SUERF Annual Lecture 2019, held by Claudio Borio during the SUERF/BAFFI CAREFIN Centre Conference on “Populism, Economic Policies and Central Banking” in Milan, on 8 November 2019.

Since the Great Financial Crisis, central banks have been facing a triple challenge: economic, intellectual and institutional. The institutional challenge is that central bank independence – a valuable institution – has come in for greater criticism. This essay takes a historical perspective and draws parallels with the previous waxing and waning of central bank independence. It suggests that this institution is closely tied to globalisation, as both spring from the same fountainhead: an intellectual and political environment that supports an open system in which countries adhere to the same principles and governments remain at arm′s length from the functioning of a market economy. This suggests that the fortunes of independence are also tied to those of globalisation. The essay then proceeds to explore ways that can help safeguard independence. A key one is to narrow the growing expectations gap between what central banks are expected to deliver and what they can actually deliver. In that context, it also considers and dismisses the usefulness of recently proposed schemes that involve controlled deficit monetisation.

| “Autonomy and freedom from political control are desirable for all Central and Reserve Banks” (Montagu Norman, 1921) |

“I assure Ministers … at all times … to do what they direct us as though we were under legal compulsion” (Montagu Norman, 1936) |

It was not supposed to be this way. During the Great Moderation, economists believed they had finally unlocked the secrets of the economy. We had learnt all that was important to learn about macroeconomics (Blanchard (2008)). Central banking could aspire to be boring (King (2000)). It was the same kind of heady feeling that had led some political scientists to declare “the end of history” (Fukuyama (2002)).

Then came the Great Financial Crisis (GFC) of 2007–09 and the Great Recession. The near collapse of the financial system did not just bring down the economy, it toppled the foregoing set of intellectual convictions. And, slowly but surely, it provided fertile ground for questioning the wisdom of those who had presided over the debacle. Recall the Queen’s famous question: “Why did nobody see it coming?” The Great Moderation had proved to be, at least in part, a Great Illusion.

Once the crisis struck, central banks rose to the challenge. They pulled out all the stops to avoid a repeat of the Great Depression. And they succeeded. They adapted the time-honoured lender of last resort function to the new economic realities – acting, in effect, as dealers (market-makers) of last resort (Mehrling (2011)). Partly as a result, greater powers in regulation and supervision were conferred on them, including a key role in macroprudential frameworks, reversing a trend dating back to the rise of inflation targeting.

Fast forward to today and the picture is quite different. Thanks to central bank actions in particular, the global economy has recovered. Economies have been close to, or even beyond, standard estimates of full employment. And price stability, by equally standard definitions, prevails. True, there is talk of a possible recession. But recessions are part of the physiology of a market economy, which every now and then has to take a breather; sooner or later they must come. “Reculer pour mieux sauter,” as they say in French.

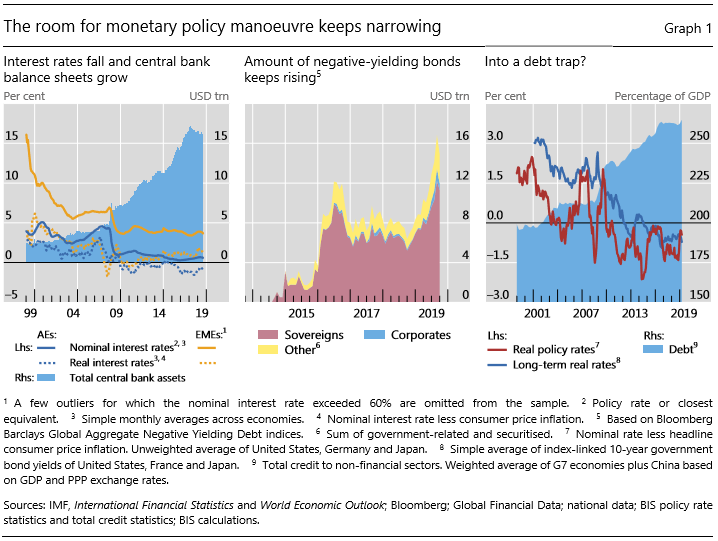

Yet, concerns remain. Central banks have run low on room for policy manoeuvre (Graph 1). Their balance sheets have bloated to an unprecedented size. Interest rates have never been as low in nominal terms and never as negative for as long in real terms, not even during the Great Inflation era. Looking ahead, they are expected to remain so for the foreseeable future. Indeed, the amount of sovereign and corporate debt trading at negative nominal interest rates has reached a peak of some $17 trillion, or 20% of world GDP. What was unthinkable just a few years back is now the norm. Such rates have been in part the result of central banks’ strenuous efforts to push a stubbornly low inflation back towards the 2% targets. What’s more, debt – both private and public – is actually higher globally in relation to GDP than pre-crisis. Historically, public sector debt has been higher only during wartime or its immediate aftermath.

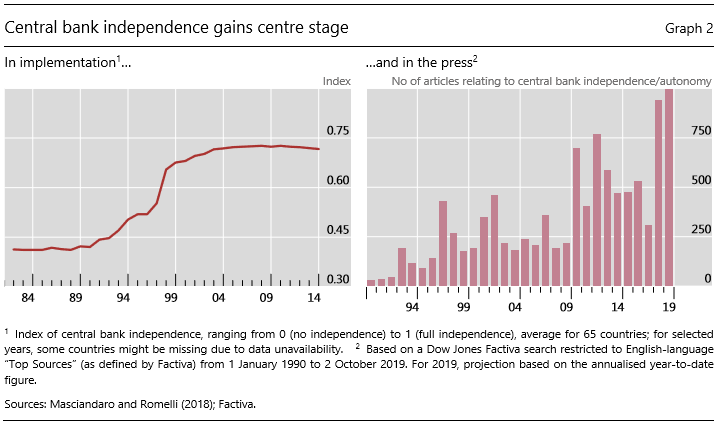

Against this backdrop, central banks have been facing a triple challenge (Borio (2011)). Economic: by their own standards, they consider low inflation a sign that they are failing in their mandated task, while justifiable questions linger about what they could do to tackle the next recession. Intellectual: the previous compass has proved unreliable. Inflation has been too unresponsive to aggregate demand pressures; central banks have discovered they know how to bring it down, but are less certain about how to push it back up. Their models for the economy have failed them.2 Last but not least, institutional: critics have questioned central banks’ wisdom and the value of their independence in setting policy, after its rapid ascendency in the 1990s (Graph 2, left-hand panel). These doubts have been voiced particularly in countries where the value of an open multilateral global economic order has come under attack. The growing number of press articles discussing central bank independence testifies to this challenge (Graph 2, right-hand panel).3

In my presentation today, I would like to offer some personal reflections on these challenges and suggest a possible way forward. My main thesis is threefold.

First, paradoxically, the economic and intellectual challenges facing central banks have taken root in the seismic developments that have yielded most of the economic gains since the early 1980s – and particularly in their profound impact on inflation and the business cycle. These developments include the wave of globalisation as reflected in open trade and financial markets. This has created an environment conducive to stubbornly low inflation and to large financial expansions and contractions (cycles) – which, in turn, has vastly complicated central banks’ pursuit of their mandates in the monetary and financial spheres, retracing their experience during the previous globalisation wave that ended with the Great Depression. Intellectual convictions have naturally crumbled too.

Second, the intellectual and political zeitgeist that supports globalisation also supports central bank independence.4 It is unsurprising that, as globalisation has come under threat, central banks have been facing an institutional challenge to their independence, just as they did in the 1930s. At the time, central banks were blamed for the crisis; today, while not fully escaping such criticism, critics blame them for the side effects of the extraordinary policies still in place designed to push inflation up towards targets, resent them for the power they have gained, and see them as a symbol of an elite-driven open economic order.

