Central banks would face trade–offs if they were to start tackling climate change, given that the array of instruments they could use to mitigate climate–related risks overlap with those already used in relation to their monetary and macroprudential mandates. It is possible to show that central banks’ effectiveness in addressing climate change will depend on two constraints: capture risk, i.e. on their independence from governments’ climate preferences; calibration risk, i.e. on their ability to calibrate their “green” easing, either monetary and/or regulatory, on the realised level of abatement and emissions.

In July 2022, the ECB took concrete steps to incorporate climate change into its monetary policy operations (European Central Bank, 2022). Amid growing concerns and public demonstrations, central banks have started wondering whether the effects of climate change will call for their intervention. In the past few years, this topic has become increasingly common in their speeches and declarations (Carney, 2015; Dikau et al., 2019; Schnabel, 2021).

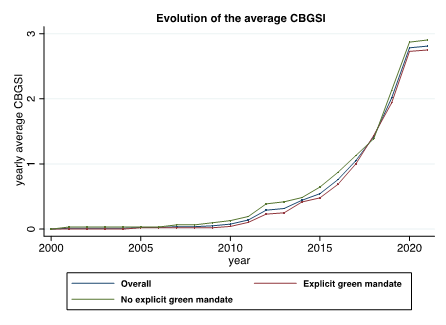

Since the signing of the Paris Agreement, several central banks in both developed and developing countries have started to stress their commitment to intervening in climate policy. D’Orazio and Popoyan (2019, 2020) propose an index allowing for the categorisation of countries around the world according to their stance on climate–related regulations. Their results show that most developed economies are now in the discussion stage. Masciandaro and Tarsia (2021) propose an index of “green sensibility” (CBGSI index, Figure 1) that accounts not only for actual implementations but also for different kinds of commitments. In line with previous results, they find an increasingly pressing discourse about climate–related interventions.

Figure 1: Evolution of Central Banks’ Green Sensibility Index (CBGSI) (2000-2020) (Average values per year: overall sample (135 central banks), central banks without an explicit green mandate (65), central banks with an explicit central bank mandate (70)); Source: Masciandaro and Tarsia 2021.

In most cases, however, this focus has not yet translated into actual policymaking (Masciandaro and Tarsia, 2021). Rather, central banks in developed countries have launched cautious investigations into whether, how and to what extent they should intervene in climate policy. The European Central Bank’s strategy review is an example in this regard.

In fact, the possibility that words may translate into actions calls for a thorough examination of what intervention in climate policy would mean in terms of: (i) the attainment of the central banks’ “core” objectives (price and financial stability) and (ii) central banks’ potential efficacy in reducing pollution.

Most of the recent literature has focused either on empirical investigations or on descriptive analyses of the central bank tools that can be deployed to support governments in the fight against climate change (Bingler et al. 2021, Restoy 2021, Weber et al. 2021, Diluiso et al. 2022, Ferrari et al. 2022, Levy et al. 2022). In other words, it seems to be assumed that central banks can effectively complement governments’ policies with respect to climate policy, and that the possible trade–offs between this goal and central banks’ core objectives would favour the former. Otherwise, central banks would have no reason to intervene.

Yet, a cautious stance in addressing such as issue stems not only from the different sensibilities of central bankers around this matter, but also from their interpretations of the different mandates they must respect. Historically, such mandates have not entailed direct references to climate change, although there have recently been some exceptions in developing countries (Masciandaro and Tarsia, 2021). Instead, central bankers generally focus on price and, since the Great Financial Crisis, financial stability, to which it is often added a corollary on sustaining or not jeopardising economic growth.

Whether the scope of these mandates could be stretched to allow central banks to take climate–related actions is an open debate from both a policy–oriented and an academic point of view (McKibbin et al. 2020 and 2021, Bremus et al. 2021, Boneva et al. 2022a and 2022b, Hartman et al. 2022). The policies or policy mix that would be the most effective option for reducing pollution is subject to debate (Krogstrup and Oman, 2019).

