In this note, we discuss how the too-big-to-fail dilemma for large financial institution is addressed in the regulatory framework and how (differently) regulators in the EU apply it. The European Banking Authority (EBA) has devised a buffer guideline for identifying other systemically important institutions (OSIIs) to address this issue. This guideline defines how to identify OSIIs by a scoring process but does not specify how to map these scores into additional capital buffers. In this study, we empirically show that the OSII buffer assignment is very heterogeneous in Europe. Based on all EU banks that are classified as OSIIs between 2015 and 2018, we show that the OSII score has less impact on the OSII buffer than the headquarter country dummy of the bank after controlling for other important bank specific variables. We also quantify the extent of country heterogeneity in the buffer assignment, which would increase additional capital requirements in the euro area by 90 bn EUR. Finally, we discuss if our results could be partially explained by regulatory capture.

Introduction

The recent financial crisis has shown that identifying systemically important financial institutions is a key topic in financial regulation. The depth and severity of the financial crisis were clearly amplified by the assumption that certain financial institutions were too big to fail (e.g. Lehman Brothers). Policy makers and regulators had to address the too-big-to-fail dilemma. In Article 131(3) of Directive 2013/36/EU (CRD) a guideline defines the scoring process (OSII score) for assessing the systemic importance of institutions. Furthermore, the article defines a minimal score above which banks have to be classified as other systemically important institution (OSIIs) and that and an additional (OSII) capital buffer of up to 2% of the total risk exposure amount consisting of Common Equity Tier 1 capital can be set for each OSII.

In EBA (2014), the technical standards for this guideline are further specified for other systemically important institution (OSIIs). The OSII score is defined between 0 and 10,000. The OSII score is weighted sum of 10 variables from four different categories (each with a weight of 25%) based on bank-specific data: (1) Size: Total assets, (2) Importance: (2A) value of domestic payment transaction, (2B) private sector deposits from depositors in the EU, (2C) private sector loans to recipients in the EU, (3) Complexity: (3A) Value of over the counter derivatives (notional), (3B) cross-jurisdictional liabilities, (3C) cross-jurisdictional claims and (4) Interconnectedness: (4A) intra financial system liabilities, (4B) intra financial system assets, (4C) debt securities outstanding. By dividing each weighted criterion by the weighted sum (across all banks in a country) of each criterion, it is possible to compare OSII scores across countries. In this step, the EBA scoring process adjusts for different sizes of the banking sector across countries.

However, most critically, EBA (2014) does not specify how to translate the OSII scores into OSII buffers. In line with the literature (Wheelock, 2000), EBA (2014) states that the OSII buffer should reduce an institution’s probability of default and therefore reduce the expected losses caused by this institution in the financial system. Therefore, in theory a higher OSII score should lead to a higher OSII buffer. However, the benefits of lower OSII buffers for banks are also straightforward. Ceteris paribus, a higher capital ratio reduces the return on equity. Some OSIIs might be forced to raise new capital, while for all others at least their management buffer shrinks. There is obviously a conflict of interest between the public (taxpayer) and the banking industry. Given this conflict, Carpenter (2014) suggests checking five points for a potential case of regulatory capture.

In our recent paper (Sigmund, 2020), we empirically show how differently the regulatory authorities of the EU member states translate OSII scores into OSII buffers, despite the unified guideline how to identify and score OSIIs. In the process, we test the assumption that the OSII score has an influence on the OSII buffer for all European OSIIs. Second, we debate the “international cooperation perspective hypothesis” vs. the “special interest perspective hypothesis” (Schuknecht and Siegerink, 2018) in the view of potential regulatory capture (Stigler, 1971; Laffont and Tirole, 1991; Carpenter, 2014). Third, we test the robustness of our results by different estimation methods and sub samples of our data. Fourth, we formalize the qualitative approach to regulatory capture (Carpenter, 2014) by a Nash bargaining problem.

