This policy brief is based on a Banco de España Working Paper, No 2506 “Carbon pricing, border adjustment and renewable energy investment: a network approach” and an ECB Working Paper, No 3020. The views expressed are those of the authors and do not necessarily reflect those of the Banco de España, the ECB or the Eurosystem.

Abstract

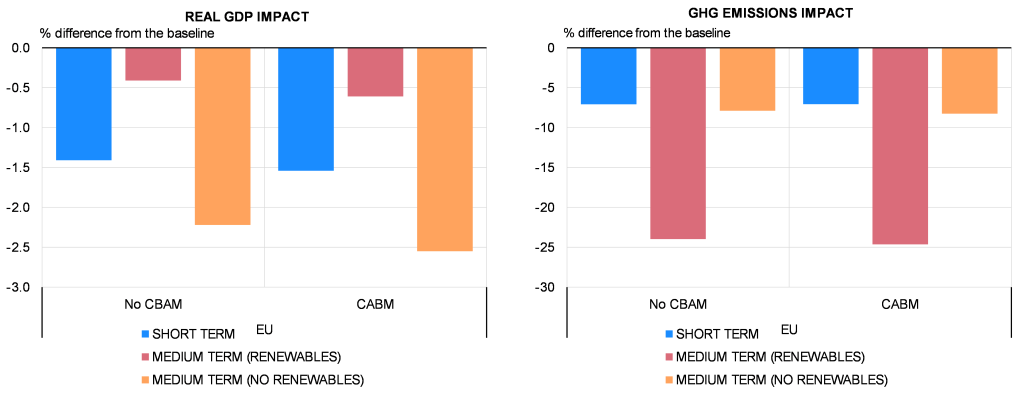

An increase in EU carbon prices reduces greenhouse gases emissions by changing production and consumption patterns but lowers GDP due to higher energy costs and carbon leakage. Using a multi-sector, multi-country model augmented with an energy block that includes endogenous renewable energy investment, we find that this endogenous investment in renewables mitigates electricity price increases in the medium term, resulting in smaller GDP losses (up to 0.4%) and larger emissions reductions (24%). While introducing a Carbon Border Adjustment Mechanism (CBAM) reduces carbon leakage but slightly increases GDP loss and inflation due to higher costs of imported inputs. Ignoring renewable investment overestimates the negative economic impact of carbon prices and the of the CBAM.

The European Union has a target of reducing 55% its Green House Gases (GHG) emissions by 2030, compared with 1990. To achieve its goals, the Fit for 55 Package proposes a combination of expanding carbon pricing, introducing a carbon border adjustment mechanism (CBAM), and boosting renewable energy, among other measures. The EU justifies carbon pricing and the CBAM as essential tools for achieving the climate goals. Carbon pricing, through the EU Emissions Trading System, internalizes the cost of pollution, incentivizes clean technology adoption, generates revenue for green investments, and aligns with emissions reduction targets. Meanwhile, CBAM prevents carbon leakage by imposing tariffs on imports from countries with weaker climate policies, ensuring fair competition for EU industries while encouraging global climate action. Together, these two mechanisms create a market-driven approach to reducing emissions and reinforcing the EU’s commitment to climate neutrality by 2050.

Our model stands out in the literature by enhancing a dynamic, multi-sector, multi-country model with a more realistic energy block. This is an open economy production and investment network model following Baqaee and Farhi (2020). A key innovation of this analysis is the inclusion of the energy block, which captures investment decisions in clean energy and their impact on electricity prices. Our model ability to account for endogenous investment in renewable energy, reveals that it helps offset higher electricity costs and reduces the overall economic burden of climate policies in the medium term. Thus, these results highlight the importance of incorporating renewable energy investments in carbon reduction strategies.

To assess the effects of carbon pricing and CBAM, we developed an economic model that represents various industries and their interactions across the EU and international markets. The model captures how firms react to increased carbon costs by adjusting production, changing intermediate inputs, shifting investments, and substituting energy sources. It also accounts for how trade patterns change when CBAM is applied, ensuring that imported goods face similar carbon costs as domestic products.

Moreover, the energy block reflects the interaction between fossil fuels and electricity, which can be generated from both fossil and renewable sources. Importantly, it features endogenous investment in renewable energy and accounts for the merit-based electricity pricing system used in the EU. This provides a more realistic representation of the energy transition. In fact, it accounts for market cannibalization of renewables. When renewable electricity generation is low, it is remunerated at the same price as the fossil fuel-based electricity. As green generation capacity increases, certain periods of the day (such as during sunny or windy conditions) may arise when fossil fuels are not needed, as renewables alone can meet the demand. This leads to lower prices and reduced remuneration compared to fossil fuel-based electricity.

