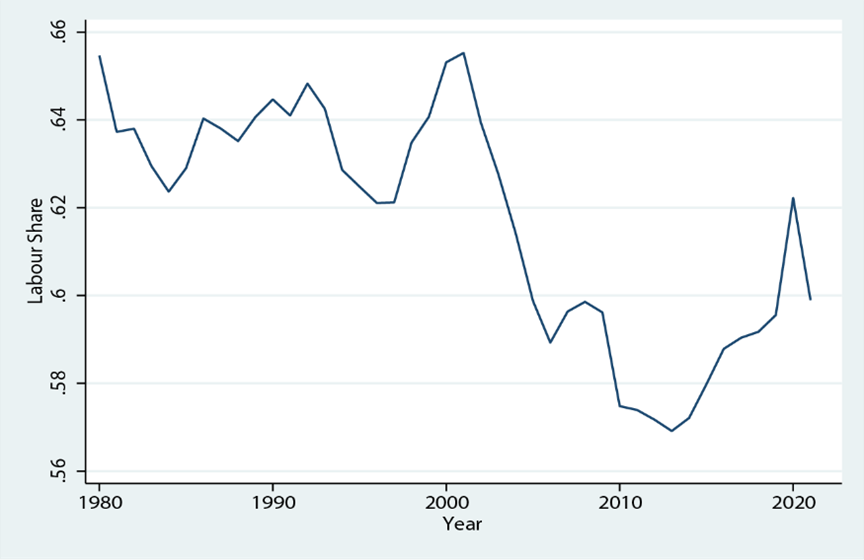

Increased market concentration has been a salient feature of capitalist economies in recent decades, accompanied by the rise of superstar firms and monopoly profits. At the macroeconomic level these aggregate into a decreasing share of labour (Figure 1) and, with some qualifications, an increasing share of profits in gross value added (Figure 2).

While these trends are often associated with rising income and wealth inequalities, the distortions implied by increasing market concentration also have significant implication for aggregate economic efficiency. Although policymakers aim to induce firms to take social welfare into account, they struggle to deliver effective regulation to address distortions arising from market power. With this in mind, we look for alternative solutions based on firm-level institutional incentives.

Figure 1. Labour share in Gross Value Added

Source: Bureau of Economic Analysis

Source: Bureau of Economic Analysis

Figure 2. Corporate profit share in Gross Value Added

Source: Bureau of Economic Analysis, authors’ calculations

Source: Bureau of Economic Analysis, authors’ calculations

In standard neoclassical macroeconomic models (such as the real business cycle (RBC) model) with monopolistic competition, all firms are owned by a representative household who delegates management rights to a profit-maximising manager. These firms then exploit their monopoly power in the factor markets, so that labour and capital are underpaid relative to their marginal products. The resultant monopoly profits are transferred by the manager as a lump-sum payment to households. These residual payments do not have any substitution effect on factor provision, at best having an income effect. We define this absence of factor substitution incentives as an “incentive leakage.”

To understand this idea better, we first consider the problem of a firm-based social planner. Such a planner is not concerned with profit directly, but maximises utility of the owners. Note that in standard macroeconomic models, the representative agent owns all firms. The notion of ownership is then moot. To carry out the firm-based planner’s exercise, we need to clarify the structure of ownership. Indeed, throughout the paper, we consider different ownership structures, so, unlike the standard model, this notion is critical for us. To this end, we assign a measure of agents to each firm. The assigned agents then own the firm. Now we have a clearly defined problem for the firm-based planner: maximise the utility of agents who are assigned to the firm. Note that a planner simply decides the factor levels – there are no prices. Even in this exercise we find that the factor inputs and output are the same as under profit maximisation. Indeed, if we try to come up prices to implement the planner’s solution, we get the same leakage as under profit maximisation. This tells us that the idea of incentive leakage is quite a general one – the feature arises even when a planner maximises the utility of the owners of a firm.

