The views expressed in this policy brief are those of the authors and do not necessarily represent the views of the Banca d’Italia or the Eurosystem.

Abstract

Services inflation in the euro area has been slowly declining from the peak reached in the summer of 2023. At the same time, the inflation rate of non-energy industrial goods has already returned to pre-pandemic levels. The strong growth in services prices in 2021 and 2022 was driven by fast-moving services such as travel and restaurants, as well as housing and vehicle maintenance. Since 2023, however, services inflation has also been driven by late-mover items, such as insurance, rents, health, education, cultural, social and administrative services, which continued to increase gradually in 2024 when the fast-movers had already slowed down. The unprecedented shocks to energy prices in 2021 and 2022 have led to a more rapid increase in fast-movers and a more delayed and slower catch-up by the late-comers in comparison to previous periods of rising energy prices. As long as long-term inflation expectations remain anchored, the delayed disinflation of late-comers should not be a source of concern for the return of headline inflation to the ECB’s target.

In mid-2021, inflation started increasing rapidly in advanced economies due to a number of global factors, including the COVID-19 pandemic, global supply chain disruptions, and the energy crisis, which was exacerbated by the Russian invasion of Ukraine. The euro area was severely affected. During the pandemic, the sharp fall of services consumption and the strong demand for goods, raw materials, and logistics led to supply-demand imbalances, which pushed up prices and caused delivery delays.1 The unprecedented shocks had a significant but heterogeneous impact on the inflation rates of services and non-energy industrial goods (NEIGs).

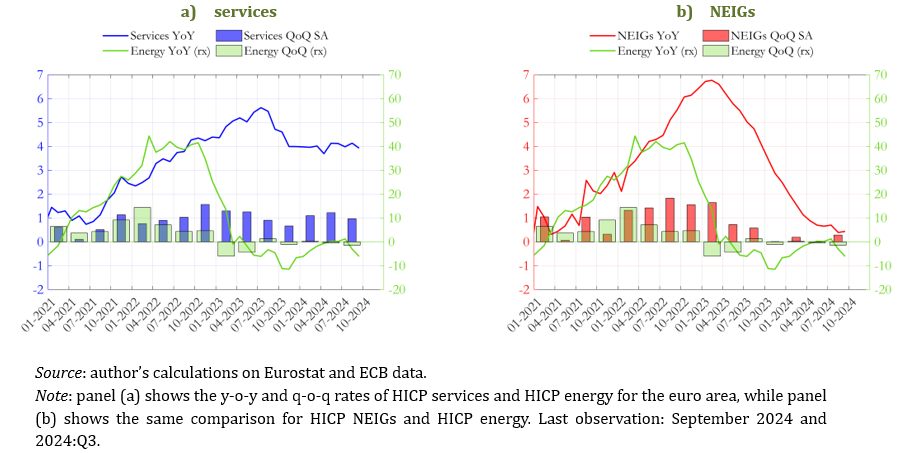

Services inflation has passed its peak but remains elevated and above the pre-pandemic average. Services inflation increased in 2022 and in the first half of 2023 when headline inflation was already on a declining path due to falling energy prices (Figure 1a). The situation is different for NEIGs inflation, which peaked earlier and returned in 2024 to the low levels that prevailed in the first half of 2021 (Figure 1b).

