In recent stress episodes, the margin calls of Central Counterparties (CCPs) reached unprecedented levels, raising liquidity risk for some market participants in Europe and US. For example, the additional US$ 300 BN of initial margins (IM) called during the Covid Crisis in March 2020 contributed to a “dash for Cash”1, which even affected the US Treasury market. CCPs allow market participants to manage and reduce counterparty and liquidity risks. In this respect initial margins are key to protect a CCP against the potential future exposure that a CCP could face in case of a clearing member default. Understanding how initial margin models work is crucial for market participants to predict their liquidity needs and reduce liquidity risk. Summarizing our recently published ECB Occasional Paper, we present a current picture of initial margin models in Europe. We find that initial margin model frameworks vary significantly, depending on past choices and the products cleared by CCPs, while pointing towards a trend to adopt Value-at-Risk (VaR) frameworks for initial margin calculation purposes. We conclude by highlighting current and upcoming challenges and risks to CCP initial margin model frameworks.

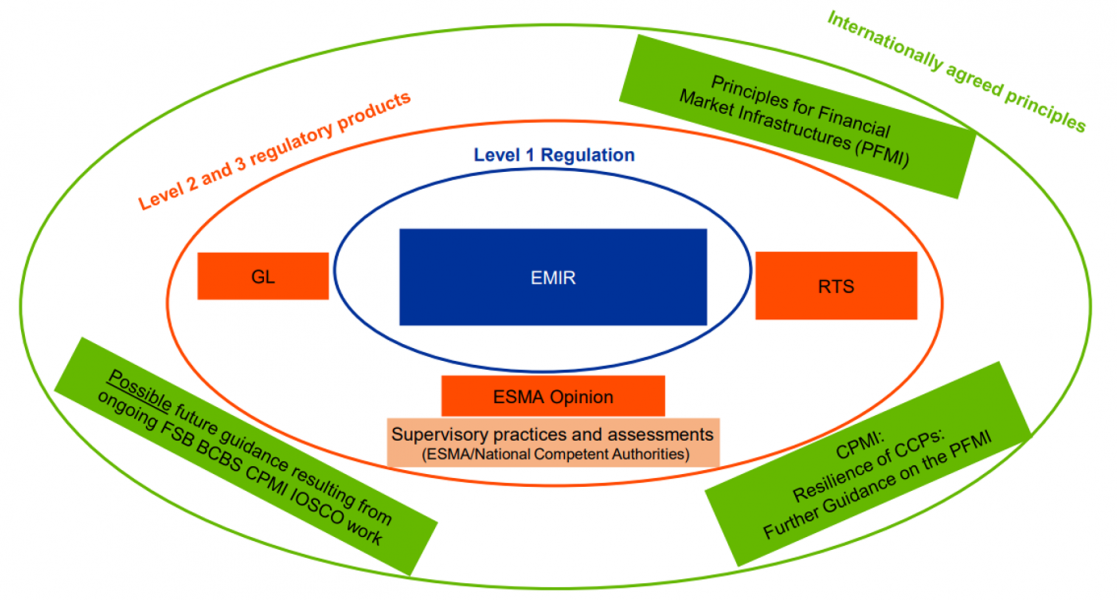

To quantify and assess risks CCPs rely notably on initial margin (IM) models which are key to protect a CCPs from a clearing member default event. In Europe, CCP risk management frameworks are regulated via the European Market Infrastructure Regulation (EMIR)2. Additionally, the Committee on Payments and Market Infrastructures (CPMI) and the International Organization of Securities Commissions (IOSCO) have shared global expectations on CCP margin models which are also relevant for all European CCPs3.

Figure 1: Schematic overview of the European regulatory framework for IM models

Sources: Authors’ illustration.

