The views expressed are those of the authors and not necessarily those of the institutions they are affiliated with.

As the potential risks from climate change become increasingly unavoidable, a sudden materialisation of climate change transition risk may end up impacting the banking and financial system, with repercussions on the ability of economies to effectively finance the green transition. While “immediate and deep emission reductions” (IPCC, 2022) are the only way to get back on track to meet the goals of the Paris Agreement, informed and efficient action requires an evaluation of the potential risks and impacts arising from climate policies. To this end, we analyse the effects of increases in climate policy stringency on the European banking system, with policy stringency proxied by the carbon price. We use a banking contagion model where borrowers are negatively impacted by increases in carbon prices under different firm emission reduction strategies. Our results suggest that a gradual increase in climate policy stringency would not lead to adverse impacts on the banking system, particularly under scenarios in which firms reduce their emissions consistently with “net zero” strategies. Conversely, a delayed and more abrupt policy strengthening may instead imply more disruptive effects on the financial system, especially if firms fail to reduce their emissions.

In order to meet the goals of the Paris Agreement, policymakers are currently aiming at strengthening measures to mitigate climate change, enabling a transition to low carbon economies. In particular, the European Commission has proposed a broad set of measures in order to reduce emissions in the EU to net zero by 2050, and by 55% until 20302 (“Fit for 55 package”). This includes in particular a broadened and extended EU Emissions Trading System (EU ETS) and a revision of energy taxation, but also targets for the implementation of renewable energies. In addition, central banks and financial institutions have intensified efforts in assessing the potential effects of climate change, and climate change mitigation strategies, onto the economy as well as the financial system. Banks and the broader financial system could for example be impacted through the following channel: if unprepared to transition or forced to transition very abruptly, firms might suffer losses and decreased productivity following sharp increases in the price of fossil energy, carbon taxes, or shifts in consumer preferences to less polluting options. Such a situation could lead to decreased loan performance and higher default rates. Crucially, a weakened and unstable financial system may not be able to fulfil its role in providing necessary credit to the growing green sector, and to finance the financial needs required in a green transition.

We analyse the risks posed to the financial system stemming from a transition to a low carbon economy in a forward-looking manner. The results are published in a recent working paper (Belloni et al., 2022). We use a banking system contagion model, where banks are connected through loans and securities exposures, and where firms suffer from rises in carbon prices that are absorbed on their balance sheets and therefore may affect their likelihood to default.

The impact of climate policies on firms’ probability of default depends on the level of carbon emissions produced by each firm, on their leverage ratio, and on their ability to pass carbon prices onto their customers. We assess the impact of climate policies using a set of NGFS scenarios (NGFS, 2020), in which policy stringency is expressed through a “shadow” carbon price. Only a fraction of this shadow carbon price can be interpreted as an explicit carbon tax. However, for this study we assume that this shadow carbon price represents the full cost firms bear through transition policies.

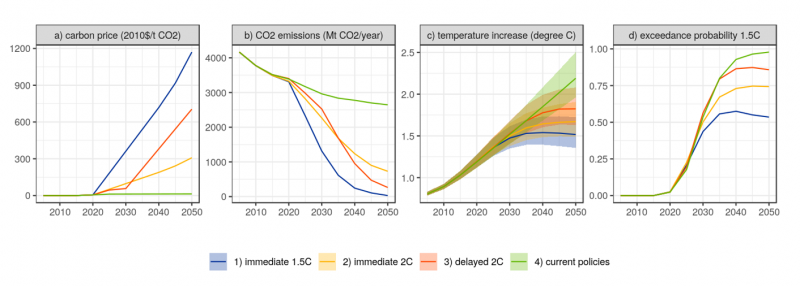

We consider four different stylised policy scenarios and corresponding emission pathways (Figure 1). First, an immediate increase in carbon price allowing to limit the increase in global mean temperature to below 1.5°C with a probability of 75%. Second, an immediate implementation of policies targeted at 2°C, with increasing carbon prices, albeit with a less steep trajectory compared to the first scenario. Third, a scenario representing a further delay of climate change-mitigating policies, with only mild carbon price increases until 2030, followed by a sharp increase from 2030 onwards. In the latter two scenarios, the probability of limiting global warming to 1.5°C by the end of the century is only ca. 40%, implying a higher risk from physical consequences of climate change, including the risk to cross dangerous tipping points (IPCC, 2021). Finally, we consider the baseline pathway associated with current policies.