Finally, while central bank independence and globalisation are closely tied, there are specific steps that can be taken to safeguard this valuable institution. Ultimately, independence is simply a means to an end; as such, it is not a right and must be earned by retaining public legitimacy. This is not just a matter of how central banks perform their tasks, namely being transparent and accountable. It is also a matter of what it they do and, in particular, whether they succeed in meeting expectations. A key step towards retaining independence would be to seek to reduce the growing “expectations gap” between what central banks are expected to deliver and what they can deliver. This will help address the triple challenge of the times. But the difficulties involved should not be underestimated. And the risk of a new form of fiscal dominance, de facto voiding independence, looms large.

Let me first address the economic-cum-intellectual challenge. I will then examine the institutional challenge before turning to some suggestions about the way forward.

The historical phase that started in the early 1980s and gathered momentum thereafter has become known as the second wave of globalisation. The analogy is with the first one, which took shape, roughly speaking, between the 1870s and World War I and which staggered on until the 1930s, when the Great Depression struck.

In the second wave, financial markets were liberalised, both domestically and internationally. By the early 1990s, the transformation from a government-led to a market-led global financial system was largely complete (Padoa-Schioppa and Saccomanni (1994)). And with the fall of the Berlin Wall in 1989 and the opening of China and the emerging market economies, the long march of trade liberalisation took a major leap forward. Some 1.7 billion people were able to join the global labour force.

This momentous change paved the way for much of our postwar prosperity. The dampening effect of the current trade dispute on the global economy illustrates this in spades. At the same time, the change had a major influence on business fluctuations, which changed remarkably in character from those that prevailed during the Great Inflation era. Two effects stand out.

First, the change provided ample scope for the unstable forces within the financial system to take hold. I have in mind the financial expansions and contractions (or financial cycles) that reflect the interaction of loosely anchored perceptions of value and risk, on the one hand, and liquidity constraints, on the other (Borio (2014a)). Such forces had been kept at bay during the previous financial repression phase. The most relevant financial cycles for economic activity within countries take the form of medium-term fluctuations in credit and property prices. But there is also a global financial cycle, which waxes and wanes across borders through gross capital flows (Rey (2013)) and which can interact with the domestic ones (Aldasoro et al (2019)).

Second, trade integration and the entry of new low-cost countries put downward pressure on inflation. Here I am not referring to the relative importance of domestic and global slack in the inflation process (eg Auer et al (2017)) – a cyclical phenomenon. I have in mind the convergence in unit labour costs when exchange rates do not take the brunt of the adjustment and also labour’s and firms’ loss of pricing power as markets become more contestable, weakening second-round effects (Borio (2017)). In turn, quickening technological innovation has amplified and reinvigorated the impact of globalisation. Think of global value chains, as distance shrunk, as well as of the substitution of capital for labour and of the so-called Amazon effect.

Paradoxically, while taking root in fundamentally positive forces, these changes in business fluctuations – financial cycles alongside structural disinflation pressures – sprang challenges from unsuspected quarters. The authorities were slow in recognising them and in adjusting policies accordingly. For one, prudential countermeasures lagged behind. There was too much trust in the self-equilibrating capacity of the financial system and the economy at large (eg Greenspan (2005)). In addition, monetary policy failed to adapt to the new environment. A combination of a focus on near-term inflation and progressive disregard for monetary and credit aggregates meant that there was no reason to tighten during strong financial expansions as long as inflation remained low and stable.5

What is the evidence for all this? I have examined this extensively in previous work and speeches (eg Borio et al (2019)). It is fair to say that the notion of the financial cycle has become part of the furniture, as it were. It is, for instance, at the core of the post-crisis macroprudential frameworks. By contrast, the role of globalisation and technology in the inflation process is still more controversial.6 If you asked any entrepreneur, fearful of losing market share, or worker, fearful of losing their job, the hypothesis would appear self-evident. But it is less appealing to the profession, focused on models of inflation that rely on domestic slack plus a direct role for expectations – although one may legitimately wonder whether the fear of loss should not trump expectations. Such models pay too much attention to demand forces and leave no room for the slow-moving supply factors that can result in secular disinflationary pressures, for any given degree of economic slack.

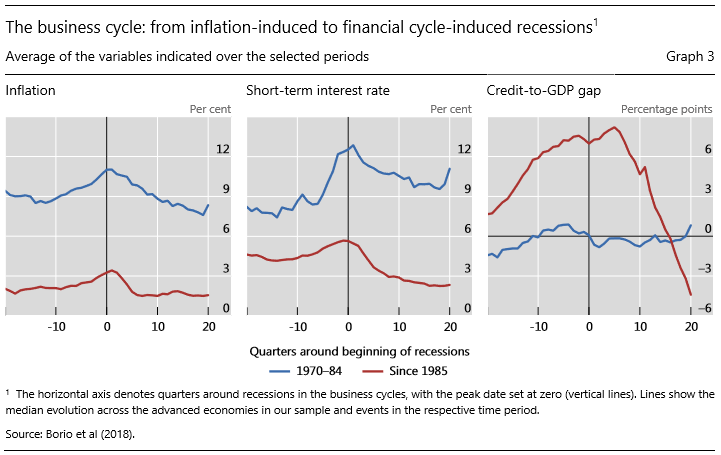

What is undeniable, although yet to be fully appreciated, is how the nature of recessions has changed (Graph 3). Until the mid-1980s, a rise in inflation would induce central banks to tighten substantially, which helped trigger the downturn; at the same time, the expansion and contraction in credit or the financial cycle remained muted. Since then, the bust of a previous financial boom has coincided with relatively stable inflation and a mild monetary policy tightening. You could say that we have shifted from inflation-induced to financial cycle-induced recessions.

In recent research, we have found more formal supporting evidence (Borio et al (2018, 2019)). Since the mid-1980s, in a large set of advanced and emerging market economies, financial cycle proxies outperform the popular yield curve as indicators of recession risk.

Look back and the similarities with the first globalisation wave are more than just a coincidence. Then, as now, financial markets and trade were liberalised. Volatility aside, linked to the composition of output, inflation was quite low and stable. In fact, mild deflation up to 1896 was followed by mild inflation thereafter. Financial cycle-induced recessions and financial crises were the norm.7 And central banks followed a rather passive policy rule: they kept interest rates roughly constant until the internal or external convertibility constraint came under pressure, thereby providing no brake against financial expansions.8

To my mind, the changing nature of the inflation process and of business cycles largely explains the post-crisis economic and intellectual travails of central banks. Like any other major financial crisis, the GFC ushered in a slow and prolonged recovery from a sharp downturn: painful deleveraging played itself out and resources shifted back, no less painfully, from overblown sectors, such as real estate and finance, to the others.9 At the same time, the tailwinds of globalisation and technology, which had helped central banks keep a lid on inflation pre-crisis, turned into strong headwinds post-crisis. They complicated central banks’ attempts to push inflation back to the pre-crisis targets and resulted in prolonged ultra-low interest rates and swollen balance sheets. They invalidated the previously well tried compass.

In such an environment, the economic and intellectual challenges central banks face have gone hand in hand with an institutional one: detractors have called central bank independence into question. Press articles on the topic have been multiplying (see also Graph 2).10 Policymakers, politicians and academics alike have been increasingly reflecting on the issue. This conference is just another example of the trend. And all this criticism creates a challenge also for those who, like me, value that independence.

There are three sets of factors behind the institutional challenge.

The first relates to policy measures.