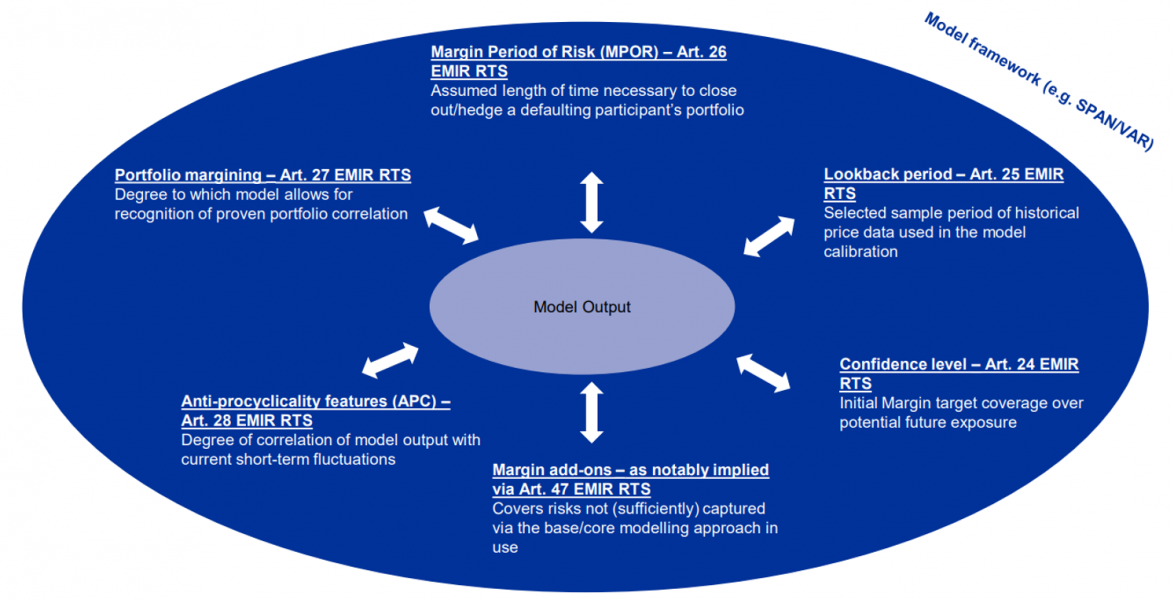

Although this regulatory framework establishes a range of minimum requirements, specific rules for initial margin models remain largely principle-based, with the underlying assumption that CCPs are in the better position than regulators to understand the risks of their clearing members and products4. Consequently, IM model framework vary significantly across CCPs although they can roughly be subdivided into two major categories: Standard Portfolio Analysis of Risk (SPAN)5 and Value at Risk (VaR) models6.

Figure 2: Schematic overview of IM model output determinants

Sources: Authors’ illustration.

Recent market episodes of financial turmoil, coupled with the existence of differing modelling practices, have raised awareness of the divergence in outcomes and the performance of the models currently used by CCPs to derive their IM requirements, putting the item atop the regulatory agenda both in Europe and at international level7.