On the one hand, some claim that the effects of climate change on economic performance may jeopardise financial stability and that central banks should account for these effects, and then call for central banks’ interventions (Campiglio, 2016). On the other hand, many suggest that letting central banks take on responsibilities beyond their monetary and macroprudential obligations would make their overall action ineffective. These actors suggest that climate policy should be left to fiscal authorities (Batten et al., 2016), given that that any role played by central banks could be detrimental (Tirole, 2021) or insufficient if not properly coupled with governmental action (Bolton et al., 2020; McConnell et al., 2022; Dafermos and Nikolaidi, 2021; Hansen, 2022).

Our starting point is that, given the early stage of the discussion, we cannot assume for sure that the support central banks may provide would be effective in reducing CO2 or other kinds of emissions. On the other hand, this may be enough to jeopardise their ability to properly conduct monetary and macroprudential policies. Whether this is the case should be determined through analyses of the potential, and limits, of central banks’ institutional design with respect to the other main player – governments. Then the crucial questions becomes: would the current institutional design of central banks allow them to withstand and contribute to governments’ climate policies without detrimental effects on the targets of monetary and macroprudential policies? Alternatively, would governments be better left alone?

So far, research around central banks’ “green” policies has mostly been oriented towards empirical investigations of specific sectors or qualitative analyses of central banks’ potential tools. It has not focused on justifying policy recommendations based on a general institutional setting that accounts for the interactions and incentives of the two main institutions – government and central bank – and, on top of that, that the central bank can undertake climate action through two toolkits: its monetary and/or macroprudential instruments.

Such an approach can be implemented using a principal–agent setting (Masciandaro and Russo 2022) that allows to assess whether central banks’ participation in climate policy would be beneficial, detrimental or neutral in terms of “greening” the economy, and if this outcome would come at the cost of missing central banks’ monetary and macroprudential targets.

Since the publication of Kydland and Prescott’s (1977) well–known work, interactions among society, governments and central banks have successfully been modelled through principal–agent theory. This strand of literature provides a useful and tested toolkit that has not been widely applied to climate policy despite its relevance. Notably, as central bankers are unelected officials, their potential interventions in climate policy can only stem from the mandates that elected governments hand over to them (Bartholomew and Diggle, 2021). This envisions a twofold relationship – on the one hand, the government takes climate concerns into account due to the sensibility of the electorate or genuine social–welfare concerns. On the other hand, the government delegates the task to the central bank, which acts as its agent.

The institutional setting is such that the government serves as the agent of voters with a climate sensibility, and it leverages on the central bank’s own sensibility to its preferences to ensure that it accounts for climate risks within its price and financial stability mandates.

With regard to which voters the politician would like to please, two cases can be analysed: the helping–hand view (Pigou, 1938) assumes that the policymaker wishes to please citizens, rather than a particular constituency or lobby, which is referred to as the grabbing–hand view (Shleifer and Vishny, 1998). According to the latter view of the political actor (Frye and Shleifer, 1996; Friedman et al., 2000; Brown et al., 2009), policymakers are motivated by a desire to please specific, well–defined voters in order to win elections (Masciandaro and Quintyn, 2008). We assume that the policymaker is benevolent. Moreover, it is worth noting that the two views do not automatically produce different outcomes. For example, in countries where policymakers are more likely to be grabbing–hand politicians, they can still implement delegation choices that are consistent with welfare and efficient criteria (Becker et al., 2016) in order to signal their competence and skills (Gratton et al., 2021).

Regarding the central bank, its degree of independence is determined in the first step of a two–stage process, with two events subsequently taking place: a “constitutional” event and a “business–cycle” event (Masciandaro, 2022a). In the first stage, society operates with a long–run perspective and the lawmakers determine the relevant features of the central bank’s institutional design.1 In this perspective, the delegation of monetary policy to non–elected central bankers has been motivated, showing that bureaucrats are preferable to politicians in technical policy (Alesina and Tabellini, 2007). The same perspective can be used to define the central bank’s involvement as a prudential policy actor (Masciandaro and Volpicella, 2016; Masciandaro, 2022b). Given the institutional setting, citizens and policy makers interact in the second stage, which is characterised by a shorter horizon, and the focus is on defining policy actions to address the business cycle.

