Drawdowns on credit commitments by firms reduce a bank’s regulatory capital ratio. Using the Austrian Credit Register, we provide novel evidence that during the 2008-09 financial crisis, capital-constrained banks managed this concern by substantially cutting partly or fully unused credit commitments. Controlling for a bank’s capital position, we also find that greater liquidity problems induced banks to considerably cut such credit commitments during the crisis. These findings suggest that banks actively manage both capital and liquidity risk caused by undrawn credit commitments in periods of financial distress, but thereby reduce liquidity provision to firms exactly when they need it most. In light of our results, the increased capital charge on undrawn credit commitments and the introduction of the Liquidity Coverage Ratio (LCR) in Basel III may help to soften the impact of bank capital and liquidity problems on credit supply and thereby increase future financial stability.

A significant fraction of corporate bank lending is done via credit commitments that allow a firm to choose the actual credit usage level. Specifically, such facilities commit a bank to lend to a firm up to an agreed amount for an agreed period of time unless the firm violates a covenant, which makes them a particularly flexible source of debt financing. The classic credit commitment is a revolving credit line, but also a term loan that can be obtained within a certain period (and perhaps be split in several parts) or a bank guarantee on a loan are credit commitments. A commitment that is not fully used provides liquidity insurance and also sends a positive signal on the quality of the firm to other financial market participants (Mosebach, 1999). From the bank’s perspective, commitment fees charged on the unused portion make up an important source of revenue (Sufi, 2009). These earnings come at relatively low cost for the bank as long as the commitment remains unused. The reason is that from a regulatory perspective, the undrawn portion of a credit commitment is largely off-balance sheet and must therefore be backed by only little capital in the Basel framework. The flip-side is that additional drawdowns result in a direct and possibly unexpected increase in the size of the bank’s balance sheet and thus decrease in its regulatory capital ratio. This reduces a bank’s buffer towards its minimum capital requirement, which limits the bank’s potential to absorb future losses and also harms its stock market performance (Demirgüç-Kunt et al., 2013). Exposure to unused credit commitments may therefore put a bank’s capital buffer at risk. This source of risk has received very little attention in the academic literature and by policymakers. At the same time, it is far from negligible: if the usage of all credit commitments that we observe increased to match their committed volume in early 2008, the average bank in our sample would have had to increase its capital stock by up to eight percent to keep its capital ratio and thus capital buffer constant. Without raising extra capital, the bank would suffer a decrease in its capital buffer by up to 20 percent.

The described risk of capital buffer reductions is particularly relevant in periods of financial distress. The reason is that the capital position of banks is then typically weakened, raising capital is more expensive and drawdowns on credit commitments are more likely. This raises the question of whether and to what extent banks actively manage capital concerns that come with exposure to undrawn credit commitments in crisis times, and what consequences this has on lending to the corporate sector. In this policy note we discuss our recent and novel analysis of this question (Pelzl and Valderrama, 2019). In principle, banks can adjust their credit commitment portfolio after covenant violations by firms, after expiring maturities or, for revocable credit commitments, by using the right to cut or abandon the commitment unilaterally. Using bank-firm level data from the Austrian Credit Register and exploiting the 2008-09 financial crisis as an exogenous shock to the capital position of banks, we find that capital-constrained banks made use of these options. In particular, they reduced the risk of capital buffer reductions by substantially cutting the volume of partly or fully unused credit commitments over 2008-09, and the larger the unused volume, the more so. This result sheds light on a novel yet important link between capital regulations and bank lending to the real economy. The present policy note further discusses a second contribution of our paper, which is to show that also liquidity problems induced banks to cut partly or fully unused commitments at the peak of the crisis. Our findings therefore suggest that during crisis times banks reduce both capital and liquidity risk posed by unused credit commitments at the expense of reducing liquidity insurance for their client firms.

