References

Andolfatto, David. (2018). “Assessing the Impact of Central Bank Digital Currency on Private Banks”. Working Paper, 25, FRB St Louis. https://dx.doi.org/10.20955/wp.2018.026

Bindseil, Ulrich. (2020). “Tiered CBDC and the financial system”. Working paper, 2351, European Central Bank. https://dx.doi.org/10.2139/ssrn.3513422

Champ, Bruce, Bruce D Smith and Stephen D Williamson. (1996). “Currency elasticity and banking panics: Theory and evidence”. Canadian Journal of Economics, 29(Nov.), pp. 828-864. https://doi.org/10.2307/136217

Dwyer Jr, Gerald P. (1996). “Wildcat Banking, Banking Panics, and Free Banking in the United States”. Economic Review, 81, FRB Atlanta. https://www.atlantafed.org/research/publications/economic-review/1996/no3-6/vol81nos3-6_wildcat-banking.aspx

Goodhart, Charles. (1988). The evolution of central banks. MIT press. https://mitpress.mit.edu/9780262570732/the-evolution-of-central-banks/

Humphrey, David, Lawrence Pulley and Jukka Vesala. (2000). “The Check’s in the Mail: Why the United States Lags in the Adoption of Cost-Saving Electronic Payments”. Journal of Financial Services Research, 17(1), pp. 17-39. https://doi.org/10.1023/A:1008163308353

Lambert, Claudia, Barbara Meller, Cosimo Pancaro, Antonella Pellicani, Petya Radulova, Oscar Soons and Anton van der Kraaij. (2024). “Digital euro safeguards–protecting financial stability and liquidity in the banking sector”. Occasional Paper, 345, European Central Bank. https://dx.doi.org/10.2139/ssrn.4800259

Meller, Barbara, and Oscar Soons. (2023). “Know your (holding) limits: CBDC, financial stability and central bank reliance”. Occasional Paper, 326, European Central Bank. https://dx.doi.org/10.2139/ssrn.4543369

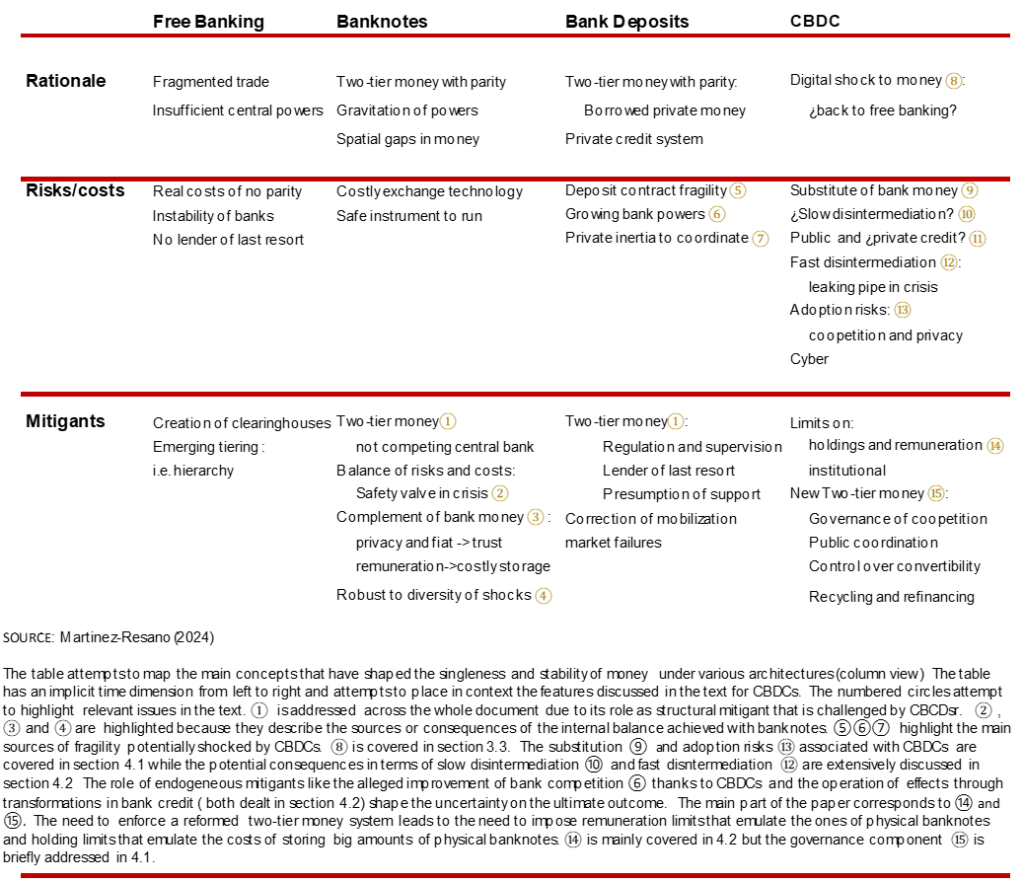

Martinez-Resano, José Ramon. (2024). ” CBDCs, banknotes and bank deposits: the financial stability nexus”. Working Paper, 2436, Bank of Spain. https://repositorio.bde.es/handle/123456789/38457?locale=en

Mayer, Thomas. (2023). The digital euro: An opportunity likely to be missed. In: Flossbach von Storch.

https://www.flossbachvonstorch-researchinstitute.com/en/studies/the-digital-euro-an-opportunity-likely-to-be-missed/

Padoa-Schioppa, Tommaso. (2004). Shaping the payment system: a central bank’s role. European Central Bank. Retrieved 05/13/2004. https://www.ecb.europa.eu/press/key/date/2004/html/sp040513_1.en.html

Whited, Toni M, Yufeng Wu and Kairong Xiao. (2022). “Will Central Bank Digital Currency Disintermediate Banks?”, Working Paper, University of Michigan. https://dx.doi.org/10.2139/ssrn.4112644

Leibbrandt, Johan Gottfried. (2004). Payment systems and network effects [Thesis]. University of Maastricht. https://cris.maastrichtuniversity.nl/files/612143/guid-dcaa651e-4d40-4aa0-8226-ae95f3b7b04c-ASSET1.0.pdf&ved=2ahUKEwilzN7QrpiJAxVqcvEDHaOCKCUQFnoECBUQAQ&usg=AOvVaw0H0qwwHRL419iaHqxnJj-B