This policy brief note is based on a study that revisits an old debate about the way the institutional settings that determine the conduct of monetary policy and prudential regulation and supervision of the banking system influence policymakers’ actions in pursuing their designated mandates. We assess whether the allocation of policy mandates affects central banks’ primary objective of inflation stabilization by employing dynamic heterogeneous panel methods, using data for 25 industrialised countries from 1960 to 2018. Once we appropriately control for relevant policy and institutional factors, we show that the institutional settings of prudential policy and monetary policy do not have a significant effect on inflation outcomes.

In its recent monetary policy strategy review, the European Central Bank acknowledges the importance of taking into account financial stability considerations in its monetary policy decision processes, calling for an enhanced role of the monetary analysis pillar.1,2 It stresses that financial stability is a precondition for price stability and vice versa. Although microprudential and macroprudential policies should be considered the first line of defence against the build up of financial stability risks, the review emphasises that the monetary policy strategy of the ECB should retain and follow a flexible approach to deal with financial stability concerns. This conclusion strongly expresses the importance given to financial stability and its interlinkages with monetary policy, despite the existence of an effective macroprudential framework.

The macroprudential oversight of the financial system was introduced as a response to the Global Financial Crisis in 2008. In some countries, the financial stability mandate was explicitly assigned to macroprudential authorities that were endowed with proper instruments to deal with financial imbalances, while monetary authorities remained responsible for price stability. Such institutional arrangements in which stability mandates are assigned to separate policymakers with different instruments improve policy outcomes and therefore welfare according to the Tinbergen rule, provided that the policies have complementary effects on the two objectives. In contrast, when the effects from policy interplay are conflicting and coordination between policymakers is limited, internalising negative externalities by assigning both mandates to a central bank reduces the possible welfare losses.

The interaction between macroeconomic policies occurs because both macroprudential and monetary policy share the same transmission channels. Under specific economic circumstances, price and financial stability policy goals may conflict with one another, with policy actions potentially offsetting each other. First, although largely pro-cyclical, financial cycles tend to be longer than business cycles, which may lead to a decoupling between financial circumstances and economic fundamentals. Second, and perhaps more importantly, several propagation channels of monetary policy transmission are likely to interact with bank stability and ultimately with the stability of the financial system, in an asymmetric fashion. Policy rate adjustments influence asset and collateral prices which, through the financial accelerator mechanism (see Bernanke and Gertler, 1995), may encourage excessive risk-taking behaviour, undermining the goal of financial stability. Asset and collateral prices respond positively to a policy rate cut, especially when perceived to be prolonged, leading to an ease of credit standards, which stimulates credit provision and encourages banks and borrowers to take on greater risks. As such, monetary policy transmission via the asset pricing and risk-taking channels may sow the seeds for financial instability (see Borio and Zhu, 2012).

In this brief, we revisit an old debate regarding the separation of the two policy mandates, taking also into consideration the new institutional arrangements encompassing macroprudential policy. We examine whether the institutional structure of policymaking affects macroeconomic outcomes by influencing the monetary and prudential policies interaction and the central banks’ primary objective of inflation stabilisation.

While there are many arguments in favour of the separation of the two policy mandates, the main criticism has been that it can lead to sub-optimal results when stabilisation policies have negative spillovers and coordination between policymakers is limited.3 A summary of arguments for and against the separation of the two mandates can be found in Ioannidou (2005) and Doumpos et al. (2015). In the case of the separation of the policy mandates, by taking into account the impact that the micro and the macroprudential regulators’ actions have on inflation, the central bank enhances monetary stability but potentially at the detriment of financial stability. This negative externality could be reduced if the central bank is instead assigned both monetary and prudential mandates such that the effects of monetary policy on financial stability are considered. Indeed, interest rate changes could adversely affect banks’ profitability and soundness by influencing risk perceptions and altering the value of banks’ net worth. However, a looser monetary policy would consequently lead to inflation bias.

In the case where central banks are also in charge of micro and macroprudential policy, they have to deal with the potentially conflicting goals of controlling inflation at the target levels, while maintaining financial stability. The decisions may depend on the emphasis that is given to financial stability, but the conflict of interest argument implies that central banks may opt for being more flexible in their inflation mandates, when financial stability is at stake.4 Goodhart and Schoenmaker (1995), among others, argue that central banks responsible for prudential policy have incentives to be particularly attentive to the effects of their interest rate decisions on the profitability and stability of the banking sector.

