We use a random controlled trial among Dutch households to analyze whether communication about monetary policy instruments impacts inflation expectations and trust in the ECB. All participants in the survey receive information about the ECB’s goal, but only a subset also receives information about how the ECB tries to achieve this. Our results suggest that individuals who are informed about policy instruments have inflation expectations closer to the ECB’s target inflation than individuals who only receive information about the ECB’s objective. Our evidence also indicates that communication about the ECB’s instruments does not impact average trust in the ECB.

Over the past two decades, monetary policy has increasingly become the art of managing expectations. Initially, central banks focused primarily on audiences of specialists, such as financial market participants, academics, and journalists (see Blinder et al. 2008 and de Haan and Sturm 2019 for surveys). Likewise, research focused on the effects of central bank communication on financial markets. In their survey of the pre-crisis literature on central bank communication, Blinder et al. (2008) concluded that: “Virtually all the research to date has focused on central bank communication with the financial markets. It may be time to pay some attention to communication with the general public.”

Nowadays, central banks not only communicate to financial markets but also to the general public. The increased emphasis by central banks on communication with the general public has various reasons. To start with, as central banks have become more independent over time, they have to pay closer attention to explaining what they do and what underlies their decisions. In line with this, central banks have strengthened their presence in social media, provide layered communication that explains the content at different levels of complexity, and have broadened the availability of educational resources, for instance via their websites. Informing society became even more important after central banks introduced controversial unconventional monetary policy instruments (Blinder et al., 2017). Christine Lagarde, president of the European Central Bank (ECB), even considers the general public as “a new frontier” for central bank communication, arguing that: “Central banks have to be understood by the people whom they ultimately serve. This is a key to rebuilding trust”.

Apart from accountability, communication with the general public is also important because it may help achieving price stability (Binder, 2017) through two channels: 1. anchoring inflation expectations, and 2. stabilizing economic conditions through managing inflation expectations. The anchoring of inflation expectations is a necessary condition for central banks to maintain price stability, as it prevents temporary shocks to inflation from feeding into the mechanisms of wage and price formation. Several studies report that communicating the central bank’s inflation target helps to anchor inflation expectations (Binder and Rodrigue, 2018; Coibion et al., 2019). As the public’s perceptions of actual inflation are often wrong, providing information on inflation may also move inflation expectations closer to the central bank’s target (Binder and Rodrigue, 2018; Coibion et al., 2019; Rumler and Valderrama, 2020). Next to anchoring inflation expectations, communication with the general public could be used to stabilize economic conditions when nominal interest rates reach their effective lower bound. By raising expected inflation through communication, the real rate of interest can be reduced (Candia et al., 2020).

The effects of central bank communication to the general public have only recently drawn researchers’ attention. Most studies in this line of research have two elements in common: they focus on the impact of communication on inflation expectations and use a random controlled trial (RTC) to isolate the effect of receiving information about the central bank on inflation expectations. These studies show that receiving information moves inflation expectations closer to the inflation target of the central bank. However, there is no consensus about what the public should be informed. Evidence suggests that inflation expectations shift towards the inflation target when people receive information about: current inflation (Binder and Rodrigue, 2018; Coibion et al., 2019), the inflation target of the central bank (Binder and Rodrigue, 2018; Baerg et al., 2018) and, the central bank’s inflation forecasts (Coibion et al., 2019). In a recent paper (Brouwer and de Haan, 2021), we use a RTC to examine whether communication about both the ECB’s goal and monetary policy instruments is more effective than providing only information about its goal.

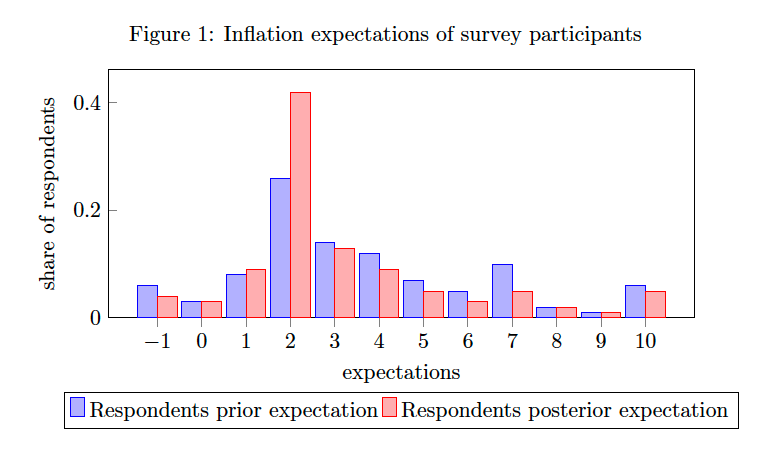

Our analysis is based on data collected using the Dutch Household Survey (DHS). We embed a vignette experiment into a survey to identify the impact of providing information. First, each participant receives information about the inflation target of the ECB and current inflation. Next, the participants are randomly assigned across four groups. Three of these groups receive additional information about a particular instrument of the ECB (interest rate policy, negative interest rates, and asset purchase program). Before and after receiving this treatment, the respondents were asked about their inflation expectations (see Figure 1). We test the effect of providing information about policy instruments on inflation expectations by comparing the treatment groups’ answers to these two questions (before and after presenting the text to those of the control group which did not receive this information).

