The views expressed in this policy brief are those of the authors and do not necessarily represent the views of the Bank for International Settlements.

Abstract

We examine the relationship between digital payment innovation, economic growth and informal activities in 101 economies over 2014–19. We find that a one-percentage point increase in digital payments use is associated with increases in the growth of GDP per capita of 0.10 percentage points over a two-year period, and a decline in the share of informal sector employment of 0.06 percentage points over a two-year period. Digital payments do not appear to be significantly associated with rises in total factor productivity, once controlling for general measures of digitalisation and government effectiveness, but they are linked to greater financial inclusion and credit access. Our results reinforce the case for government policies to encourage digital payments and, access to the financial sector and information technology.

One of the most critical developments in global finance in recent years has been the adoption of cutting-edge information technology. Among the many applications of financial technology (fintech) has been the development of digital payment methods. Digital payments, also known as electronic payments, refer to any transfer of value using digital devices or channels, and include such means as bank transfers, mobile money, quick response (QR) codes and payment instruments such as credit or debit cards and help to avoid the use of cash. Digital payments also encompass the use of cryptocurrencies, such as bitcoin or so-called stablecoins1, and central bank digital currencies (CBDCs).2

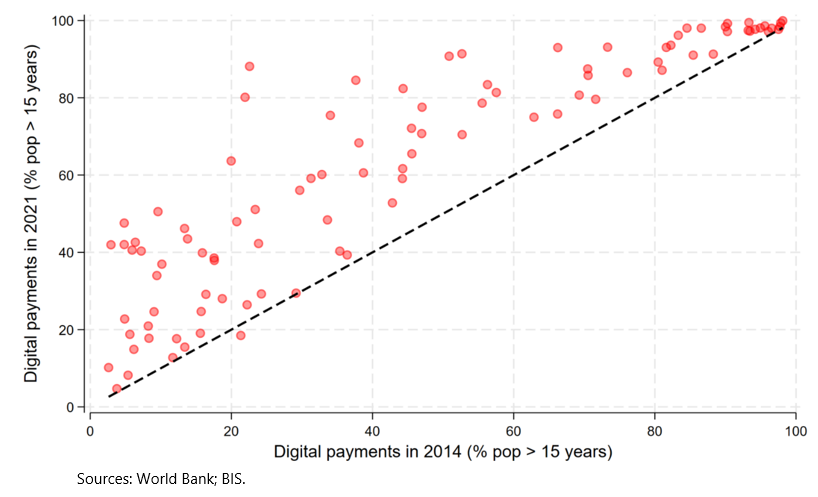

Although the adoption of digital payments has become quite widespread in advanced economies (AEs), it is advancing as rapidly in emerging market and developing economies (EMDEs). Between 2014 and 2021, the share of adults in developing countries using digital payments rose from 35% to 57%, according to World Bank Findex data (Figure 1). In China, private digital payments platforms such as Alipay and WeChat Pay, based on digital wallets and QR codes, have made substantial inroads into retail cash payments (Klein, 2020). Similarly, the mobile money system M-Pesa, introduced in 2007, has revolutionised retail payments in Kenya, as has the Unified Payments Interface (UPI) in India (Prasad, 2021; Aurazo and Gasmi, 2024). Brazil’s central bank has developed a retail fast payments system, Pix, that similarly has become widely adopted (Alfonso et al, 2020; Duarte et al, 2022). Finally, it is notable that all of the CBDCs that have become operational to date have been issued by EMDEs: the Bahamas, Eastern Caribbean, Jamaica and Nigeria (Alfonso et al, 2022).

Given the proliferation of digital payments in EMDEs, it is natural to ask what role these payments might play in the process of economic growth and development. This question is of more than purely academic interest. In particular, public policy can importantly affect the pace of adoption of digital payments, both through regulation or encouragement of private payments providers and through direct provision of payments services such as retail fast payment systems or CBDCs.3

