The views expressed are those of the authors and do not necessarily reflect those of the Banque de France.

The energy transition will require large quantities of critical raw materials (CRMs). Against this backdrop, the European Union (EU) has recently enacted legislation aimed at increasing the security of its supplies of critical raw materials (Critical Raw Materials Act, 2024). However, mining and processing of CRMs is geographically concentrated in countries that are geopolitically distant from the EU. While the geographical concentration of resources is well documented (Buysse and Essers, 2023; IRENA, 2023; Javorcik et al., 2023), ownership interests in extractive companies are less so. Yet documenting the sources of control of mining companies is essential for assessing strategic dependencies. In a recent paper, we show that investors from outside the European Union control a significant share of the capital of global listed companies involved in the mining of cobalt, copper, lithium, nickel and rare earths. Our results underscore the need to enhance the EU’s strategic autonomy and point to the need for a metal-specific strategy.

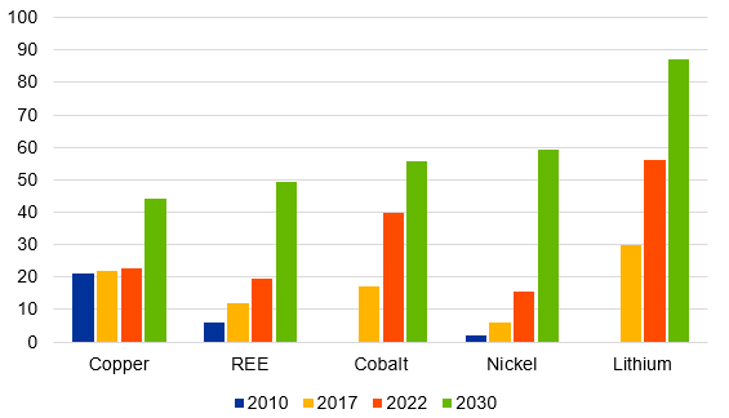

The energy transition will require large quantities of critical raw materials (CRMs). Projections by the International Energy Agency (IEA, 2023) indicate that the primary drivers of increased demand for CRMs will be the roll-out of electric vehicles and power grids. The increase in demand for CRMs is expected to be particularly strong for copper, cobalt, lithium, nickel and rare earth elements (see Figure 1).

Against this backdrop, the European Union (EU) has recently enacted legislation aimed at increasing the security of its supplies in critical raw materials and making itself more strategically autonomous (Critical Raw Materials Act, 2024). The European Commission has identified 34 critical materials (EC, 2023), selected based on their economic importance for the EU and supply risk.

Figure 1. Global demand for critical raw materials due to the energy transition (% of total demand)

Note: energy transition technologies accounted for 56% of global lithium demand in 2022. This share is expected to reach 87% in 2030 under an ambitious climate transition scenario (Net zero CO2 emissions by 2050). Neodymium demand is used as an indicator for rare earth elements (REE).

Sources: IEA (2023) and authors’ calculations.

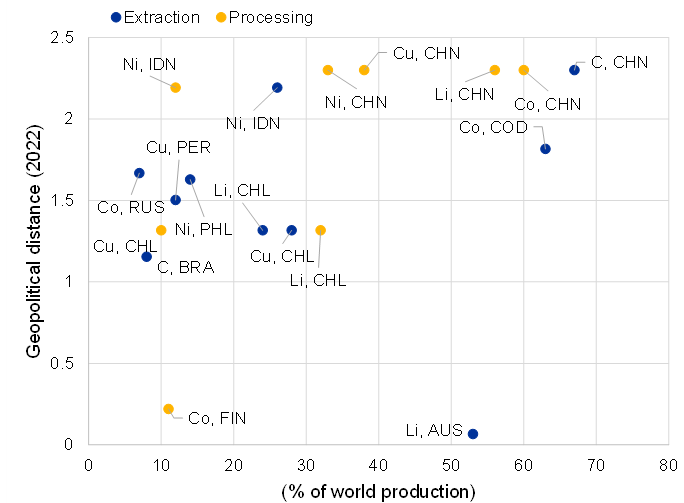

The mining and processing of critical raw materials is geographically concentrated in countries that are geopolitically distant from the EU. For instance, 73% of all cobalt is mined in the Democratic Republic of the Congo, 69% of rare earth elements are mined in China and half of the global nickel supply comes from Indonesia (USGS, 2023).

