The views expressed are those of the author and do not commit the University of Orléans. The author thanks John Kiff and Nicolas de Sèze for their remarks and remains sole responsible for any error. This paper is based on a presentation at the Forward Financial Thinking Forum, held on 25 September 2024 in Luxembourg (Luxembourg).

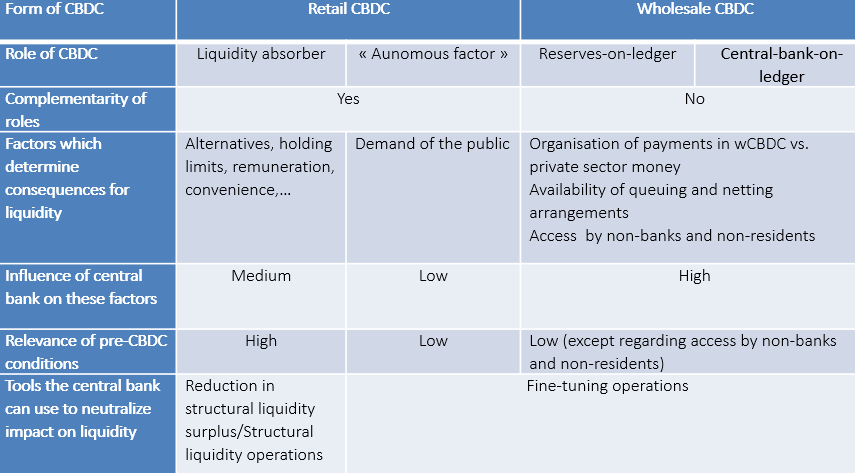

Central bank digital currency (CBDC) has been attracting a lot of attention in academic and political circles in the recent years. However, its potential consequences on liquidity, defined here as the volume of reserves held by banks, are not often discussed. I first describe the state of play at the global level, distinguishing between the two sorts of CBDC, the retail one (rCBDC), accessible to the general public, and the wholesale one (wCBDC), available only to some financial institutions. In a second part, I present the trade-offs in the design of a CBDC that matter for their consequences for liquidity. The third part of the paper presents these consequences, which vary according to the sort of CBDC, the use of it foreseen by the central bank and, for wCBDC, the extent it wishes to use the possibilities opened by recourse to Distributed Ledger Technology (DLT).

According to a survey conducted each year by the BIS, with the latest round published in June 2024 (Di Iorio et al., 2024), 94% of the central banks they had surveyed in 2023 were exploring a CBDC. Also, at the end of July 2024, rCBDC was being explored, or had recently been explored, in 104 jurisdictions (with a currency union, as the euro area, counting for one jurisdiction) (Kiff, 2024). wCBDC was being explored, or had recently been explored, in 23 jurisdictions.

More precisely,

Overall, interest in rCBDC seems to be abating at the global level. This may also be the case for wCBDC in the private sector. Indeed, Citi recently surveyed almost 500 individuals working in financial institutions around the globe, including FMIs, custodians, banks, broker dealers, investment managers and institutional investors. It found that only 15% of respondents expressed a need for CBDC for digital asset settlement, versus 52% of respondents to a similar survey in 2023, and 49% in 2022. Instead, 65% of respondents preferred alternative digital payment methods (against 35% in 2023 and 23% in 2022), including stablecoins, tokenized deposits and tokenized money market funds (Citi, 2024).

Furthermore, providing a link between central bank money and the blockchain universe would also be feasible without launching a wCBDC, using an alternative such as the “trigger solution” experimented by the Deutsche Bundesbank (Diehl and Drott, 2023).3

There are many trade-offs in designing a CBDC. Regarding the retail version, one much talked about trade-off is between privacy and the implementation of AML/CFT requirements. However, in the following, I mention only those trade-offs I consider most relevant in relation to their potential consequences for liquidity.

The main trade-off in the design of a rCBDC, from the perspective of its potential consequences on liquidity, is between being unsuccessful and being too successful. In the first case, central banks could be seen as having wasted public money; in the second case, they could crowd out the private sector. In particular, banks could be disintermediated (i.e. “too many” deposits would be converted into rCBDC), creating a risk for financial stability. The idea is thus to make the use of rCBDC attractive as a means of transaction but not as a store of value. Hence, rCBDC should benefit from legal tender status (Pfister, 2024a), easy access, a high level of safety and security, high convenience (instant settlement, interoperability, automatic funding, offline capabilities,..) and low transaction costs to counter the first of bring unsuccessful. They should bear a zero-interest rate, and be subject to limits on individual holdings and on access for non-residents to counter that of being too successful.

The main trade-offs for wCBDC are between the desire to reduce credit and liquidity risks in wholesale payments for tokenized assets and that to limit the impact of wCBDC on liquidity, and between fully exploiting the capacities of DLT and keeping the monetary policy implementation framework as little changed as possible.4 I elaborate on the second trade-off in the next part and focus on the first trade-off in this part.

The potential consequences of a wCBDC for liquidity could differ according to the organization of payments in wCBDC and, similarly to the case of rCBDC, the use of wCBDC it would imply. This is important because, as indicated in the first part of this paper, there are alternatives to the use of wCBDC and more generally to that of central bank money (the latter point also applies to rCBDC). Two scenarios can be this:

In both cases, an issue would still be to arrange netting and queuing arrangements before final settlement in central bank money, in a way which replicates current arrangements in existing private and public infrastructures.5

rCBDC would be a liquidity-absorbing “autonomous factor” (i.e., in central bankers’ jargon, a factor influencing liquidity, but beyond the immediate control of the central bank).

rCBDC as structural liquidity absorber

Indeed, banks (or other financial intermediaries distributing rCBDC) would have to exchange rCBDC and would get reserves when the holders of wallets exchange it for deposits. So, rCBDC should weigh on the volume of liquidity, all the more so as it would substitute for deposits instead of banknotes.

