Abstract

This policy brief examines the role of capital markets in accelerating the adoption of renewable energy sources across Europe. Well-designed transition strategies towards renewable energy are important to help mitigating climate change and to shield European economies from energy price volatility and geopolitical disturbances. Our findings show, that capital markets play an important role in speeding up the adoption of renewable energy production through more risk-tolerant investments. This applies in particular to investments in wind energy, but arguably also to large-scale investments in solar power generation. Results suggest that stronger EU capital markets and the completion of the Capital Markets Union (CMU) could play an important role in speeding up the transition towards a green EU energy sector.

Climate change causes major risks for economic development and financial stability. Following the Paris Climate Agreement in 2015, the EU took major steps towards decarbonising the European economy. An important element of the decarbonisation process relates to energy production, one of the main emitters of greenhouse gas. Moving from fossil fuels to sustainable electricity sources such as solar and wind energy entails, however, substantial capital requirements. Moreover, investments in sustainable energy production are often associated with higher risks than standard corporate and household lending. This in turn raises the concern that banks, the dominant player in the EU’s financial system, cannot or do not want to meet all the funding needs associated with decarbonising Europe’s energy sector (Mauderer, 2022).

Renewable energy production is based on a heterogeneous set of technologies, whose applicability varies strongly between countries and regions. Moreover, the scale of implementation varies largely from small installations of individual households (e.g. solar panels on residential real estate) to large infrastructure projects, e.g. large wind farms or hydroelectric installations. The financing requirements will thus differ substantially between individual EU countries.

In this policy brief, we shed light on the role of capital market development for the transition towards renewable energy production in European countries. We follow up on the findings in Horky and Fidrmuc (2024), by disentangling the impact of capital market development for different renewable energy sources. We show the heterogeneous influence of financial institutions and capital markets on electricity generation from hydropower, wind and solar and call for a renewed focus on capital market development in Europe. Improved European capital markets could help to satisfy the large and relatively risky investment needs associated with the transition towards sustainable energy production.

Transitioning to renewable energy sources helps mitigating climate change. Additionally, energy production from fossil fuels has significantly higher marginal costs compared to renewable energy sources (Kremer et al., 2021) and energy prices are a key factor for producer and consumer prices (Ingoglia et al., 2024). Renewable energy adoption is thus not only a mitigant against climate change but also helps to shield European economies from energy price volatility as well as geopolitical disturbances.

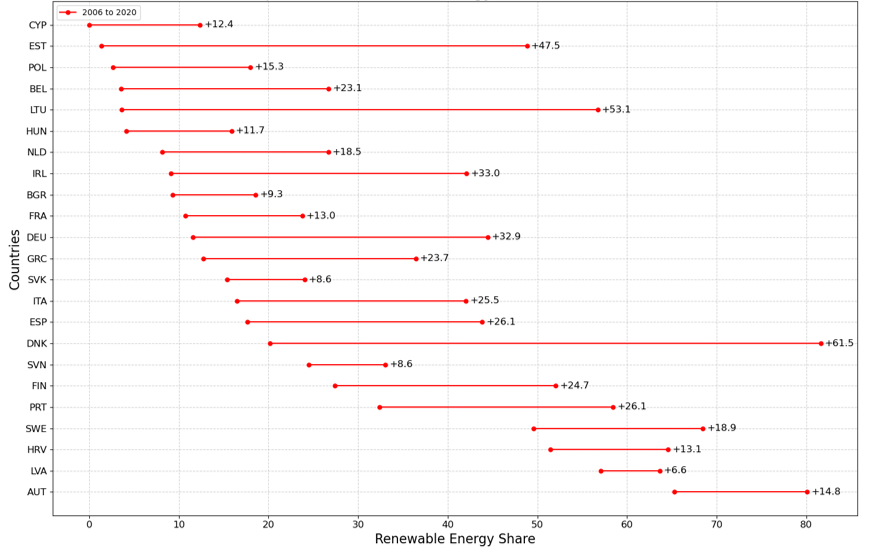

The adoption of renewable energy in Europe between 2006 and 2020, as depicted in Chart 1, varies a lot across countries. While some nations, have made substantial progress, others have seen much more modest increases in their renewable energy share. This uneven growth appears to be independent from the initial share of renewable electricity production, indicating that the successful adoption of renewable energy is not solely dependent on existing infrastructure but also on favorable economic conditions, supportive policy frameworks, and the financial environments.

Chart 1. Development of renewable energy production share from 2006 to 2020

Source: Author’s own calculations based on https://ourworldindata.org/grapher/share-electricity-renewables

Notes: The graph depicts the change of renewable energy production share in European countries between 2006 and 2020.