Figure 2 illustrates the concentration of critical raw materials extraction and transformation in relation to the geopolitical distance between the largest European economies (Germany, France, Italy and Spain) and critical raw materials producers. For cobalt (Co), nickel (Ni), lithium (Li) and copper (Cu), a significant share of global extraction and transformation is carried out by countries which are geopolitically distant from the EU.

The concentration of supply raises concerns that dominant countries may use their market position as leverage to pursue other strategic priorities (Buysse and Essers, 2023), highlighting an urgent need to strengthen the EU’s raw material strategy.

The geographical concentration of production is compounded by a concentration of firms controlling the supply of critical raw materials, yielding oligopolistic market structures (IRENA, 2023). A handful of multinational companies and state-owned (SOEs) or -controlled enterprises dominate a considerable share of global production. For instance, the top four mining companies control around 55% of cobalt output, while the top five mining companies control 80% of global lithium output. The concentration of supply is even higher for rare earth elements (REE), where a single Chinese company controls more than 40% of global output.

Figure 2. Share of world production of EU imports (x-axis) relative to the geopolitical distance of critical raw materials producers from the EU ( y-axis).

Note: The geopolitical distance reflects state positions toward the US-led liberal order, based on a dynamic ordinal spatial model, using United Nations General Assembly votes as inputs. The indicator has no unit and ranges from 0 to 6. Only the two main producing countries are shown for each mineral and production stage. C denotes natural graphite, Co cobalt, Cu copper, Li lithium and Ni nickel. AUS stands for Australia, BRA for Brazil, CHL for Chile, CHN for China, COD for the Democratic Republic of the Congo (DRC), FIN for Finland, IDN for Indonesia, PER for Peru, PHL for Philippines and RUS for Russia.

Sources: Bailey et al. (2017), European Commission (2023) and authors’ calculations.

While the geographical concentration of resources is well documented (IRENA, 2023; Javorcik et al., 2023), the ownership interests in extractive companies is less so. Yet documenting the sources of control of mining companies is essential for assessing strategic dependencies. Leruth et al. (2022) highlight the importance of understanding who controls the global supply chains of critical minerals and analyse how major shareholders can affect voting decisions in the top mining companies involved in the mining of CRMs.

To document the nationality of shareholders involved in the mining of critical raw materials, we design a comprehensive database documenting the origin of the shareholders of global listed companies involved in the mining of cobalt, copper, lithium, nickel and rare earths (Faubert et al., 2024). In line with the existing literature (Gulley et al., 2019), we equate influence (or control) over production with ownership share.

We develop several indicators to map the geographical origin of capital-owners, including production- and market capitalization-weighted holding rates, complemented by indicators focused on majority holdings.

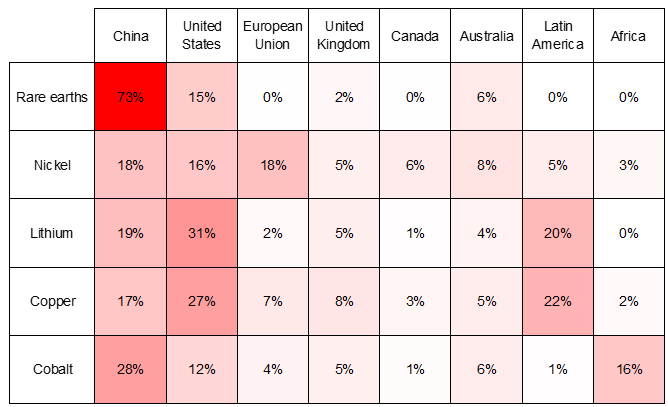

All indicators suggest that non-European investors control a significant share of the capital of critical raw materials listed mining companies. Figure 3 summarises ownership rates by investor origin for cobalt, copper, lithium, nickel and rare earths.