However, initial conditions would matter. To take the example of the euro area, at the end of August 2024, banks held more than €3tn on their deposit facility accounts. Correspondingly, overnight deposits held by households in the euro area amounted to a little more than €5bn. This means that, everything else equal and even without any substitution of rCBDC for banknotes, if a digital euro were to be issued tomorrow, up to 60% of overnight deposits held by households6 could be converted into rCBDC without generating a liquidity deficit (the situation that prevailed before the Great Financial Crisis).

In the opposite direction, if banks wish to rely on central bank money to fulfil their prudential liquidity requirements, even if there is a structural liquidity surplus, a rCBDC could at times complicate banks’ treasury management. This could in turn be accommodated with an adjustment in the central bank’s liquidity provision.

rCBDC as another “autonomous factor”

The demand of the public for rCBDC would be driven by a variety of factors, such as private consumption, financial conditions,…. As a consequence, the gyrations in the demand for rCBDC could create extra volatility in the volume of liquidity, possibly warranting an intervention of the central bank in the money market to supply or withdraw liquidity. To which extent rCBDC would create such volatility would in part depend on whether it substitutes for banknotes, and hence covaries negatively with them.7 However, such substitution, if any, is more likely to prevail in the medium to long run than in the short run, and would thus not matter much for day-to-day liquidity management by the central bank. Of more concern is that, in case of a financial crisis, the demand for banknotes and for rCBDC would likely increase simultaneously. This could also be accomodated by the central bank conducting fine-tuning operations.

As indicated above, the potential consequences of a wCBDC for liquidity could differ according to the degree of exploitation of DLT possibilities by the central bank. For the sake of simplicity, these consequences can be discussed in the context of two highly differentiated models, with respectively a restrained and an extensive use of the possibilities offered by recourse to DLT, although many variants can be envisaged in-between the two models. I call the first model the “reserves-on-ledger” model, and the second one “central-bank-on-ledger” model (for more details, see Pfister, 2024b).

Reserves-on-ledger

This model would allow to keep monetary policy instruments and procedures basically unchanged, using DLT mainly for “notary” purposes, with the central bank validating all transactions. Apart that a wCBDC would be issued, it would be very close to a “trigger solution”. wCBDC could only be created by transferring reserves onto the wCBDC platform and destroyed by converting wCBDC back to the reserve accounts. The wCBDC platform would operate only during central bank working hours and wCBDC could bear a zero interest rate. At the end of the day, wCBDC would be converted back into reserves. Clearly, just as “trigger solutions” (see footnote 5), the “reserves-on-ledger” model could only be transitory if tokenization takes hold.

Central-bank-on-ledger

This model aims to draw as much as possible on the possibilities offered by DLT, implying significant amendments to the monetary policy instruments and procedures. wCBDC could be created directly on the wCBDC platform, for instance by purchasing assets or by conducting refinancing operations on it. Transactions would be validated by participants. The wCBDC platform would operate on a 24×7 basis. At some point, this could lead the central bank to also operate on a 24×7 basis. Finally, giving non-banks (e.g., payment service providers) or non-resident banks access to wCBDC could be considered.

Actually, many of these changes do not presuppose the issuance of wCBDC (for instance, the Swiss National Bank already gives access to non-residents banks). Rather, issuing a wCBDC would provide an opportunity to implement them in the context of a central bank for the digital era. They would also bring central banks’ practices closer to those regarding cryptoassets, access to which is permanent, global, and open to all categories of agents.

CBDC: Potential consequences for liquidity

Bank of Canada (2024), Digital Canadian Dollar.

Citi (2024), Securities Services Evolution 2024 – Disruption and transformation in financial market infrastructures

Diehl M., Drott C. (2023), Empowering Central Bank Money for a Digital Future, SUERF Policy Note, 312, June.

Di Iorio A., Kosse A., Mattei I. (2024), Embracing diversity, advancing together – results of the 2023 BIS survey on central bank digital currencies and crypto, BIS Papers, 147.

Kiff J. (2024), Kiffmeister Chronicles, 5 September, https://kiffmeister.com/2024/09/05/jurisdictions-where-retail-cbdc-is-being-explored-3/.

Pfister C. (2024a), Digital Euro: The Case Against Legal Tender, 2024, SUERF Policy Brief 799, February.

Pfister C. (2024b), Issuing a Wholesale Central Bank Digital Currency: Why and How, Intereconomics, 59(1).

The Regulated Liabilities Network (2023), The Regulated Liabilities Network – Digital Sovereign Currency – Whitepaper, 15 November.

The BIS also counts the Eastern Caribbean as having launched a rCBDC whereas, according to Kiff (2024), it is just a pilot, thus not an official launch.

The difference between a “pilot” and a “proof of concept” (POC) is that a pilot involves actual users, whereas a POC does not, even though some POCs may involve central bank staff.

A trigger solution would build a technical bridge between the central bank’s RTGS and the asset chain on which tokenized assets are issued, traded and settled. However, this solution could probably not dispense from issuing a wCBDC in the longer run, incase the tokenization of financial assets generalized.

Unlike rCBDC, wCBDC would necessarily use DLT since reserves are already available in digital format.

This would be similar to the use of “layer 2 protocols” like the Ligthning networks in cryptoassets transactions, but would take place in a regulated environment.

The ECB envisages that only individuals could hold the digital euro.

To remind, Var (X + Y) = Var(X) + Var(Y) + 2Cov(X, Y).