Figure 1: Trajectories of carbon price, CO2 emissions, global mean temperature increase and exceedance probability of 1.5°C warming under the different policy trajectories (1)-(3) considered in this study, compared to current policies. The carbon price in (a) can be interpreted as a proxy for policy stringency. The temperature increase in (c) is relative to 1850-1900, and shaded areas denote the 25th-75th percentiles. Data source: NGFS (2020), model REMINDMAgPIE 1.7-3.0. All trajectories assume limited deployment of carbon dioxide capturing technologies.

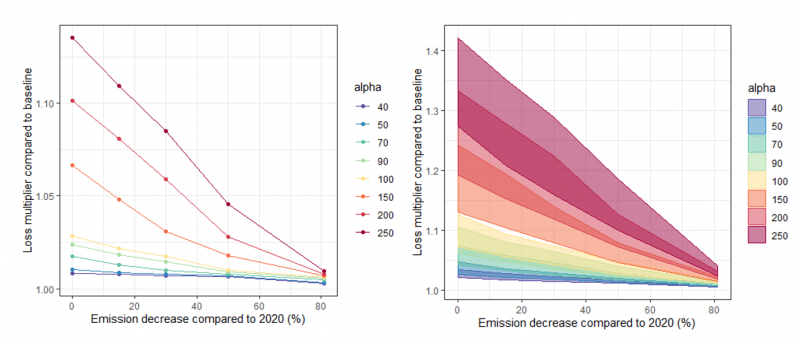

Under the assumption of firms’ emissions remaining constant, a large and abrupt adjustments in climate policy stringency may imply considerable tail risks in the banking system (Figure 2). While on average the expected impact would be relatively contained, estimates on the impact on the tails of the loss distribution suggests rare events might acquire more importance with increasing likelihood of large shocks materialising. This implies that the expected impact of a scenario in which the (shadow) carbon price increases suddenly and drastically, while firms do not adjust emissions accordingly, may have an impact that is comparable to the shock induced by Covid-19 in 2020.

Tail losses remain sizeable for large and abrupt adjustments in climate policy stringency and moderately ambitious levels of emission reductions (Figure 2). For example, with a reduction in firm emissions by 30% and an increase in the effective cost of carbon born by firms of 150€/t (parameter alpha in Figure 2), tail losses are estimated to reach ca. 14%, compared to the baseline. This reduction in emissions corresponds to average estimated emission reductions by 2025 compared to 2020 when pursuing policies to limit global warming to 1.5°C by 2100 (see Fig. 3, blue line). In the same scenario, firm emission reductions of 50% would imply tail losses to only increase by ca. 7% compared to the baseline. Assuming ambitious firm-level emission reductions of 50% or more compared to 2020 levels, our results suggest contained banking system losses on average even for very high changes in the effective cost of carbon born by firms. With firm emission reductions of 50% and an increase in the effective cost of carbon born by firms of 100€/t, average banking system losses are estimated to increase only by ca. 1% compared to the baseline. This situation corresponds approximately to the estimated change in emissions and necessary 5-year change in carbon price in 2035 compared to 2030, with policies limiting global warming to 2°C by 2100.

Figure 2: Increase in banking system losses declines with increase in firm emission reductions; median banking system losses (LHS) and tail losses (95th to 99th percentiles, RHS). The sensitivity parameter alpha, can be interpreted as the intensity of transition risk, capturing the effective cost per unit of emissions borne by firms. The level of alpha depends on the stringency of climate policy, including direct and indirect carbon taxes, but also other policy measures, and on the extent to which firms can pass-through the higher cost of carbon to their customers.

Overall, these results suggest that in order to buffer themselves from losses, banks should assess lending to firms that are not following ambitious emission reduction strategies. Importantly, the results presented here underline the importance of banks’ knowledge of their clients’ carbon footprints and emission reduction strategies. Consequently, policy measures are needed to foster bank and firm disclosure of both direct and indirect emissions as well as the disclosure of verifiable strategies to reduce emissions. Prudential measures may also be necessary to prevent the built-up of banking system losses or pockets of risks through bank exposures to firms that are not able to adapt their business models to a strategy consistent with meeting the goals of the Paris agreement.

Finally, although the need to deeply and immediately reduce emissions may imply some tail risks for the banking system, these appear to be limited compared to the physical consequences of climate change documented in the literature. Global consequences of unmitigated climate change may trigger currently unforeseen consequences – with potentially compound risks through simultaneous extreme events, the threat of crossing climate tipping points, and an increasing loss of habitable places on Earth – threatening lives and the economic and political stability of societies.

The views expressed are those of the authors and not necessarily those of the institutions they are affiliated with.

Compared to 1990 levels.