In the monetary sphere, 10 years after the GFC, emergency monetary policy measures are still in place, as underlined by the condition of central bank balance sheets and prevailing interest rates. Moreover, if anything, the prospect is for the phenomenon to intensify at least in the near term. Central banks have eased again around the world, through both quantities and interest rates (BIS (2019a)).

This state of affairs has had two effects. On the one hand, it has drawn attention to distributional issues, be these in terms of wealth and income, creditors and debtors or the young and the old.11 While monetary policy has always had distributional effects, they become much more salient once policy tools reach unprecedented settings.12 On the other hand, this has blurred the line between monetary and fiscal policy, and debt management (Borio and Disyatat (2010)), as balance sheet policies can only be properly understood in the context of the consolidated public sector balance sheet, combining the government and the central bank.13 Critics have variously expressed concerns about financing governments through large-scale debt purchases,14 about the policies’ impact on credit allocation, as central banks have purchased private sector assets or have subsidised banks, or about the huge increase in foreign currency reserves, which tend to be seen as war chests that could be used for more useful purposes, despite their critical macroeconomic function.15

In the prudential sphere, the GFC has resulted in central banks playing a bigger role in financial regulation and supervision. Detractors argue that the institution has become too powerful and, again, that they are responsible for measures with clear distributional consequences. Examples include macroprudential tools, valuable as they undoubtedly are.16 For instance, loan-to-value ratios and debt-to-income ratios strengthen resilience and can help contain financial imbalances, but they also reduce the access to finance of younger and less well off people.

The second set of factors relates to policy outcomes.

For one, despite having managed the crisis successfully and having played a key role in stabilising the economy, they have not fully avoided criticism. Some of those critics have seen the emergency measures as favouring the interests of the financial sectors; others have regarded central banks as having contributed to the build-up of vulnerabilities. This was either through accommodative monetary policy17 or through inadequate banking regulation and supervision, where central banks were responsible for these areas.18

In addition, some argue, independence is now less valuable. If high inflation was the main reason to confer independence in the first place, what is the point of having it now, when the problem is actually how to push inflation up towards central banks’ targets?19 And if one reason for independence was the need to resist the government’s temptation to exploit artificially cheap finance, why is this still relevant now if, in seeking to boost inflation, central banks have willingly driven interest rates to extraordinarily low, sometimes negative, levels?

The third set of reasons relates to policy perceptions.

Since the GFC, an expectations gap has grown between what central banks can deliver and what they are expected to deliver. Central banks are not just expected to fine-tune inflation, but also to take care of output and employment, to avoid all recessions and, for many, to be the prime engine of growth. Paradoxically, this largely reflects the fact that central banks have taken the brunt of the burden of supporting the recovery – the “only game in town” syndrome (El Erian (2016)). It looks as if people have come to believe the economy is a simple machine and the interest rate lever is sufficient to do the job. This can only be a recipe for disappointment. As a result, if growth falters and central banks are unable to restore it, detractors will accuse them of not doing enough and for misusing their independence.

More generally, the sentiment against globalisation and the elites, seen as its guardians and symbol, has grown. Those voicing that sentiment tend to regard central bankers as members of a cosmopolitan elite, capable of moving what appear to be unimaginably vast sums of money within and across countries in defence of the interests of a powerful and unrepentant financial sector, all to support the status quo.20

A look at history indicates that the link between independence and globalisation is indeed quite close. Many consider the previous globalisation era as the heyday of central bank independence.21 It was back then that Montagu Norman, Governor of the Bank of England, dreamt of an independent central banking community.22 And the principle of central bank independence became “engraved in the tables of the League of Nations” (Toniolo (2010)). Independence was the gospel that the dominant countries preached and followed around the world.23 It was only natural that when the Great Depression shattered that world, central bank independence suffered the same fate.

What explains the link? For one, globalisation and independence spring from the same intellectual and political fountainhead: support for an open system in which countries adhere to the same principles and governments remain at arm’s length from the functioning of a market economy. Independence then acts as both a signal of the adherence to those principles and a mechanism to reassure markets of that adherence: governments will not interfere.24 Conversely, those intellectual and political strands that oppose globalisation – be they from the historical left or the nationalistic right – tend to see little value in independence, as they do in checks and balances more generally.

This indicates that the link between central bank independence and inflation control is of more recent vintage; independence has deeper roots. In the gold standard days, inflation was not a threat. More recently, the pursuit of price stability, and central bank independence as a way of underpinning it, have played the same role as support for convertibility did during the previous wave of globalisation.

One significant difference between the two historical periods is the immediate reaction to the financial crisis. In the 1930s, central banks were often blamed for the slump – just as they have been by the current generation of central bankers (Bernanke (2002)).25 In the aftermath of the GFC, and despite some criticism of their role, they were initially rightly held up as the saviours of the economy; heroes, not villains. The open global economic order survived the shock remarkably well. But as the legacy of the crisis has lingered, and the anti-globalisation sentiment has grown, similar forces as those prevailing in the aftermath of the Great Depression appear to have emerged, with a lag.

This deep link between central bank independence and the political environment suggests that, in a fundamental sense, independence is “endogenous”.26 It is an institution that reflects more basic societal, or at least political, preferences.27 For very much the same reason, imposing it on an unreceptive environment is unlikely to produce the desired results.28

What does all this suggest for the future of central bank independence? It suggests that its future could well be tied to the future of the current open global economic order. The probability of having substantive central bank independence, as opposed perhaps to its appearance, in countries that withdraw from that order is likely to be low. This is a sobering thought for those, like me, who believe that this order and central bank independence are valuable, as evidence indeed indicates.29

Fundamentally, central bank independence is valuable because it raises the bar. It makes it harder for the government of the day to pursue short-term objectives at the cost of long-term economic performance and to take decisions for narrow electoral purposes rather than looking after society’s long-term well-being – in short, it makes it more difficult for elected representatives to behave as mere politicians rather than as statesmen. Central bank independence has an option value, just like that of the judiciary or other government agencies.30

This also means that tensions between the government and the central bank should not be seen as a sign that independence has failed. Rather, they are precisely a sign that it is playing the intended role – in finance lingo, that the option is exercised. Recall what the late Tommaso Padoa-Schioppa used to say about the Stability and Growth Pact in Europe: if no one complains, it means the pact is not biting. Today, central bank independence is an option that is very much “in the money”.

Preserving an open, multilateral economic order is a major collective task. At the same time, there are more modest steps that can help safeguard independence.

How to safeguard central bank independence is a sub-question of a more important one: how can central banks be most effective in pursuing society’s longer-term well-being? After all, independence is a means to an end, not an end in itself. It is only worth preserving if it improves economic outcomes. Ultimately, this is the key to gaining and keeping legitimacy in the eyes of the public31 and body politic. Independence is not a natural right; it must be earned day after day.

Hence two implications.

For one, important as they are, pure political economy considerations, based on how central banks go about pursuing their goals, provide only a partial answer. There is no question that transparency and accountability are critical.32 But they cannot be the whole story. From a positive perspective, central banks have taken strides to improve both, but that has not prevented the current wave of inimical sentiment. From a normative one, what central banks do matters at least as much as how they do it.

The importance of the “what” means that any suggestion for how to retain legitimacy requires taking a stand on what a central bank’s best contribution to society’s long-term well-being can be. This, in turn, calls for taking a stand on how the economy works – a thorny and highly controversial issue.

Here, let me offer only some personal suggestions.

I don’t think restricting (again) central bank mandates to price stability at the exclusion of financial stability is a good idea. I fully understand the reasons for the recommendation. Price stability is more easily measurable, and is thus better suited to supporting accountability. Accountability is easier to enforce in the case of a single objective. And if central banks perform only one function, they would be less vulnerable to the charge of being too powerful. But as history indicates, a narrow objective would not spare central banks for being blamed when things go wrong. The argument loses force if we look at it from the perspective of the “what”.