The remainder of this article is structured as follows. Section II provides details on the regulation of credit commitments in the Basel regulatory framework. In Section III we discuss how we measure a bank’s exposure to capital and liquidity problems during the 2008-09 crisis and how we identify changes in credit supply to their borrowing firms, and touch upon the Austrian institutional context. In Section IV we present our main findings, while Section V concludes and discusses several policy implications of our results.

Basel II, which was fully implemented in Europe in January 2008 and was practised until 2013, requests banks to hold capital worth at least eight percent of their risk-weighted assets. Independently of the risk associated with an individual credit commitment, the used portion and the unused portion of the commitment do not equally enter risk-weighted assets in this framework. The used portion obtains a “credit conversion factor” (CCF) of 100%, which implies that it fully enters risk-weighted assets. The unused portion in turn only obtains a CCF of at most 50%. This implies that a rise in the usage of the credit commitment triggers an increase in risk-weighted assets for the granting bank and thus a reduction in its capital ratio, unless the bank raises additional capital.

The specific CCF of the unused portion of a credit commitment in the Basel II framework depends on the type and maturity of the commitment. The unused portion of an irrevocable credit commitment has a CCF of 20% if the original maturity is below one year and a CCF of 50% otherwise. A credit commitment is irrevocable if its volume cannot be reduced before the commitment matures unless the firm violates a covenant. Revocable commitments, which are unconditionally cancellable by the bank at any time but only before a firm actually draws down credit, face no capital charge in Basel II. While Basel II already brought the unused portion of credit commitments more on the balance sheet of banks compared to Basel I, Basel III continued this process for most types of commitments. Specifically, in Basel III irrevocable commitments have a CCF of 40% irrespective of their maturity and revocable commitments have a CCF of 10%.

While the 2008-9 financial crisis generally had a negative effect on bank capital, there was substantial heterogeneity across banks. To proxy for how the capital position of a bank was affected by the crisis, we use a bank’s pre-crisis holdings of US assets divided by total assets, and show that this variable significantly predicted a bank’s total losses over 2008-09. Furthermore, we incorporate a bank’s individual bank capital buffer into the analysis to capture a bank’s ability to absorb a given capital shock. The buffer is computed as the ratio of the bank’s Tier 1 + Tier 2 capital holdings and its individual minimum capital requirement. This is a more precise indicator of how well a bank can absorb capital losses than the simple ratio of bank capital over total assets, which has been used by many existing studies. Data on banks’ exposure to US assets as well as bank capital buffers are provided by the Oesterreichische Nationalbank (OeNB). Since we also study the supply of credit commitments by liquidity-constrained banks during the crisis, we further need a measure for a bank’s exposure to liquidity problems during the crisis. Following previous literature (e.g. Ongena et al. 2015), we achieve this by computing the bank’s pre-crisis ratio of international interbank borrowing to total assets, again based on OeNB bank balance sheet data.

Our source of credit data is the Austrian credit register, which documents all bank-firm-specific credit commitment and usage levels at the end of a given month as long as the granted volume exceeds €350,000. This results in a coverage of 90% of the total credit commitment volume in Austria. The availability of both volume and usage data allows us to measure the risk of additional drawdowns for each individual credit relationship we observe, which is crucial for our analysis. We study the change in the bank-firm-specific commitment volume between the two months of January 2008 and December 2009, and condition the effect on the bank-firm-specific volume of unused credit at the onset of the crisis. 58% of credit commitments were partly or fully unused in January 2008, the average unused volume across all commitments equaled roughly 2 million Euros and the median stood at roughly 100,000 Euros.

The Austrian credit market is an ideal setting to study our research questions. This is in part because Austrian banks have traditionally had relatively small capital buffers compared to banks in other countries (Fonseca and González, 2010), which makes them particularly vulnerable to large credit drawdowns. Furthermore, Austria′s Financial Market Stability Board has pointed out that “central risks for the Austrian banking system emanate (…) from banks′ specific ownership structures, which would not fully ensure the adequate recapitalization of banks in the event of a crisis” (FMSG, 2017). The background is that same as in Germany many Austrian banks are organised in banking groups, which makes it difficult for a specific group member to raise capital from financial markets without diluting the equity share of other members. This constraint further exacerbates the risk that Austrian banks face from unused credit by their corporate borrowers. However, also in other countries this risk and therefore the novel channel we describe through which bank capital regulations affect lending to the real economy in crisis times are clearly relevant. While no comparable studies on other countries exist, we hypothesize that the channel’s relevance increases with the importance of bank credit as a source of funding in a country and decreases with the average strength of bank capital buffers and the ability of banks to raise external capital in crisis times.