Figure 3. Production-weighted holding rates in critical raw materials listed mining companies

Note: The EU’s holdings in the nickel mining sector, which includes an estimated 14% share for Russian investors, is closer to 4% when European investors representing Russian interests are excluded. The EU’s holdings in the cobalt mining sector, which includes an estimated 3% share for Russian investors, is closer to 1% when Cypriot investors representing Russian interests are excluded.

Sources: Refinitiv and authors’ calculations.

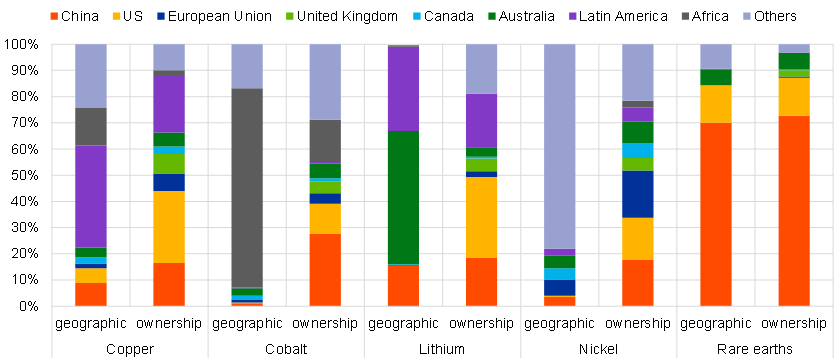

Figure 4 highlights the discrepancy that can exist between the geographical concentration of production and that of investors analysed through firm ownership. US investors, and, to a lesser extent, EU and UK investors, play a higher role in the copper and lithium supplies, relative to the production located in their respective countries. By contrast, Chinese investors have significant stakes in nickel and cobalt companies, while these minerals are predominantly mined in Indonesia for nickel and the Democratic Republic of the Congo for cobalt. For rare earths, production and capital ownership are aligned, with both the U.S. and China being major producers and investors.

Figure 4. Geographical concentration of production and ownership

Note: Nickel production is geographically concentrated in Indonesia, resulting in a substantial contribution from the ‘Others’ category in the bar chart that shows nickel production by region.

Sources: US Geological Survey, Refinitiv and authors’ calculations

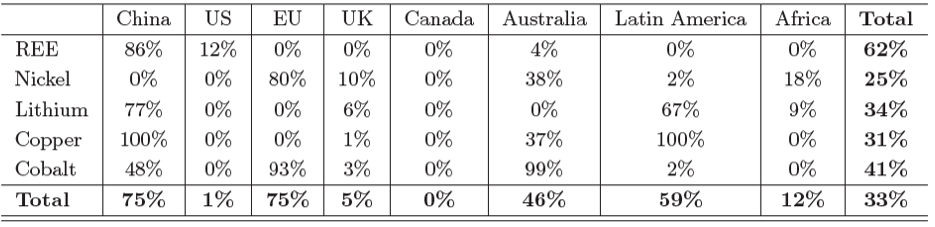

Table 1 documents the preponderance of strategic investors such as state-owned enterprises (SOEs) and other strategic investors (including founding families, board members, or management teams) in the ownership of firms involved in the mining of rare earths, and, to a lesser extent, in the mining of cobalt, lithium and copper. Chinese investors are overwhelmingly strategic investors, which concurs with the literature (IRENA, 2023). For instance, strategic investors account for 100%, 86% and 77% of Chinese investors’ holdings in firms extracting copper, REE and lithium, respectively. Strategic investors also play an important role in the exploitation of lithium and copper resources in Latin America. Indeed, strategic investors constitute 100% and 67% of Latin American investors’ holdings in firms extracting copper and lithium, respectively. Overall, the last column in Table 1 confirms the predominance of strategic investors for rare earths companies, which are largely owned by Chinese investors. Strategic investors also own about a third of the capital of firms involved in the mining of cobalt, lithium and copper. For instance, two strategic entities (Chile’s Pampa Group and China’s Tianqi Lithium) control half the capital of Sociedad Quí mica y Minera (SQM), the world’s second largest lithium company.