Note: This histogram shows the distribution of inflation expectations of the respondents. This question has been answered twice by all participants: before and after receiving information about the ECB (prior and posterior expectations, respectively). The numbers shown refer to inflation expectations of all respondents.

Our estimation results (see Brouwer and de Haan, 2021 for details) suggest that providing information about the inflation target and monetary policy instruments affects inflation expectations more than solely providing information about the inflation target. Compared to individuals who only receive information about the inflation target of the ECB, individuals who receive additional information about how the ECB tries to achieve this objective adjust their inflation expectations more towards this target. This result suggests that central bank communication towards the general public may support policies aimed at price stability. Interestingly, our results suggest that age matters for the effect of our treatment. We find a significant effect for all of our treatments for individuals aged between forty and seventy and no significant treatment effect for the other age groups.

In their presentation at the 2020 Jackson Hole conference, Candia et al. (2020) argue that “an important lesson from the RCT approach is that simple pieces of information, when they get through to the public, can have very large effects on inflation expectations. This suggests that there is significant potential in using communication strategies to affect the expectations of the general public as a tool to help stabilize the economy.”

Although our results seem to be in line with this optimistic conclusion, an important caveat is in order here. Just like most previous research on the impact of central bank communication with the general public, our evidence is based on a random controlled trial, which has the obvious advantage of strong identification. However, in a RTC set-up, it is ensured that participants get exposed to central bank communication, while in real life the public may be inattentive. In contrast to financial market participants and professional forecasters, households and firms seem to have a low desire to be informed by the central bank (van der Cruijsen et al., 2015) and are relatively inattentive to information concerning monetary policy and inflation dynamics. This failure is readily explained by rational inattention theory. Households and firms are more likely to pay attention to communication if they believe it will benefit them (net of any costs) by, for example, making better decisions. Households and firms which do not understand what the central bank aims for, or how its policies affect economic conditions, or how these conditions affect them personally (all of which are common) will be less attentive (Binder, 2017). Ironically, as pointed out by Coibion et al. (2020), successful monetary policy breeds inattention to monetary policy: Economic agents in countries with long histories of low and stable inflation have little incentive to track inflation and monetary policy closely. Consequently, if the public ignore central bank information and thus do not process it, communication cannot be effective.

Public trust enhances the political legitimacy of central banks. Furthermore, public trust may help central banks to achieve price stability as a higher level of trust is reported to lead to more accurate individual inflation forecasts (Rumler and Valderrama, 2020) and inflation expectations which are closer to the central bank’s inflation target (Christelis et al., 2020). According to Haldane (2017), communication can increase the level of knowledge about the central bank, which may increase public trust. Previous studies report that more knowledge about the ECB comes with more trust in the ECB. For instance, using a public opinion survey among German households conducted in 2011, Hayo and Neuenkirch (2014) find that respondents with knowledge about the ECB have more trust in the ECB than respondents who do not have this knowledge. Likewise, Mellina and Schmidt (2018) report that knowledge about the mandate of the ECB is an important driver of trust.

Much of the research related to trust has been conducted for the case of the ECB, given readily available survey data from the Eurobarometer. These data reveal clearly that trust in the ECB has fallen substantially after the European sovereign debt crisis and following the introduction of unconventional monetary policy (Bergbauer et al., 2019). In their analysis of the determinants of trust following the global financial crisis and the European sovereign debt crisis, Ehrmann et al. (2013) report that the fall in trust reflected the deterioration of the economic situation, a more generalized fall in the trust in European institutions in the wake of the crisis, and the severity of the banking sector’s problems, to which the ECB was associated in the public opinion.

In our research, we also examine whether communication is related to trust in the ECB. As far as we know, this is the first time that the impact of central bank communication on trust is examined based on a RTC. The data used in Brouwer and de Haan (2021) has several advantages over the use of the Eurobarometer data. First, the DHS provides detailed information on respondents’ characteristics, such as their education level, gender, and employment situation for which we can control. Second, we can control for respondents’ knowledge about the ECB’s objectives and their financial sophistication. This is important as several studies suggest that financial literacy is important: more knowledgeable individuals have inflation expectations that are more realistic, more accurate and more in line with the central bank’s inflation target (Van der Cruijsen et al., 2015; Baerg et al., 2018).