Against this background, it is therefore argued that an inflation bias may arise in institutional mandates characterized by central banks with supervisory functions, in opposition to an institutional set-up in which banking regulation is assigned to a separate authority. The potential inflation bias stems from a less strict monetary policy stance towards inflation than in the case in which the monetary policymaker is not concerned about financial stability. In this sense, the argument can be stated as follows: countries in which central banks are prudential policymakers will experience higher inflation rates, on average, than countries in which prudential policy is assigned to an agency other than the central bank.

This is largely an empirical question. Previous studies suggest that there is a degree of inflation bias, with Hasan and Mester (2008), Di Noia and Di Giorgio (1999) and Goodhart and Schoenmaker (1995) finding that countries whose central banks do not have supervisory duties exhibit lower inflation rates. In the same vein, Ioannidou (2005) finds that the Fed relaxes bank supervision when monetary policy is tightened. More recently, Ampudia et al. (2019) find that an integrated structure does not seem to be correlated with more price and/or financial instability, but their results are not robust across specifications. However, once we allow for heterogeneous effects, the possibility of common shocks, the use of appropriate controls and a much larger sample, there is no evidence of an inflation bias.

With this purpose, we built a dataset that encompasses annual time series data for 25 OECD countries over the period 1960-2018. The dependent variable is the annual inflation rate and the main explanatory variable of interest is Separate, representing central banks’ mandate in terms of prudential policy. This variable is a dummy that takes the value of 1 if the responsibility of prudential policy (in both micro and macroprudential perspectives) is assigned to an authority independent from the central bank, and the value of 0 if it remains the central bank’s responsibility. In addition, we consider the explanatory variables used in related empirical literature and also a number of other regressors, which we split in four categories: institutional, external, economic and banking structure.

As mentioned, the variable Separate classifies the allocation of policy mandates. Monetary policy mandates are typically assigned to central banks, while the institutional arrangements for micro and macroprudential policy are usually much more diverse, particularly after recent widespread reforms concerning macroprudential mandates. Thus, countries where the central bank is also in charge of micro and macroprudential policies are classified as having a combined regime, while countries in which prudential mandates are assigned to independent entities are classified as having separate regimes.5

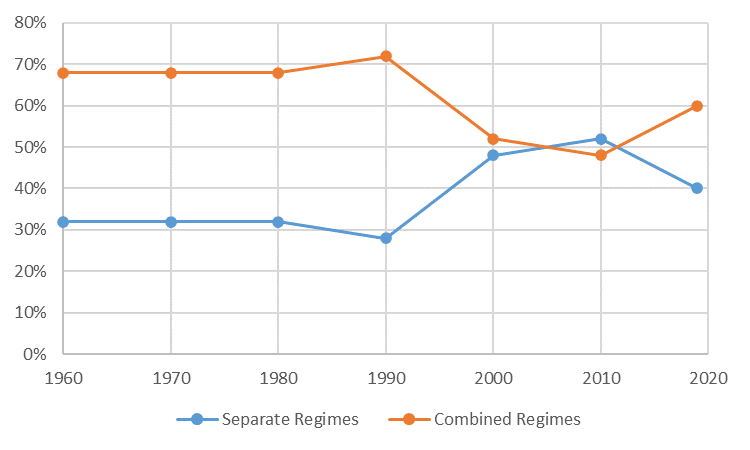

Figure 1 shows the evolution of the institutional arrangements for prudential policy in the OECD countries over time, classified as separate and combined regimes. In 1960, central banks were responsible for both price stability and micro/macroprudential policy in two-thirds of the OECD countries, while in the remaining countries the micro/macroprudential policy was assigned to an independent authority. This distribution remained stable until the late 1990s, a period in which we observe an increase in the number of countries that have opted to separate prudential responsibilities from the central bank. As a consequence of those reforms, in the early 2000s, there was a balance between the number of OECD countries exhibiting the two institutional settings. Over the next decade, separation of mandates became an equally prevailing institutional setting, reaching 14 countries out of 25 over 2003 to 2009. Following the 2008 Global Financial Crisis, some countries decided to allocate the micro responsibility back to the central bank and create a macroprudential oversight of the financial system. This tendency is already reflected in 2019 figures, which illustrate a decrease in the number of countries with separate prudential policy mandates over the most recent years of the sample.

