The in-house credit assessment systems (ICASs) developed by euro area national central banks (NCBs) are an important source of credit risk assessment within the Eurosystem collateral framework. They allow counterparties to mobilise as collateral the loans granted to non-financial corporations (NFCs). This ultimately leads not only to a widened collateral base and an improved transmission mechanism of monetary policy, but also to a lower reliance on external sources of credit risk assessment such as rating agencies. The importance of ICASs is exemplified by the collateral easing measures adopted in April 2020 in response to the coronavirus (COVID-19) crisis. Looking ahead, ICASs already include some relevant and available environmental, social and governance (ESG) indicators in their rating process. The Eurosystem is working towards greater integration of ESG factors, in particular factors related to climate change risks, in the ICAS methodologies.

The collateral framework is one of the pillars supporting the Eurosystem’s monetary policy implementation. It consists of a set of rules and requirements – eligibility criteria, minimum credit quality, haircuts, etc. – that financial assets have to satisfy in order to be used to secure refinancing operations.

Although once called the “open secret of central banks” (Nyborg, 2016), an increasing number of papers and books have investigated various aspects of the Eurosystem collateral framework (BIS (2013), Bindseil (2014), Bindseil and Papadia (2006), Bindseil et al. (2009, 2017), Cheun et al. (2009), ECB (2006, 2011, 2015), and Tamura and Tabakis (2013), Calza et al. (2021), and Mésonnier et al. (2017)).

Nevertheless, our paper with Auria et al. (2021), which is summarised in this Policy Brief, is the first to provide a comprehensive overview of the entities that conduct Eurosystem-internal credit assessments of a non-negligible part of non-marketable collateral: the ICASs operated by NCBs in the euro area (see Antunes et al. (2016), Deutsche Bundesbank (2015), Giovannelli et al. (2020), Schirmer (2014), Wukovits (2016) for descriptions of individual NCBs’ ICASs).

In Auria et al. (2021) we analyse in detail the role of ICASs in the context of the Eurosystem’s credit operations, describing the relevant guidelines and requirements in terms of, among other factors, the estimation of default probabilities, the role of statistical models versus expert analysis, input data, validation analysis and performance monitoring. We also provide information on the size and sector distribution of rated NFCs and a detailed description of each of the seven ICASs currently accepted by the Eurosystem. This Policy Brief focuses on selected topics, mainly related to the role of ICAS in the collateral framework and the integration of ESG factors into ICASs; interested readers may refer also to the longer paper.

The collateral framework is meant to protect the Eurosystem’s balance sheet against losses related to the default of a monetary policy counterparty. It thus implements the statutory requirement to base all lending on adequate collateral. At the same time, the collateral framework ensures that sufficient collateral is available to smoothly implement monetary policy and to provide a level playing field, across jurisdictions, for counterparties in need of liquidity when they mobilise financial assets as collateral.

A key requirement of the collateral framework is a high credit quality of the assets to be mobilised. In this context, the Eurosystem credit assessment framework (ECAF) defines the procedures, rules and techniques which ensure that all assets eligible for monetary policy operations meet the Eurosystem’s credit quality requirements. The ECAF is thus the basis for the credit quality assessment of assets mobilised as collateral in Eurosystem credit operations and of assets purchased under the current purchase programmes.

At present, to assess the credit quality of eligible assets, the Eurosystem takes into account information from credit assessment systems belonging to three categories: (1) credit rating agencies accepted as external credit assessment institutions (ECAIs), (2) NCBs’ ICASs, and (3) counterparties’ internal ratings-based (IRB) systems that are accepted for determining banks’ regulatory capital requirements.

However, ICASs play a special role among ECAF credit assessment sources due to the fact that they allow counterparties to mobilise as collateral the loans granted to NFCs, which in many cases are not assessed by other credit assessment systems available to these counterparties. ICASs are used in particular by small and medium-sized banks that lend primarily to small and medium-sized enterprises (SMEs) but do not have an IRB system and are not in a position to fund themselves by issuing asset-backed securities (ABSs) or covered bonds. Moreover, ECAI ratings are available only for a small share of NFCs, while they are usually not available for SMEs.