Our empirical specification should capture potential changes in credit commitment supply during the crisis and possible heterogeneity across banks with different exposure to capital or liquidity problems and across credit commitments with different usage levels. Therefore, we set up the following difference-in-difference specification:

![]()

where ΔCredCommij approximates the percentage change in the total credit commitment volume offered by bank j to firm i between January 2008 and December 2009; USexpj and Interbankj are computed as described in the first paragraph of Section III; and SmallBufferj is a dummy that equals one if the bank’s capital buffer (see again the first paragraph of Section III for the computation) is smaller than the median across our sample. UnusedVolij is in most regressions a bank-firm-level dummy variable that equals one if the credit commitment is not fully used in January 2008, and otherwise equals the log of the bank-firm-specific unused credit volume if positive and zero otherwise. Cij is a vector of bank-firm-specific characteristics including the credit type composition, the importance of the bank for the firm in terms of overall funding, and the lending relationship duration, all measured in January 2008. fi are firm fixed effects in the spirit of Khwaja and Mian (2008) that absorb all firm-specific factors that lead to a change in the granted credit commitment volume between January 2008 and December 2009, such as credit demand or creditworthiness. The implication of including firm fixed effects is that we restrict our sample to firms that borrowed from multiple banks in both January 2008 and December 2009. bj are bank fixed effects that control for bank-specific characteristics other than US asset exposure, interbank funding dependence and capital buffer size that affected a bank’s change in credit supply during the crisis. In selected specifications we replace the bank fixed effects by bank variables to estimate a larger range of effects. Conditional on equation (1), the remaining identification assumption to purely capture supply effects is the absence of a correlation between bank-firm-specific demand effects regarding the credit commitment volume and the bank variables included in equation (1). For several reasons that we describe in detail in our paper, such effects appear unlikely, but nonetheless we address this concern in robustness checks. To analyse potential credit substitution across banks we aggregate the left-hand side of equation (1) to the firm level and compute weighted averages across the firm’s banks on the right-hand side. To analyse real effects, we also do the latter and feature firm-level investment and employment as dependent variables. A more detailed description of our empirical strategy and the mentioned identification assumption can be found in Pelzl and Valderrama (2019).

Our results based on the study of the Great Recession indicate that during crisis times, capital-constrained banks manage the risk of capital ratio reductions via increased credit drawdowns by significantly cutting partly or fully unused credit commitments. In particular, we find that a one standard deviation increase in US asset exposure leads to a 11.4 percent reduction in the supply of partly or fully unused commitments over 2008-09 if the bank has a small capital buffer at the onset of the crisis. This effect, which is large in magnitude, is absent for US-exposed banks with a large capital buffer and banks with a small capital buffer but no US asset holdings. These results are intuitive since it is the banks that suffer losses during the crisis and have a small cushion to absorb these losses that are most affected by additional credit drawdowns. Our interpretation that banks carry out precautionary credit commitment cuts to avoid capital ratio reductions is supported by a range of additional findings. First, we find that the larger the initial unused credit volume at the bank-firm level, the larger is the reduction in the granted credit amount. Second, banks that face a larger volume of unused corporate credit in the aggregate in January 2008 reduce individual credit commitments that are partly or fully unused by more. Both results indicate that the larger the consequences of additional drawdowns, the more banks take preventive action. Third, we find that firms that are more likely to default on their loans (as evaluated by their banks) face significantly larger cuts on partly or fully unused commitments. This can be explained by the fact that additional credit drawdowns by such firms result in a larger capital requirement increase for the granting bank. Further evidence focusing on the two months around the Lehman default shows that capital-constrained banks cut partly or fully unused credit commitments very quickly as capital concerns become more severe, but only those commitments with a relatively large unused volume.

