While the Covid-19 shock to the world economy is, in many respects, unprecedented, the recovery that is expected could nevertheless be similar to past ones. Reconstruction and sectoral reallocation of activity and employment are processes that take time, and debt is likely to weigh on aggregate demand. The speed of the recovery will therefore depend less on the nature of the shock than on the measures taken to limit its impact.

The contraction in activity caused by the Covid-19 pandemic will almost certainly be, in many countries, the largest year-on-year contraction since the 1929 crisis. The Eurosystem forecasts a year-on-year decline in GDP of 8.7% in the euro area, and the Banque de France projects a 10.3% fall in France in 2020. While in most European countries the use of short-time working has considerably curbed the rise in unemployment, the lack of such a mechanism in the United States led to a sharp rise in the unemployment rate, from 3.5% in February to 14.7% in April.

The initial impact of lockdown on economic activity was unavoidable, and an initial rebound was to be expected when it was lifted. However, the speed of the recovery in the coming months and years is more uncertain, as is the peak in the unemployment rate, which the Banque de France forecasts at 11.8% in mid-2021 for France.

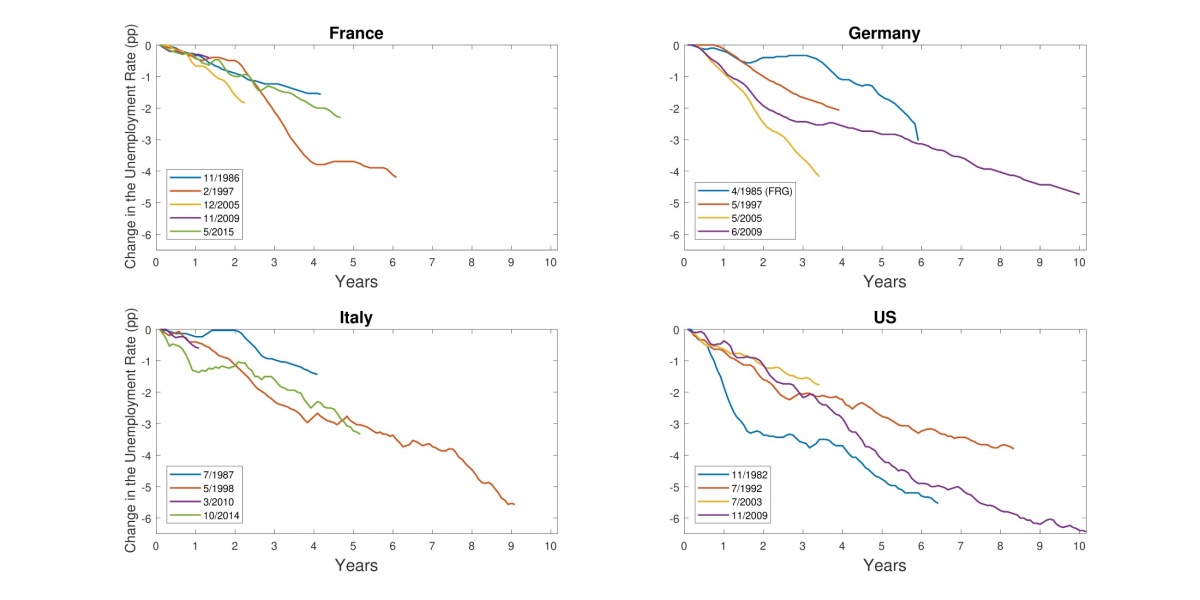

If we measure the business cycle by changes in the unemployment rate, the recessions of the last 40 years have nevertheless been characterised by the consistency of the speed of their recovery, both in the United States and in the euro area. Chart 1 shows that in France, Germany, Italy, and the United States, once the unemployment rate peaked, it fell at a rate that was fairly similar from one crisis to the next: on average 0.55 percentage point (pp) per year in France and Italy, 0.7 pp in Germany, and 0.63 pp in the United States.

Chart 1: Fall in Unemployment in France, Germany, Italy and the United States during recent recoveries.

Percentage point change in the unemployment rate relative to the maximum level reached at the end of each contraction (date shown in the key). The end of contraction and end of expansion dates are determined using changes in the unemployment rate, following the method described in Dupraz Nakamura Steinsson (2020). With unemployment rising significantly in the wake of the European sovereign debt crisis in France and Italy (but not in Germany and the United States), the method puts the end of the recovery from the 2008 crisis at 2012 for France and Italy (and at 2019 for Germany and the United States).