Overall, four institutional cases emerge. The first, which only envisions the government intervening in climate policy, represents the benchmark case. Then, it is possible to consider three other settings in which, along with the fiscal tools set by the government, the central bank pursues its price and financial stability mandates under certain climate–related constraints. In so doing, it is possible to consider such constraints to be binding, initially on monetary policy, then on macroprudential policy, and finally on both monetary and macroprudential policy.

The general setting allows to consider in systematic way the numerous tools of fiscal, monetary or macroprudential nature that have been so far proposed. In general, one can distinguish between those tools requiring governments’ action and those that have to be put in place by central banks.

On the fiscal side, the main instrument that has been proposed and introduced is the carbon tax (or carbon pricing), which is levied on firms in proportion to their CO2 emissions (Stiglitz and Stern, 2017; Blanchard and Tirole, 2021; BIS, 2021; OECD, 2021). On the monetary and macroprudential side, possible interventions relate to the inclusion of climate–related risks in capital requirements, climate stress testing and the integration of ESG criteria into asset–purchase programmes (Campiglio et al., 2018; Dafermos et al., 2018; Monnin, 2018; De Grauwe, 2019; Dikau et al., 2020).

Basically, these interventions envision the introduction of climate risks into the existing framework central banks use to carry out monetary and macroprudential policies, and the subsequent recalibration of the current instruments without an explicit need for new mandates or tools (Krogstrup and Oman, 2019). In addition to the weight always assigned to central banks’ core missions, this also reflects the fact that, at least in major monetary jurisdictions, the introduction of an additional, explicit mandate would require the amendment of international treaties (e.g., the TFUE for the ECB) or complicated institutional procedures that would make this option hardly feasible. As such, the way forward is to make central banks’ policymaking subject to climate constraints.

Therefore central banks’ climate action, where present, is assumed to stem from the inclusion of climate risks within the scope of price and financial stability. The variables to stabilise for achieving these two objectives are respectively assumed to be inflation (Walsh 1995; Chortareas and Miller, 2003, 2004) and credit, whose relevance in determining the financial cycle is well established in the literature (Schularick and Taylor, 2009; Jordà et al., 2010; Gourinchas and Obstfeld, 2011; Claessens et al., 2012; Drehmann et al., 2012; Borio, 2012; Caruana and Shim, 2016).

Our general results (Masciandaro and Russo 2022) show that monetary and financial dynamics are anchored to the central bank’s targets in all cases, even though the instruments that are set under climate constraints depend on carbon emissions. Therefore, concerns about the capability of central banks to achieve their core objectives and simultaneously account for climate risks do not seem automatically justified.

Nevertheless, two caveats shall be highlighted. First, no trade–off emerges only if the central bank is completely independent in setting its strategies, that is: if it is not subject to external pressures – politicians and/or private lobbies – that could force it to pursue a biased level of the target variables. Indeed, even if the central bank accounts for climate risks as a form of delegation by the government, such delegation is implemented in a way which depends exclusively on the degree of its sensibility to the government’s climate preferences. The more the incumbent government can interfere with the central bank preferences, the less likely will be a monetary policy where climate change considerations can be consistent with monetary and financial stability. The opposite is true if the government’s objectives remain in line with those of the central bank.

Second, and with regards to emissions, the results indicate that central banks’ inclusion of climate risks in their policymaking would not necessarily be beneficial in the fight against climate change. Their potential efficacy also depends on their ability to make their “green” easing, either monetary and/or regulatory, dependent on the realised level of abatement and emissions. In fact, the only case in which the central bank’s interventions would undoubtedly be beneficial is the one in which it could ensure the full channelling of its resources to the reduction of abatement costs.

