This policy brief is based on European Central Bank Occasional Paper Series No. 345. The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank (ECB).

Abstract

This policy brief summarises two of the main findings presented in our paper ‘Central Bank Digital Currency and Monetary Policy Implementation’. A retail central bank digital currency (CBDC) could affect monetary policy implementation if it changes the volume of commercial bank deposits held by customers, as this would, in turn, affect the central bank reserves in the system. While it is often assumed that customer deposits would decrease if a CBDC was introduced, we provide arguments why this is by no means clear cut and deposits could even increase if the conversion of bank deposits into CBDC is easy and cost-free. If bank deposits do decrease, banks would need to draw on, and therefore reduce, their central bank reserve holdings. Moreover, uncertainty as to the timing and extent of any conversions of deposits into CBDC might prompt banks to scale up their demand for central bank reserves to hold larger precautionary buffers. Consequently, central banks might need to adjust their reserve supply and other features of their monetary policy implementation. Design features already announced by the ECB for the digital euro would minimise the risk of such complications for monetary policy implementation.

A CBDC is a new form of central bank money. Like banknotes, it is a claim on the issuing central bank that can be used to make payments with instant settlement 24 hours a day, seven days a week. But, unlike banknotes, it exists only in digital form. If it is available to the general public, including households and non-financial corporations, it is referred to as a retail CBDC. If it can only be used by (financial) institutions, it is referred to as a wholesale CBDC.

Central banks around the world have been assessing the advantages and disadvantages of CBDCs. In 2022, 80 out of the 86 central banks that responded to a survey conducted by the Bank for International Settlement (BIS) said that they were engaged in work on the issue of CBDCs. A small number of central banks had already introduced a retail CBDC (the central banks of Nigeria, the Bahamas, Jamaica and the Eastern Caribbean Currency Union) or were conducting pilot tests (on a large scale for example in China and India). Other central banks have announced concrete investigations into a retail CBDC (e.g. the Bank of England and the ECB).

In our paper ‘Central Bank Digital Currency and Monetary Policy Implementation’, we discuss the potential implications of a retail CBDC for the implementation of monetary policy. One of the main objectives of monetary policy implementation is to steer short-term market interest rates to the level that is considered appropriate for the monetary policy stance being pursued. For most central banks, this is achieved by, among other things, controlling the amount of reserves that the banking sector holds with the central bank. Given that a retail CBDC could have an impact on the stock of reserves, it is a potentially relevant factor to be considered in relation to monetary policy implementation. Consequently, our paper looks at different aspects of the introduction of a retail CBDC and the likely implications for monetary policy implementation, focusing in particular on the impact on bank deposits and central bank reserves. The analysis refers to a generic retail CBDC –not to a specific initiative such as the digital €– and traces out the implications for different monetary policy operational frameworks.

The introduction of a retail CBDC may have a strong impact on how people pay for goods and services: some items that would have been paid for with cash or from bank deposits before the CBDC was available would now be settled in CBDC. If individuals who wish to pay for an item with a CBDC need to convert cash or bank deposits into CBDC beforehand, a demand for CBDC would be generated and the demand for cash and/or bank deposits would be reduced.