What if we then impose a condition saying that incentive leakage is not permitted? With an incentive leakage, both factors are underpaid in real terms relative to their marginal product. We show that the removal of leakage implies that if one factor (say labour) is underpaid, then the other factor (in this case capital) must be overpaid. This indicates that shutting down the leakage has important implications for the aggregate outcome.

Starting from the above observation, our paper goes on to consider different ownership and remuneration structures within a firm. Firms have the same monopoly power as standard monopolistic competition, but each of the arrangements we consider is characterized by zero leakage. We study the outcomes of such structures, and, most importantly, their welfare properties compared to standard monopolistic competition (with incentive leakage) as well as perfect competition (which features zero leakage via absence of monopoly).

Specifically, we start with the standard macroeconomic model with monopolistic competition. This is a model based on the well-known work of Avinash Dixit and Joe Stiglitz, 1977. In the model, a large (infinite) number of (intermediate good) firms compete, with each firm having a monopoly power indexed by a variable ε. Full monopoly is obtained at ε equal to 1. Monopoly power dissipates as ε rises, with the fully competitive case obtaining in the limit as ε goes to infinity.

Starting with this model, we keep the structure of monopoly power unaltered, but change the organisation of firms to ones that eliminate the incentive leakage. In doing this, a key notion is that of a tied factor. Any owner of a firm can supply labour or capital to the economy-wide market, or only to own firm. If an owner supplies, say, labour to the economy wide market, while supplying capital only to own firm, we say that capital is the tied factor, while labour is not tied. Each of the organisational structures we consider ties at least one of the factors to the firm.

We then make two changes to the firm structure. First, any untied factor is remunerated as usual, with price determined in an economy-wide market. All residual revenue (which includes profits) is then paid to the tied factor. Agents are remunerated in proportion to their tied-factor supply. That is, if capital is the tied factor (say), an agent who saves more relative to the total savings by all owners gets paid a greater share of the residual revenues. Second, the decision to hire the tied factor is decentralised. In the example above, the firm simply hires the total capital supplied by all agents.

If both factors are tied (which is the case of a workers’ enterprise, with workers owning the firm), a further stage is needed. The firm must first decide the share of revenue allocated to each factor. Then the usual proportional remuneration scheme is applied for both factors.

As noted above, our approach preserves monopoly but eliminates leakage through alternative ownership and remuneration structures. Consider a firm that is owned by its workers and that rents capital in an economy-wide competitive market. In this case, labour is the tied production factor while capital is not. We call this the Entrepreneurial Workers (EW) arrangement. Conversely, when the firm is owned by its capital providers and labour is rented outside, capital is the tied factor. This is called the Entrepreneurial Shareholders (ES) arrangement. We also consider the more general arrangement with both factors tied (Workers Enterprises or WE).

These structures effectively reduce the exploitation of monopoly power. The idea is as follows. The proportional remuneration scheme explained above generates extra competition among the tied-factor providers, incentivising more of the tied factor supply, which, in turn, raises firm output. We can also see this through the lens of externalities. Say capital is the tied factor. An agent who supplies more capital captures a greater share of future profits. But this imposes a negative externality on all other owners supplying the tied factor. Since the externality is not internalised, the equilibrium level of tied factor supply is too high relative to the joint optimum of agents. This then leads the firm output to be higher than the joint optimum, so that the firm effectively under-exploits its market power in equilibrium. But the firm-level oversupply is a boon for other firms as it boosts demand for their products. That is, each firm exerts a positive externality on other firms. This implies that the aggregate output rises. Following Olivier Blanchard and Nobuhiro Kiyotaki (1987), we call this an aggregate demand externality.

We also show that the ownership and remuneration structures that engender such efficacious properties are stable, in the sense that no agent has an interest in deviating from the arrangement. Through harnessing monopoly profits, these remuneration structures generate extra incentives not available under perfect competition.