Therefore, the decision to invest in renewables hinges on non-renewable electricity prices and market share capture, with carbon prices initially driving up costs and incentivizing higher green generation until market cannibalization among renewables diminishes these gains. The introduction of variable elasticities of substitution between renewable and non-renewable energy input is novel to this model.

Finally, a relevant feature of our model is its ability to analyse the decomposition of GHG emission reductions. This decomposition enables us to separate the percentage of emissions saved by various factors: a decrease in production, sectoral reallocation of production, changes in the mix of intermediate inputs, energy savings, and an increase in renewables within electricity production.

In our paper, we analyse the economic and environmental effects of two situations, first, an increase of effective carbon prices of € 100 per tonne of CO2 equivalent emissions in all EU countries and, second, the additional border adjustment mechanism in the EU, introduced as equivalent surcharge on EU imports according to their carbon content.

In the short term, firms and households adjust their demands to the new prices due to the increase in the carbon prices and CBAM, leading to higher input costs, especially for energy. This results in a lower consumption of carbon-intensive inputs and goods, substituting carbon intensive domestic production with imports. Thus, the return on capital for European companies decreases because of falling demand and higher costs, leading to stranded assets. All in all, the increase in carbon prices results in a 1.4% decrease in EU GDP.

In the medium term, to account for its macroeconomic and environmental effect of renewable energy investment, the impact of the increase of carbon prices is analysed under two alternative model configurations: with and without it. Thus, endogenous investment in renewables mitigates the economic impact of rising carbon prices by increasing green energy production. Without renewables, reduced investment exacerbates the negative economic impact. This contrast highlights the importance of this mechanism in evaluating medium-term environmental fiscal reforms.

Renewable deployment is fundamental for achieving large emission reduction goals and minimize the economic costs of the transition policies. According to our results, GDP in the medium term with renewable energy would be only 0.4 % lower than in the absence of the carbon tax, so the short-term negative impact of the increase in carbon prices is reduced by more than 70 %. On the other hand, emissions would be up to 24 % lower, which is more than triple the savings achieved in the short term. The presence of renewables mitigates the energy cost increase for EU producers, the magnitude of import substitution is clearly smaller and, therefore, the carbon leakage is also lower.

The significant difference between the results with and without renewable energy investment underscores that neglecting it significantly overestimates the adverse impact on environmental tax reforms economic activity and underestimates their capacity to reduce GHGs emissions.

Our model shows that implementing a CBAM effectively curbs carbon leakage but incurs additional GDP costs. The increase in costs is due to the border adjustment rendering energy-intensive sectors, which serve as key input suppliers for other economic sectors like chemicals and metallurgy, more expensive. Consequently, the protectionist nature of the CBAM in certain sectors leads to an overall economic loss. This outcome is overlooked by models that disregard the complex structure of global value chains. Additionally, we show that once considered the endogenous response of renewable energy, the economic impact of the CBAM decrease, as domestic production become less polluting and energy costs increases are mitigated.

Figure 1. Impact of carbon prices and CABM on EU GDP and GHG emissions

Source: own elaboration

The increase in effective carbon prices is fundamental in the EU decarbonisation strategy, shifting consumption and production to less carbon intensive goods. In this strategy, our work reveals that renewable energy plays a substantial role, as its deployment significantly reduces GHG emissions and economic transition costs. Higher energy prices from carbon pricing incentivize renewable investments, increasing their share in the energy mix, lowering electricity prices, and promoting electrification. Renewable investment reduces economic losses and boosts environmental benefits, with GDP impacts minimized by 1.8 percentage points and carbon footprint reductions increased by over 15 points. On the other hand, the CBAM mitigates the carbon leakage but incurs greater economic losses, making energy-intensive sectors like chemicals and metallurgy costlier. This outcome is overlooked by models that disregard the complex structure of global value chains.

Baqaee, D. R. and Farhi, E. (2020). Productivity and misallocation in general equilibrium. The Quarterly Journal of Economics, 135(1):105–163.

Delgado-Téllez, M., Quintana, J. and Santabárbara, D. (2025). Carbon pricing, border adjustment and renewable energy investment: a network approach. Banco de España Working Paper No 2506.