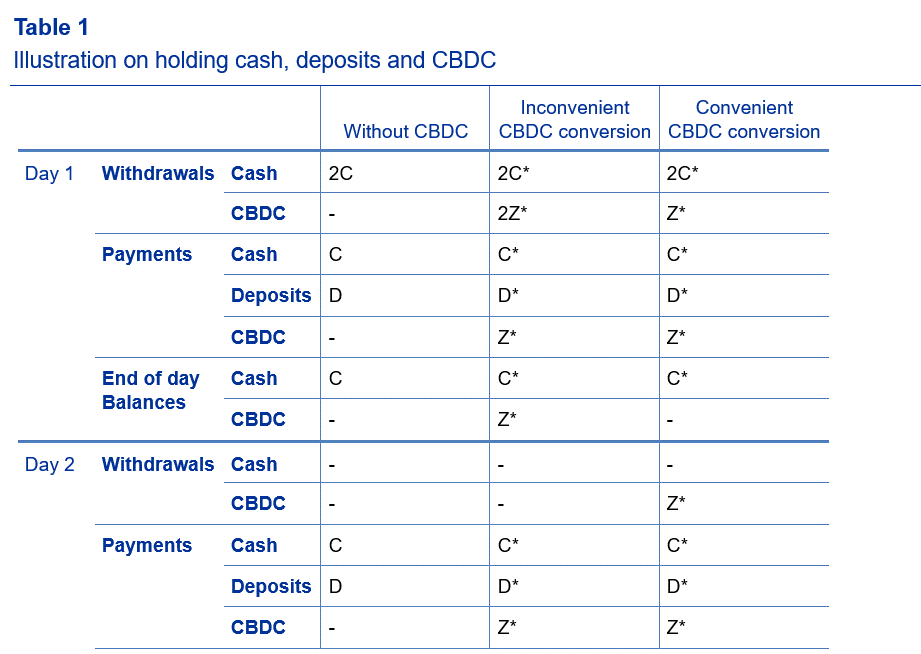

However, the mechanics of converting bank deposits into other means of payment would have a decisive impact on demand for bank deposits. To give a simple example, an individual initially holds only bank deposits and would like to conduct transactions for an amount P on each of two consecutive days. Assuming that a CBDC is not available, that individual wishes to make a cash payment of C and a payment from a bank deposit of D (C + D = P) on each of the days. Since going to an ATM on two separate days would be inconvenient, the individual decides to go there only on day 1 and to withdraw 2 ∙ C in cash. Consequently, the individual pays one cash amount of C on day 1 and holds the other cash amount of C overnight from day 1 to day 2. Assuming that amounts paid to merchants in central bank money (cash or, in the further course of our example, CBDC) are converted into bank deposits on the same day C, is the portion of the cash withdrawn from the individual’s deposits that remains in circulation from day 1 to day 2. This situation is summarized in the first column of Table 1.

Now suppose in this example that a CBDC has been introduced and it is accepted for settling transactions, some of which were previously made in cash and some in bank deposits. Our individual would now like to make on each of the two days a cash payment of C^*<C, a payment with bank deposits of D^*<D and a CBDC payment of Z^*, where C^*+D^*+Z^*=C+D=P. On day 1, she now withdraws a cash amount of 2∙C^* and converts an amount of 2∙Z^* of deposits into CBDC, assuming that it is also sufficiently inconvenient to convert bank deposits into CBDC on each of the two days. As a result, she now holds an amount of central bank money (cash plus CBDC) of C^*+Z^*>C overnight from day 1 to day 2, i.e. there is less demand for bank deposits than in the situation without the CBDC. The situation with a CBDC and in which it is inconvenient to convert bank deposits into CBDC is summarised in the second column of Table 1.

If, however, it is sufficiently convenient to convert bank deposits into CBDC and back, then the introduction of a CBDC could increase the demand for bank deposits. Consider again the example from above but assume now that the CBDC has been designed so that conversion is instantaneous, continuously possible, costless and easy. The individual may now decide to convert only an amount of Z^* into CBDC on day 1 and the same amount again on day 2. As a result, our individual holds an amount of C^* of cash overnight, but no CBDC and as C^*<C, the amount of bank deposits held by her overnight has now increased compared to the situation without the CBDC. This is illustrated in the third column of Table 1.

CBDC design features that allow the automatic conversion of bank deposits into CBDC impact significantly convenience and are therefore relevant for reducing incentives to accumulate CBDC instead of bank deposits. An example of such a feature is a so-called “reverse waterfall”, which allows a payer to make a CBDC payment that is larger than the payer’s CBDC holdings: any amount needed for the payment and not available in the payer’s CBDC account would be automatically transferred from the payer’s bank account into the CBDC account and the payment is then triggered instantly. An individual could decide to have no CBDC holdings at all but could nevertheless make CBDC payments as the reverse waterfall would always convert any required amount from bank deposits into CBDC whenever needed. That means a CBDC with a reverse waterfall could increase the demand for bank deposits, especially if bank deposits are remunerated.

The situation may, however, be different in crisis times. CBDC is a liability of the central bank in its domestic currency and, as such, is not subject to default risk. This could make it a particularly attractive option in a systemic banking crisis, when depositors may wish to convert large amounts of bank deposits into central bank money for fear of losses. Converting bank deposits into CBDC would be easier and faster than converting them into banknotes. Furthermore, holding CBDC would not be subject to the risks, storage and insurance costs that holding large amounts of cash entails. As such, a CBDC might reduce the demand for bank deposits in a banking crisis. Holding limits are an effective tool for preventing large holdings of CBDC to the detriment of bank deposits in such a situation, limiting the possible negative impact of a CBDC on the demand for bank deposits.

While these considerations would apply generally to all retail CBDCs, the ECB has announced its intention to offer reverse waterfall functionalities to all digital euro end-users and to apply digital euro holding limits. The arguments set out above suggest that by incorporating these design features, the digital euro might not have a negative impact on the demand for bank deposits in normal times and could avoid undue loss of bank deposits during a banking crisis.