Source: OCDE.

But given the particular nature of the current crisis, are past recoveries a good predictor of the forthcoming recovery? If the Covid-19 crisis is in many ways unprecedented – in terms of the “deliberate” nature of the initial drop in activity, and the combination of supply and demand shocks – the aspect that could give some grounds for optimism as to its recovery is the exogenous nature of the Covid-19 shock. Indeed, the current recession is not the result of the usual economic factors.

This optimism can take several forms: the future recovery may be faster because the Covid-19 crisis does not stem from the overheating of the economy, it is not the result of a misallocation of production factors, and did not primarily affect the financial sector.

The first argument is that the current crisis does not stem from an economy that was operating above its potential, and that it would therefore be easier to return to the previous level of production, initially taking into account the new health constraints. This conception of the business cycle is common in macroeconomics: economic activity is said to fluctuate around a natural rate, with recessions usually occurring when activity is too buoyant and recoveries starting when it is too subdued.

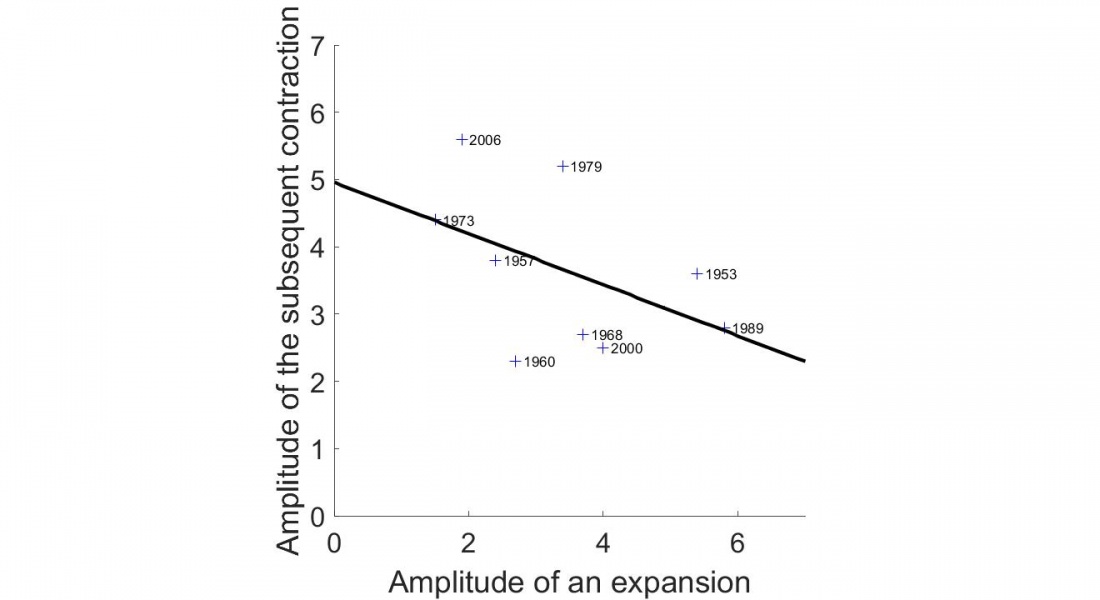

Chart 2: The unpredictability of the amplitude of recessions in the United States from 1948 to 2019.

A contraction (expansion) is defined here as an increase (decrease) in the unemployment rate by more than 1.5 percentage point and its amplitude as the amplitude of the increase (decrease) in the unemployment rate (see Dupraz Nakamura Steinsson (2020) for a more precise definition). Source: BLS, seasonally adjusted civilian unemployment rate.