As argued in detail elsewhere, price and financial stability are joined at the hip (Borio (2019)). They are fundamental properties of a smoothly functioning monetary system. They are both ways of safeguarding the value of money, by protecting against default, erosion of purchasing power, or a dysfunctional payments system. Accordingly, central banks have always been key players in safeguarding stability. This was true under the gold standard, when they were the guardians of convertibility. It has been even more so in recent times. Think, in particular, of the lender of last resort function and, in many countries, long-standing prudential responsibilities. If the role of central banks in financial stability is inevitable, it is only appropriate that they should have the instruments to pursue it.

In fact, the core arguments in favour of central bank independence in the context of price stability apply with equal, if not greater, force to financial stability. They apply to the need to take a longer horizon: the lag between the build-up and materialisation of risks is longer than that between excess demand and inflation – because financial cycles are much longer than business cycles (Borio (2014a)). They apply also to the need to resist the political economy pressures to disregard the long term. Much of the population has grown to dislike inflation, but there is hardly any constituency against the inebriating feeling of getting richer during a financial boom.33 In part reflecting these considerations, as well as more targeted pressures when dealing with individual institutions, the principle of independence for prudential authorities is enshrined in the core principles of banking supervision (BCBS (2006)).34

What, then, are the more promising steps to safeguard independence? I would highlight three.

First step: make a clear distinction between crisis prevention and crisis management (Borio (2011)). Independence is essential in crisis prevention, but it is less justifiable in crisis management whenever solvency is at stake, rather than just liquidity. At that point, public money may be needed and central banks will need to work in close coordination with the government. As Charles Goodhart says, “he who pays the piper calls the tune” (Goodhart and Schoenmaker (1995)). It is worth reflecting on how to put in place arrangements along these lines, including ways to insulate the central bank’s balance sheet from losses incurred in crisis management so as to facilitate exit.

Second step: make the price stability objective more flexible. At very low rates, inflation may be less responsive to policy. For instance, empirical evidence indicates that at very low inflation rates relative price changes account for a larger share of aggregate inflation (Reis and Watson (2010)).35 Some of these changes in relative prices may be cyclical, but a large part could also be structural, and hence less amenable to monetary policy. Under such conditions, strict and very precise36 targets could push central banks to adopt ever more ambitious measures and run the risk of exhausting the ammunition to tackle the next recession. The public would then find it harder to understand why a 2% target should be reached regardless of circumstances.37 Indeed, there are signs that public support for attempts to raise inflation above current levels is waning.38 After all, independence aimed to help bring inflation down and keep it under control; credibility is less likely to come into question if inflation is persistently low, even if below agreed objectives.

Furthermore, such a flexible target is desirable in itself for at least two reasons. First, the fear of the zero lower bound may be overestimated. If, as argued, globalisation and technology have played a key role in keeping inflation so low, the impact on output is benign. Indeed, there is considerable historical evidence indicating that price declines have not tended to coincide with weaker output39 – a sign that such supply side factors have been at work. The Great Depression is an exception. The current deep-seated fear of falling prices, regardless of circumstances, is what Raghu Rajan has rightly called “the deflation bogeyman” (Rajan (2015)). In addition, as argued in detail elsewhere, greater flexibility would also allow central banks to better reconcile price stability with financial and hence macroeconomic stability (eg Borio (2014b)). It would make it possible to employ the interest rate lever in combination with macroprudential measures with a clear longer-term orientation.

Third step: above all, reduce the expectations gap between what central banks can deliver and what they are expected to deliver. A more flexible inflation target would obviously help. But the expectations gap goes well beyond central bank’s ability to fine-tune inflation. It is important to ensure that communication makes crystal clear what central banks can and cannot do in the context of output, employment and financial stability.40 And it is equally important to dispel the notion that central banks can be the engine of growth (Carstens (2019)). Sustainable growth requires a balanced mix of policies, not least structural ones. Unless central banks can manage expectations successfully, those expectations can only be disappointed. The credibility, independence and effectiveness of central banks would suffer as a result.

The question of the policy mix brings me to a thorny topical issue, which looms large when considering the possible need for coordination between monetary and fiscal policy: that is, the risk of fiscal dominance. Fiscal dominance de facto deprives monetary policy of its independence, regardless of de jure arrangements, as it tightly constrains what the central bank can do.

The possible need for coordination between monetary and fiscal policy is again in the limelight. A common argument is that, with the monetary room for policy manoeuvre so narrow, the only way to boost output and increase inflation is to ramp up the fiscal firepower by monetising the corresponding deficits. This would work by putting money directly into the hands of the people, especially if coupled with a promise not to tax that money back for a long time. The reasoning is common to a number of proposals, including pure forms of “helicopter money”41 (Turner (2015), Buiter (2014)) and the more constrained proposal by Bartsch et al (2019).

I believe these arguments are analytically dubious and potentially harmful. The resulting policies reach for short-term gains at the expense of potential large long-term losses. Let me explain.

It is well recognised that helicopter money, in its pure form, involves a promise never to tax the money back; so that expenditures are neither debt nor tax-financed.42 What is less recognised is that this would also require central banks to keep interest rates at zero forever (Borio et al (2016)).43 Any surplus cash will find its way into bank reserves. As a result, lifting rates at some point would call either for paying interest on excess reserves – which would be equivalent to debt financing through the consolidated public sector balance sheet – or else imposing a non-remunerated reserve requirement – which is a tax.44 Not only is the prospect unrealistic, it is hardly reassuring.

The Bartsch et al (2019) proposal – a “constrained” version of helicopter money – raises slightly different issues. Here the promise not to tax the money back, and to keep interest rates at zero, lasts only for as long as inflation is below target. But this begs the question of why “monetary financing” is needed in the first place. For the public at large, it makes no difference whether it is the central bank or the government that credits their account: money is money. With interest rates at zero, the government can finance itself as cheaply as the central bank. Moreover, it can do so at a longer maturity than at the overnight or short-term maturities the central bank can apply, locking in the cost.

More broadly, these proposals expose the central bank to critical medium-term risks.

First, low-for-long interest rates create financial stability risks.45 Over time, this threatens to erode the legitimacy of central banks, whether or not financial stability objectives are explicitly part of their mandates or not.

Second, the proposals reinforce the expectation that central banks are more powerful than they really are. There is nothing fundamentally special about money when interest rates are zero; it has no magical power.

Third, the proposals heighten the risk of fiscal dominance.46 Helicopter money would amount to an extreme form of dominance. In this type of “coordination”, the central bank would effectively commit itself to giving up the use of the monetary policy lever for anything but the agreed purpose. In the more constrained version, a quid pro quo could easily emerge. If the government lends the fiscal levers to the central bank under some conditions,47 why should the central bank not lend the monetary policy levers to the fiscal authorities under some others? After all, coordinated policy – fiscal expansion coupled with interest rate cuts – is more effective, at least in the short run. Moreover, one can easily imagine the pressure on the central bank not to raise rates if, during the monetisation phase, government debt has risen substantially – a kind of “debt trap” (Borio (2014a)).48

Let me be clear. I am not saying that in the next downturn fiscal policy should have no special role to play. Nor am I saying that the central bank and the government should refrain from working in a mutually consistent way in their respective spheres of competence. On the contrary, central banks will need a helping hand in countries that still have some room for fiscal policy manoeuvre – although, unfortunately, that room has been narrowing and the number of countries falling. What I am saying is that schemes involving explicit deficit monetisation are unnecessary and potentially harmful. And that fiscal dominance should be avoided.