However, and at least so far, this is unlikely to hold in reality. Central banks only have the mandate, and probably the capability, to monitor financial institutions, not the final recipients, i.e. the firms. In other words, lags and frictions can harm the capacity of the central bank to exactly calibrate its green action on the actual emissions of non–financial corporations. All in all, preserving their independence on the one side, and increasing their monitoring capacity on the other side, seems to be the Scylla and Charybdis that the central banker, as Odysseus, shall consider in designing the new monetary and macroprudential sailing.

The extant literature on potential central–bank interventions in climate policy mostly focuses on empirical or descriptive evaluations of the tools central banks could deploy to support governments. As such, it implies that the two policymakers could cooperate optimally. Nevertheless, questions remain about the scope of central banks’ mandates as well as the negative effects that climate responsibilities may entail for their independence and the achievement of their targets, suggesting that cooperation around this matter may not necessarily be the best way forward. Using a principal –agent framework it is possible to show under which conditions central banks’ interventions in climate policy would be a positive sum game.

Our results suggest that, on the one hand, central banks would still be able to achieve their core price and financial stability objectives when accounting for climate risks. On the other hand, their ability to induce a reduction in emissions is only verified for sufficiently independent central banks with adequate monitoring capacity. This latter point is the most controversial, as central banks are unelected institutions that lack the authority and, most likely, the capability to directly monitor productive and polluting sectors. In the absence of these two conditions, central banks’ interventions in climate policy may actually increase emissions, thereby working against governments’ actions. Only clearly independent central banks with at least a moderate supervisory authority should consider intervening in climate policy.

Potential extensions of the baseline setting may consider interdependence. Nevertheless, as long as the delegation process is effective and the government’s objectives remain in line with those of the central bank, this case would reasonably lead to results similar in meaning but greater in size, as the effect of an active government’s influence would add to the effect stemming from the “institutional” parameters. A more interesting case would be the introduction of an interest group with conflicting preferences. This could push the central bank to deviate from the delegated targets (Chortareas and Miller, 2003, 2004), mimicking a “grabbing–hand” framework.

Alesina, A., Tabellini, G. (2007). “Bureaucrat or politician? Part I: A single policy task”, American Economic Review, 97(1), 169–179.

Becker, S.O., Boeckh, K., Hainz, C., Woessmann, L. (2016). “The Empire is Dead, Long Live the Empire! Long Run Persistence of Trust and Corruption in the Bureaucracy”. Economic Journal, 126 (590), 40-74.

Bingler, J.A., Colesanti Senni C., Monnin, P. (2021). “Uncertainty is not an excuse. Integrating climate risks into monetary policy operations and financial supervision”. Suerf Policy Briefs, n.72.

Boneva, L., Ferrucci, G., Mongelli, F.P. (2022a). “Why climate change is relevant for monetary policy”, Vox, June, 17.

Boneva, L., Ferrucci, G., Mongelli, F.P. (2022b). “The role for monetary policy in the green transition”, Vox, June, 18.

Borio, C. (2012). “The financial cycle and macroeconomics: What have we learnt?”, BIS Working Paper No. 395.

BIS (2021). “Climate–related financial risks: Measurement methodologies”, Basel Committee on Baking Supervision.

Blanchard, O., Tirole, J. (2021). “Major future economic challenges”, France Stratégie.

Bolton, P., Despres, M., Pereira da Silva, L. A., Samama, F., Svartzman, R. (2020). “The Green Swan: Central banking and financial stability in the age of climate change”, Report, Banque de France and Bank of International Settlements.

Bremus, F., Schütze, F., Zaklan, A. (2021). “The impact of ECB corporate sector purchases on European green bonds”, DIW Discussion Paper No. 1938.