As argued above, a CBDC could increase or reduce the demand for bank deposits, depending on the design features of the CBDC and the economic environment. If a CBDC were to reduce the demand for bank deposits, then the banking sector would lose central bank reserves: on the liability side of the banking sector’s balance sheet, deposits decline – and on the asset side, central bank reserves decline.

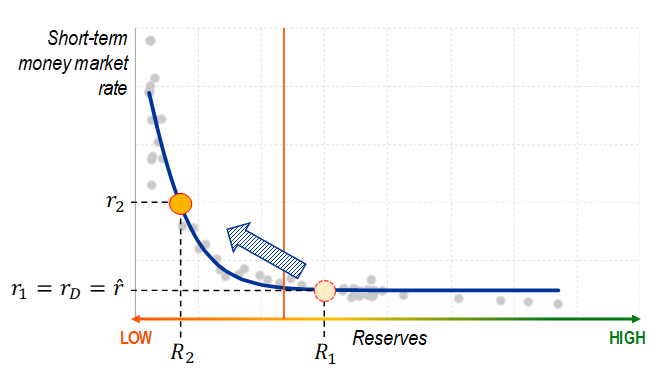

If the introduction of a CBDC were to entail a loss of reserves held by the banking sector, short-term market rates could increase. This situation is illustrated in Chart 1. The chart shows in a stylized way the relationship between the reserves held by banks (horizontal axis) and the short-term money market rate (vertical axis). While there are still abundant reserves (R1), the money market rate (r1) remains at the central bank deposit rate. If reserves decline (R2), for example due to the introduction of a CBDC, an increasing number of banks would be faced with a shortage of reserves and would try to borrow reserves in the money market. This would drive the money market rate up (r2). The threshold amount of reserves below which market rates increase above the deposit rate is indicated by the vertical red line in the chart.

The money market rate could be retained close to the deposit rate if banks were offered the possibility to elastically borrow reserves from the central bank and therefore push the amount of reserves in the system to the right again. This would be the case in a so-called “demand driven” floor system, such as the one announced by the ECB or the Bank of England. Alternatively, the central bank could conduct asset purchases to actively inject additional reserves to the system and thus restore the money market equilibrium at the central bank deposit facility rate. “Supply driven” floor systems, such as the one operated by the Federal Reserve would work in this manner.

Chart 1. The conversion of bank deposits into CBDC could reduce central bank reserves below the amount required to anchor money market rates

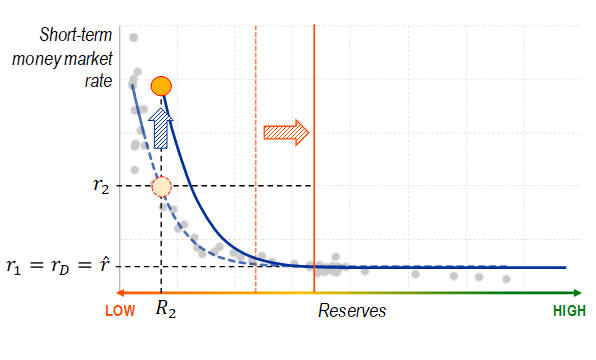

The introduction of a CBDC may not only entail a reduction in reserves, but also an increase in the demand for reserves by the banking sector. Banks may need to hold reserves for different reasons. For example, bank customers can withdraw deposits in the form of cash or CBDC or make instant payments at any time, including at times when the central bank does not offer new liquidity through monetary policy operations. This may require banks to build up a reserve buffer in the days before. This reserve buffer may need to be higher after a CBDC has been introduced because the CBDC may increase the uncertainty about the timing, frequency and size of withdrawals. Consequently, the introduction of a CBDC might shift to the right the curve describing the relationship between reserves and market rates, as shown in Chart 2. This shift would mean an increase in the threshold amount of reserves below which market rates increase above the deposit rate.

Chart 2. The CBDC could also increase bank demand for reserves

Central banks have different options available to them to reduce the additional reserves buffer that banks might need to hold as a result of a CBDC. For example, they could offer new reserves at the same conditions on a daily basis so that precautionary reserve buffers would not be needed. This might not, however, be possible on weekends. Central banks could also design a CBDC in a way that would limit deposit outflows. One way of doing this would be to apply well calibrated CBDC holding limits for all CBDC users.

Caccia, Enea and Tapking, Jens and Vlassopoulos, Thomas (2024), Central Bank Digital Currency and Monetary Policy Implementation, European Central Bank Occasional Paper No. 345.