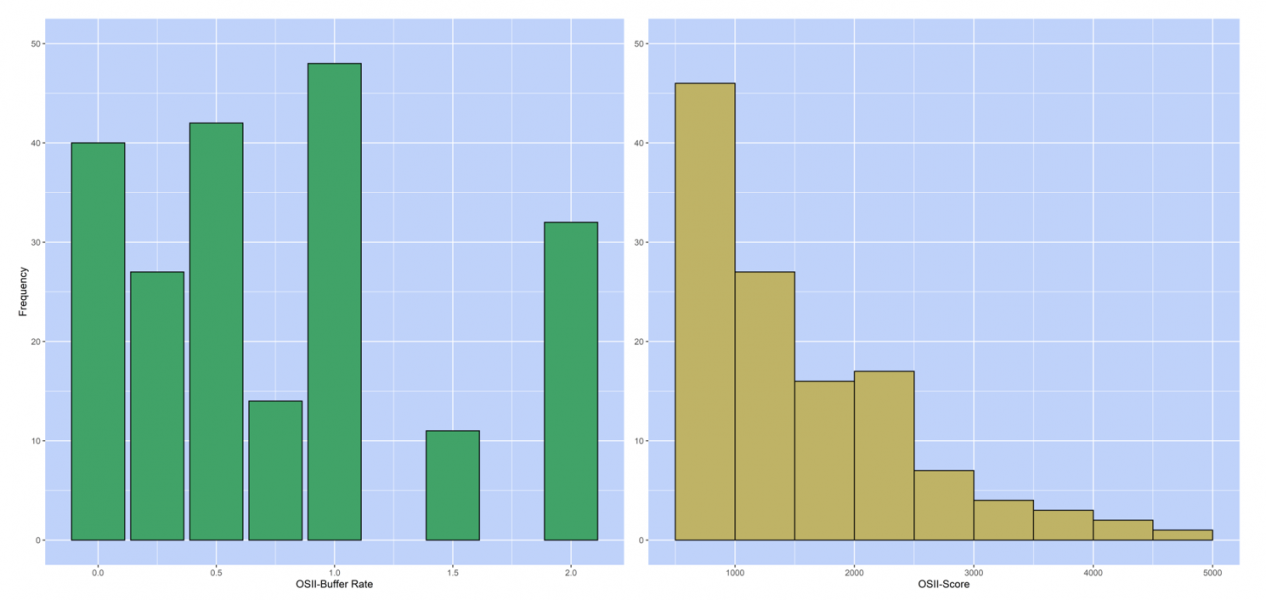

The main findings of the paper can be summarized in Figure 1.

Figure 1: OSII Buffers vs. OSII Score Frequency

The left histogram shows the frequency of OSII buffers between 0% and 2%. The right histogram shows the frequency of OSII scores between 0 and 5000.

The difference in the distributions of the OSII buffers and the OSII scores already implies that the OSII scores are not solely responsible for the resulting OSII buffer sizes.

To measure the amount of country heterogeneity in OSII buffer assignment, we estimate ordered probit models, Poisson count data models and ordinary least squares models with the OSII score and country dummies as explanatory variables for the OSII buffer.

