This policy brief is based on SNB Working Paper 01/2025. The views, opinions, findings, and conclusions or recommendations expressed in this paper are strictly those of the author. They do not necessarily reflect the views of the Swiss National Bank (SNB). The SNB takes no responsibility for any errors or omissions in, or for the correctness of, the information contained in this paper.

Abstract

I introduce a novel high-frequency motive classification strategy – the Trading Markov Sign Restriction (TMSR) – to map pure monetary policy and central bank information motives onto monetary surprises. It considers high-frequency dynamics on the interest rate futures and the stock market and examines systematic phases of expectation adjustment behaviour within 30-minute windows around policy announcements. I show that three systematic phases of expectation adjustment intensities can be observed for monetary policy announcements from the Swiss National Bank (SNB). Based on these identified phases, trends in trading directions on the interest rate futures and stock market are then weighted by a measure of expectation adjustment intensity to classify pure monetary policy and central bank information motives per policy announcement. This allows for a more precise analysis of the distinct effects of central bank information and pure monetary policy surprises on economic and financial variables.

Central bank’s monetary policy announcements often simultaneously convey information about the monetary policy stance and the central bank’s assessment of the economic outlook. For a central bank, it is therefore essential to recognise that its communication can influence how monetary policy decisions are perceived by economic agents, potentially translating into very different effects on financial markets and the economy (Romer & Romer (2000)). If, for example, economic agents primarily react to the news about the policy stance itself, a negative interest rate surprise is, as textbooks suggest, expansionary. However, if the central bank in the same announcement reveals a rather pessimistic assessment of the economic outlook, research shows that a negative interest rate surprise might exhibit contractionary effects as the confidence of economic agents weakens.

This issue has been reassessed by recent literature focusing on the co-movement between monetary surprises and stock prices around short windows at policy announcements to classify the motives of the reactions of economic agents to policy announcements (Cieslak & Schrimpf (2019), Jarociński &Karadi (2020), Lewis (2023)). Thereby, the fact is leveraged, that standard theory makes unambiguous predictions about the reactions of certain variables in response to unanticipated changes in monetary policy. By the classical asset pricing theory, for example, stock prices decrease in response to monetary policy tightening because dividends are expected to decrease while the discount rate increases. A reaction in line with the theory prediction can thereby be interpreted as a ”pure” monetary policy motive, while a reaction contradicting the theory prediction is a central bank information motive. As the monetary surprise itself indicates which direction of response in economic variables is expected according to theory, these motives are then mapped onto the monetary surprises, allowing for the separation of pure monetary policy and central bank information surprises.

In Borner (2025), I propose a novel high-frequency motive classification strategy– I call it the Trading Markov Sign Restriction (TMSR) – to map pure monetary policy and central bank information motives onto monetary surprises. This strategy explicitly considers the high-frequency dynamics of trading patterns and the expectation adjustment behaviour of participants on interest rate futures and stock markets within 30-minute windows around policy announcements to classify motives. I show that disregarding such dynamics might lead to misclassification of motives. Therefore, a classification strategy such as the TMSR allows for a more precise analysis of the distinct effects of central bank information and pure monetary policy surprises on economic and financial variables.

I study 114 monetary policy announcements (MPA) from 2000 to March 2024. From 2000 to June 2019, the Swiss National Bank (SNB) targeted the CHF 3M LIBOR range. In June 2019, the SNB introduced the SNB policy rate and the SARON as its new operational target (e.g., reference rate). The SNB holds quarterly monetary policy meetings where policy decisions are communicated to the broader public through press releases. In such press releases, the decision on the monetary policy stance and a brief assessment of the economic outlook are provided.1 However, if monetary policy actions need to be taken outside regular meetings, the SNB can intervene without pre-announcements. Notable examples of such irregular policy decisions mark the policy decisions on 8 October, 6 November and 20 November 2008, when the SNB took action against the unfolding of the Great Financial Crisis (GFC). The list of irregular policy decisions also includes the introduction of the minimum exchange rate at CHF 1.20 per euro on 6 September 2011 (a week before the regular MPA), the introduction of negative interest rates on 18 December 2014 (a week after the regular MPA), and the discontinuation of the minimum exchange rate and simultaneous rate cut to historical lows of -0.75% on 15 January 2015. Both types of monetary policy decisions (regular and irregular) are included in the sample.

