The views expressed are those of the authors and do not necessarily reflect those of their institutions.

Abstract

Effective climate risk policymaking relies on accurate carbon measurement, ie trustworthy, accurate, consistent, and interoperable carbon information at all levels – products, companies, industries, and countries. Such measurement will have to entail both “direct” and “indirect” emissions, using best practices and relevant auditing procedures. A promising way forward are the evolving carbon accounting standards, enabled by disclosure requirements at the international and regional levels as well as global statistical initiatives, such as the G20 Data Gaps Initiative (DGI). Official statistics can play a vital role in supplementing missing information and providing a consistent framework.

This brief draws upon the take-aways from an international workshop on carbon content measurement hosted by the Deutsche Bundesbank in early 2024. Based on IFC Report #16, the brief outlines the workshop’s findings and suggests pathways for future action. The workshop was co-organised by the Bank for International Settlements with its Irving-Fischer Committee on Central Bank Statistics (IFC), the Central Bank of Chile, the Deutsche Bundesbank, Eurostat, the International Monetary Fund (IMF), and the University of Oxford. The workshop gathered industry specialists, academics, standards-setters, central bankers, and statisticians to discuss challenges and solutions in carbon accounting.

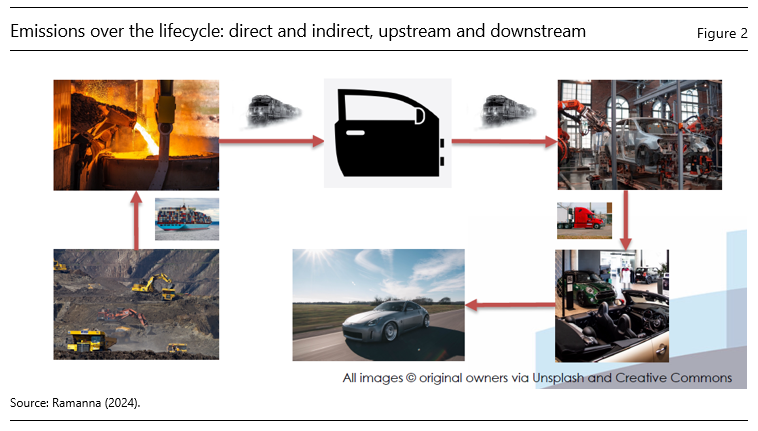

Measuring the carbon content of economic activities is a necessary condition for rational, environmentally-oriented decision-making across the whole spectrum of climate policies. The term refers to direct and upstream indirect emissions of carbon dioxide (CO2) and other greenhouse gases (GHGs) created during the production of goods or services, “cradle to gate”.

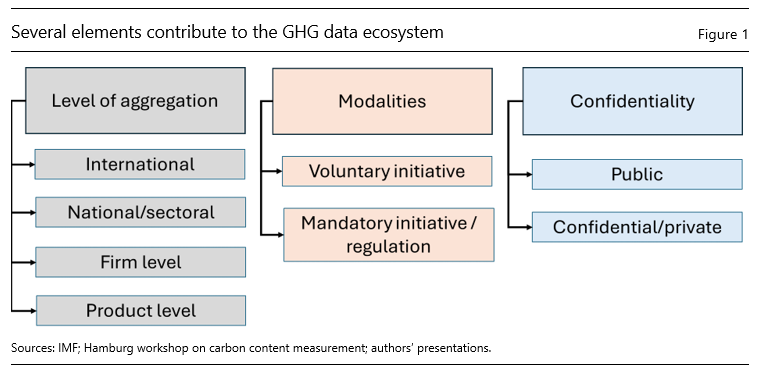

The measurement and disclosure of carbon content would benefit many stakeholders, including companies (to move towards more climate-friendly production processes), consumers (to better understand the environmental consequences of their purchases), investors (to redirect financial resources towards climate-friendly investments), banks (to better assess climate risk) and authorities (to take appropriate policies). Carbon content information is needed at three levels: first, at the aggregate level, with reliable statistics by country and economic sector; second, at the company level; and third, at the product level (Figure 1).

However, there is currently a lack of harmonised, comprehensive global statistics to properly measure the carbon content of economic activities. On the one hand, there are obvious data gaps to be filled. For example, many companies fail to provide accurate data on their carbon emissions, and when such information is available, it is often based on rough estimates. These shortcomings have an impact not only on firm-level measures of direct and indirect emissions, but also on macro-level aggregate statistics. On the other hand, consistent and coherent methodological frameworks are still missing.

In view of these shortcomings, it is essential to develop policy options to close data gaps, by involving the various interested stakeholders (industry specialists, official statisticians, academics, standard-setters, central banks and international organisations) so as to share experience and reflect on potential actions to address the challenges posed by the measurement of carbon content.