Figure 1. Level of use of digital payments in 2014 vs 2021

Supporters of digital payments, including private providers, argue that their adoption can accelerate economic growth through a number of channels. First, digital payments are cheaper, faster and more efficient than cash or cheques, reducing the deadweight costs of payments to merchants and the economy more generally. As a related matter, they facilitate online purchases, enabling the development of e-commerce (IDB Lab and World Economic Forum, 2022). Second, for large subgroups of the population in many countries for whom banknotes and coins are their only financial assets, greater adoption of digital payments could be the gateway to the financial system, encouraging ownership of financial accounts. This could create greater opportunities for saving and credit (CPMI and World Bank, 2020). Third, widespread adoption of digital payments may create a “data trail” and encourage informal sector enterprises to move into the formal sector. This could lead to firms with greater scale, credit records (and access to credit) and investment (A.T. Kearney and Visa, 2018).4 Fourth, and relatedly, the use of digital payments for payroll may help to formalise informally employed workers, again promoting financial inclusion for households and greater productivity for firms as they move into the formal sector. All these could create a virtuous circle where informal employers and employees enter the formal sector, encouraged by the convenience of digital payments and then by the benefit of using financial services. In principle, this could support growth and productivity by these firms.5 Finally, digital payments could improve the administration of government finances, both by enabling better collection of revenues (including by reducing informality) and by facilitating transfer payments; stronger fiscal positions help to support public investment and increase debt sustainability, both of which support economic growth.

Although these advantages of digital payments are plausible, there is relatively little empirical analysis to support these claims and gauge the strength of the association between digital payments and economic growth. Much of the literature comes from non-peer reviewed, private sector sources.6 Our recent research aims to provide a rigorous and objective assessment of the developmental benefits of digital payments (Aguilar et al 2024).

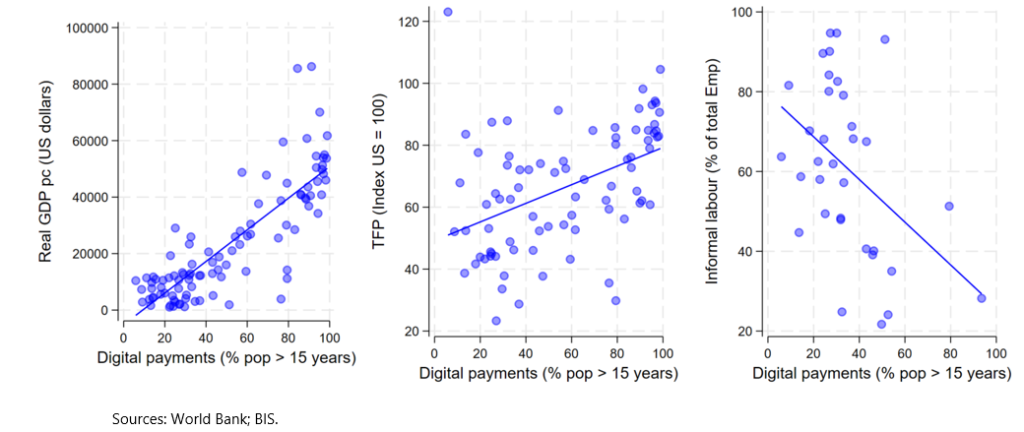

There is a strong correlation between digital payments and measures of growth and development. Figure 2 below shows that the level of digital payments use across countries is positively correlated with the level of per capita GDP and total factor productivity (TFP) and negatively correlated with the share of informal sector employment. However, these correlations could reflect reverse causality from measures of economic development to digital payments, or spurious correlations of both variables with other factors such as the dissemination of information technology, levels of governance or broader measures of financial development.

To control for these sources of potential bias, we follow the growth literature and estimate panel regressions relating growth rates of GDP per capita, TFP and the share of informal sector employment to lagged levels of these variables, the extent of digital payments use and various controls for alternative influences on development. We also employ instrumental variables estimation as a further check on endogeneity. Our analysis uses data from up to 101 economies over 2014-2019.

Figure 2. Higher levels of the use of digital payments are associated with higher levels of GDP and productivity, and lower levels of informality. Figures for 2017.

We find that a one percentage-point rise in digital payments use is associated with increases in growth rates of GDP per capita of 0.10 percentage points (or 0.05 percentage points annually) over a two-year period. Digital payments are also associated with lower estimated informal employment, with a reduction by 0.06 percentage points (or 0.03 percentage points annually) over a two-year period. Insofar as the reported share of the population making digital payments ranges nearly from 0 to 100 percent, this indicates a substantial effect on growth and informality. Finally, digital payments are associated with greater access to credit and other financial services.