In the land of Giambattista Vico, the 18th century Neapolitan philosopher-cum-historian, it is fitting to recall his view of history (Vico (1744)).49 It is a view of corsi (courses) and ricorsi (recurrences), with a cyclical rhythm of rise and fall, of resurgence, decadence and barbarism. Without going that far, there are uncanny similarities between the two most recent waves of globalisation, although the compression of time, as if accelerated by the pace of technology, is spellbinding.

Then, as now, a phase of seemingly never-ending prosperity paved the way for a deep slump – the roaring twenties ushered in the Great Depression just as the Great Moderation ushered in the Great Recession. Then, as now, a credit boom that ended badly led to a financial crisis (Eichengreen and Mitchener (2004)). Then, as now, intellectual convictions crumbled along with the economy.

That said, there are differences, too. So far, one full decade on, the open global economy has faltered, yet it has held up. The institutional fabric of society has seen threats, yet it has survived. And central bank independence has come under strain, yet it has endured. There are steps that can be taken to support this valuable institution, as part of the broader task of adjusting policies to promote society’s well-being. The question is whether what we have seen is a temporary setback or a temporary reprieve. Only time will tell.

Acemoğlu, D, S Johnson, P Querubín and J Robinson (2008): “When does policy reform work? The case of central bank independence”, NBER Working Papers, no 14033.

Aldasoro, I, S Avdjiev, C Borio and P Disyatat (2019): “Global and domestic financial cycles: variations on a theme”, BIS Working Papers, forthcoming.

Alesina, A and A Stella (2010): “The politics of monetary policy”, NBER Working Papers, no 15856, April.

Alesina, A and L Summers (1993): “Central bank independence and macroeconomic performance: some comparative evidence”, Journal of Money, Credit and Banking, vol 25, no 2, pp 151–62.

Alquist, R and B Chabot (2011): “Did gold-standard adherence reduce sovereign capital costs?”, Journal of Monetary Economics, vol 58, pp 262–72.

Amaral, P (2017): “Monetary policy and inequality”, Federal Reserve Bank of Cleveland, Economic Commentary, no 2017-01, 10 January.

Ampudia, M, D Georgarakos, J Slačálek, O Tristani, P Vermeulen and G Violante (2018): “Monetary policy and household inequality”, ECB Working Papers, no 2170, July.

Apaitan, T, P Disyatat and P Manopimoke (2018): “Thai inflation dynamics: a view from micro CPI data”, Puey Ungphakorn Institute for Economic Research Discussion Papers, no 85.

Atkeson, A and P Kehoe (2004): “Deflation and depression: is there an empirical link?”, American Economic Review, vol 94, no 2, May, pp 99–103.

Auer, R, C Borio and A Filardo (2017): “The globalisation of inflation: the growing importance of global value chains”, BIS Working Papers, no 602, January.

Bade, R and M Parkin (1988): “Central bank laws and monetary policies”, University of Western Ontario, mimeo.

Banerjee, R and B Hofmann (2018): ”The rise of zombie firms: causes and consequences”, BIS Quarterly Review, September, pp 67–78.

Bank for International Settlements (2018): Annual Economic Report 2018, June, Basel.

——— (2019a): Quarterly Review, September, Basel.

——— (2019b): Annual Economic Report 2019, June, Basel.

Barr, M (2015): “Accountability and independence in financial regulation: checks and balances, public engagement, and other innovations”, Law & Contemp. Probs., vol 78, no 3, pp 119–28.

Barro, R and D Gordon (1983): “A positive theory of monetary policy in a natural rate model”, Journal of Political Economy, vol 91, pp 589–610.

Bartsch, E, M Boivin, S Fischer and P Hildebrand (2019): “Dealing with the next downturn: from unconventional monetary policy to unprecedented policy coordination”, Macro and Market Perspectives, Blackrock Investment Institute, August.

Basel Committee on Banking Supervision (2006): Core Principles for Effective Banking Supervision, updated version of the original from 1997.

Bernanke, B (2002): “On Milton Friedman’s ninetieth birthday”, remarks at the conference in honour of Milton Friedman, University of Chicago, 8 November.

Blanchard, O (2008): “The state of macro”, NBER Working Papers, no 14259, August.

Bloomberg (2018): “All around the world, central bank independence is under threat”, article by A Nag, R Vollgraaff and W Brandimarte, 10 December.

Bordo, M and A Redish (2004): “Is deflation depressing: evidence from the Classical Gold Standard”, in R Burdekin and P Siklos (eds), Deflation: current and historical perspectives, Cambridge University Press.

Bordo, M and H Rockoff (1996): “The gold standard as a ‘good housekeeping’ seal of approval”, The Journal of Economic History, vol 56, no 2, pp 389–428.

Borio, C (2011): “Central banking post-crisis: what compass for uncharted waters?”, in The future of central banking, Central Banking Publications, 2011. Also available as BIS Working Papers, no 353, September 2011.

——— (2014a): “The financial cycle and macroeconomics: what have we learnt?”, Journal of Banking & Finance, vol 45, August, pp 182–98. Also available as BIS Working Papers, no 395, December 2012.

——— (2014b): “Monetary policy and financial stability: what role in prevention and recovery?”, Capitalism and Society, vol 9, no 2, article 1. Also available as BIS Working Papers, no 440, January 2014.

——— (2017): “Through the looking glass”, OMFIF City Lecture, London, 22 September.

——— (2019): “On money, debt, trust and central banking”, Cato Journal, vol 39, no 2, pp 267–302. Also available, slightly expanded, as BIS Working Papers no 763, January 2019.

Borio, C and P Disyatat (2010): “Unconventional monetary policies: an appraisal”, The Manchester School, vol 78, no 1, pp 53–89. Also available as BIS Working Papers, no 292, November 2009.

Borio, C, P Disyatat, M Juselius and P Rungcharoenkitkul (2019): “Monetary policy in the grip of a pincer movement”, in A Aguirre, M Brunnermeier and D Saravia (eds), Monetary policy and financial stability: transmission mechanisms and policy implications, Central Bank of Chile. Also available as BIS Working Papers, no 706, March 2018.

Borio, C, P Disyatat and A Zabai (2016): “Helicopter money: the illusion of a free lunch”, VoxEU, CEPR Policy Portal, 24 May.

Borio, C, M Drehmann and D Xia (2018): “The financial cycle and recession risk”, BIS Quarterly Review, December, pp 59–71.

——— (2019): “Predicting recessions: financial cycle versus term spread”, BIS Working Papers, no 818, October.

Borio, C, M Erdem, A Filardo and B Hofmann (2015): “The costs of deflations: a historical perspective”, BIS Quarterly Review, March, pp 31–54.

Borio, C, E Kharroubi, C Upper and F Zampolli (2015): “Labour reallocation and productivity dynamics: financial causes, real consequences”, BIS Working Papers, no 534, December.

Borio, C and G Toniolo (2008): “One hundred and thirty years of central bank cooperation: a BIS perspective”, in C Borio, G Toniolo and P Clement (eds), The past and future of central bank cooperation, Cambridge University Press. Also available as BIS Working Papers, no 197, February 2006.

Borio, C and H Zhu (2012): “Capital regulation, risk-taking and monetary policy: a missing link in the transmission mechanism?”, Journal of Financial Stability, vol 8, no 4. Also available as BIS Working Papers, no 268, December 2008.

Bourguignon, F (2016): “Inequality and globalization”, Foreign Affairs, January/February 2016 issue, <https://www.foreignaffairs.com/articles/2015-12-14/inequality-and-globalization>, last accessed on 2 January 2017.

Buiter, W (2014): “The simple analytics of helicopter money: why it works – always”, Economics, vol 8, 2014-28, August.