Effective measurement of carbon content can start with the information that is collected and disclosed by companies about their direct emissions, on a voluntary or mandatory#f1 basis. This provides the foundation necessary to ensure the recording and reporting of the environmental impact of economic activities – with data that should be duly analysed, verified, audited and shared with relevant authorities or also the public at large.

The next step is to adequately measure upstream indirect emissions, which requires more than the simple disclosure at the level of entities. The objective is to track carbon emissions across the whole supply chain, from the level of raw materials to the outputs of companies (Figure 2). This should ideally be done in real-time and in an accurate and verifiable manner, to create comparable and consistent figures. It is important that the gathering of information is cumulative, following the build-up of indirect emissions over the value chain across the network of producers. This calls for effective communication between input providers and producers. Such communication could take the simple form of including accumulated carbon content in the bill for the inputs.

The third step is to ensure the proper integration of company- and product-level data in the overall statistical framework for analysing economic activities. Official statisticians, as custodians of publicly available data, have a key role to play in this endeavour. Macroeconomic statistics can provide estimates where no adequate microdata is available from input providers; in addition, official statisticians can set up examples of best practices for data compilation and ensuring the quality of the granular information collected. On the other hand, the availability and disclosure of better micro data has the potential to enhance the quality of the macro indicators that constitute the corner stone of official statistics.

A number of major initiatives are under way to provide better data that can be used to measure carbon content of economic activities (NGFS (2024)). First, international standards are being refined to include the provision of carbon information. At the firm level, the International Sustainability Standards Board (ISSB) has produced global accounting standards on sustainability-related disclosures in capital markets. A related framework is provided by the Corporate Sustainability Reporting Directive (CSRD) in the European Union (EU), and there are also a number of voluntary initiatives#f2 for different aggregation levels. More broadly, important international work is progressing to develop methodologies and address the most pressing data gaps (see for a recent example UNECE (2024a)). The ongoing development of aggregate statistics at the national, regional and international levels will foster a better understanding of the interactions between carbon emissions and economic activities – a noteworthy example being the third phase of the DGI endorsed by the G20 (IMF et al (2023)).

Implementation of the three above steps would allow the development of an adequate and effective global carbon accounting framework that provides accurate, credible and verifiable data across the global economy. The accounts produced should be comparable and consistent, calling for strong quality assurance processes and close international collaboration.

A number of initiatives are under way to achieve this objective, with the aim of supporting both corporate decision-making and policy actions. At the micro level, one would ideally properly record product carbon content at each stage of the value chain.#f3 At the macro level, the further development of air emissions accounts (AEAs) and input-output modelling is useful to track carbon emissions throughout the value chain, as well as their interactions with the broader economy. In this regard, it would be very useful if existing country and industry-specific data on average carbon content could be made easily available to non-specialists. Linking and consolidating the information available from different sources, especially with the use of satellite data, and carefully mapping the various elements involved in the carbon data ecosystem is a promising way forward. Moreover, global standards are being refined to enhance the disclosure of carbon information, use existing statistical classifications and develop taxonomies, not least to improve the consistency between micro- and macro-level information. In this context, the GHG Protocol#f4 provides the world’s most widely used accounting standards designed as a framework for businesses, governments, and other entities.#f5 Lastly, important international work has been initiated to address the most pressing data gaps related to the link between carbon emissions and economic activities.

A similar approach would also help to better analyse the carbon offset market,#f6 which is reportedly characterised by a lack of comprehensive and reliable data. One concern is that a significant part of the reported information on carbon offset offerings may not meet basic accounting standards, making it difficult to distinguish between genuine offset practices and avoidance schemes.

While there has been significant progress, many obstacles remain. Access to and sharing of micro-level data need to be improved to reduce reporting burdens. Common regulation and disclosure standards are still lacking. Moreover, it is essential to ensure that information disclosed by firms adhere to well-established international statistical classifications eg on products and activities. However, the existing statistical infrastructure presents important shortcomings, and more work is needed to develop global agreed definitions and classifications, especially in the area of climate finance, as well as of product- and firm-level identifiers. Additionally, official statisticians often face resource constraints that severely limit their ability to meet the growing demand for data. Therefore, there is an urgent need for stronger collaboration and innovative solutions, such as integrating cutting-edge digital technology and developing incentive mechanisms for voluntary carbon reporting.

Overcoming these challenges requires close collaboration and innovation by all parties involved. Central banks, as statistical producers as well as users of data to support their specific policy mandates on financial stability, monetary policy and reserve management, are important stakeholders from this perspective. They can be instrumental in spurring the establishment of the statistical infrastructure necessary to better measure the impact on climate change, building on a comprehensive and consistent carbon accounting framework.