Already in normal times, the acceptance of ICASs thus contributes to sufficient collateral availability for a wide range of counterparties with different business models and operating in different markets, ensuring a smooth implementation of monetary policy. Accepting bank loans as collateral helps avoid the need for counterparties to hold specific marketable assets only for the purpose of collateralising monetary policy operations. Bank loans have relatively low opportunity costs as collateral, whereas marketable assets are increasingly used as collateral in private market repo transactions.

At the same time, the acceptance of illiquid bank loans leads to certain side effects, including operational challenges and risks for the Eurosystem. Collateral eligibility and use requirements as well as risk control measures aim to ensure that these bank loans are treated in an equivalent manner to other eligible assets from the perspective of the Eurosystem’s risk exposure (see, for example, Tamura and Tabakis, 2013, and ECB, 2015).

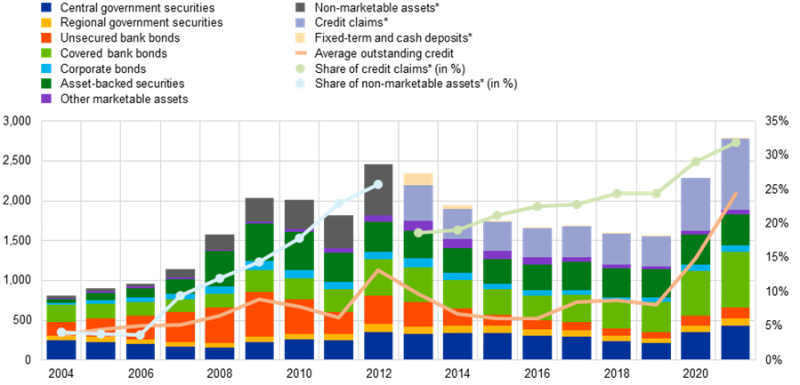

ICASs provide an even more important contribution to the transmission mechanism in times of market tension, as they allow banks to increase the share of non-marketable collateral (provided that the minimum credit quality requirement is satisfied) when there is a shortage of marketable assets or the latter have lost value. This role is exemplified by the measures adopted by the Eurosystem in April 2020, during the pandemic-related financial and economic crisis, when the Eurosystem introduced a set of collateral measures to facilitate an increase in bank funding (de Guindos and Schnabel (2020)). This increase was to be achieved by expanding the use of bank loans (also called “credit claims”) as collateral, in particular the so-called Additional Credit Claims frameworks, that allow NCBs to enlarge the scope of eligible bank loans for counterparties in their jurisdictions. The effectiveness of these measures was demonstrated by the significant increase in such collateral that was observed in several jurisdictions in 2020 and 2021, as shown in Chart 1 below.

Chart 1: Increasing use of bank loans as collateral in Eurosystem credit operations

(left scale: EUR billions after valuation and haircuts; right scale: share of total mobilised collateral after valuation and haircuts)

Source: ECB.

Notes: Use of collateral: averages of end-of-month data; credit: based on daily data.

* Until 2012, “credit claims” (i.e. bank loans) and “fixed-term and cash deposits” were reported jointly in the category “non-marketable assets”.

Besides these direct benefits for counterparties and for the implementation of monetary policy, ICASs offer several further indirect advantages for the Eurosystem. By allowing banks to mobilise loans rather than government bonds or other marketable assets, ICASs help to diversify Eurosystem balance sheet risks. In addition, ICASs provide Eurosystem-internal credit assessments for a large number of European NFCs as an alternative or complement to ratings by rating agencies, thus helping to reduce the Eurosystem’s reliance on these agencies and contributing to implementing the recommendations of the Financial Stability Board (Principles for reducing reliance on credit rating agency ratings).