We find that liquidity-constrained banks also cut credit commitments with a positive unused volume and thereby reduce the risk of additional credit drawdowns. However, this effect is concentrated around the Lehman default when liquidity problems are most serious, and is driven by credit commitments with a relatively large unused volume. Specifically, banks with a one standard deviation higher reliance on international interbank funding cut such commitments by 3.3 percent compared to less liquidity-constrained banks between the end of August and the end of October 2008. Over the baseline period from January 2008 to December 2009, our results on credit supply by liquidity-constrained banks also exhibit heterogeneity across fully-used commitments (which are not at all cut by capital- or liquidity constrained banks) and commitments with a positive unused volume, but the overall evidence is less negative. This might reflect that government help via Austria’s interbank support package which started in November 2008 was conditional on extending credit supply and was not entirely unsuccessful in that regard.

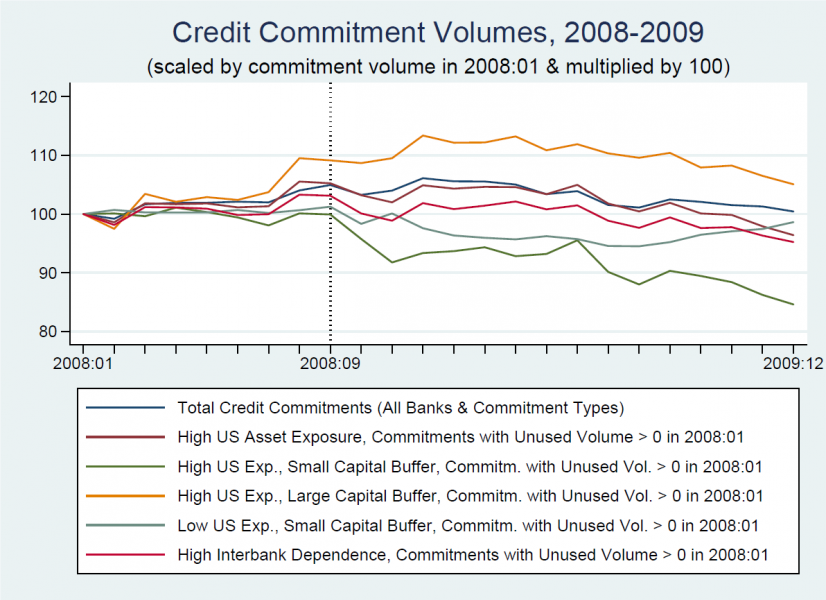

Figure 1 shows complementary graphical evidence that illustrates heterogeneity in the development of aggregate credit commitment volumes across more and less capital- or liquidity-constrained banks throughout 2008-09. While the graphs are obviously not suitable to isolate supply from demand effects contrary to our regression framework, the evidence is in line with our parametric results and improves our understanding of the time dimension of the effects. Specifically, Figure 1 shows that banks take most action in the months after the Lehman default when capital and liquidity concerns as well as overall uncertainty are most pronounced. As much as our data permits, in our paper we also present parametric evidence suggesting that constrained banks mostly cut revolving credit lines as opposed to other credit types. Further graphical evidence in our paper suggests that credit commitment reductions are at least partly a response to increased drawdowns on revolving credit lines shortly after the Lehman default.

In terms of implications for firms, the magnitude of credit commitment cuts does not imply acute credit constraints on the average holder of a partly or fully unused credit commitment who borrows from a constrained bank, even if the firm is fully using all its other credit commitments. This is because the average ratio of usage to granted volume of credit commitments with a positive unused volume equals around 60 percent in January 2008. That said, the identified credit commitment supply cuts by capital-constrained banks and to a smaller extent also liquidity-constrained banks do reduce liquidity insurance for the borrowing firms. On the positive side, we find that firms are largely able to substitute credit commitment cuts via increased credit from less affected banks, and we do not find any real effects in terms of investment or employment. However, this latter result is based on a non-representative sub-sample of firms due to limited data availability, and generally the outcomes on credit substitution and firm performance may be more detrimental in other countries with different institutional features or where the crisis had a more severe impact.