Figure 1: Classification of countries according to their prudential policy institutional regimes

Source: Own calculations, based on the Bank Regulation and Supervision Surveys (2001, 2003, 2007, 2011 and 2019) provided by the World Bank and complemented with other sources of information, namely the central banks’ and supervisory agencies’ webpages.

The dataset covers a sufficiently wide time span to allow for some of these countries to restructure their institutional mandates of prudential policy more than once. These were the cases of Ireland, Luxembourg, Iceland, and the United Kingdom. For the remaining countries, there is a predominance of jurisdictions that never changed their supervisory arrangements (17 out of 25), while only 8 countries introduced reforms over the last 60 years. This analysis suggests that the institutional settings of prudential policy in advanced countries are quite stable over time.

To examine whether central banks with monetary and prudential mandates experience a bias in their inflation outcomes, we exploit both cross section and time variation in institutional arrangements by employing a flexible dynamic macro-panel data approach that is well suited to our set-up (25 countries and nearly 60 years for the period 1960-2018). In particular, we resort to the newly developed Dynamic Common Correlated Effects (DCCE) estimator of Chudik and Pesaran (2015), which is particularly useful when both the cross-section and the time series dimensions are sufficiently large. Moreover, the DCCE allows for both observed and unobserved heterogeneity across countries, as well unobserved common factors, which are likely to be present in our panel. We thus take into account the dynamic nature of inflation rates and the presence of global factors (brought about by increased financial integration or common business cycles), which, if not appropriately recognised, induce significant biases in standard estimators. In addition, we consider proxies that aim at capturing other aspects of the policymaking structure, such as the monetary policy regime (i.e. inflation targeting) and the presence of deposit insurance schemes, together with variables that account for the degree to which open economies are exposed to ‘imported’ inflationary shocks.

In contrast with earlier, and somewhat crude, empirical literature, our estimation results show that the institutional separation of prudential policy does not have a significant impact on inflation, suggesting that inflation rates are not systematically higher in countries in which central banks are also in charge of micro/macroprudential policy. We show that the same applies to inflation volatility. Moreover, we evaluate how different supervisory arrangements impact on policy inputs in the shape of central banks’ preferences, measured by a central banks’ conservatism (CBC) index as in Levieuge and Lucotte (2014) and Levieuge, Lucotte and Pradine-Jobet (2019). These results shore up our main conclusion that central banks with both monetary policy and prudential policy functions do not display lower inflation aversion that those with a single mandate of price stability.

These findings are robust along several dimensions. Namely, we use alternative classifications of the Separate variable for countries for which there is some ambiguity about the institutional arrangements. Moreover, we carry out sub-sample analysis in order to test whether the 2008 crisis has had an effect on the empirical findings obtained, given that it motivated the reformulation of the institutional setups of prudential policy in several countries. Furthermore, we also obtained pooled estimates for the Separate variable while allowing for parameter heterogeneity in the other explanatory variables.

Our results also suggest that there are other characteristics of the monetary and banking supervision architecture that could be driving forces of low inflation rates, such as inflation targeting and deposit insurance systems, the latter by steering confidence in the well functioning of the banking system. In addition, economic factors such as the output gap and the degree of openness of the economy are also important determinants of inflation levels and volatility.

In this study we investigate the implications that the delegation of microprudential and macroprudential policy has on macroeconomic outcomes, with a focus on price stability, using a data set comprising of 25 OECD countries from 1960 to 2018. We improve upon existing literature by adopting a more appropriate dynamic macro-panel data approach that allows for cross-country heterogeneities as well as global unobserved drivers of inflation. Contrary to previous empirical evidence, our estimation results for all relevant specifications show that separation of prudential regulation from the central bank does not have a statistically significant impact on inflation. As such, no evidence was found to suggest that the additional mandate of financial stability restrains central banks in the conduct of monetary policy or that it gives rise to an inflation bias. In addition to possible complementarities in the pursuit of stabilisation policies, it is reasonable to argue that central banks are always concerned with the stability of the banking system, independently of the assigned mandates, since distress in the banking sector may disrupt the transmission channels of monetary policy impairing its effectiveness. Indeed, the importance of financial stability considerations for the conduct of monetary policy was, as already referred, recently acknowledged by the European Central Bank.

Although no evidence was found to associate inflation bias with the institutional structure for the countries in our sample, other concerns (such as ‘reputation risks’ and ‘organisational costs’) may pose higher challenges for central banking. Recent reforms to assign an explicit financial stability mandate to monetary authorities (via macroprudential responsibilities) may imply new sources of conflicts with monetary policy. In this new environment for policymaking, the most important challenge for central banks is to avoid severe disruptions in the banking system or regulatory capture by the banking industry as they damage its reputation as a monetary policymaker.