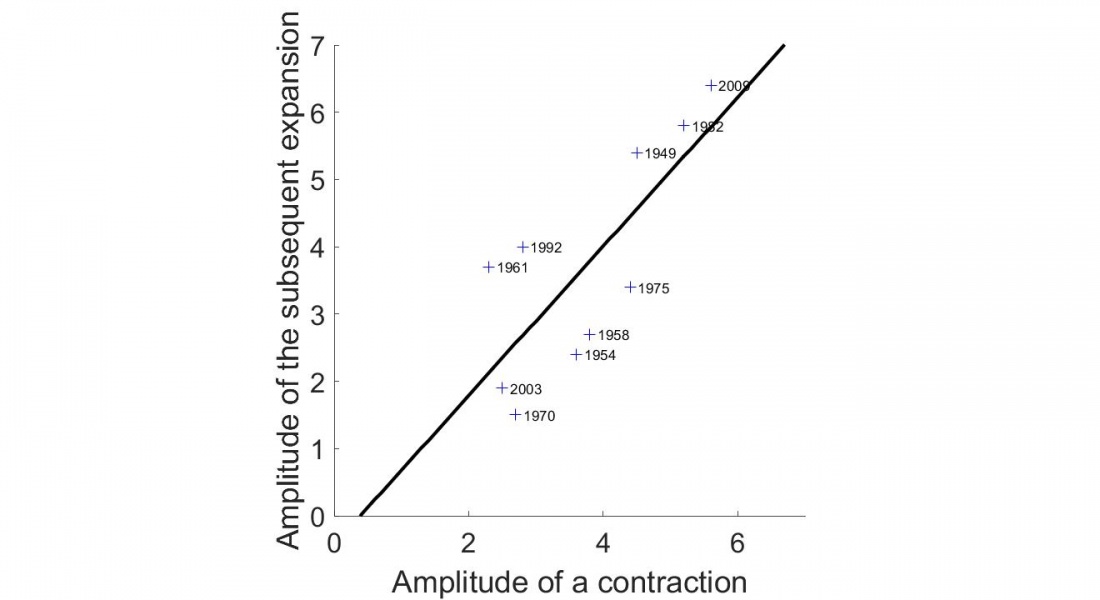

Dupraz, Nakamura and Steinsson show, however, that there is little support for this view in the data. If this were the case, we should observe that the largest contractions occur after the largest expansions, when the economy is most overheated. Yet Chart 2 shows that, if we look at the United States since 1948, we observe nothing of the kind; a regression even gives a negative, but not statistically significant, relationship. But conversely, as Chart 3 shows, the amplitude of an expansion is very similar in each case to that of the previous contraction (1.09 times on average). The business cycle in the United States seems to be better described by Milton Friedman’s “plucking model”: the economy mostly operates below its potential, towards which it would converge if contractions did not periodically delay it from reaching this level. The current and past recessions would therefore be similar in this respect: they are destroying jobs and businesses that were not excessive in view of production capacity. The “plucking model”, while implying that the post-Covid-19 recovery should be broader than past recoveries, therefore also suggests that the speed of past recoveries is not a bad indicator of the time it will take to rebuild the jobs and businesses destroyed by the Covid-19 crisis. The recovery will therefore not necessarily be faster.

Chart 3: The “plucking” property in the United States from 1948 to 2019

A contraction (expansion) is defined here as an increase (decrease) in the unemployment rate by more than 1.5 percentage point and its amplitude as the amplitude of the increase (decrease) in the unemployment rate (see Dupraz Nakamura Steinsson (2020) for a more precise definition). Source: BLS, seasonally adjusted civilian unemployment rate.

A second argument is that if ordinary crises are followed by slow recoveries, it is because they occur as a reaction, if not to excess production, at least to misallocated production, often due to the misallocation of credit: for example, over-investment in real estate and construction before the 2008 crisis, or in low-productivity enterprises. The following recession then leads to a slow reallocation within and across sectors. As the Covid-19 crisis is not directly caused by a misallocation of production, a faster recovery could be expected.

However, the Covid-19 crisis is also expected to lead to significant sectoral reallocations that could slow the recovery. The various sectors have been affected by the crisis in very different ways, with some, such as the IT sector and large retailers, even experiencing an increase in demand. Some of the changes in consumption and production patterns resulting from social distancing – in catering, culture, work organisation (teleworking) and telemedicine – are likely to persist. Public health care investment projects and the relocation of certain industries are also major structural changes that will take time.

The third argument is that the current crisis is not a financial crisis, which is often followed by a slow recovery. We could therefore hope for a quicker recovery.

While some of the causes of these slow recoveries might also be present in this recovery – for example, the Covid-19 crisis has seen a sharp increase in corporate and government debt ratios, which could weigh on aggregate demand – other aspects do indeed give grounds for optimism. The banking sector, which is in a stronger position than in 2008, has this time acted as a shock absorber rather than an amplifier of the crisis. Its ability to play this role is also thanks to the scale of the measures taken by governments and central banks: in the euro area, through the easing of bank refinancing conditions and EUR 1.35 trillion in asset purchases.

The lesson is more general: the time it takes for the economy to recover depends more on the economic policies implemented to avoid the destruction of jobs and businesses beyond those necessary for a reallocation of activity, than on the possibility of recreating them more rapidly than usual.