We also find a statistically significant association between digital payments and the growth of TFP. However, this association appears to reflect that digital payments are highly correlated with measures of internet penetration and government effectiveness, which themselves boost productivity growth. Nevertheless, TFP is difficult to estimate, and it would be premature to write off a positive effect of digital payments. Moreover, given the dependence of digital payments on the broader environment for information technology, distinguishing the separate effects of digital payments and internet penetration is difficult, particularly at the country level.

All told, our study underscores the link between digital payments and economic development. Countries with greater use of digital payments could be associated with greater output and lower informality. This argues for government policies to encourage the establishment of digital payment platforms in their jurisdictions. Strong correlations between digital payments, financial inclusion and internet penetration suggest that these factors all complement each other. Going forward, further research can assess these links with micro data from individual jurisdictions. This can help to better understand the links and how government policies to promote growth and reduce informality can best be targeted.

Aguilar A, J Frost, R Guerra, S Kamin and A Tombini (2024), “Digital payments, informality and economic growth”, BIS Working Papers, no 1196, July.

Alfonso, V, S Kamin, and F Zampolli (2022), “Central bank digital currencies (CBDCs) in Latin America and the Caribbean”, BIS Working Papers, No 989, January.

Alfonso, V, A Tombini and F Zampolli (2020), “Retail payments in Latin America and the Caribbean: present and future”, BIS Quarterly Review, December.

Arner, D, R Auer and J Frost (2020), “Stablecoins: risks, potential and regulation”, Bank of Spain Financial Stability Review, November.

A.T. Kearney and Visa (2018), “Digital payments and the global informal economy”.

Auer, R, G Cornelli and J Frost (2023), “Rise of the central bank digital currencies”, International Journal of Central Banking, vol 19, no 4, pp 185–214.

Aurazo, J and F Gasmi (2024), “Digital payment systems in emerging economies: Lessons from Kenya, India, Brazil, and Peru”, mimeo.

Committee on Payments and Market Infrastructures (CPMI) and the World Bank (WB) (2020): “Payment aspects of financial inclusion in the fintech era”, April.

Duarte, A, J Frost, L Gambacorta, P Koo Wilkens and H S Shin (2022): “Central banks, the monetary system and public payment infrastructures: lessons from Brazil’s Pix”, BIS Bulletin, no 52, March.

IDB Lab and World Economic Forum (2022), “Accelerating digital payments in Latin America and the Caribbean”, White paper, May.

Khera, P, S Ng, S Ogawa and R Sahay (2021), “Is Digital Financial Inclusion Unlocking Growth?” International Monetary Fund Working Paper, WP/21/167, June.

Klein, A (2020), “China’s digital payments revolution”, Brookings Institution, April.

Levy, S (2018), Under-Rewarded Efforts: The Elusive Quest for Prosperity in Mexico, Washington, DC: Inter-American Development Bank.

Prasad, E (2021), The future of money: how the digital revolution is transforming currencies and finance, Cambridge: Harvard University Press.

Although popularly described as payments instruments, in practice, cryptocurrencies like Bitcoin are not used widely for payments. Stablecoins are a type of cryptocurrencies that aim to maintain a stable value relative to a specified asset, or a pool or basket of assets. See Arner et al (2020).

CBDCs are a digital payment instrument, denominated in the national unit of account, that is a direct liability of the central bank. See Auer et al (2023).

The aim of this study is to estimate the temporary contribution of digital payments to growth and not to provide a thorough explanation of the factors behind growth or informality. Digital payments use may eventually be close to universal, and thus this is unlikely to be a long-term source of growth.

Levy (2018) provides a detailed description of the relationship between informality and low productivity in Mexico.

Alvarez and Ruane (2019) show how informal firms and employees with similar characteristics are smaller and less productive than formal ones. They also show that, for the case of Mexico, removing barriers to formalisation could be an important source of productivity gains.

One prior analysis that empirically identifies a link between economic growth and digital payments is Khera et al (2021), which also uses a cross-country regression approach. Our study goes beyond Khera et al (2021) by examining the impact of digital payments on productivity growth and informality, as well as by controlling for the tight correlation between digital payments and broader measures of information-technology proliferation.