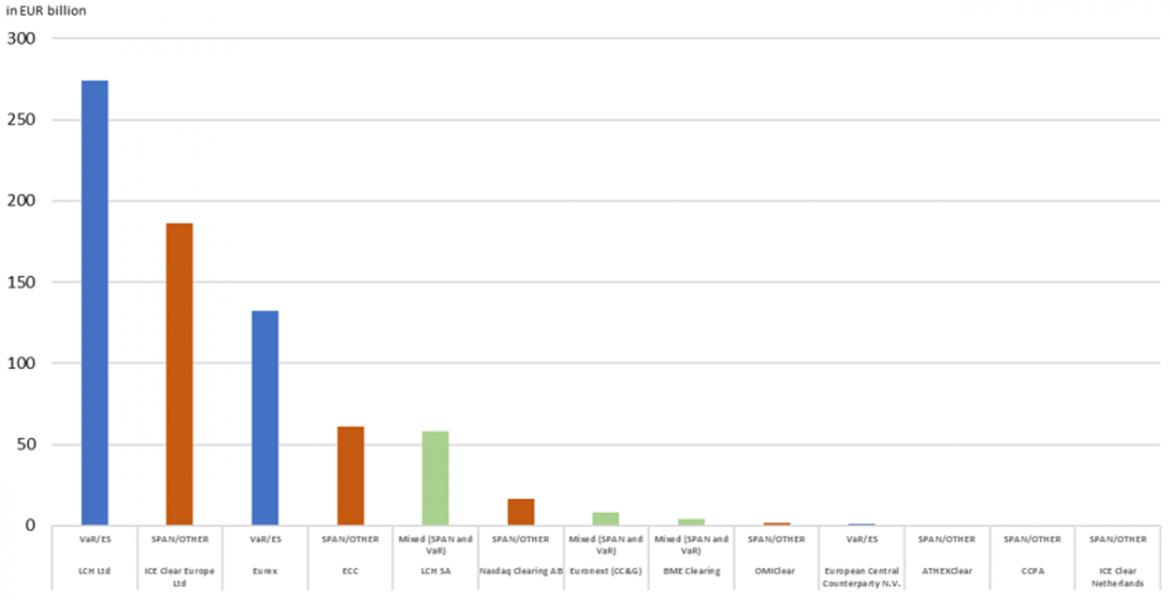

In our paper, we provide a comparison of IM model frameworks in Europe, albeit refraining from voicing any preference for a specific model framework. On the one hand, SPAN frameworks have been used for decades. Performing adequately, they have proven to be generally less reactive and more conservative, thus feeding into procyclical feedback loops to a lesser extent when compared to VaR/Expected Shortfall (ES) models. On the other hand, VaR frameworks also have a strong track record and are also used by banks to calculate market risk. VaR modelling offers a more direct, risk-sensitive margin computation, including for more complex products and portfolios.

When reviewing modelling practices across CCPs, we found that depending on the CCP and derivatives type, initial margin model approaches differ. As of year-end-2022, a majority of CCPs in the relevant sample used SPAN-based or non-VaR proprietary models to derive their margins across their cleared products. Other CCPs used both SPAN and VaR model frameworks to derive their margins (depending on the derivative types) and only 2 CCPs applied VaR models across all their cleared product offerings.

This is bound to change in the foreseeable future as a range of CCPs have committed to move from SPAN to VaR frameworks. Aside from a dependence on the CCP, the decision of using a certain model framework also depends on the product category, e.g., commodities are nearly exclusively margined via SPAN, whilst swaps are usually margined in VaR models.

Going forward and despite a trend to VaR frameworks, SPAN models are likely to subsist for simpler products at smaller CCPs, which may not see the need or have the resources to transition to VaR/ES frameworks. These models are likely to undergo further changes, which is likely to lead to more divergence between CCPs as each develops their own product-specific (sub) models.

VaR/ES models are also likely to become the framework of choice for larger CCPs, especially when complex product portfolios are ubiquitous. Nevertheless, no model “monoculture” is likely to emerge, as model frameworks are likely to differ materially depending on the products cleared and methodology chosen.

Figure 3: Schematic overview of European IM model frameworks across CCPs

Sources: Authors’ illustration, based on publicly available CCP Information.

*Whilst largely relying on a VaR-based IM framework, margins for a small subset of products are still derived via a SPAN-like model.