I identify monetary surprises using the classical event-study type high-frequency identification framework (Kuttner (2001), Gürkaynak et al. (2005a), Gertler & Karadi (2015), Nakamura & Steinsson (2018)). Thereby, the impact of monetary policy news is isolated by measuring changes in interest rate futures prices within a short window around MPAs (typically 30 minutes, i.e. 10 minutes before to 20 minutes after the announcement).

Interest rate futures are financial derivatives that allow market participants to hedge or speculate on future interest rate movements.2 The implied rate of an interest rate futures contract represents the market’s expectation of the future level of the underlying reference rate at the contract’s expiration date and is derived from the contracts price. Therefore, any changes in the market price for such contracts reveal changes in market participants’ expectations about the future level of the underlying reference rate.

By focusing on changes within a narrow window around MPAs, one can infer the surprise component of monetary policy – the so-called monetary surprise. In detail, positive (negative) price changes indicate contractionary (expansionary) surprises in the sense that a higher (lower) than expected policy rate was set by the central bank. Therefore, such measures are considered exogenous because these surprises are, by construction, unanticipated and, therefore, orthogonal to the information set of financial market participants.

The idea is simple – a surprise tightening in monetary policy is expected to increases interest rates and decreases stock prices. In contrast, a surprise about the central bank’s positive assessment of the economy does not decrease but increases stock prices.3 Therefore, according to these basic principles of motive classification by sign restriction, one can compare the sign of monetary surprise and the sign of change in the stock market on days of policy announcements to classify motives. If the resulting signs do not match (theory prediction), a pure monetary policy motive is classified and assigned to the surprise; if the signs match (”wrong-signed”), a central bank information motive is classified and assigned to the surprise.

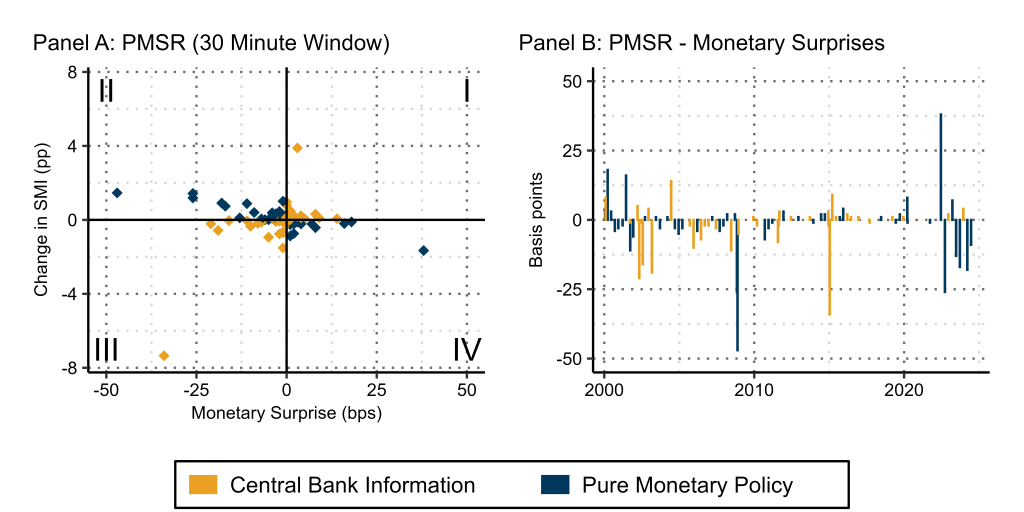

The most straightforward and widely used motive classification strategy is referred to as the Poor Man’s Sign Restriction (Jarociński & Karadi (2020)). By the PMSR, a simple two-point change of stock prices and interest rates representing assets is calculated (window-end price minus window-start price). This is typically illustrated in a scatterplot as shown in Panel A of Figure 1, where the MPAs with classified pure monetary policy motives are the ones falling into quadrants II and IV, and the MPAs with classified central bank information motives are the ones falling into quadrants I and III. Panel B in Figure 1 then shows the resulting mapping of classified motives onto monetary surprises.