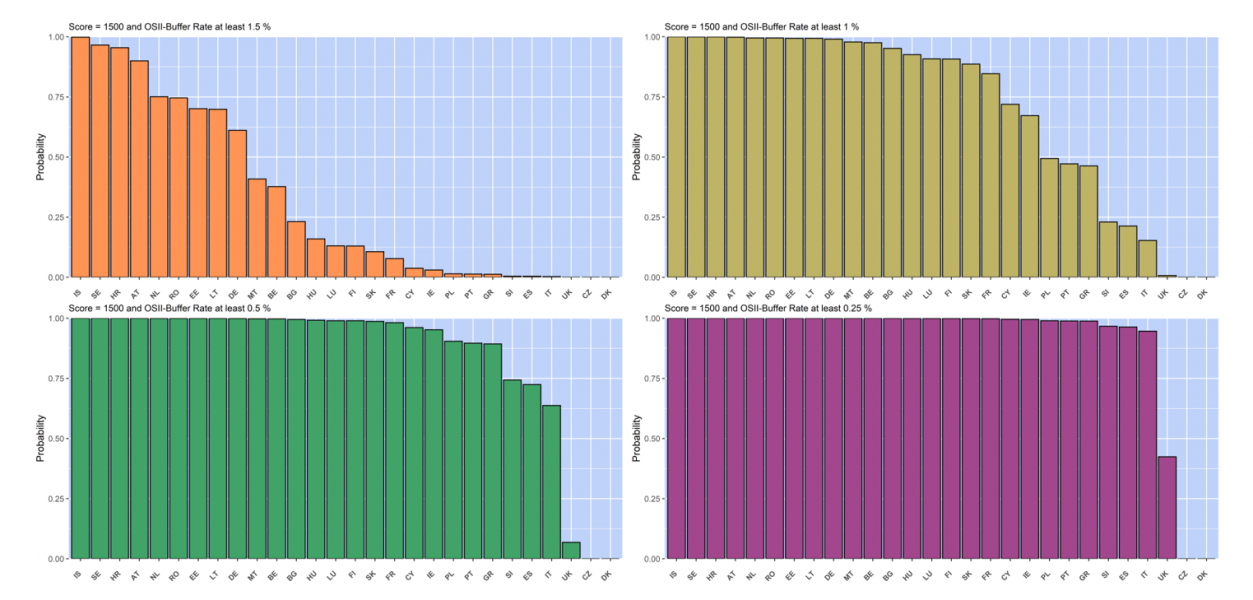

Figure 2: Probabilities with the declared OSII buffer rate and a score of 1500.

Source: Sigmund (2018) Table 3. Estimated probabilities of an OSII buffer of 1.5% (top left), of 1% (top right), of 0.5% (down left) and of 0.25% (down right) given an OSII score of 1500 points. The estimated probabilities are based on an ordered probit model with OSII score and 28 country dummies as explanatory variables.

In Figure 2, we translate the estimation results of the ordered probit model (with OSII score and country dummies as explanatory variables) to specific buffer probabilities. Figure 2 shows how large the probabilities of a bank with a score of 1500 are to obtain a certain OSII buffer size ( 1.5 %, 1 %, 0.5 % and 0.25 % respectively).These probabilities give a very good impression, how differently regulatory authorities in the EU member states assign OSII buffers to their respective banks even if the OSII scores are similar. How much buffer an institution is attributed, does not only depend on the institutions’ OSII score, but also depends – and even more strongly – on the local regulator. Obviously, financial stability would benefit from a race to the top (all countries apply the most prudent translation process) than from a race to the bottom. However, reducing heterogeneity could also be accomplished by assigning lower OSII buffers for all banks. However, this would be against the expected impact theory (BSBC, 2013; Governors of the Federal Reserve System, 2015). The expected impact theory uses three key features to derive capital surcharges: (1) an estimation of probability of default, (2) a method of measuring social losses given default, (3) a choice of a reference bank. Based on the impact theory, Passmore and Hafften (2019) claim that OSII buffers should be much higher and lie between 3% and 8.25%, mainly to reduce the estimated probability of default.

We also implement a potential capital requirement scheme simulation, where each regulator would copy the German OSII buffer translation. The regulatory minimum capital of European banks would increase by 90 billion Euro. To put 90 billion Euro in perspective, we refer to Eurostat (2015) and Eurostat (2018), which report the total costs for the general governments in the EU-28 to support financial institutions to 241.3 bn euro from 2007 to 2017.

Consequently, we search for other variables to explain the country heterogeneity in the OSII buffer assignment. Following the theory on regulatory capture (Stigler, 1971; Laffont and Tirole, 1991), we use the step-by-step approach of Carpenter (2014) to make the case for potential regulatory capture and then identify variables that could serve as good proxies.

First, we include the Tier 1 capital ratio and the operating income ratio (income divided by total assets) as possible predictors for the OSII buffer. These variables capture the strength of a bank and we assume that weak banks might try harder to lobby for a lower OSII buffer assignment.

Next, we look at a very specific macroprudential regulation, namely the systemic risk buffer (SyRB), and its national implementation. The SyRB is intended to mitigate the vulnerability of institutions against risks emanating from parts or the whole financial system. Financial institutions are then required to hold additional own funds to increase their loss-absorbing capacity. Interestingly, only five euro area member states (AT, EE, FI, NL and SK) and a few other EU member states (BG, HR, CZ, DK, HU, IS, RO and SE) have implemented the SyRB in their national regulation. We believe that the implementation and the setting of the SyRB is a good indicator of regulatory capture.

On the country level, we add a variable that measures control of corruption from the worldwide governance indicators database (Kaufman et al., 2011). Control of corruption captures perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as capture of the state by elites and private interests.