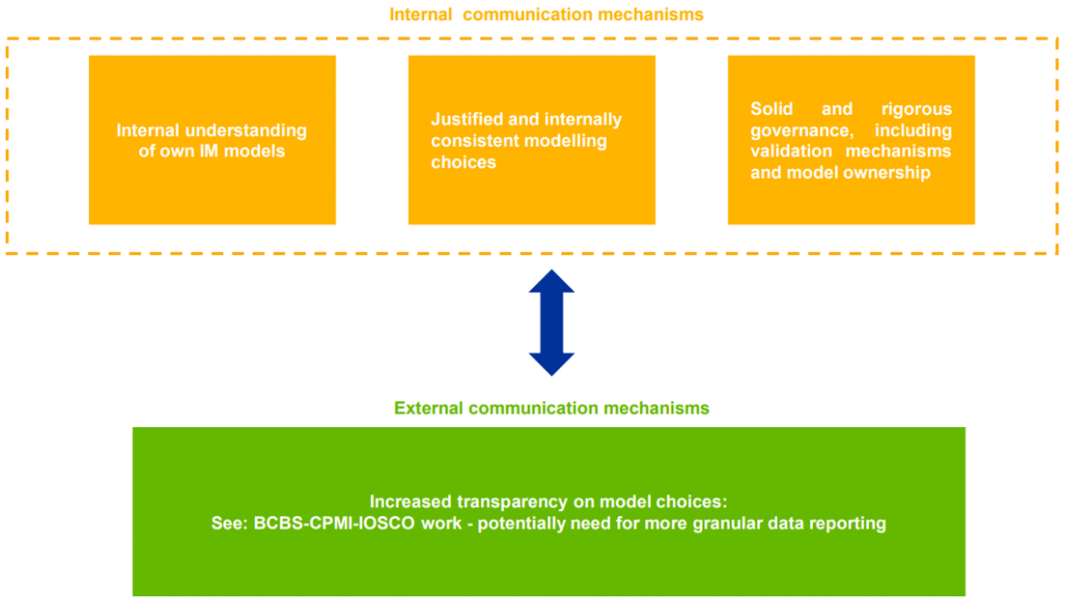

Despite the fact that regulatory requirements are largely principles-based and a significant degree of model diversity is likely to persist, we firmly believe that a push for increased transparency on modelling choices, as well as stronger and converging industry practices will rank high on regulators’ agenda over the next years.

First and foremost, CCPs are expected to continue investing and understanding the strengths and weaknesses of their IM models. As CCPs update their model frameworks, it will be important to have updated documentation on modelling choices, have the capabilities to perform ongoing monitoring of modelling outputs and engage in comprehensive deliberations on upcoming changes and required modifications.

Consistency is key also to establishing clear decision-making procedures, thus facilitating the implementation of proper governance. When opting for a certain methodological choice, CCPs will ideally implement a cost-benefit analysis of the various available methodological choices and provide reasoning and evidence for their choice, avoiding regulatory arbitrage and cherry picking.

Finally, CCPs shall maintain solid and rigorous governance and validation mechanisms, which are ideally risk-based and go beyond the regulatory minimum, where deemed appropriate.

It has become clear that additional efforts are needed to provide further transparency to market participants (clearing members and clients) about CCPs’ IM models. Certain counterparties seem to have been insufficiently prepared for sudden margin spikes and have struggled to source sufficient collateral in the required time, which also raises liquidity concerns for some sectors. While the recent volatility episodes were driven by largely exogenous and unforeseeable events, a better understanding of margin models by market participants could have smoothed over the situation and muted the liquidity strains in the system.

Figure 4: Schematic overview of focus areas for sound IM modelling prarctices

Sources: Authors’ illustration.

Armakolla, Angela and Bianchi, Benedetta (2017), “The European central counterparty (CCP) ecosystem”, IFC Bulletin chapters in: Bank for International Settlements (ed.), Data needs and Statistics compilation for macroprudential analysis, volume 46, Bank for International Settlements.

Committee on Payments and Market Infrastructures and Board of the International Organization of Securities Commissions (2012), “Principles for financial market infrastructures”.

Committee on Payments and Market Infrastructures and Board of the International Organization of Securities Commissions (2021), “Consultative Report: Review of margin practices”, Bank for International Settlements, Basel, October.

Mourselas, Costas (2019), “The great migration: CCPs ponder life after Span”, August.

European Central Bank (2021), “Lessons learned from initial margin calls during the March 2020 market turmoil”, Financial Stability Review, Frankfurt am Main, November.

Financial Stability Board (2021), “Enhancing the Resilience of Non-Bank Financial Intermediation”, November.

Gurrola-Perez, Pedro and Murphy, David (2015), “Filtered historical simulation –-Value-at-Risk models and their competitors”, Bank of England staff working paper, 525, February.

LCH (2015), “On the Margin – Portfolio Managing at a CCP”, August.

See Basel Committee on Banking Supervision, Committee on Payments and Market Infrastructures and the International Organization of Securities Commissions “Review of margining practices”, September 2022.

In Europe, further guidance and specifications on CCP IM models are provided via ESMA/NCA supervisory practices as well as a Regulatory Technical Standard (RTS), a Guideline (GL) and an ESMA opinion.

See CPMI/IOSCO “Principles for financial market infrastructures,” April 2012 and “Resilience of central counterparties (CCPs): Further guidance on the PFMI,” July 2017.

It is important to highlight that the the level of prescriptiveness varies across jurisdictions.

See CME Group (2019), “CME SPAN Standard Portfolio Analysis of Risk” for further information on SPAN.

This dichotomy is by no means absolute, and delimitations have weakened over time.

See ECB (2021), “Lessons learned from initial margin calls during the March 2020 market turmoil”, Financial Stability Review, November.