Figure 1. PMSR Motive Classification

Notes: Each diamond in Panel A represents an SNB monetary policy announcement. In Panel B, positive values indicate higher policy rates than expected (i.e., contractionary shocks); negative values indicate lower policy rates than expected (i.e., expansionary shocks).

For the Swiss case, the PMSR classifies 55% of all non-zero monetary surprises as exhibiting pure monetary policy motives and 45% as central bank information motives. This is slightly more than estimates presented in the mentioned studies for the Euro Area but less than that of the US.

The largest and smaller monetary surprises (≥ |20 bps| and ≤ |10 bps|, respectively) are predominantly classified as exhibiting pure monetary policy motives, whereas the large monetary surprises (> |10 bps| and < |20 bps|) are relatively equally distributed in terms of motives.

There are some announcements with considerable movement simultaneously in stock prices and monetary surprises; however, there are many occasions with less variation, as suggested by the simple 30-minute window change terminology.

The question arises as to whether a simple two-point change approach is appropriate to classify motives by sign restriction. It remains unclear whether the dynamics within the 30-minute window reveal informative patterns in market behaviour in response to announcements and should be regarded for motive classification. If such patterns are present, ignoring this information could lead to misclassification of motives.

With the TMSR, I propose a high-frequency motive classification strategy that explicitly considers high-frequency dynamics in trading, expectation adjustment intensities and patterns within 30-minute windows around policy announcements to classify motives.

Trading because the strategy focuses on high-frequency interest rate, price and trading volume data.