Figure 1. The heterogeneous dynamics of services and NEIGs consumer prices

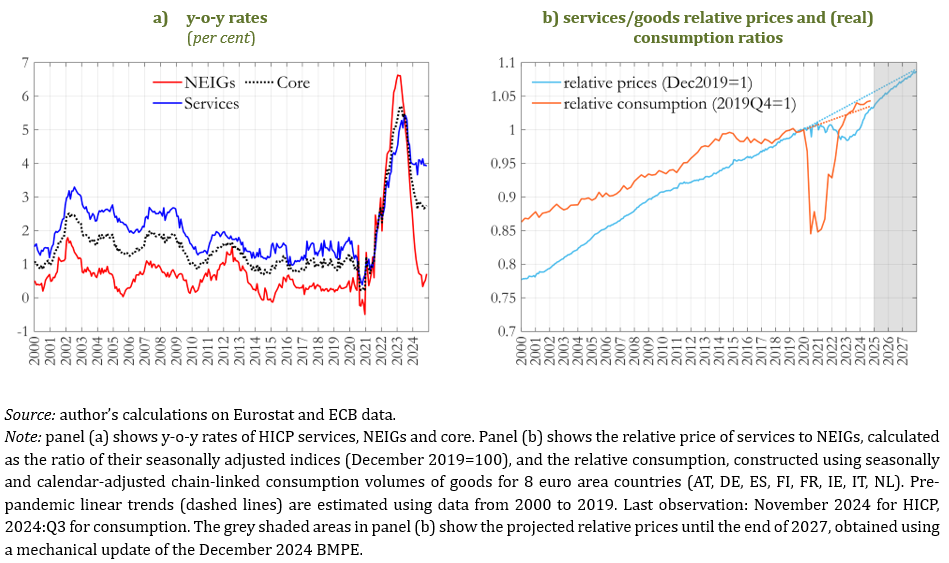

Historically, services inflation has consistently exceeded that of NEIGs (Figure 2a). However, the pandemic and the energy shocks had a significant impact on the relative price of services to NEIGs. The return to the pre-Covid trend has been slow; it could still require some time (Figure 2b), unlike relative consumption, which has already reached its pre-pandemic trend. Indeed, bringing forward the relative price using the December 2024 Eurosystem’s projections, shows that the gap with respect to the pre-pandemic trend would continue to narrow only gradually.

Figure 2. Inflation rates, relative prices and relative consumption in the euro area

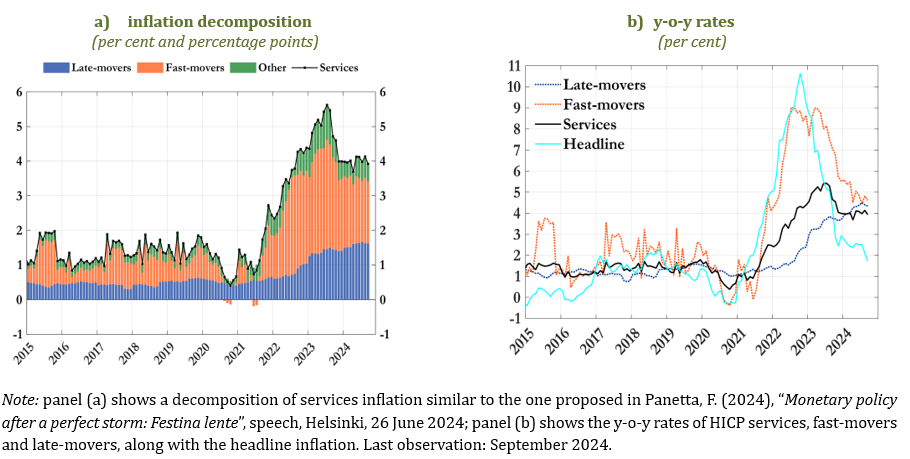

The developments of services inflation mask a layer of heterogeneity. Indeed, most of the strong growth in services prices in recent years has been driven by fast-moving items (Figure 3a), such as travel-related items, restaurants and services related to housing and vehicle maintenance. Since 2023, however, services inflation has also been fuelled by a group of late-mover items (insurance, rents, health, education, cultural, social and administrative services), whose inflation rate has gradually increased in 2024 (Figure 3b), when fast-mover items were already decelerating.

Inflation of fast-movers was increasing in 2021 and 2022, in parallel with headline inflation. These fast-moving items are sensitive to energy prices (e.g. transport-related services), to food prices (e.g. restaurants and cafes) or to the business cycle (e.g. accommodation, package holidays). As the energy and food shocks faded, the prices of fast-movers started decelerating.

Late-movers behaved very differently. Not only did they have very low inflation rates in 2022, but their prices started accelerating gradually only in 2023.