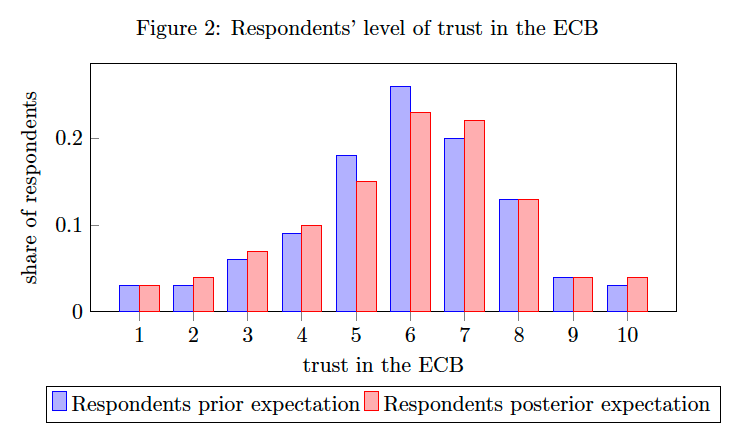

Christelis et al. (2020), who asked DHS participants about their trust in the ECB in 2015 using the same question as the present study, report a mean of 4.7 for trust in the ECB, whereas in our survey average trust amounts to 5.7. Furthermore, the standard deviation in our survey is lower (1.8 versus 2.1). This suggests that trust in the ECB has increased between 2015 and 2020.

In our survey, we ask participants to indicate how much they trust the ECB before and after the information treatment (see Figure 2). By comparing the answers to these two questions, we can identify the impact of communication on trust in the ECB.

Note: This histogram shows the distribution of respondents’ trust in the ECB. Respondents had to rate trust in the ECB on a scale from very low (1) to very high (10). This question has been answered twice by all participants: before and after receiving information about the ECB (prior and posterior expectations, respectively). The numbers shown refer to trust in the ECB of all respondents.

Our results suggest that providing information about ECB instruments does not impact average trust in the ECB. There are several possible explanations for this finding. A first possibility could be that individuals did not understand the provided information. However, this possibility seems improbable as we did find an effect of the information treatment on inflation expectations. A second option could be that the level of trust in the ECB is relatively rigid: a text is not sufficient to change peoples’ feelings towards the ECB. For instance, studies in sociology stress the importance of “engagement” instead of merely providing information. More research is needed to examine whether more frequent or more interactive communication increases trust in the central bank.

Baerg, N., D. Duell, and W. Lowe (2018). Central Bank Communication as Public Opinion: Experimental Evidence. Unpublished manuscript.

Bergbauer, S., J.-F. Jamet, H. Scho lermann, L. Stracca and C. Stubenrauch (2019). Global Lessons from Euroscepticism, VoxEU, 20 September 2020, available at https://voxeu.org/article/global-lessons-euroscepticism.

Binder, C. (2017). Fed Speak on Main Street: Central Bank Communication and Household Expectations. Journal of Macroeconomics 52, 238-251.

Binder, C., and A. Rodrigue (2018). Household Informedness and Long-Run Inflation Expectations: Experimental Evidence. Southern Economic Journal 85(2), 580-598.

Blinder, A.S., M. Ehrmann, J. de Haan, and D. Jansen, D. (2017). Necessity as the Mother of Invention: Monetary Policy after the Crisis. Economic Policy 32(92), 707-755.

Blinder, A.S., M. Ehrmann, M. Fratzscher, J. de Haan, and D. Jansen, D. (2008). Central Bank Communication and Monetary Policy: A Survey of Theory and Evidence. Journal of Economic Literature 46, 910-45.

Brouwer, N. and J. de Haan (2021). The Impact of Providing Information about Instruments on Inflation Expectations and Trust in the ECB: Experimental Evidence. DNB Working Paper 707.

Candia, B., O. Coibion, and Y. Gorodnichenko (2020). Communication and the Beliefs of Economic Agents. Paper presented at the Jackson Hole Economic Symposium, August 2020.

Christelis, D., D. Georgarakos, T. Jappelli, and M. van Rooij (2020). Trust in the Central Bank and Inflation Expectations. International Journal of Central Banking 65, 1–37.

Coibion, O., Y. Gorodnichenko, and M. Weber (2019). Monetary Policy Communications and their Effects on Household Inflation Expectations. NBER Working Paper 25482

Coibion, O., Y. Gorodnichenko, and M. Weber (2020). Does Policy Communication During Covid Work? NBER Working Paper 27384.

de Haan, J., and J-E. Sturm (2019). Central Bank Communication. In The Oxford Handbook of the Economics of Central Banking. Oxford University Press.

Ehrmann, M., M. Soudan and L. Stracca (2013). Explaining European Union Citizens’ Trust in the European Central Bank in Normal and Crisis Times. Scandinavian Journal of Economics 115(3), 781–807.

Haldane, A. (2017). A Little More Conversation, a Little Less Action. Bank of England-Speech.

Hayo, B. and E. Neuenkirch (2014). The German Public and its Trust in the ECB: The Role of Knowledge and Information Search. Journal of International Money and Finance 47, 286–303.

Mellina, S., and T. Schmidt (2018). The Role of Central Bank Knowledge and Trust for the Public’s Inflation Expectations. Deutsche Bundesbank Discussion Paper 32/2018.

Rumler, F., and M.T. Valderrama (2020). Inflation Literacy and Inflation Expectations: Evidence from Austrian Household Survey Data. Economic Modelling 87, 8–23.

van der Cruijsen, C., D. Jansen, and J. de Haan (2015). How Much Does the Public Know about the ECB’s Monetary Policy? Evidence from a Survey of Dutch Households. International Journal of Central Banking 11, 169–218.