Table 1. Share of strategic investors in CRM mining companies in 2022

Note: Strategic investors account for 86% of Chinese investors’ holdings in the rare earths sector. Strategic investors account for 62% of all investors’ holdings in the rare earths sector.

Sources: Refinitiv and authors ’ calculations.

Several caveats should be borne in mind when interpreting our results:

Despite these limitations, our database provides an overview of ownership interests in listed CRM companies, against a backdrop of increasing geopolitical risks.

The EU’s CRM Act aims to reduce strategic dependencies by diversifying the EU’s supplies. However, it does not address vulnerabilities associated with the concentration of capital. Indeed, the CRM Act sets diversification targets at producer country level. Such targets do not address concentration risks linked to capital ownership. Assessing concentration in the mining sector through shareholdings data shows a very different picture compared with the geographical mine location. Hence, our database could be useful for identifying vulnerabilities linked to capital ownership and for refining the diversification targets set by the EU.

The CRM Act also aims to improve the EU’s capacities for the extraction, processing and recycling of critical raw materials. Developing the European mining industry will require substantial funding from private sources (Hache and Normand, 2024). In light of the EU’s commitment to strengthen its economic security, assessing the sources of control of European mining companies is paramount for gauging supply and geopolitical risks within the EU. Against this background, our results suggests a need for increased transparency regarding the sources of control of new mining projects announced in the EU. Overall, our analysis highlights the need to enhance the EU’s strategic autonomy and suggests the need for a metal-specific strategy. In particular, our database could be instrumental in guiding investment decisions, should European entities seek to increase their shareholdings in major CRM firms.

Michael A. Bailey, Anton Strezhnev, and Erik Voeten (2017), “Estimating Dynamic State Preferences from United Nations Voting Data.” Journal of Conflict Resolution, 61(2):430–456, February.

Kristel Buysse and Dennis Essers (2023), “Critical raw materials: from dependency to open strategic autonomy?” Economic Review, pages 1–35, November.

European Commission (2023), “Study on the critical raw materials for the EU 2023: final report.” Publications Office of the European Union, May.

Violaine Faubert, Nathan Guessé and Julien Le Roux (2024), “Capital in the Twenty-First Century: Who owns the capital of firms producing critical raw materials?” Banque de France Working Paper, July.

Andrew L. Gulley, Erin A. McCullough, and Kim B. Shedd (2019), “China’s domestic and foreign influence in the global cobalt supply chain”, Resources Policy, 62:317–323, 2019. ISSN 0301- 4207.

Emmanuel Hache and Emilie Normand, (2024), “Critical materials: assessing the EU strategy”, Veblen Institute, March.

IEA (2023), “Critical minerals market review 2023”.

IRENA (2023), “Geopolitics of the Energy Transition: Critical Materials”, July.

Beata Javorcik, Lucas Kitzmüller, Sushil Mathew, Helena Schweiger, and Xuanyi Wang (2023), “The green transition and geopolitical tensions”, VoxEU, 21 Nov 2023.

Luc Leruth, Adnan Mazarei, Pierre Régibeau, and Luc Renneboog (2022), “Green energy depends on critical minerals. Who controls the supply chains?” Working Paper Series WP22-12, Peterson Institute for International Economics, August.

USGS (2023), “Metals and minerals. Minerals Yearbook”, US Geological Survey.