References

Bank of Italy (2021). Annual Report for 2020.

Greenstone, M., Mas, A., & Nguyen, H. L. (2020). Do credit market shocks affect the real economy? Quasi-experimental evidence from the great recession and “normal” economic times. American Economic Journal: Economic Policy, 12(1).

Goldfarb, A., & Tucker, C. (2017). Digital economics. Technical report, National Bureau of Economic Research.

Goldstein, I., Jiang, W., & Karolyi, G. A. (2019). To fintech and beyond. The Review of Financial Studies, 32(5).

Gomes, F. (2020). Portfolio choice over the life cycle: A survey. Annual Review of Financial Economics, 12.

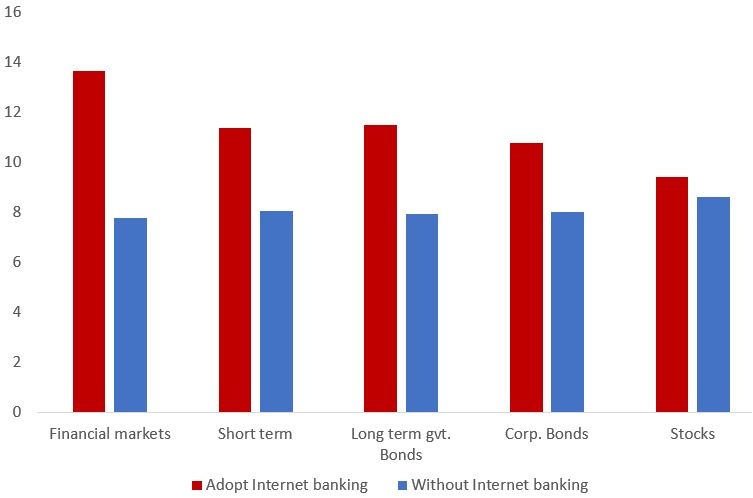

Michelangeli, V., & Viviano, E. (2021). Can Internet banking affect households’ participation in financial markets and financial awareness?, Bank of Italy Working Papers, No. 1329.

The London Economic (2018). https://www.thelondoneconomic.com/tech-auto/modern-technology-saves-brits-the-equivalent-of-two-weeks-every-year/05/12/

Vissing-Jorgensen, A. (2002). Towards an explanation of household portfolio choice heterogeneity: Nonfinancial income and participation cost structures. Technical report, National Bureau of Economic Research.