Finally, we add the dummy variable “Mapru by CB” to measure regulatory capture. The simple idea is the central bank should be more independent from industry and other political influences than other institutions, since central banks in most developed countries are institutionally independent from political interference. The dummy variable “Mapru by CB” has a value of 1, if the central bank has the leading role in the macroprudential regulation and, consequently writes the first draft on the OSII buffer assignment and 0 otherwise. This group of countries includes BE, CY, CZ, EE, FI, FR, GR, HU, IE, LT, MT, NL, PT, RO, SE, SK and additionally AT, BG, DE, LV and SI.

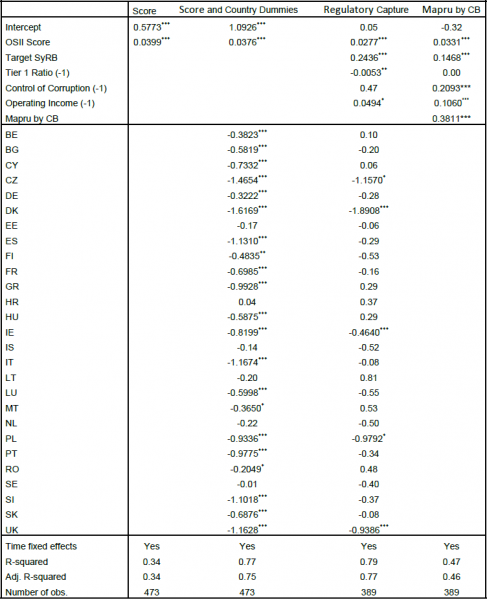

In order to make the interpretation of the estimated coefficients straightforward, we present the ordinary least squares results. The coefficients show by how much the OSII buffer would be changed if the explanatory variables increase by one unit.

Table 1: OSII Buffer Models

***p < 0.001; **p < 0.01; *p < 0.05. The dependent variable is the OSII buffer.

In all models, the OSII score coefficient is positive and statistically significant. A higher score increases the probability of a higher OSII buffer.

However, as shown in the “Score and Country Dummies” column of Table 1 the coefficients of the country dummies are completely different and reach from around -1.62 to around 0 with AT being the reference country. It leads to an important question: How much does the country of an OSII matters for the OSII buffer? The size of the country dummies already indicate that it might be more important than the OSII score. In the “Regulatory Capture” column of Table 1, we are able to reduce the significance and the size of many country dummies by adding the explanatory variables Target SyRB, Tier 1 Ratio (-1), Operating Income Ratio (-1) and Control of Corruption (-1). Regulators who assign positive SyRBs also assign higher OSII buffers. A higher control of corruption in a country leads ceteris paribus to a higher OSII buffer.

Finally, the coefficient of “Mapru by CB” also has a positive sign and is highly significant, supporting the hypothesis that central banks are more independent than other public institution as well as the recommendation by ESRB (2011) that the national central bank should have a leading role in macro-prudential oversight.

Following Calomiris and Haber (2015) who state that regulation is a complex bargaining between industry and politics, we also provide a theoretical model for the OSII buffer assignment. It is modelled as a (Nash) bargaining process (Nash, 1953) between the regulatory authority and banks’ representatives. Assigning the OSII buffer can be seen as a variant of “the diving a dollar”, where the regulator prefers to assign an optimal OSII buffer, depending on certain bank/country characteristics (tier 1 capital ratio, operating income ratio, systemic risk buffer and regulatory quality) and the banks’ representatives prefer a buffer of 0%. Using the bargaining outcome, which is the OSII buffer, we can calculate the bargaining power of each country regulator. Details on the bargaining power as well as many other robustness checks can be found in Sigmund (2020).

In this paper, we present a first empirical analysis of how differently EU member states calibrate their buffer rates for other systemically important institutions. Given the fact that the identification of OSIIs is based on the unified approach by EBA (2014) and is comparable across countries, our results on the OSII buffer assignment are quite surprising. Although the OSII score has the expected positive coefficient, implying that on average banks with a higher OSII score receive a higher OSII buffer, the country specific dummies are more important. A different degree of regulatory capture and/or different preferences of the national regulators in the OSII assignment process might be a potential explanation for this finding. We also show that there is probably a missing link in the recommendation by EBA (2014) of how to map the OSII scores into OSII buffers.