Finally, ICAS credit quality assessments have also proven useful beyond monetary policy: ICAS ratings are used for financial stability analyses, for economic research, and for macroprudential and microprudential supervision. They provide benchmarks for banks’ IRB systems and guidance for estimating allowances and provisions for credit risk losses, among other purposes.

The assessment of credit quality has always been important for collateral purposes. This was the case even before the creation of the Economic and Monetary Union. Four euro area members already had an ICAS before 1999 and kept using it after the adoption of the euro: first in the period in which a two-tier system for collateral was in place, in order to allow a smooth transition from the national frameworks, and subsequently under the unified collateral framework (“single list”) adopted in 2007. Other ICASs were set up after the sovereign debt crisis of 2012, in order to increase collateral availability and facilitate the temporary framework for “Additional Credit Claims” adopted by several Eurosystem NCBs at the time. Additional Eurosystem central banks may develop ICASs in the coming years. The introduction of AnaCredit in 2018 overcame a major obstacle for the development of credit risk models by central banks that previously lacked a credit register.

The quality and reliability of ICAS credit assessments are ensured through a common set of Eurosystem-wide rules. These have to be followed by any NCB deciding to operate an ICAS, both in the initial acceptance phase and once the system is in regular usage. ICASs have to comply with certain standards in terms of organisation, adequate resources and governance. A key tool for the regular due diligence of ICASs is the annual Eurosystem “performance monitoring process”.

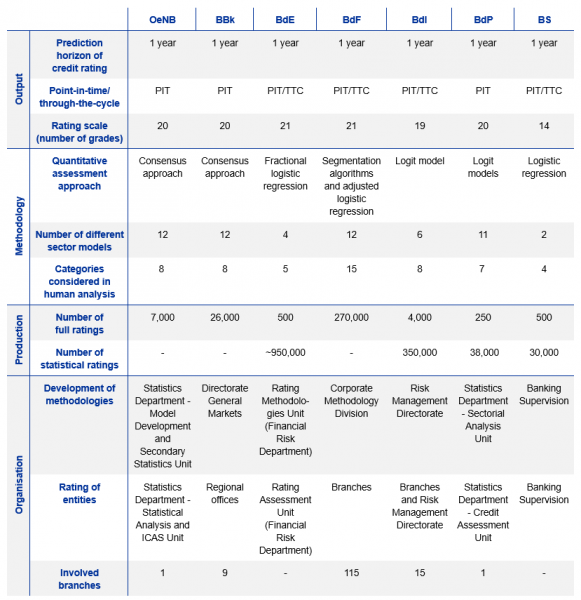

The ICASs thus share many common features such as a one-year prediction horizon, the usage of timely available data sources such as the latest financial statements and information from the credit register, or aspects covered in the expert system such as sector and business risk. Within the boundaries of the commonly agreed requirements, ICASs vary in terms of specific procedure and implementation. Table 1 shows that differences exist in terms of output, statistical methodologies, production size (e.g. the number of full ratings) and internal organisation (e.g. some NCBs rely on local branches, others do not).

Table 1: Cross-country comparison of the main features of ICASs

Source: National central banks.

There is a growing general consensus that ESG risk factors may have a relevant impact on credit risk: ESG factors, including climate change risks, can affect borrowers’ cash flows and the likelihood that they default on debt obligations. To this effect, ICASs have already been working on achieving a consistent and adequate measurement and incorporation of ESG factors into credit ratings, and substantial progress is envisaged.

At present, ICASs have heterogeneous approaches towards the explicit incorporation or consideration of ESG factors within their rating models and methodologies. When environmental factors are included in the rating methodologies, this is usually done within the expert assessment. Incorporating ESG factors into credit ratings and disclosing which factors are relevant and material for a rating assignment may not be straightforward in a context of limited availability of sufficiently harmonised and homogeneous data to be used for a statistical analysis.