Central banks will benefit in this endeavour from the network provided by the IFC to foster joint and complementary work of the various stakeholders involved in carbon accounting, support the provision of harmonised and reliable information, and thereby contribute to an international solution for addressing the global phenomenon of climate change and its regional impacts. In particular, the Committee can play a useful role in sharing experience and best practices, keeping central banks informed about ongoing relevant initiatives, and taking stock of existing data sources and future plans – with a number of specific action points being pursued accordingly.

Béguin, J-Mc, C Cazes, J Cazes, J-L Leban, F Meunier, A Minczeles, A Paille and V Vanwormhoudt (2024): “Piloter les émissions de gaz à effet de serre – Le potentiel immense de compter en 3D”, Variances.eu, 9 September.

IMF, Inter-Agency Group on Economic and Financial Statistics and Financial Stability Board Secretariat (2023): G20 DGI-3 Workplan – people planet economy, March.

Irving Fisher Committee on Central Bank Statistics (IFC) (2024): Empowering carbon accounting: from data to action, IFC Report no. 16, October.

Von Kalckreuth, U (2022a): “Pulling ourselves up by our bootstraps: the greenhouse gas value of products, enterprises and industries”, Deutsche Bundesbank Discussion Paper, no 23/2022, July.

——— (2022b): “Product level greenhouse gas contents – how to get there?”, SUERF Policy Note, no 288, September.

Kaplan, R and K Ramanna (2021a): “How to fix ESG reporting“, Harvard Business School Working Paper, no 22-005, July.

——— (2021b): “Accounting for climate change“, Harvard Business Review, vol 99, no 6, pp 120–31.

Network for Greening the Financial System (NGFS) (2024): “Improving greenhouse gas emissions data”, NGFS Information Note, July.

Ramanna, K (2024): “Levelling up on carbon accounting and reporting“, presentation at a workshop on “Carbon content measurement for products, organisations and aggregates: creating a sound basis for decision-making“, Hamburg, 21–23 February.

United Nations Economic Commission for Europe (UNECE) (2024a): Guidelines for the application of environmental indicators, 2023 edition, ECE/CEP/200, August.

World Resources Institute (WRI) and World Business Council for Sustainable Development (WBCSD) (2004): The greenhouse gas protocol: a corporate accounting and reporting standard, revised edition.

——— (2011a): Corporate value chain (scope 3) reporting standard; supplement to the GHG protocol corporate accounting and reporting standard. Empowering carbon accounting: from data to action

——— (2011b): Product life cycle accounting and reporting standard.

——— (2013): Technical guidance for calculating scope 3 emissions; supplement to the corporate value chain (scope 3) accounting and reporting standard.

It is estimated that about 40 countries have mandatory GHG reporting requirements, at least for some elements.

These initiatives include the Carbon Disclosure Project (CDP), the Net-Zero Data Public Utility (NZDPU) and a number of private sector initiatives that aim to facilitate the exchange of information related to carbon emissions, either to the wider public or on a peer-to-peer basis, eg Partnership for Carbon Transparency (PACT) or Catena-X.

One option is the environmental-liability (E-liability) approach (Kaplan and Ramanna (2021a, 2021b)) and the related initiative by “Carbones sur factures” in France (Beguin et al (2024)) to tracking firms’ total direct and supplier emissions as well as the carbon content of any of their products and services. The core idea is that carbon contents are passed on along the supply chain, similar to VAT. In practice, companies may not have full access to their suppliers’ data and would need to complement them with generally accepted reference data. By iterative use in the supply network, the constraint of missing data will vanish; on this, see von Kalckreuth (2022a,b).

The GHG Protocol is widely used for disclosing and reporting corporate information. This Protocol identifies three types (or “scopes“) of carbon emissions and provides explicit guidance for measuring and reporting them at the entity or product levels: Scope 1: direct emissions from sources that are owned or controlled by a company, such as its production and transportation equipment; Scope 2: emissions at facilities that generate electricity and heat bought and consumed by the company; Scope 3: emissions from upstream operations in a company’s supply chain (ie from “cradle to gate”) and from downstream activities by the company’s customers and end-users.

The standards include in particular the corporate standard, the corporate value chain (scope 3) standard and the product life cycle accounting and reporting standard (the “product standard”). For GHG scope 1 and 2 emissions, see WRI and WBCSD (2004). For scope 3 emissions, see the standards for enterprise-level and product-level disclosure and the technical guidance provided by WRI and WBCSD (2011a, 2011b, 2013).

Carbon credits, also known as carbon offsets, are permits that allow the owner to emit a certain amount of carbon dioxide or other GHFs.