Investments in renewable energies are linked to several financial risks, due to the typically high investment costs and uncertain prospects (Kim & Park, 2016). Predominant risks in the renewable energy sector include curtailment risk, policy reversal risk, price risk, resource risk, and technology risk, given the high-tech nature of most renewable energy production infrastructure (Egli, 2020). Research by Horky & Fidrmuc (2024) suggests that a higher share of bank-based finance, tends to reduce renewable energy consumption per capita. This is contrasted by the positive impact of capital market development on renewable energy adoption.

These findings are not altogether surprising. Banks tend to be relatively more cautious than market-based financial investors in their lending decisions, prioritizing the safety of customer deposits and minimizing risks, which leads to a more conservative approach towards funding renewable energy projects. By contrast, capital markets tend to have a greater tolerance for risk in return to profits. Given that they do not take deposits, they are also generally more lightly supervised and less constrained in their decision-making. They are thus better positioned to support innovative sectors like renewable energy technology and production. Additionally, banks often have well-established relationships with their existing clients, including long-term existing fossil energy producers. These relationships can create additional disincentives to financing renewable energy producers. Capital markets are often less bound by such ties.

We utilize the IMF financial development scores#f1 (Svirydzenka, 2016) to analyse the impact of banking sector and capital markets development on renewable energy production in Europe.

(FI) and capital markets (FM) each of which cover the depth and the accessibility of the financial institutions and markets.

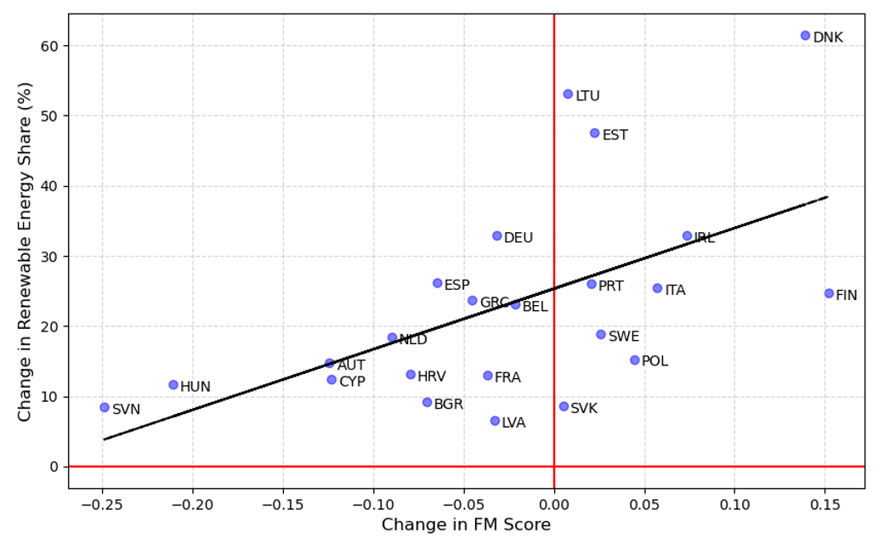

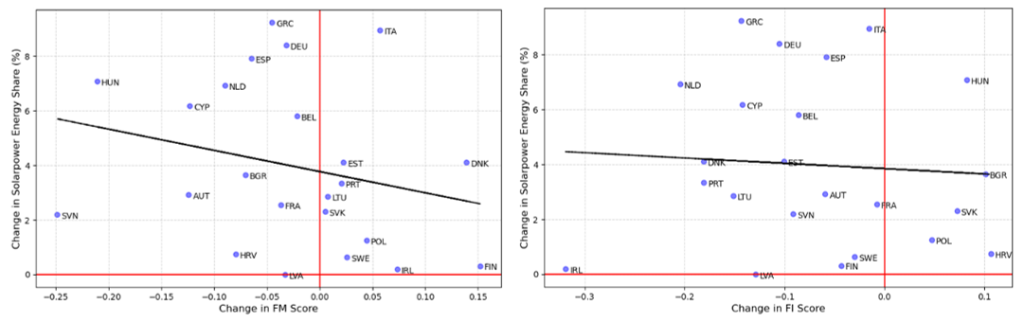

Chart 2. Change in capital markets development vs. change in renewable energy production share (2006 – 2020)

Source: Author’s own calculations based in the IMF capital market development score and the share of electricity production from renewables as taken from https://ourworldindata.org/grapher/share-electricity-renewables