Current efforts by ICASs focus on the selection of climate change risk indicators to be included in the statistical model or in the expert model; for example, within the latter, climate change risk factors may be fully incorporated in the system of soft indicators by standing as a category on their own. The Eurosystem is developing minimum standards for the incorporation of climate change risks into its internal ratings (see the ECB press release and the detailed roadmap).

Antunes, A., Gonçalves, H. and Prego, P. (2016), “Firm default probabilities revisited”, Economic Studies, Banco de Portugal, April.

Laura Auria, Markus Bingmer, Carlos Mateo Caicedo Graciano, Clémence Charavel, Sergio Gavilá, Alessandra Iannamorelli, Aviram Levy, Alfredo Maldonado, Florian Resch, Anna Maria Rossi and Stephan Sauer (2021), “Overview of central banks’ in-house credit assessment systems in the euro area”, ECB Occasional paper No 284, October.

Bank for International Settlements (2013), “Central bank collateral frameworks and practices”, Markets Committee Papers, No 6, March.

Bindseil, U. (2014), Monetary Policy Operations and the Financial System, Oxford University Press, Oxford.

Bindseil, U., and Papadia, F. (2006), “Credit risk mitigation in central bank operations and its effects on financial markets: the case of the Eurosystem”, Occasional Paper Series, No 49, ECB, Frankfurt am Main, August.

Bindseil, U., González, F. and Tabakis, E. (eds.) (2009), Risk Management for Central Banks and Other Public Investors, Cambridge University Press, Cambridge.

Bindseil, U., Corsi, M., Sahel, B. and Visser, A. (2017), “The Eurosystem collateral framework explained”, Occasional Paper Series, No 189, ECB, Frankfurt am Main, May.

Calza, A., Hey, J., Parrini, A. and Sauer, S. (2021), “Corporate loans, banks’ internal risk estimates and central bank collateral: evidence from the euro area”, Working Paper Series, No 2579, ECB, Frankfurt am Main, July.

Cheun, S., von Köppen-Mertes, I. and Weller, B. (2009), “The collateral frameworks of the Eurosystem, the Federal Reserve System and the Bank of England and the financial market turmoil”, Occasional Paper Series, No 107, ECB, Frankfurt am Main, December.

De Guindos, L. and Schnabel, I. (2020), “Improving funding conditions for the real economy during the COVID-19 crisis: the ECB’s collateral easing measures”, The ECB Blog, ECB, Frankfurt am Main, 22 April.

Deutsche Bundesbank (2015), “The Common Credit Assessment System for assessing the eligibility of enterprises”, Monthly Report, January, pp. 33-45.

European Central Bank (2015), “The financial risk management of the Eurosystem’s monetary policy operations”, Frankfurt am Main, July.

Giovannelli, F., Iannamorelli, A., Levy, A. and Orlandi, M. (2020), “The in-house credit assessment system of Banca d’Italia”, Occasional Paper Series, No 586, Banca d’Italia, November.

Mésonnier, J. S., O’Donnell, C. and Toutain, O. (2017), “The Interest of Being Eligible”, Working Paper Series, No 636, Banque de France, October.

Nyborg, K. (2016), Collateral Frameworks: The Open Secret of Central Banks, Cambridge University Press, Cambridge.

Schirmer, L. (2014), “The Banque de France company rating system: a tool to facilitate companies’ access to bank credit”, in Banque de France, Banque de France Bulletin, No 35, Autumn, pp. 5-20.

Tamura, K. and Tabakis, E. (2013), “The use of credit claims as collateral for Eurosystem credit operations”, Occasional Paper Series, No 148, ECB, Frankfurt am Main, June.

Wukovits, S. (2016), “Bonitätsbeurteilung von nichtfinanziellen Unternehmen – das OeNB-Expertenmodell”, in Oesterreichische Nationalbank, Statistiken – Daten & Analysen, Q1/16, pp. 42-47.

The views expressed are those of the authors and do not necessarily reflect those of the Banca d’Italia, Oesterreichische Nationalbank, the European Central Bank or the Eurosystem.