Caballero, R (2010): “Macroeconomics after the crisis: time to deal with the pretense-of-knowledge syndrome”, Journal of Economic Perspectives, vol 24, no 4, pp 85–102.

Carstens, A (2018): “Central banking: trending and cycling”, panel remarks at Sveriges Riksbank’s 350th anniversary conference on 350 years of central banking: the past, the present and the future, Stockholm, 25 May.

——— (2019): “Time to ignite all engines“, speech on the occasion of the BIS Annual General Meeting, Basel, 30 June.

Casiraghi, M, E Gaiotti, L Rodano and A Secchi (2018): “A ‘reverse Robin Hood’? The distributional implications of non-standard monetary policy for Italian households”, Journal of International Money and Finance, vol 85, July, pp 215–35.

Cavallo, A (2018): “More Amazon effects: online competition and pricing behaviors”, NBER Working Papers, no 25138.

Committee on the Global Financial System (2018): “Financial stability implications of a prolonged period of low interest rates”, CGFS Papers, no 61, July.

Cukiermann, A (1992): Central bank strategy, credibility and independence: theory and evidence, MIT Press.

Debelle, G and S Fischer (1994): “How independent should a central bank be?”, in C Fuhrer (ed), Goals, guidelines, and constraints facing monetary policymakers, Federal Reserve Bank of Boston, pp 195–221.

de Haan, J and J Klomp (2008): “Inflation and central bank independence: a meta regression analysis”, Paolo Baffi Centre Research Paper Series, no 2008-03.

Derviş, K (2016): “Time for helicopter money?”, Project Syndicate, 3 March.

Disyatat, P (2008): “Monetary policy implementation: misconceptions and their consequences”, BIS Working Papers, no 269, December.

Domanski, D, M Scatigna and A Zabai (2016): “Wealth inequality and monetary policy”, BIS Quarterly Review, March, pp 45–64.

Drake, P (1989): The money doctor in the Andes: the Kemmerer missions, 1923–33, Durham, NC.

The Economist (2019): “The independence of central banks is under threat from politics”, Leaders section, 13 April.

Edge, R and N Liang (2017): “New financial stability governance structures and central banks”, Hutchins Center Working Papers, no 32, August.

Eichengreen, B (2017): “Central banks in the dock”, Project Syndicate, commentary, 10 November.

Eichengreen, B and K Mitchener (2004): “The Great Depression as a credit boom gone wrong”, Research in Economic History, vol 22, pp 183–237. Also available as BIS Working Papers, no 137, September.

El Erian, M (2016): The only game in town, Random House Publishing Group, January.

Flandreau, M, J Le Cacheux and F Zumer (1998): “Stability without a pact? Lessons from the European gold standard, 1880–1914”, Economic Policy, vol 13, no 26, pp 115–62.

Flandreau, M and F Zumer (2004): The making of global finance, 1880–1913, OECD.

Forbes, K (2019): “Has globalisation changed the inflation process?”, BIS Working Papers, no 791, July.

Friedman, M (1962): “Should there be an independent monetary authority?”, in L Yaeger (ed), In search of a monetary constitution, Cambridge: Harvard University Press, pp 219–43.

——— (1969): “The optimum quantity of money”, Chapter 1 in M Friedman, The optimum quantity of money and other essays, Adline Publishing Company.

Fukuyama, F (2002): The end of history and the last man, Free Press.

Giannini, C (2011): The age of central banks, Edward Elgar.

Goodhart, C (2011): “The changing role of central banks”, BIS Working Papers, no 326, November.

Goodhart, C and P Delargy (2002): “Financial crises: plus ça change, plus c’est la même chose”, International Finance, vol 1, no 2, pp 261–87.

Goodhart, C and R Lastra (2017): “Populism and central bank independence”, Discussion Paper Series, DP12122.

Goodhart, C and D Schoenmaker (1995): “Should the functions of monetary policy and banking supervision be separated?”, Oxford Economic Papers, vol 47, pp 539–60.

Greenspan, A (1994): Testimony before the Subcommittee on Economic Growth and Credit Formation of the Committee on Banking, Finance and Urban Affairs, US House of Representatives, 22 February.

——— (2005): “Risk transfer and financial stability”, remarks at the Federal Reserve Bank of Chicago’s Forty-first Annual Conference on Bank Structure, Chicago, 5 May.

Grilli, V, D Masciandaro and G Tabellini (1991): “Political and monetary institutions and public financial policies in industrial countries”, Economic Policy, vol 13, pp 341–92.

Gros, d and F Roth (2009): “The crisis and citizens’ trust in central banks”, VoxEU, 10 September.

Issing, O, V Gaspar, I Angeloni and O Tristani (2001): Monetary policy in the euro area, Cambridge University Press.

James, H (2010): “Central banks between internationalisation and domestic political control”, BIS Working Papers, no 327, November.

King, M (2000): “Monetary policy: theory in practice”, speech, Plymouth, 7 January.

Kydland, F and E Prescott (1977): “Rules rather than discretion: the inconsistency of optimal plans”, Journal of Political Economy, vol 85, pp 473–90.

Lenza, M and J Slačálek (2018): “How does monetary policy affect income and wealth inequality? Evidence from quantitative easing in the euro area”, ECB Working Papers, no 2190, October.

Lévy, R-G (1911): Banques d’émission et trésors publics, Paris: Librairie Hachette.

Löwith, K (1949): Meaning in history, University of Chicago Press.

Masciandaro, D and D Romelli (2018): “Beyond the central bank independence veil: new evidence”, Bocconi Working Paper Series, no 71, January.

Masciandaro, D, M Quintyn and M Taylor (2008): “Financial supervisory independence and accountability – exploring the determinants”, IMF Working Papers, WP/08/147, June.

Masciandaro, D and A Volpicella (2016): “Macro prudential governance and central banks: facts and drivers”, Journal of International Money and Finance, vol 61, pp 101–19.

McCallum, B (1995): “Two fallacies concerning central bank independence”, NBER Working Papers, no 5075.

Mehrling, P (2011): The New Lombard Street: how the Fed became the dealer of last resort, Princeton University Press.

Miles, D, U Panizza, R Reis and A Ubide (2017): “And yet it moves – inflation and the Great Recession: good luck or good policies?”, Geneva Report on the World Economy, no 19, International Center for Monetary and Banking Studies, CEPR.

Neuenkirch, M and M Nöckel (2018): “The risk-taking channel of monetary policy in the euro area”, Journal of Banking and Finance, online.

Nordhaus, W (1975): “The political business cycle“, Review of Economic Studies, vol 42, no 2, pp 169–90.

Obstfeld, M and A Taylor (2003): “Sovereign risk, credibility and the gold standard: 1870–1913 versus 1925–31”, Economic Journal, vol 113, pp 241–75.

Padoa-Schioppa, T and F Saccomanni (1994): “Managing a market-led global financial system”, in Managing the world economy: fifty years after Bretton Woods, Washington DC, IIE, pp 235–68.

Parkin, M (2013): “The effects of central bank independence and inflation targeting on macroeconomic performance: evidence from natural experiments”, Economic Policy Research Institute EPRI Working Paper Series, June.

Passacantando, F (2013): “Challenging times for central bank independence”, speech at the World Bank Treasury Reserves Advisory and Management Program Executive Forum for Policymakers and Senior Officials, Washington DC, April.

Posen, A (1998): “Central bank independence and disinflationary credibility: a missing link?”, Oxford Economic Papers, vol 50, no 3, pp 335–59.

Quintyn, M and W Taylor (2003): “Regulatory and supervisory independence and financial stability”, CESifo Economic Studies, vol 49, pp 259–94.

Rajan, R (2015): Panel remarks at the IMF Conference, Rethinking Macro Policy III, Washington DC, 15–16 April.