Figure 1: Heterogeneity in Credit Commitment Volumes over the Crisis

In this article, we shed light on a novel channel through which bank capital regulations affect lending to the real economy in crisis times. We departed by highlighting that exposure to undrawn credit commitments may put a bank’s regulatory capital buffer at risk, since additional credit drawdowns increase the size of the bank’s balance sheet. This is particularly problematic during periods of financial distress, since the capital position of banks is then typically weakened, raising capital is more costly and drawdowns on credit commitments are more likely. We then provided plausibly causal evidence that banks whose capital position was hit relatively hard during the 2008-09 financial crisis and whose initial capital buffer was low reduced the risk of additional drawdowns by substantially cutting the volume of partly or fully unused corporate credit commitments over 2008-09. While this is good news from the perspective of banking system stability, it implies a reduction of liquidity provision and insurance to firms exactly at a time in which they need it most. On the positive side, in Austria firms were largely able to substitute the loss in credit via other banks, and we also do not find negative real effects. However, this result may not hold in other countries with different institutional features or where the crisis had a more severe impact. Generally speaking, our results therefore do provide an additional rationale for the regulator’s quest to strengthen bank capital buffers. What’s more, at least from the viewpoint of financial stability our findings justify the higher capital charge on the unused portion of most credit commitment types in Basel III, and may call for a further increase. This is because a higher capital charge makes banks more reluctant ex ante to grant excessively high credit commitment volumes that cannot be sustained during crisis times. This in turn smoothens credit supply over the business cycle, limits liquidity risk transfers from banks to firms in crisis times and reduces the impact of potential runs on unused credit commitments on banks in periods of financial distress.

As a second contribution, we showed that also larger liquidity problems induced banks to cut partly or fully unused credit commitments at the peak of the crisis, controlling for a bank’s capital position. The introduction of the Liquidity Coverage Ratio (LCR) in Basel III, which requires banks to hold an adequate stock of unencumbered high-quality liquid assets, may better prepare banks for liquidity problems and a potential rise in credit drawdowns and thereby also increase future financial stability.

Demirgüç-Kunt, A., E. Detragiache and O. Merrouche (2013). Bank capital: lessons from the financial crisis. Journal of Money, Credit and Banking 45(6), pp. 1147-1164.

Fonseca, A. R. and F. González (2010). How bank capital buffers vary across countries: the influence of cost of deposits, market power and bank regulation. Journal of Banking & Finance 34(4), pp. 892-902.

FMSG (2017). Recommendation concerning the adjustment of the systemic risk buffer (FMSG/4/2017). https://www.fmsg.at/en/publications/warnings-and-recommendations/2017/recommendation-fmsg-4-2017.html

Khwaja, A. I. and A. Mian (2008). Tracing the impact of bank liquidity shocks: evidence from an emerging market. The American Economic Review 98(4), pp. 1413-1442.

Mosebach, M. (1999). Market response to banks granting lines of credit. Journal of Banking & Finance 23(11), pp. 1707-1723.

Pelzl, P. and M.T. Valderrama (2019). Capital regulations and the management of credit commitments during crisis times. DNB Working Paper No. 661/2019.

Ongena, S., J.-L. Peydro, and N. Van Horen (2015). Shocks abroad, pain at home? Bank-firm-level evidence on the international transmission of financial shocks. IMF Economic Review 63(4), pp. 698-750.

Sufi, A. (2009). Bank lines of credit in corporate finance: an empirical analysis. The Review of Financial Studies 22(3), pp.1057-1088.

This Policy Note is based on the DNB Working Paper No. 661/2019 , published in December 2019.