We derive a series of results characterising the outcome under the three institutional forms mentioned above: ES, EW and WE. In each case, the firm maximises the utility of owners. We show that in the equilibrium under ES, each firm exploits labour in the same way as under standard monopolistic competition, then pays the surplus revenue to capital. As explained above, agents compete to capture future surplus, which leads to a rise in the supply of capital. In particular, note that since capital earns more than its marginal revenue product, the rise in supply is such that steady-state capital outstrips not just monopolistic competition, but, for standard values of parameters, also the level under perfect competition. The same ranking obtains for steady-state output. This result is key to understanding the significant welfare-enhancing impact of ES, which we discuss in the next part.

In the equilibrium under EW, on the other hand, capital is underpaid in the same way as under standard monopolistic competition, while the surplus is allocated to labour. This raises labour directly through the usual competition effect. The rise in labour in turn raises capital, but not as much as under ES which provides direct capital incentives.

Finally, under WE, shares for factors are chosen optimally before the usual factor remuneration schemes are applied. From a formal point of view, this is a more general arrangement compared to the ones considered above. This is because the WE firm can choose the mimic either ES or EW. The optimum under WE turns out to be close to the ES structure, the one which raises capital more and therefore has a greater impact on steady-state output, generating greater positive externality for the economy as a whole. This is interesting since WE owners simply maximise their own utility, but the result is that they decide to exploit labour to reward capital.

Let us now turn to welfare comparisons.

Thus altering ownership and remuneration structures can be an effective solution to counteract the distortions arising from monopoly power. But how do the proposed structures embedded in a monopolistic competition framework, affect welfare?

To answer this question, we first need an appropriate welfare criterion. The usual dynamic welfare criterion applied commonly in macroeconomics makes the following comparison. Suppose a policy is adopted at time t. We can derive the dynamic path that the economy follows and calculate the discounted lifetime utility at time t with and without the policy. This would give us a measure of welfare change from the policy. Such comparisons are very useful over business cycle frequencies. However, in this paper we are considering changes in the institutional structure of firms. The impact of this can vary over time, so that the welfare comparison at the time of change can differ from that a few periods later. We feel a better criterion for evaluating institutional change is to look at the long-term steady-state outcomes.

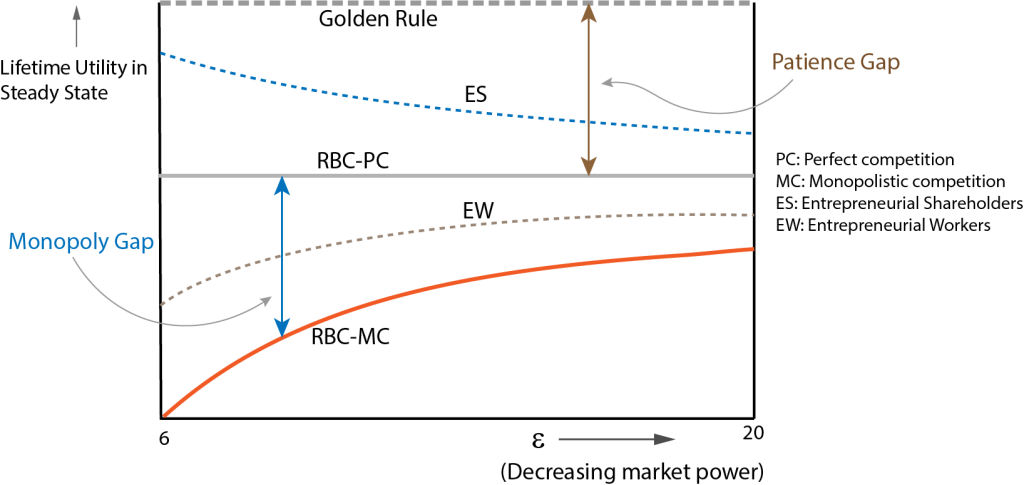

The best possible long-term welfare outcome that any perfectly competitive economy can achieve is given by the Golden Rule, whereby agents saving behaviour is characterised by indifference between immediate and future consumption. Compared to this benchmark, other models face two sources generating welfare gaps. First, the agents’ preference has a certain discount factor. We can show that the Golden Rule can be attained under perfect competition if agents do not discount the future at all. Therefore, given any time-preference structure, a model of perfect competition cannot implement the Golden Rule in the steady sate. In other words, in the steady state, a gap opens up between the welfare under the Golden Rule and that under perfect competition. We call this the “patience gap.”