We also provide evidence that there is different degree of regulatory capture in all countries following the qualitative approach by Carpenter (2014) step-by-step. For example, many countries have not yet implemented the SyRB, which also a macroprudential tool to address the too-big-to-fail dilemma or set very low SyRBs. In some countries, the ESRB recommendation (ESRB, 2011) to establish a macroprudential authority has been ignored or the independence of such an authority is questionable.

Finally, we make a case for a unified OSII scoring and assignment process across all EU countries to ensure a level playing field for all OSIIs in the European union. If regulators and policy maker cannot agree on such a unified assignment process, which is very likely, any form of minimal standards would improve the bargaining power of the regulator. After all, based on the bank data of the financial crisis in 2007/2008, Passmore and Hafften (2019) claim that OSII buffers should be much higher and lie between 3% and 8.25%.

SUERF Policy Notes (SPNs) focus on current financial, monetary or economic issues, designed for policy makers and financial practitioners, authored by renowned experts. The views expressed are those of the author(s) and not necessarily those of the institution(s) the author(s) is/are affiliated with.

Editorial Board: Natacha Valla (Chair), Ernest Gnan, Frank Lierman, David T. Llewellyn, Donato Masciandaro.

SUERF – The European Money and Finance Forum

c/o OeNB

Otto-Wagner-Platz 3

A-1090 Vienna, Austria

Phone: +43-1-40420-7206

www.suerf.org • suerf@oenb.at

Basel Committee on Banking Supervision (2013). Global Systemically Important Banks: Updated Assessment Methodology and the Higher Loss Absorbency Requirement. Bank for International Settlements (July). Available at https://www.bis.org/publ/bcbs255.pdf.

Board of Governors of the Federal Reserve System (2015). Calibrating the G-SIB Surcharge. White Paper (July 20). Available at https://www.federalreserve.gov/aboutthefed/boardmeetings/gsib-methodology-paper-20150720.pdf.

Calomiris, C. and Haber, S. (2015). Fragile by design: The political origins of banking crises and scarce credit. Princeton University Press.

Carpenter, D. (2014). Detecting and measuring capture. In Carpenter, D. and Moss, D., editors, Preventing Regulatory Capture – Special Interest Influence and How to Limit It, chapter 3, pages 57–68. Cambridge University Press.

EBA (2014). On the criteria to determine the conditions of application of Article 131(3) of Directive 2013/36/EU (CRD) in relation to the assessment of other systemically important institutions (O-SIIs). EBA guideline, European Banking Authority.

ESRB (2011). Recommendation of the European systemic risk board of 22 December 2011 on the macro-prudential mandate of national authorities. Technical Report ESRB/2011/3, European Systemic Risk Board, Frankfurt.

Eurostat (2015). Supplementary Table for the Financial Crisis. Background note, Eurostat.

Eurostat (2018). Supplementary Table for Reporting Government Interventions to Support Financial Institutions. Background note, Eurostat.

Kaufmann, D., Kraay, A. and Mastruzzi, M. (2011). The Worldwide Governance Indicators: methodology and analytical issues. Hague journal on the rule of law 3(2), 220-246.

Laffont, J. and Tirole, J. (1991). The politics of government decision-making: A theory of regulatory capture. The quarterly journal of economics,106(4), 1089-1127.

Passmore, W. and von Hafften, A. (2019). Are Basel’s Capital Surcharges for Global Systemically Important Banks Too Small? International Journal of Central Banking, 15(1), 107-156.

Sigmund, M. (2020). The Capital Buffer Calibration for Other Systemically Important Institutions – Is the Country Heterogeneity in the EU caused by Regulatory Capture? OeNB Working Paper Series, 232. https://www.oenb.at/Publikationen/Volkswirtschaft/Working-Papers/2020/working-paper-232.html

Stigler, G. (1971). The theory of economic regulation. The Bell journal of economics and management science, 3-21.

Wheelock, D. and Wilson, P. (2000). Why do banks disappear? The determinants of U.S. bank failures and acquisitions. The Review of Economics and Statistics, 82(1):127-138.

Oesterreichische Nationalbank, Economic Analysis Division, michael.sigmund@oenb.at. The views expressed in this article are exclusively those of the authors and do not necessarily reflect those of the OeNB or the Eurosystem.