Figure 3. Services inflation: the role of late – and fast-movers

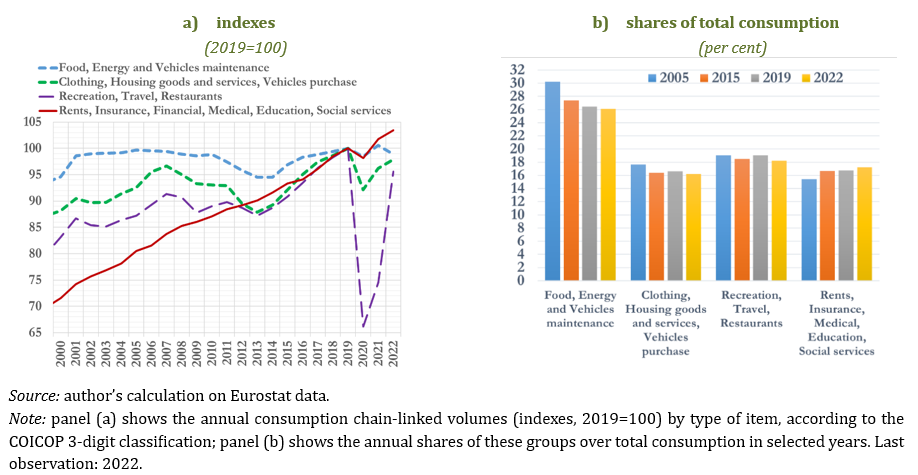

Late-movers are less sensitive to energy prices and to monetary policy, as their demand is less cyclical.2 This may be related to the consumption of these services being more affected by structural factors, as changes in household preferences also related to demographic trends. Indeed, Figure 4 (panel a) shows that since the early 2000s, the consumption of late-movers has been trending upward and has been less affected by downturns compared with NEIGs and leisure services. In fact, the share of late-movers has increased over the past two decades. By 2022, their weight was roughly equal to that of fast-moving leisure services (each accounting for about 40 percent of services consumption).

Allayioti et al. (2024) document that discretionary items tend to be more sensitive to monetary policy shocks, while items that are typically administered prices are not sensitive.

Figure 4. Euro area household expenditure by consumption purpose

We use an econometric model to assess whether the delayed acceleration in the prices of late-comers is consistent with historical regularities and whether it poses a risk to the convergence of inflation to the ECB’s 2 per cent target.

We estimate the model over two sample periods: the full sample (2001-September 2024) and a sample that excludes the energy crisis (2001-June 2021).3 The comparison allows us to uncover potential nonlinearities and state dependence related to the recent unprecedented shocks (Neri, 2024). Indeed, recent economic theory postulates that price setting may depend on the state of the economy, rather than following a fixed schedule as suggested by traditional New Keynesian models. Using granular data, Cavallo et al. (2023) show that price adjustments became significantly more frequent after the large shocks of 2022, as firms reacted quickly to substantial changes in marginal costs (“large shocks travel fast”).

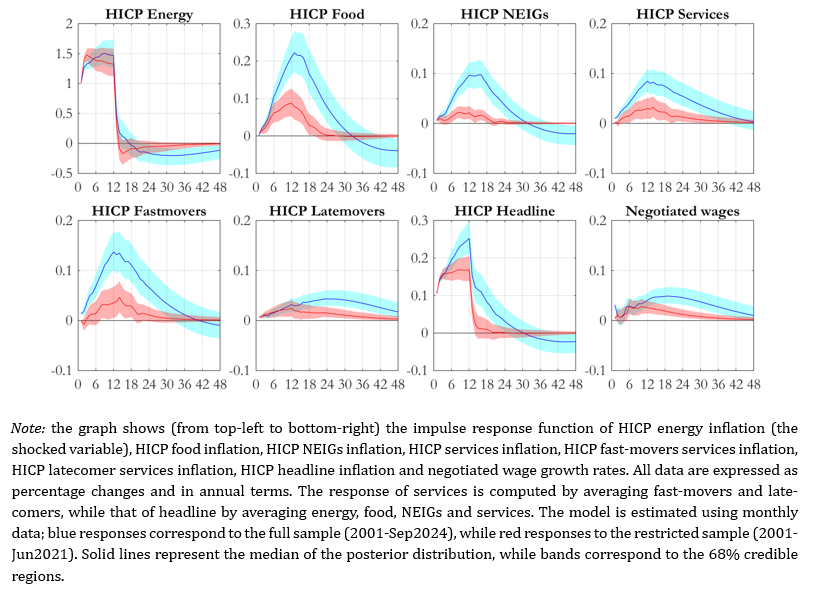

Regardless of the sample, food inflation experiences the larger pass-through from an energy shock, as highlighted in Corsello and Tagliabracci (2023) and Neri (2024). The response of NEIGs is very different between the two samples, with a stronger pass-through in the longer sample. In both cases, the response of NEIGs is absorbed relatively quickly, similar to food inflation. Services inflation responds more slowly than NEIGs and food goods (Panetta, 2024). Within services, fast-movers inflate their prices immediately, reaching their peak response at the same time as NEIGs. For these items, the story of large shocks traveling fast is expressed at its full power

Figure 5. Impulse responses following an energy shock in the euro area

(per cent and percentage points; deviation from unshocked paths)

The picture is very different for late-comers, which instead show a small pass-through and, in particular, a delayed response in the full sample, consistent with the behavior of the raw data shown in the previous section. Inflation of late-comers returns to the baseline after four years. When the sample ends in June 2021, the response of late-comers is similar in magnitude but very different in persistence. This evidence suggests that large shocks not only propagate quickly to the fast-movers, but also cause late-comers to adjust and “catch-up” very slowly. This late acceleration causes only a delayed normalization of services inflation, while the return of headline inflation to the baseline is not affected by this late catch-up.