Next, since monopoly distorts outcomes relative to perfect competition, the outcome under monopolistic competition faces a further “monopoly gap” in welfare. Figure 3 below shows the twin gaps.

Our welfare results show that the Entrepreneurial Workers arrangement improves upon the monopolistic competition. Essentially, the direct incentive on labour raises that input, raising firm output. This ultimately raises aggregate output beyond the monopolistic competition level. The resulting welfare improvement eliminates part of the monopoly gap. Figure 3 shows the improvement.

Entrepreneurial Shareholders and Workers’ Enterprise arrangements have a more dramatic welfare impact. These forms incentivise capital directly. The resulting improvement not only eliminates the monopoly gap entirely, but also covers part of the patience gap, thus outperforming even perfect competition RBC (real business cycle) in the long run (See Figure 3).

Figure 3. Patience and monopoly welfare gaps in the long run as functions of market power, which is decreasing in the parameter ε

The basic intuition for the difference between the EW case and ES/WE cases lies in the differing intertemporal incentives. We show formally that the welfare ranking is related to capital accumulation incentives across firm types. Note that a crucial feature of all the zero-leakage forms we study is that they use the monopoly power to generate rents from one factor that are then used to incentivise the other factor so that there is no incentive leakage. This contrasts with perfect competition, where each factor is paid its marginal product, so that (under constant returns to scale, which we assume throughout) there is again no incentive leakage.

We can therefore think of EW form as starting from perfect competition, then reducing capital so that the real return falls below marginal product, while adding incentives on labour to preserve zero-leakage. The main impact of this is on the current period output, and the fall in capital reduces steady-state welfare below perfect competition. Therefore while EW improves upon monopolistic competition, it falls short of perfect competition.

On the other hand, we can think of ES (and WE) as starting from perfect competition, then reducing labour while providing extra capital incentives. This has a much greater intertemporal incentive in raising output. Indeed, given that agents save more, it is as if they act in a more patient manner. This as-if rise in patience then raises the welfare outcome closer to the Golden Rule compared even to perfect competition.

The results indicate that a direct incentive on capital has a much greater impact compared to one on labour. Further, given that monopoly power is harnessed to deliver the improvements, a higher monopoly power implies greater welfare improvements across all forms. This is evident from Figure 3. As market power vanishes, all forms converge to the perfect competition case.

A firm in the standard model can be thought of as being run by a manager, who makes input hiring decisions. The zero-leakage arrangements we suggest make decentralised decisions since they simply aggregate the factor supply of agents. Our results highlight the difference between the two. As we eliminate even part of the incentive leakage, and allow some degree of decentralised decision making, aggregate welfare rises. Essentially, the decentralised setting generates within-firm negative externalities resulting in input provision beyond the managerial optimum. Since each firm behaves this way, the aggregate output is raised. That is, zero-leakage structures generate an aggregate demand externality.

The results also have implications for tax policies. Rather than trying to tax profits, or trying to limit monopoly power through competition policies, targeting taxes on firm structure can deliver greater benefits. For example, the results show that a preferential tax treatment of firms that link profits to factor provision incentives might have a more desirable long-run impact compared to alternative policies that focus more on market structure.

Blanchard, Olivier Jean and Kiyotaki, Nobuhiro (1987), “Monopolistic competition and the effects of aggregate demand,” American Economic Review, pp. 647-666

Dixit, Avinash K. and Stiglitz, Joseph E. (1977), “Monopolistic Competition and Optimum Product Diversity,” American Economic Review, 67(3), pp. 297-308