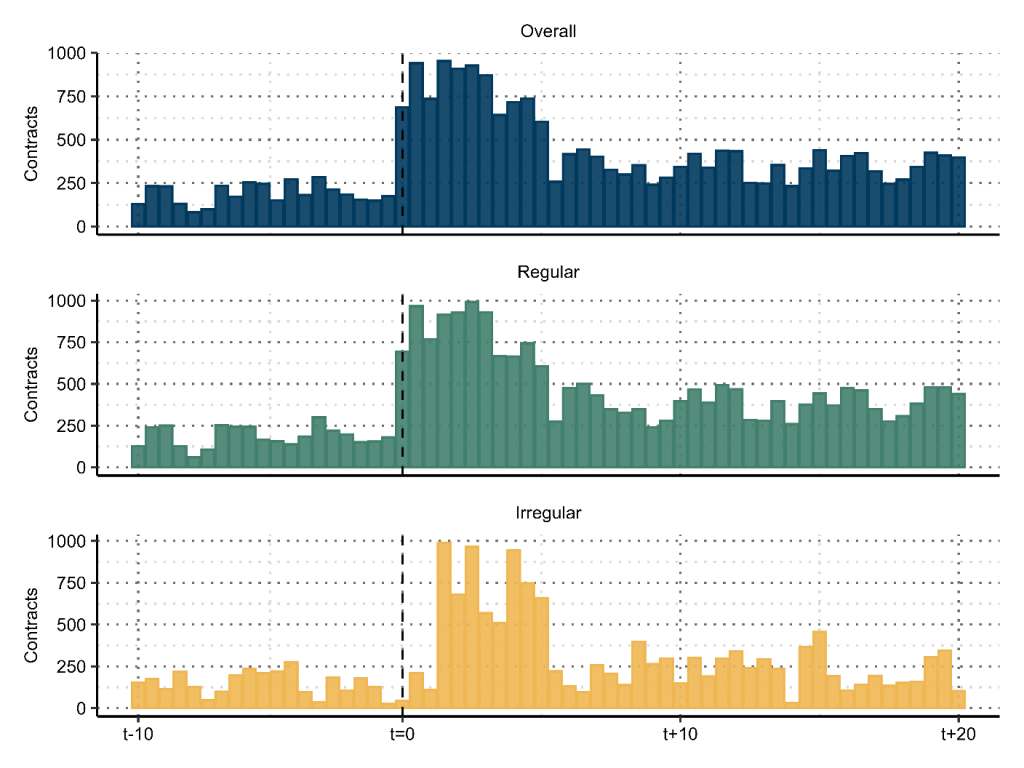

Markov because using a Markov switching model allows for identifying systematic phases of expectation adjustment behaviour within 30 minutes around policy announcements. I study volatility patterns in interest rate futures markets around monetary policy announcements. Figure 2 reveals a pattern of expectation adjustment behaviour of market participants: Overall, the expectation adjustment behaviour, as reflected by dynamics in trading volumes, is low in the 10 minutes before the announcement. Then, with the announcement, it abruptly transitions into high-intensity expectation adjustment behaviour, which persists for five minutes, before decreasing again but still staying at an elevated level compared to the pre-announcement window for the remaining 15 minutes. For irregular announcements, the same patterns are observed for the 10 minutes before the announcement and the last 15 minutes of the 30-minute window. However, market participants need up to one-and-a-half minutes to adjust their expectations after an irregular policy announcement.

Figure 2. Expectation Adjustment Behaviour around Policy Announcements

Notes: The figure shows the 30-second bucket volatility of trading volumes on the CHF interest rate futures market around policy announcements. The X-axis shows a 30-minute window, where t=0 marks the release of the announcement and where 10-minute steps are marked from 10 minutes before (t-10) to 20 minutes after (t+20) the policy announcement.

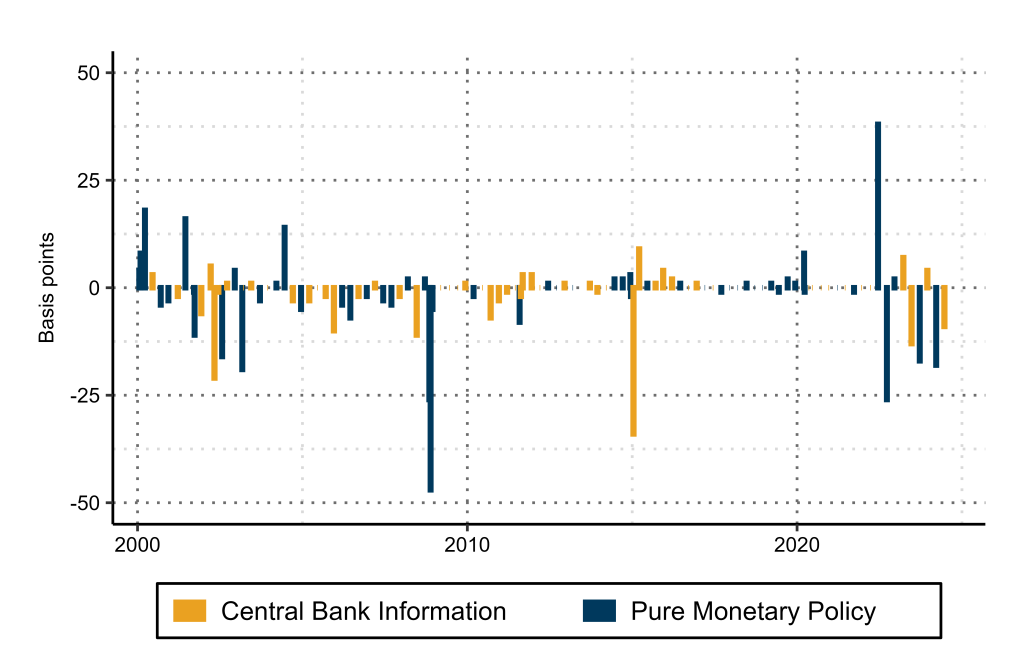

Sign Restriction because, for each identified systematic expectation adjustment phase, the trends in trading directions on the Swiss interest rate futures and stock market are used to classify motives. Furthermore, I construct a measure reflecting the phase-specific expectation adjustment intensities, which I call the trading Markov (TM) weights. This measure is designed to properly weight the previously classified phase-specific motives by the phase-specific trading intensity induced by the policy announcement.4 After weighing these classified motives by the TM weights, the overall motive tendency can be inferred from this strategy for each policy announcement. Figure 3 shows the results after mapping the identified motives onto monetary surprises.