Two factors explain the results: i) the feedback from late-comers’ prices to other components is very likely to be limited or null; and ii) the response of wages is very similar to the late-comers’, with a small, hump-shaped, and delayed pass-through, but with a slightly earlier peak. Indeed, wages in the euro area are often staggered, backward-looking and slow-moving, and this empirical evidence does not suggest that late catching-up could trigger a wage-price spiral. In line with this evidence, although services prices are more sensitive to labor costs, the more wage-intensive sectors are not making a larger and increasing contribution to services inflation. These items have not fueled services inflation in 2024.

Taken together, the results suggest that the recent acceleration in the prices of latecomer services is consistent with the lagged response of these prices to the exceptional energy shocks in 2021 and 2022 and does not pose a challenge for monetary policy, given the absence of wage-price spirals and well-anchored long-term inflation expectations.

Since the end of 2023 and throughout 2024, services inflation has continued to increase at a faster rate than that of non-energy industrial goods inflation, suggesting a longer-lasting impact of past supply-side shocks. As documented in Panetta (2024), this is mainly due to the high degree of price-setting heterogeneity within services, the largest component by weight in the euro area consumer basket.

A significant proportion of the services components have reacted quickly and extensively (“fast-movers”) to cost shocks, while an equally large proportion of services have, instead, exhibited a delayed and gradual acceleration (“late-comers”). These contrasting trends have resulted in services inflation remaining at approximately 4 per cent in 2024. Fast-movers are mainly private sector, cyclical and energy-intensive services, whereas late-comers include administered and acyclical ones whose prices adjust with long delays.

The aforementioned explanation is validated using a VAR model and identifying shocks to energy prices. We show that the response of food and NEIGs to the energy shock peaks before that of services. The latter masks precisely the heterogeneity between fast-movers and late-comers, which was amplified by the unprecedented size and frequency of energy shocks in 2021 and 2022. In the absence of wage-price spirals and with well-anchored long-term inflation expectations, late-comers will not jeopardise the stability of headline inflation around the ECB’s 2 per cent target.

Allayioti, A., Gόrnicka, L., Holton, S. and Hernández, C. M. (2024). “Monetary Policy Pass-Through to Consumer Prices: Evidence from Granular Price Data”. ECB Working Paper No. 2024/3003

Cavallo, A., Lippi, F., and Miyahara, K. (2024). “Large shocks travel fast”. American Economic Review: Insights, 6(4), 558-574.

Corsello, F. and Tagliabracci, A. (2023). “Assessing the pass-through of energy prices to inflation in the euro area”, Banca d’Italia, Occasional paper 745.

Neri, S. (2024). “’There has been an awakening’. The rise (and fall) of inflation in the euro area”, Banca d’Italia, Occasional paper 834.

Neri, S. (2024). “The transmission of energy price shocks in the euro area”, Banca d’Italia mimeo.

Panetta, F. (2024). “Monetary policy after a perfect storm: festina lente”, speech 3rd Bank of Finland International Monetary Policy Conference on ‘Monetary Policy in Low and High Inflation Environments’, Helsinki, 26 June 2024.

For a detailed chronostory of euro area inflation in the post pandemic, see Neri (2024) “There has been an awakening. The rise (and fall) of inflation in the euro area”.

Allayioti et al. (2024) document that discretionary items tend to be more sensitive to monetary policy shocks, while items that are typically administered prices are not sensitive.

The responses are obtained from a Vector Auto Regressive (VAR) model that includes in the (log-differenced) HICP energy, HICP food, HICP NEIGs, HICP services fast-movers, HICP services late-comers, as well as negotiated wage growth. All variables refer to the euro area as a whole. The model is estimated using Bayesian methods with a Minnesota prior. The energy shock is obtained as an innovation in HICP energy, identified using an orthogonal scheme.