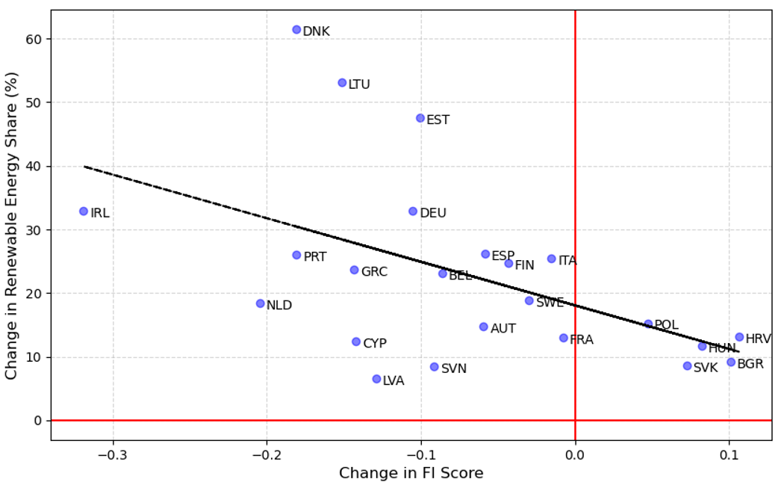

Chart 3. Change in financial institutions development vs. change in renewable energy production share (2006 – 2020)

Source: See, Chart 4.

The analysis indicates that more developed capital markets have a significant positive impact on the adoption of renewable energy, as reflected in an increasing share of renewables in total energy production. Conversely, the development of bank-based finance appears to have a negative impact on renewable energy adoption, even though this impact appears somewhat weaker.

Although we can see overarching patterns regarding the link between renewable energy adoption and financial development, it is worth investigating separately different sources of renewables. Therefore, we look specifically at wind power and solar energy generation and their connection to financial development. We do not specifically look at hydropower, the oldest and most mature form of renewable energy production. Moreover, conventional hydropower plants, involving massive infrastructure like dams, have significant socio-environmental impacts (Burke et al., 2009), making hydropower generally a highly regulated energy source.

Wind energy technology has seen significant advancements over the past few decades, leading to increased output and more efficient turbine designs (Herbert et al., 2007). It is one of the most capital-intensive forms of energy production, requiring substantial initial investments (Tarroja et al., 2012). Despite these high upfront costs, the marginal cost of electricity generated by wind energy once the infrastructure is up and running is relatively low (Tarroja et al., 2012), making it an attractive option for large-scale energy production.

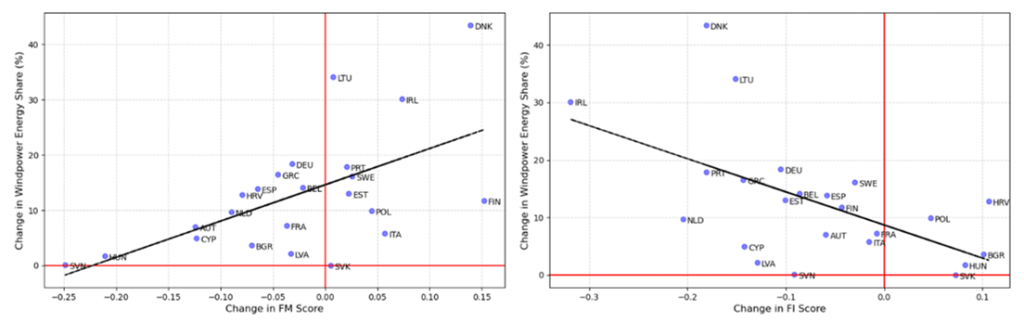

As depicted in Chart 4, there is a strong positive relationship between the development of capital markets and the increase in the share of wind energy. On the other hand, the relationship between banking sector development and wind energy adoption is significantly negative. In fact, the link between financial structure and wind energy generation is close to the overall trends visible for renewable energy generation. The risk profile of wind energy generation investments tends to be relatively high, given that the turbines are typically located in areas with a greater likelihood and intensity of damage from natural catastrophes (Sarma & Zabaniotou, 2021).

Chart 4. Change in financial institutions and capital markets development vs. change in wind energy production share (2006 – 2020)

Source: Author’s own calculations based in the IMF capital market development score and the share of electricity production from the specific renewable energy source as taken from https://ourworldindata.org/grapher/share-electricity-renewables

Solar power has rapidly evolved into a widely adopted renewable energy source in recent years. With increased experience and technological advancements, both technological and perceived investment risks have significantly decreased. While there is some risk associated with the physical degradation of photovoltaic (PV) panels, this is relatively manageable, as most parts of a plant continue to function even if individual modules are damaged or need replacement (Egli, 2020).