——— (2017): “Central banks’ year of reckoning”, Project Syndicate, 21 December.

Reis, R and M Watson (2010): “Relative goods’ prices, pure inflation and the Phillips correlation”, American Economic Journal: Macroeconomics, vol 2, no 3, pp 128–57.

Rey, H (2013): “Dilemma not trilemma: the global financial cycle and monetary policy independence”, paper presented at the Federal Reserve Bank of Kansas City Economic Policy Symposium on Global dimensions of unconventional monetary policy, Jackson Hole, 22–24 August.

Rogoff, K (1985): “The optimal degree of commitment to an intermediate monetary target”, Quarterly Journal of Economics, vol 100, no 4, pp 1169–89.

Romer, P (2016): “The trouble with macroeconomics”, The American Economist, forthcoming.

Rosenberg, E (1999): Financial missionaries to the world: the politics and culture of dollar diplomacy, 1900–30, Harvard.

Rungcharoenkitkul, P, C Borio and P Disyatat (2019): “Monetary policy hysteresis and the financial cycle”, BIS Working Papers, no 817, October.

Sayers, R (1976): The Bank of England 1891–1944, Appendices, Cambridge University Press.

Shaikh, B (2017): “Retreat of globalisation: central banks in the crosshairs”, Gateway House, 14 February.

Smets, F (2013): “Financial stability and monetary policy: how closely interlinked?”, Sveriges Riksbank, Economic Review, vol 3, Special Issue, pp 121–59.

Svensson, L (1999): “Monetary policy issues for the eurosystem”, Carnegie-Rochester Conferences Series on Public Policy, vol 51, no 1, pp 79–136.

Taylor, J (2010): “Macroeconomic lessons from the Great Deviation”, remarks at the 25th NBER Macro Annual Meeting, May.

Toniolo, G (ed) (1988): Central banks’ independence in historical perspective, Walter de Gruyter.

Toniolo, G (2010): “What is a useful central bank? Lessons from the interwar years”, Oslo, 18 November.

Turner, A (2015): “The case for monetary finance – an essentially political issue”, paper presented at the Sixteenth Jacques Polak Annual Research Conference, IMF.

Tucker, P (2018): Unelected power: the quest for legitimacy in central banking and the regulatory state, Princeton University Press.

Vickers, J (2010): “Central banks and competition authorities: institutional comparisons and new concerns”, BIS Working Papers, no 331, November.

Vico, G (1744): Principii di Scienza Nuova, Stamperia Giuziana. English translation: The new science, 1948, Cornell University Press.

Volcker, P (2018): Keeping at it: the quest for sound money and good government, Hachette Book Group.

Woodford, M (2003): Interest and prices, Princeton University Press.

Wray, R (2015): Modern money theory, second edition, Palgrave MacMillan.

I would like to thank David Archer for providing background material as well as critical feedback. I would also like to thank Stijn Claessens, Fiorella de Fiore, Piti Disyatat, Marc Flandreau, Charles Goodhart, Fernando Restoy, Andreas Schrimpf and Egon Zakrajšek for their comments. The views expressed are my own and not necessarily those of the BIS.

The mainstream formal models belong to the New Keynesian tradition, imposing nominal rigidities on a real business cycle structure; so-called dynamic stochastic general equilibrium (DSGE) models fall into this category. These models generally assume that the economy tends to revert smoothly to equilibrium and, in general, have ignored destabilising financial booms and busts or found it very difficult to incorporate them. Moreover, in these models banks do not create credit, but simply allocate resources. For a model that seeks to overcome these limitations, see Rungcharoenkitkul et al (2019). For a more general critique of DSGE models, see Caballero (2010) and Romer (2016).

Consider, for instance, the views expressed at a recent Bank of England conference (September 2017) on central bank independence, reflecting the perceived mood of the times. Central bank independence has been described as “a product of its time” (Willem Buiter), “nice to have while it lasted” (Charles Goodhart), an arrangement that is “unlikely to survive much longer” (Guy Debelle, Deputy Governor of the Reserve Bank of Australia) and that will continue only as long “as the political class, sensitive to the electorate, remains convinced that it delivers some clear benefits” (Andrew Tyrie, former chair of the House of Commons Treasury Committee). (The video is available at https://www.bankofengland.co.uk/events/2017/september/20-years-on.) A recent survey of Central Banking Journal’s Editorial Advisory Board, made up largely of former senior central bankers, found that 61% of them thought central banks will be less independent going forward (https://www.centralbanking.com/central-banks/4376401/central-banks-face-loss-of-independence-central-banking-survey).

In what follows, I will not make an explicit distinction between goal and instrument independence (Debelle and Fischer (1994)) or between the related but different concepts of political and economic independence (Grilli et al (1991). This would require too much elaboration and distract from the bigger picture and trends.

The academic consensus shifted decidedly in that direction; see eg Woodford (2003). Central banks that retained some role for monetary or credit aggregates came under heavy criticism. The ECB, with its two-pillar policy, is a clear such example; see eg Issing et al (2001) and Svensson (1999). The criticism persistent after in 2003 the ECB adjusted the monetary pillar to put more emphasis on credit and financial instability rather than money and inflation.

On globalisation, for a recent contribution containing references to the literature, see Forbes (2019). On technology, so far there is hardly any evidence. For one, very partial, analysis, addressing only the Amazon effect, see Cavallo(2018).

See eg Goodhart and De Largy (2002).

The main difference is that prudential regulation was largely absent, weakening further the safeguards against financial booms and busts.

See eg Borio et al (2016).

See eg Bloomberg (2018) and The Economist (2019).

See Goodhart and Lastra (2017) for a discussion of distributional issues. For some empirical cross-country evidence on the impact of monetary policy on wealth distribution, see Domanski et al (2016). For jurisdiction-specific studies that refute the negative distributional impact of monetary policy on distribution in specific jurisdictions (positive on income; negligible on wealth), see Ampudia et al (2018), Lenza and Slačálek (2018), Casiraghi et al (2018) and Amaral (2017). Amaral (2017) and Ampudia et al (2018) also include a review of the literature.

See also Goodhart and Lastra (2017), who in addition discuss the implications of a (perceived) non-vertical Phillips curve, which introduces a trade-off between inflation and output, and put the issue of central bank independence in the broader context of the rise of populism.

Think, for instance, of large-scale government debt purchases. From the perspective of the consolidated balance sheet, they represent a large-scale debt management operation, whereby in effect overnight debt replaces long-term debt. This also means that the operation makes the cost of government debt more sensitive to higher policy rates, through lower central bank profit transfers. See also below.

In fact, in Japan the purchases have exceeded government deficits for quite some time (BIS (2018)).

For a recent discussion of the essential role of foreign exchange reserves, see BIS (2019b)).

That said, the most common governance structure for macroprudential frameworks involves committees, often chaired or co-chaired by the Ministry of Finance; see eg Edge and Liang (2017). See also Masciandaro and Volpicella (2016) for an analysis of the factors driving choices of structures, including their relationship to central bank independence.

See eg Taylor (2010).

James (2010) discusses these issues, including similarities with the 1930s.

On this, see eg Eichengreen (2017), who discusses various other criticisms as well.

For a discussion of these issues, see eg Rajan (2017), Bourguignon (2016) and Shaik (2017).

There is a copious literature describing the period. See eg Toniolo (1988), Flandreau et al (1998), Giannini (2011), Passacantando (2013) and references therein. Lévy (1911) describes the established doctrine advocating the separation of the central bank from the state, seeing independence as essential to maintain the credibility of the peg to gold; absent independence, markets would expect eventual debt monetisation. On the cyclical nature of central bank independence, see also Carstens (2018). That said, other scholars have argued that independence in those days was less important and controversial because it was tightly constrained by the need to ensure convertibility, eg Friedman (1962). In general, the stricter the rule, the less the need for independence as such, as the scope for discretion and the ability to influence the central bank’s behaviour are smaller.