Brown, D. J., Earle, J. S., Gehlbach, S. (2009). “Helping hand or grabbing hand? State bureaucracy and privatization effectiveness”, American Political Science Review, 103(2), 264–283.

Campiglio, E. (2016). “Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low–carbon economy”, Ecological Economics, 121, 220–230.

Campiglio, E., Dafermos, Y., Monnin, P., Ryan–Collins, J., Schotten, G., Tanaka, M. (2018). “Climate change challenges for central banks and financial regulators”, Nature Climate Change, 8, 462–468.

Carney, M. (2015). “Breaking the tragedy of the horizon – climate change and financial stability”, Speech, Lloyd’s of London.

Caruana, J., Shim, I. (2016). “La politique macroprudentielle: Un ouvrage en cours pour les banques centrales”, Revue d’Économie Financière, 1(121), 111–130.

Chortareas, E. G., Miller, S. M. (2004). “Optimal central banker contracts and common agency”, Public Choice, 121(1), 131–155.

Chortareas, E. G., Miller, S. M. (2003). “Monetary policy delegation, contract costs and contract targets”, Bulletin of Economic Research, 55(1), 101–112.

Claessens, S., Kose, M., Terrones, M. E. (2012). “How do business and financial cycles interact?”, Journal of International Economics, 87(1), 178–190.

De Grauwe, P. (2019). “Green money without inflation”, Vierteljahrshefte zur Wirtschaftsforschung, 88(2), 51–54.

Dafermos, Y., Nikolaidi, M., Galanis, G. (2018). “Climate change, financial stability and monetary policy”, Ecological Economics, 152, 219–234.

Dikau, S., Robins, N., Volz, U. (2020). “A toolbox of sustainable crisis response measures for central banks and supervisors”, INSPIRE Working Paper, London School of Economics and SOAS University of London.

Diluiso, F., Annichiarico, B., Kalkuhl, M., Minx, J.C. (2022). “Climate actions and macro-financial stability”: The role of central banks”. Suerf Policy Briefs, n.72.

D’Orazio, P., Popoyan, L. (2020). “Taking up the climate change challenge: A new perspective on central banking”, LEM Paper No. 2020/19, Sant’Anna School of Advanced Studies.

D’Orazio, P., Popoyan, L. (2019). “Fostering green investment and tackling climate–related financial risks: Which role for macroprudential policies?”, Ecological Economics, 160, 25–37.

Drehmann, M., Borio, C., Tsatsaronis, K. (2012). “Characterising the financial cycle: Don’t lose sight of the medium term!”, BIS Working Paper No. 380.

European Central Bank (2022), ECB Takes Further Steps to Incorporate Climate Change into its Monetary Policy Operations, Frankfurt, July, 4.

Ferrari, A., Nispi Landi, V. (2022). “Toward a green economy: the role of central bank’s purchases”. Suerf Policy Briefs, n.372.

Friedman, E., Johnson, S., Kaufmann, D., Zoido–Lobaton, P. (2000). “Dodging the grabbing hand: The determinants of unofficial activity in 69 Countries”, Journal of Public Economics, 76(3), 459–493.

Frye, T., Shleifer, A. (1996). “The invisible hand and the grabbing hand”, NBER Working Paper Series, n. 5856.

Gourinchas, P. O., Obstfeld, M. (2011). “Stories of the twentieth century for the twenty–first”, NBER Working Paper No. w17252.

Gratton, G., Guiso, L., Michelacci, C., Morelli, M. (2021). “From Weber to Kafka: Political Instability and the Overproduction of Laws”. American Economic Review, 111(9), 2964-3003.

Hansen, L. P. (2022). “Central banking challenges posed by uncertain climate change and natural disasters”, Journal of Monetary Economics, 125, 1–15.

Hartmann, P., Leonello, A., Manganelli, S., Papoutsi, M., Schnabel, I., Sigaux, J.D. (2022).”Central Banks, Climate Change, and Economic Efficiency”. Vox, June, 10.