Figure 3. TMSR Motive Classification

Notes: Positive values indicate higher policy rates than expected (i.e., contractionary shocks); negative values indicate lower policy rates than expected (i.e., expansionary shocks).

Overall, the TMSR classifies roughly 60% of non-zero monetary surprises as pure monetary policy motives, which is almost 10% more compared to the PMSR and of which relatively larger pre-GFC surprises are affected. Even though the TMSR and PMSR agree on the motive classification of the sample’s six largest monetary surprises (≥ |20 bps|), the two methods disagree for 50% of all non-zero surprises. In half of these cases, the TMSR assigns pure monetary policy motives to monetary surprises before the GFC. Among those are large monetary surprises (> |10 bps| and < |20 bps|). Interestingly, the opposite is true for the other half of such cases, which are smaller monetary surprises (≤ |10 bps|) where the TMSR assigns central bank information motives to the post-GFC period.

Studying the effects of pure monetary policy and central bank information surprises reveals that both types of surprises affect financial assets; however, for the Swiss case, these effects differ from each other only for the exchange rates and stock market responses.

Employing a high-frequency motive classification strategy such as the TMSR, which leverages trading dynamics and expectation adjustments within short time windows around policy announcements, enhances the robustness and reliability of motive classification. This approach enables a more precise analysis of the distinct effects of central bank information and pure monetary policy surprises on economic and financial variables.

Borner, D. (2025), ‘Central bank information and pure monetary policy surprises in Switzerland’, Swiss National Bank Working Paper No. 01/2025.

Cieslak, A. & Schrimpf, A. (2019), ‘Non-monetary news in central bank communication’, Journal of International Economics 118, 293–315.

Cochrane, J. H. & Piazzesi, M. (2002), ‘The fed and interest rates—a high-frequency identification’, American economic review 92(2), 90–95.

Engel, C. & Hamilton, J. D. (1990), ‘Long swings in the dollar: Are they in the data and do markets know it?’, The American Economic Review 80(4), 689–713.

Gertler, M. & Karadi, P. (2015), ‘Monetary policy surprises, credit costs, and economic activity’, American Economic Journal: Macroeconomics 7(1), 44–76.

Gürkaynak, R. S., Sack, B. P. & Swanson, E. T. (2005a), ‘Do actions speak louder than words? the response of asset prices to monetary policy actions and statements’, International Journal of Central Banking 1(1), 55–93

Jarociński, M. & Karadi, P. (2020), ‘Deconstructing monetary policy surprises—the role of information shocks’, American Economic Journal: Macroeconomics 12(2), 1–43.

Kuttner, K. N. (2001), ‘Monetary policy surprises and interest rates: Evidence from the fed funds futures market’, Journal of monetary economics 47(3), 523–544.

Lewis, D. J. (2023), ‘Announcement-specific decompositions of unconventional monetary policy shocks and their effects’, Review of Economics and Statistics pp. 1–46.

Nakamura, E. & Steinsson, J. (2018), ‘High-frequency identification of monetary non-neutrality: the information effect’, The Quarterly Journal of Economics 133(3), 1283–1330.

Romer, C. D. & Romer, D. H. (2000), ‘Federal reserve information and the behavior of interest rates’, American economic review 90(3), 429–457.

Press releases are typically released at 09:30 CET and are followed by a press conference, taking place 30 minutes after the release of the announcements. For regular announcements, timetables are released in advance on the official website of the SNB.

These instruments are used by highly professional and institutional market participants. Interest rate futures markets are highly sensitive to monetary policy (Cochrane & Piazzesi (2002))

Two assumptions must be made to classify motives. First, over the window of interest on announcement days, the monetary surprise is affected by no other shocks than the two motive shocks (negative and positive co-movement shocks). This motivates using narrow windows (e.g., 30 minutes) around policy announcements. Second, by the sign restrictions, two motives are separated by orthogonality so that a negative (positive) co-movement shock is associated with an increase in interest rates and a decrease (increase) in stock prices.

By design, TM weights assign zero weight to the dynamics during the pre-announcement phase when the central bank remains silent.