The dream was partly achieved with the creation of the BIS in 1930 – ironically, at a time when independence had already started to wane (Borio and Toniolo (2008)). As a sign of this reversal of fortunes, Montagu Norman, the former apostle of central bank independence, would state in parliament in 1936: “I assure Ministers that if they will make known to us through the appropriate channels what it is they wish us to do in the furtherance of their policies, they will at all times find us willing with good will and loyalty to do what they direct us as though we were under legal compulsion” (quoted in Giannini (2011)). This was a complete about-turn relative to the central banking manifesto he had prepared in 1921, laying out the general principles for the institution. The document, to be signed by central banks represented at meetings at the Bank of England, laid out several principles. The first one read: “Autonomy and freedom from political control are desirable for all Central Banks and Reserve Banks.” The second made such autonomy a necessary condition for cooperation: “Subject to conformity with the above clause a policy of continuous co-operation is desirable among central and Reserve Banks.” See Sayers (1976), Appendices, p 75.

An example was Edwin Kemmerer’s role during the 1920s in establishing independent central banks that supported adherence to the gold standard in Latin America. See eg Drake (1989) and Rosenberg (1999).

There is a literature discussing whether the adoption of a gold standard, and the corresponding commitment to convertibility, did succeed in improving access to international financial markets and reducing its cost. Some argue it has (eg Bordo and Rockoff (1996), Obstfeld and Taylor (2003)); others in subsequent work have disputed the claim (eg Flandreau and Zumer (2004), Alquist and Chabot (2011)). The point made in the text does not hinge on this debate. Success or failure will depend on much more than the mere adoption of external convertibility: as some of that work shows, or indeed, as experience with fixed exchange rates indicates more generally, domestic “fundamentals” also have to be consistent with that commitment.

Goodhart (2010) puts it starkly: “The Great Depression and the accompanying collapse of the gold standard represented a huge failure for central banks. Their objectives, their models and their mental framework all fell apart.”

A number of observers have noted the endogeneity of central bank independence, albeit focusing more specifically on the experience of individual countries (eg Posen (1998) and Acemoğlu et al (2008)). Here, of course, I am referring to institutional endogeneity, not to the difficulties in distinguishing the influence of independence from that of the inflation targeting regime (eg Parkin (2013)).

At a meta-level, this would make it difficult to establish whether independence per se is valuable in reducing inflation or whether the underlying political and economic environment would have reduced it anyway. After all, a liberal and open economic order is itself conducive to low inflation, not least through real and financial globalisation.

On this, see in particular Acemoğlu et al (2008).

There is a vast empirical literature on the value of central bank independence in controlling inflation, going back to the influential initial work by Bade and Parkin (1988), Grilli et al (1991), Cukiermann (1992) and Alesina and Summers (1993); see de Haan and Klomp (2008) for a review of the earlier literature. Since then work has continued, paying particular attention to controlling for the influence of other factors, including institutional features, such as the nature of the law and governance (eg Acemoğlu et al (2008)). See also Masciandaro and Romelli (2018) for a new index and references to the more recent studies.

See Tucker (2018) for a comparison with the independence of other agencies and the military. Vickers (2010) provides an in-depth comparison with competition authorities.

For a concerned analysis of the public’s apparent loss of trust in central banks, see eg Gros and Roth (2009).

See Tucker (2018) and the references therein for a comprehensive treatment.

These, of course, are not the only arguments for independence; Tucker (2018) provides an overview. That said, I consider them as the most important. This argument is broader than the popular technical discussion of central bank independence as a way of solving the lack of pre-commitment in game-theoretic models of inflation (eg Kydland and Prescott (1977), Barro and Gordon (1983), Rogoff (1985)), which may not be particularly convincing as a description of the reason for the rise in inflation in the 1960s and 1970s. For a critique of the normative implications, see eg McCallum (1995). The rationale for independence is arguably closer to the work on political cycles originating in Nordhaus (1975). Alesina and Stella (2010) include a short survey.

There are only relatively few studies that consider the merits of independence for banking supervisory authorities. See eg Quintyn and Taylor (2003), Masciandaro et al (2008) and Barr (2015), including references therein.

Reis and Watson (2010) find that, since 1959, the share in the case of US inflation has been some 15%. A sizeable part of this is likely to reflect the high inflation of the 1970s, since more recent estimates find “pure” inflation to be considerably lower for both the United States and the euro area (Miles at al (2017)). Similarly, Apaitan et al (2018) find that pure inflation has accounted for only around 10% of variation in headline inflation in Thailand since 2002. Presumably, the share would be higher for countries with higher average inflation rates and where the exchange rate played a key role in generating or sustaining inflation.

The degree of precision is often the result of a specific interpretation by the central bank and is not legislated.

See also Volcker (2018), who makes a similar point.

Greenspan’s (1994) famous definition of price stability is quite apt and captures this point very well: price stability prevails when “…households and businesses need not factor expectations of changes in the average level of prices into their decisions”.

See Borio et al (2015), who, apart from confirming previous work, including their own and by Atkeson and Kehoe (2004) and Bordo and Redish (2004), find that, once one controls for asset prices, the information content of declining prices of goods and services is no longer visible, even in the Great Depression. They also find little evidence of Fisherian debt deflation as opposed to a damaging interaction between asset price declines and debt.

Financial stability is a shared responsibility. And surely the realistic objective should be to reduce the likelihood and intensity of crises, not to prevent them altogether, as many seem to believe.

The notion, of course, harks back to a famous article by Friedman (1969).

The reason is to overcome “Ricardian equivalence”, whereby taxes and debt have the same impact on aggregate demand.

This is simply the result of how monetary policy is (and can be) implemented – an aspect which is often misunderstood and incorrectly portrayed in textbooks; see eg Borio and Disyatat (2010) and Borio (2019). For the broader misconceptions in macroeconomics that reflect a failure to understand the basic mechanisms involved, see Disyatat (2008).

This is to a considerable extent the result of what has come to be known as the “risk-taking channel” of monetary policy (Borio and Zhu (2012)). See Smets (2013) for a short review of the literature and Neuenkirch and Nöckel (2018) for some more recent references. See also CGFS (2018) and, for the impact of low interest rates on “zombie” firms, Banerjee and Hofmann (2018).

Fiscal dominance is the prescription of Modern Monetary Theory. The theory sees policy through the lens of the consolidated public sector balance sheet and has the government firmly at the helm. At its heart is the notion that, in the technical sense, the government need never default since it can always force the central bank to settle the debt in inconvertible fiat money; see Wray (2015). Of course, none of this would protect the sovereign from crises of confidence and flights into other currencies if the public lost trust in the value of their savings. Recognising this, and also the fact that domestic currency sovereign debt has been restructured, rating agencies assign a rating to it as well.

Of course, there are also serious questions as to whether any government would ever do so in the first place, given the implied enormous delegation of power to the central bank.

In order to avoid this risk, Bartsch et al (2019) envisage governance arrangements whereby the central bank would decide both the amount and timing of the deficit to be monetised. This sounds unrealistic, however, and would also make it harder for the central bank to avoid the charge of being too powerful and of intruding on fiscal policy beyond its legitimate sphere of action. Note also that, since the money injected is not withdrawn, all else equal, the balance sheet will be larger at the end of the process, reducing the room for manoeuvre to address future needs.

For the interested reader, Löwith (1949) provides an excellent overview of the philosophy of history, giving Vico a prominent and deserved role.