The analysis of solar power reveals an interesting deviation from wind energy and the overall renewable energy adoption. As shown in Chart 5 there is a negative relationship between capital market as well as banking sector development and the change in the share of solar power, although that negative link is weaker for capital markets. This might be attributed to the nature of solar power investments in Europe, which are often small-scale and installed on private homes. These low-cost investments typically do not require capital markets but may rely more on banks. Moreover, private PV installation is often subsidized by governments to achieve sustainability goals in private residential construction. Despite the weaker connection to capital markets, there are ways to strengthen their role in supporting solar energy. Capital markets can be leveraged to finance larger-scale solar projects and community solar initiatives, which are similar to wind power plants as regards their investment needs. Policy should support respective instruments on a European scale.

Chart 5. Change in financial institutions and capital markets development vs. change in solar energy production share (2006 – 2020)

Source: Author’s own calculations based in the IMF capital market development score and the share of electricity production from the specific renewable energy source as taken from https://ourworldindata.org/grapher/share-electricity-renewables

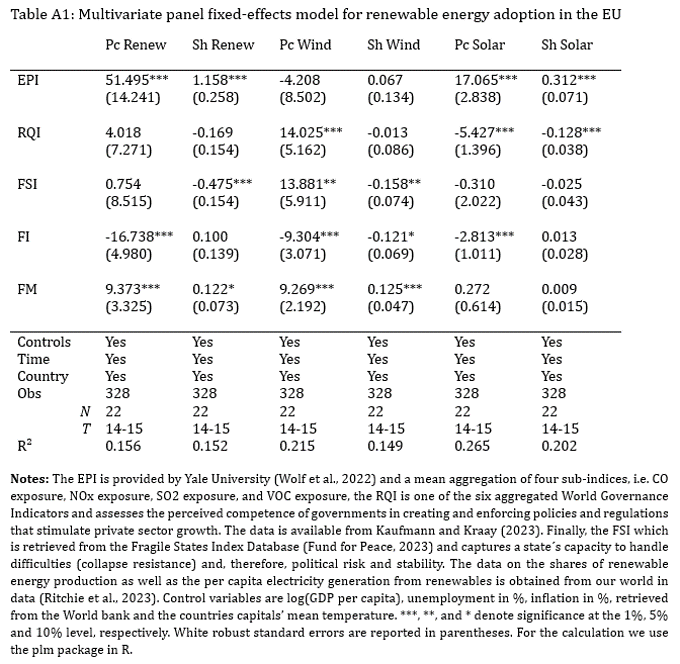

To ensure robustness, we conduct a panel fixed-effects regression analysis to investigate the drivers of renewable energy adoption across 22 European Union countries. Our model focuses on the share of renewable energy production and the per capita electricity generation from renewables as additional variable. We further include an extensive set of control variables: GDP per capita, inflation, unemployment, and average temperature to capture geographical aspects that might confound the results. The core independent variables of interest are the Financial Institutions Index (FI) and the Financial Markets Index (FM). In addition, we include other relevant variables, such as the Environmental Performance Index (EPI), the Regulatory Quality Index (RQI), and the Fragile States Index (FSI), to capture broader governance and environmental factors. The multivariate regression results can be found in Table A1 in the appendix.

The findings, in line with the previous descriptive analysis, suggest a divergent influence of financial institutions and markets on renewable energy adoption. As hypothesized, the Financial Institutions Index (FI) shows a mostly negative and significant relationship with renewable energy adoption. This influence is most pronounced on the per-capita production from renewables. Conversely, the Financial Markets Index (FM) has a positive and statistically significant impact on renewable energy adoption. While we see consistent results for overall renewable energy adoption and wind energy generation, the results for solar energy production are less pronounced, again in line with the descriptive analysis above.

Among the control variables, the EPI positively correlates with renewable energy adoption, indicating that countries with stronger environmental policies tend to invest more in renewables. Meanwhile, the RQI and FSI show mixed results, with RQI positively influencing renewable energy production in certain specifications. FSI, not surprisingly is having a less consistent impact.

For the overall adoption of renewables and wind energy generation, while financial institutions appear to be more cautious in financing such investments, capital markets emerge as an important mechanism for channeling investments into renewable energy.

The transition to renewable energy is crucial for Europe, not only to mitigate climate change but also to enhance energy security, reduce geopolitical risks, and foster economic resilience. Our analysis highlights the essential role of capital markets in supporting renewable energy adoption. Different renewable energy sources, such as wind and solar, are, however, differently affected, reflecting their distinct characteristics and investment needs.

