This policy brief is based on ECB Working Paper Series, No 2993. This policy brief represents the authors own views and does not necessarily represent the views of either the ECB or the Eurosystem.

Abstract

The relationship between political populism and its financial determinants remains complex and challenging to pinpoint. In this study, we examine how government fiscal support to credit conditions influences political preferences. Our findings from France reveal that government-guaranteed credit during the Covid-19 pandemic significantly reduced support for far-right candidates while boosting support for the incumbent government. The primary economic mechanism driving this effect is the preservation of employment, which subsequently shaped voter behaviour. The impact is most pronounced when looking at credit guarantees to microenterprises, particularly self-employed businesses where the employee, owner, and voter are often the same individual. In such cases, government support is highly salient, as beneficiaries directly attribute the stabilising effect on their economic conditions to the intervention.

In recent years, the growing electoral success of populist parties has garnered increasing attention in the fields of economics and finance. While the societal implications of this trend are significant, the rise of populism also has profound, direct and indirect effects on economic policymaking. Populist economic policies often pose risks to macroeconomic stability and public finances, potentially leading to slower GDP growth, higher debt burdens, and fiscal imbalances (Funke et al., 2022). Moreover, populist movements frequently challenge institutional norms, such as central bank independence, which can undermine monetary policy effectiveness and disrupt financial markets. Political interference in monetary policymaking, for instance, has been associated with higher inflation, highlighting the critical intersection of politics and economics in this area.

While factors such as cultural shifts, technological advancements, and demographic changes have been proposed as drivers of populism (Cantoni et al., 2019; Margalit, 2019; Norris & Inglehart, 2019), economic conditions remain a key explanatory variable (Guriev & Papaioannou, 2022). At the same time, much of the existing literature on the economic dimensions of populism focuses on its causes, yet there is limited exploration of measures that counteract its rise.

Through an analysis of French credit registry data, in a recent study (Dautovic & Hsieh, 2024) we examine the relationship between local credit conditions, government-backed financial support, and electoral outcomes in France as a case study.

In response to the economic challenges posed by the Covid-19pandemic, France introduced one of the largest state-guaranteed loan schemes, known as prêts garantis par l’État (PGE). Launched on March 23, 2020, just one week after the country’s first lockdown, the programme aimed to support businesses struggling with liquidity constraints. Initially set to expire within a year, the scheme was extended twice, eventually running until June 30, 2022, around the time of the 2022 presidential and legislative elections.

The PGE programme had an initial budget allocation of €307 billion and was implemented by the public investment bank Bpifrance. By the end of 2021, approximately €145 billion in state-guaranteed loans had been disbursed to 700,000 businesses. Most of these loans targeted smaller enterprises, providing critical cash flow support during the crisis (Benitto et al., 2022). This large-scale financial intervention highlighted the French government’s commitment to stabilising the economy and safeguarding employment during an unprecedented period of disruption.

By analysing French credit registry data and combining it with electoral, administrative and census data, we study the link between positive local shocks to credit conditions, government financial support, and electoral results. Government-guaranteed credit is aggregated at postcode-municipality level according to firms’ incorporation addresses to construct our main explanatory variable: the share of government-guaranteed credit in total credit at postcode-municipality level.

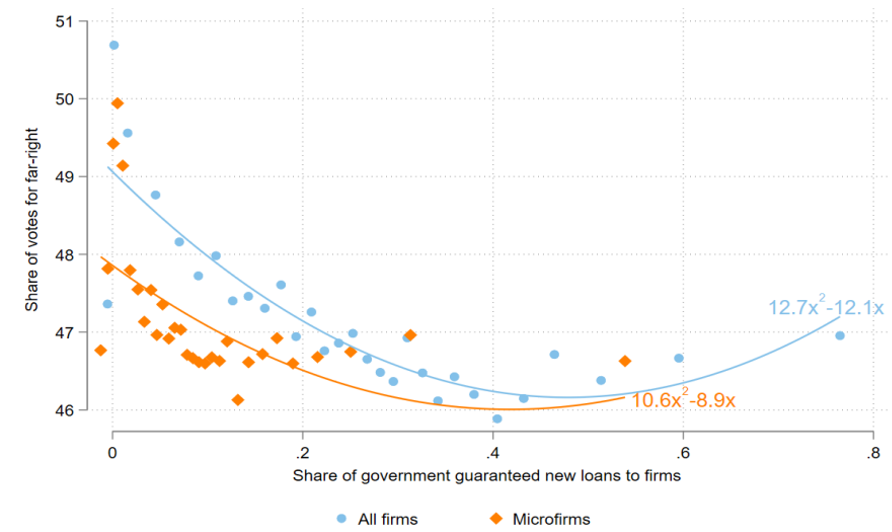

Figure 1. Government-guaranteed credit and the far right

Note: The chart shows binned scatter plots between the share of government-guaranteed credit and the share of votes for the far-right in the second round of the 2022 presidential election for all and microenterprises. The regression controls for previous presidential election first round results. Credit guarantees are grouped into 30 equally sized bins, N=5601.

The findings reveal a significant negative relation between the share of government-guaranteed credit and the rise in support for far-right populist parties. This effect is particularly pronounced in credit guarantees provided to microenterprises, including small businesses and self-employed individuals. Figure 1 presents the main findings.

To understand the mechanisms driving these results, the study explores several economic channels, identifying employment protection as the most significant factor. By helping preserve jobs, credit guarantees appear to reduce economic uncertainty and, consequently, the appeal of populist narratives. However, the study also notes that this effect is less pronounced in regions with greater economic resilience to shocks, as measured by changes in firms’ turnover during the COVID-19 pandemic.

The results indicate that government credit guarantees played a significant role in curbing support for far-right populist candidates. Specifically, we estimate that such guarantees contributed to a reduction of approximately 138,000 votes for the far-right candidate in the second round of the 2022 French presidential election. While not decisive in altering the election’s outcome, this impact is politically meaningful and highlights the potential of targeted economic policies in influencing voter behaviour.

Overall, the findings underscore the importance of fiscal interventions, such as government credit guarantees, in addressing the economic underpinnings of populism. By stabilising local economies and protecting employment, these policies can contribute to mitigating the rise of far-right populist parties and fostering more inclusive economic outcomes.

Benitto, H., Hadjibeyli, B., & Maadini, M. (2022, March). Analysis of France’s State-Guaranteed Loan Scheme at End-2021 (Tresor-Economics). Direction générale du Trésor. Paris.

Cantoni, D., Hagemeister, F., & Westcott, M. (2019). Persistence and Activation of Right-Wing Political Ideology.

Dautovic, E., & Hsieh, R., (2024) Government-guaranteed Credit and Populism, ECB Working Paper Series No. 2993

Funke, M., Schularick, M., & Trebesch, C. (2022). Populist Leaders and the Economy. From https://ideas.repec.org//p/hal/wpaper/hal-03881225.html

Guriev, S., & Papaioannou, E. (2022). The Political Economy of Populism. Journal of Economic Literature, 60 (3), 753–832.

Margalit, Y. (2019). Economic Insecurity and the Causes of Populism, Reconsidered. Journal of Economic Perspectives, 33 (4), 152–170.

Norris, P., & Inglehart, R. (2019). Cultural Backlash: Trump, Brexit, and Authoritarian Populism. Cambridge University Press.