We focused solely on the effects of policymaking institutional structure on inflation outcomes, i.e. on the effectiveness of monetary policy, but it would also be interesting to understand the impact of different institutional configurations on macroprudential outcomes. Nevertheless, financial stability does not have an established definition nor a widely accepted outcome measure, as several variables have been suggested in the literature as indicators of financial distress policymakers should respond to such, as credit spreads, credit growth, leverage ratios, or systemic risk indicators. As more data becomes available, this is certainly a topic worth exploring.

Abreu, I. and Azevedo, J. V. A., et al. 2021. “Perspectives on the ECB’s monetary policy strategy review,” Banco de Portugal, June.

Ampudia, Miguel & Beck, Thorsten & Beyer, Andreas & Colliard, Jean-Edouard & Leonello, Agnese & Maddaloni, Angela & Marqués-Ibáñez, David, 2019. “The architecture of supervision,” Working Paper Series 2287, European Central Bank.

Bernanke, Ben S. & Gertler, Mark, 1995. “Inside the Black Box: The Credit Channel of Monetary Policy Transmission,” Journal of Economic Perspectives, American Economic Association, vol. 9(4), pages 27-48, Fall.

Borio, Claudio & Zhu, Haibin, 2012. “Capital regulation, risk-taking and monetary policy: A missing link in the transmission mechanism?,” Journal of Financial Stability, Elsevier, vol. 8(4), pages 236-251.

Chudik, Alexander & Pesaran, M. Hashem, 2015. “Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors,” Journal of Econometrics, Elsevier, vol. 188(2), pages 393-420.

Carmine Di Noia & Giorgio Di Giorgio, 1999. “Should Banking Supervision and Monetary Policy Tasks be Given to Different Agencies?,” International Finance, Wiley Blackwell, vol. 2(3), pages 361-378, November.

Doumpos, Michael & Gaganis, Chrysovalantis & Pasiouras, Fotios, 2015. “Central bank independence, financial supervision structure and bank soundness: An empirical analysis around the crisis,” Journal of Banking & Finance, Elsevier, vol. 61(S1), pages 69-83.

Goodhart, C., & Schoenmaker, D., 1995. “Should the Functions of Monetary Policy and Banking Supervision Be Separated?,” Oxford Economic Papers, 47(4), new series, 539-560.

Hasan, Iftekhar & Mester, Loretta J., 2008. “Central Bank Institutional Structure and Effective Central Banking: Cross-Country Empirical Evidence,” Comparative Economic Studies, Palgrave Macmillan;Association for Comparative Economic Studies, vol. 50(4), pages 620-645, December.

Ioannidou, Vasso P., 2005. “Does monetary policy affect the central bank’s role in bank supervision?,” Journal of Financial Intermediation, Elsevier, vol. 14(1), pages 58-85, January.

Lazopoulos, Ioannis & Gabriel, Vasco, 2019. “Policy mandates and institutional architecture,” Journal of Banking & Finance, Elsevier, vol. 100(C), pages 122-134.

Levieuge, Grégory & Lucotte, Yannick, 2014. “A simple empirical measure of central banks’ conservatism,” Southern Economic Journal 81, 409-434.

Levieuge, G. & Lucotte, Y. & Pradines-Jobet, F., 2019. “Central banks’ preferences and banking sector vulnerability,” Journal of Financial Stability, Elsevier, vol. 40(C), pages 110-131.

ECB’s monetary policy strategy statement, July 2021, https://www.ecb.europa.eu/home/search/review/html/ecb.strategyreview_monpol_strategy_statement.en.html.

Abreu and Azevedo, 2021. Perspectives on the ECB’s monetary policy strategy review. Banco de Portugal, June.

In addition to the organisational differences involved in pursuing the two objectives, separation of mandates reduces the political and reputational risk faced by governments and central banks in the event of a banking crisis (Goodhart and Schoenmaker, 1995).

Using a stylized theoretical framework, Lazopoulos and Gabriel (2019) conclude that the optimal institutional setting depends on the macroeconomic shocks the economy experiences and social preferences over stabilisation objectives.

Whilst it may be argued that our baseline indicator of ‘separateness’ is oversimplified, we consider different variants of the Separate variable and further complement it with additional measures of central banks’ involvement in banking supervision.