Monetary Policy and Research department of Bank of Finland, and Monetary Policy and Research department of Bank of Finland & Economics Department of University of Turku, respectively. All opinions expressed here are our own and do not necessarily reflect those of Bank of Finland and the Eurosystem.

Summers, L. (2022) Twitter tweet on persistence of inflation on October 27, 2022. https://twitter.com/LHSummers/status/1585607005707931648

All empirical analyses in this paper are based on global cross-country data on all IMF countries (193) for 1970-2021. Further details are available in our forthcoming discussion paper.

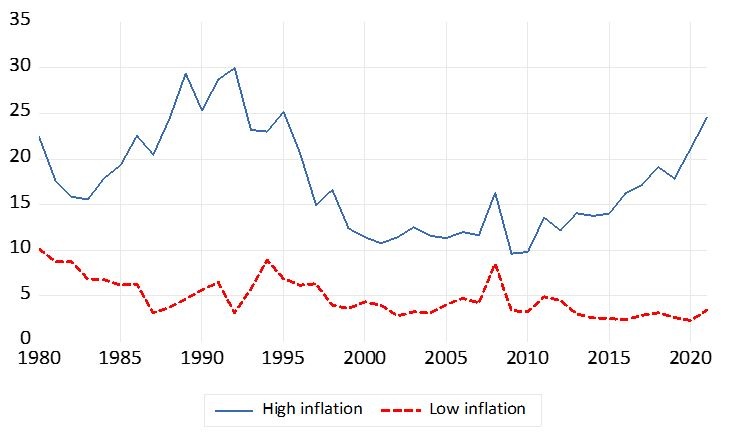

When inflation is below 10 per cent, the sample standard deviation is 2.7 but if inflation is above 10 per cent (up 100 per cent), the standard deviation is already 17.4. This regularity was already pointed by Okun (1971).