For wind energy, the results seem quite clear: well-developed capital markets play an important role by providing risk-tolerant financing for large-scale, capital-intensive wind projects. A higher share of bank-based finance, by contrast, tends to have a negative impact on wind energy adoption. For solar power, the results are mixed. The often more granular nature of photovoltaic (PV) investments, often undertaken by households, reduces the need for large-scale, relatively more risky financing, for which capital markets seem better suited. Moreover, government subsidies, such as Germany’s Renewable Energy Sources Act (EEG), often play an important role in promoting these smaller-scale solar installations. Although we didn’t test for it, it seems fair to assume that large-scale PV installations follow similar investment needs as wind parks and benefit more strongly from developed capital markets.

These findings further support the call for a strengthening of EU capital markets and the completion of the Capital Markets Union (CMU). This project has recently re-gained political momentum, which is very welcome. At the same time, the history of CMU so far has shown that substantial progress with capital market development in the EU is a very slow and cumbersome process at best. Unless this situation changes, national and regional (bottom-up) support measures for capital markets may help to improve the situation. Moreover, to speed up renewable energy adoption, it is important to ensure close cooperation between capital markets, banks, and government support. All three sources of financing have important and often complementary roles to play in financing the energy transition.

Burke, M., Jorde, K., & Buffington, J. M. (2009). Application of a hierarchical framework for assessing environmental impacts of dam operation: Changes in streamflow, bed mobility and recruitment of riparian trees in a western North American river. Journal of Environmental Management, 90 (3), 224-36.

Egli, F. (2020). Renewable energy investment risk: An investigation of changes over time and the underlying drivers. Energy Policy, 140, 111428.

Fund for Peace (2023). Fragile States Index and CAST Framework Methodology. https://fragilestatesindex.org/

Herbert, G. J., Iniyan, S., Sreevalsan, E., & Rajapandian, S. (2007). A review of wind energy technologies. Renewable and sustainable energy Reviews, 11(6), 1117-1145.

Horky, F., & Fidrmuc, J. (2024). Financial development and renewable energy adoption in EU and ASEAN countries. Energy Economics, 107368.

Ingoglia, M., Horky, F., & Fidrmuc, J. (2024). Energy, pandemic and urban economics: cost-of-living differences between European cities. Applied Economics Letters, 1-5.

Kaufmann, D., & Kraay, A. (2023). Worldwide Governance Indicators, 2023 Update. www.govindicators.org

Kim, J., & Park, K. (2016). Financial development and deployment of renewable energy technologies. Energy Economics, 59, 238-250.

Kremer, M., Kiesel, R., & Paraschiv, F. (2021). An econometric model for intraday electricity trading. Philosophical Transactions of the Royal Society A, 379(2202), 20190624.

Mauderer, S. (2022). Green energy and green finance for a sustainable Europe. Speech at the 8. Green Finance Forum, Euro Finance Week.

Ritchie, H., Rosado, P. & Roser, M. (2023) – “Energy – Data Page: Renewables consumption per capita”. Data adapted from Energy Institute, Various sources. Retrieved from https://ourworldindata.org/grapher/per-capita-renewables [online resource]

Sarma, G. & Zabaniotou, A. (2021). Understanding vulnerabilities of renewable energy systems for building their resilience to climate change hazards: key concepts and assessment approaches. Renewable Energy and Environmental Sustainability 6, 35.

Svirydzenka, K. (2016). Introducing a New Broad-based Index of Financial Development. International Monetary Fund.

Tarroja, B., Mueller, F., Eichman, J. D., & Samuelsen, S. (2012). Metrics for evaluating the impacts of intermittent renewable generation on utility load-balancing. Energy, 42(1), 546–562.

Wolf, M. J., Emerson, J. W., Esty, D. C., Sherbinin, A. de, Wendling, Z. A., & et al. (2022). 2022 Environmental Performance Index. Yale Center for Environmental Law & Policy.

The overall IMF financial development indicator takes values between zero (0) and one (1). Compared to the traditional single indicators used as proxies for financial development (e.g., domestic credit to private sector), this indicator exhibits several advantages has a broader coverage and provides a multidimensional measure of financial development using eight financial variables. We use the subindices to measure financial institutions (FI) and capital markets (FM) each of which cover the depth and the accessibility of the financial institutions and markets.

Due to data issues, we excluded Cyprus, Romania, Lithuania, Ireland, and the Czech Republic from the panel analysis.