Kydland F., Prescott E. (1977). “Rules rather than discretion: The inconsistency of optimal plans”, Journal of Political Economy, 85(3), 473–492.

Jordà, Ò., Schularick, M., Taylor, A. M. (2010). “Financial crises, credit booms and external imbalances: 140 years of lessons”, IMF Economic Review, 59(2), 340–378.

Krogstrup, S., Oman, W. (2019). “Macroeconomic and financial policies for climate change mitigation: A review of the literature”, IMF Working Paper No. 19/185.

Levy, A., Resch, F., Rossi, A.M., Sauer, S. (2022). “Central banks’ in-house credit assessment systems- supporting the Eurosystem’s response to the pandemic and its climate change action plan”. Suerf Policy Briefs, n. 297.

Masciandaro, D. (2022a). “Independence, conservatism, and beyond: Monetary policy, central bank governance and central bank preferences (1981–2021)”, Journal of International Money and Finance, 122.

Masciandaro, D. (2022b). “Politicians, central banks and macroprudential supervision”, in R. Holzmann and F. Restoy (eds), Central banks and supervisory architecture in Europe. Lessons from crises in the 21st century. Edward Elgar, forthcoming.

Masciandaro, D., Quintyn, M. (2008). “Helping hand or grabbing hand? Politicians, supervisory Regime, financial structure and market View”, North American Journal of Economics and Finance, 19(2), pp. 153–174.

Masciandaro, D., Tarsia, R. (2021). “Society, politicians, climate change and central banks: An index of green activism”, Law and Economics Yearly Review, 2021, 10(1), 34–107.

Masciandaro, D., Russo, R. (2022). “Central Banks and Climate Policy: Unpleasant Trade–Offs? A Principal–Agent Approach. Bocconi University, Baffi CAREFIN Centre Research Paper No. 2022–181.

Masciandaro, D., Volpicella, A. (2016). “Macroprudential governance and central banks: facts and drivers”, Journal of International Money and Finance, 61, 101–119.

McConnell, A., Yanovski, B., Lessman, K. (2022). “Central bank collateral as a green monetary policy instrument”, Climate Policy, 22(3), 339–355.

McKibbin, W. M., Konradt, Weder di Mauro, B. (2021). “Climate policies and monetary policies in the euro area, in Beyond the Pandemic: The Future of Monetary Policy, ECB Forum on Central Banking, Conference Proceedings, 28–29 September.

McKibbin, W. J., Morris, A. C., Panton, A., Wilcoxen, P. (2020). “Climate change and monetary policy: issues for policy design and modelling”, Oxford Review of Economic Policy, 36(3), 579–603.

Monnin, P. (2018). “Central banks and the transition to a low–carbon economy”, Council on Economic Policies Discussion Note 2018/1.

OECD (2021). “Effective carbon rates 2021: Pricing carbon emissions through taxes and emissions trading”.

Pigou, A. (1938). “The economics of welfare”. London, Macmillan & Co.

Restoy, F. (2021). “The role of prudential policy in addressing climate change”. Suerf Policy Briefs, n.213.

Schnabel, I. (2021). “From green neglect to green dominance?”. Speech, European Central Bank.

Schularick, M., Taylor, A. M. (2009). “Credit booms gone bust: Monetary policy, leverage cycles and financial crises, 1870–2008”. NBER Working Paper No. w11512.

Shleifer, A., Vishny, R. (1998). “The grabbing hand”. Cambridge, Harvard University Press.

Stiglitz, J. E., Stern, N. (2017). “Report of the High–Level Commission on carbon pricing”. CPLC, World Bank.

Tirole, J. (2021). “The political economy of climate change”, Speech, UBS Center.

Walsh, C. E. (1995). “Optimal contracts for central bankers”. The American Economic Review. 85(1), 150–167.

Weber, P.F., Erkan, B., Oustry, A., Svartzman, R. (2021). ”Climate risks and collateral: a methodological experiment”. Suerf Policy Briefs, n.72.