COVID-19 represents a major shock to the global economy with severe repercussions on financial markets. Governments, central banks and other authorities have thus taken unprecedented measures to counteract and dampen the impact of the crisis. In this policy brief, we assess how EU member states in Central, Eastern and Southeastern Europe (CESEE) have adjusted their macroprudential policies in response to the COVID-19 crisis. We utilize a recently developed, intensity-adjusted index that tracks a broad set of macroprudential policy instruments. We find that countries responded quickly to the outbreak of the crisis by relaxing capital buffer and liquidity requirements, or at least refraining from previously planned tightening. At the same time, we observe that borrower-based measures and minimum reserve requirements were only rarely relaxed and risk weights were not changed at all.

In response to the pandemic, governments, central banks and other authorities have taken unprecedented measures to counteract and dampen the impact of the ensuing economic crisis, using a mixture of fiscal, monetary, supervisory and macroprudential policies (IMF 2020, ECB 2020a). This may cushion some of the negative economic effects of COVID-19. Topcu and Gulal (2020) find that, compared to other emerging markets, CESEE economies were affected less strongly, and argue that the swift reaction of these countries may have improved the situation. Moreover, prior to the COVID-19 crisis, the banking system of the CESEE region was characterized by solid profitability, robust loan growth and ample liquidity. Nonperforming loan (NPL) ratios had declined significantly and the banking sector was more than sufficiently capitalized (see OeNB, 2020).

In this policy brief we explore which macroprudential policy (MPP) instruments have been adjusted in CESEE to counteract the adverse effects on financial markets and the real economy induced by the ongoing pandemic and the accompanying lockdown measures set by the national governments.

To describe the macroprudential policy responses during the COVID-19 pandemic, we use a recently developed, intensity-adjusted macroprudential policy index (MPPI). Described in detail by Eller et al. (2020), the MPPI captures not only the occurrence of different types of MPP measures, but also the strength of their adjustment, i.e. the change in their intensity. It covers the eleven CESEE EU member countries on a quarterly basis and starts tracking MPPs from the late nineties. An increase in the MPPI and its subcomponents indicates a net tightening in the macroprudential stance, while a decrease points to macroprudential loosening.

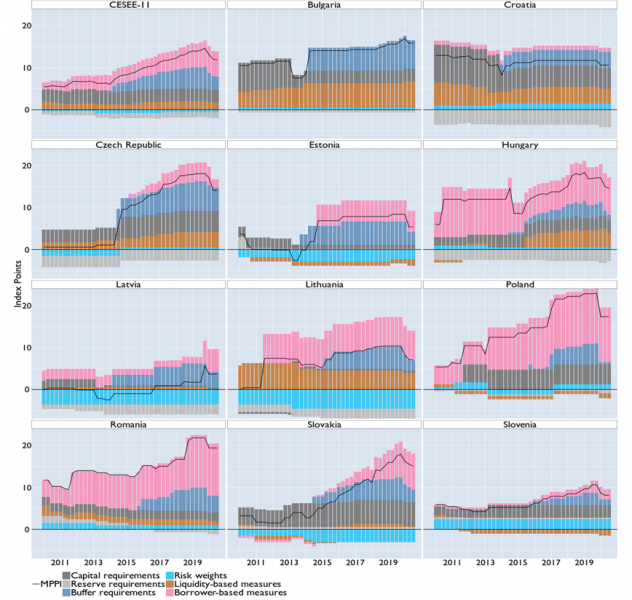

Chart 1 displays the development of the MPPI and its subcomponents for all countries under scrutiny as well as an (unweighted) CESEE-11 aggregate for the time period since 2010. A relatively steady tightening in the macroprudential stance for CESEE countries occurred in the run-up to the COVID-19 crisis. With the onset of the pandemic at the beginning of 2020, however, the MPPI indicates that macroprudential authorities in the CESEE-11 countries reacted swiftly to the crisis, in particular by reducing buffer requirements, either explicitly or by temporarily tolerating banks breaching these requirements. Furthermore, liquidity requirements were loosened in many countries. Other macroprudential instruments applied to mitigate the adverse effects of the pandemic include the easing of lending restrictions and minimum reserve requirements.

Chart 1: Intensity-adjusted MPPI in the CESEE-11, Q1 10–Q3 20

Source: Authors’ calculations.

Capital-based macroprudential requirements were eased throughout the CESEE region. Most countries increased their lenience vis-à-vis banks not fulfilling combined buffer requirements (CBR) or capital conservation buffer (CCoB) requirements. A few countries like Poland and Estonia have gone further, by explicitly reducing buffer rates or cancelling previously planned increases.3 All countries that had already activated the countercyclical capital buffer (CCyB), or had plans to do so in the near future, decided to release them either fully or partly.4 Buffer rates for some systemically important institutions (O-SII buffer) were eased in Hungary, Lithuania and Slovakia.5

Most CESEE-11 countries also relaxed macroprudential liquidity requirements. More specifically, most CESEE-11 countries relaxed their approach towards temporary breaches of the liquidity coverage ratio (LCR). As with the CBR, the ECB announced that it will take a flexible approach for directly supervised banks when approving the plans to re-reach the required LCR (ECB, 2020b). In addition, Hungary and Bulgaria took measures to reduce liquidity risks stemming from foreign currency funds or foreign institutions.

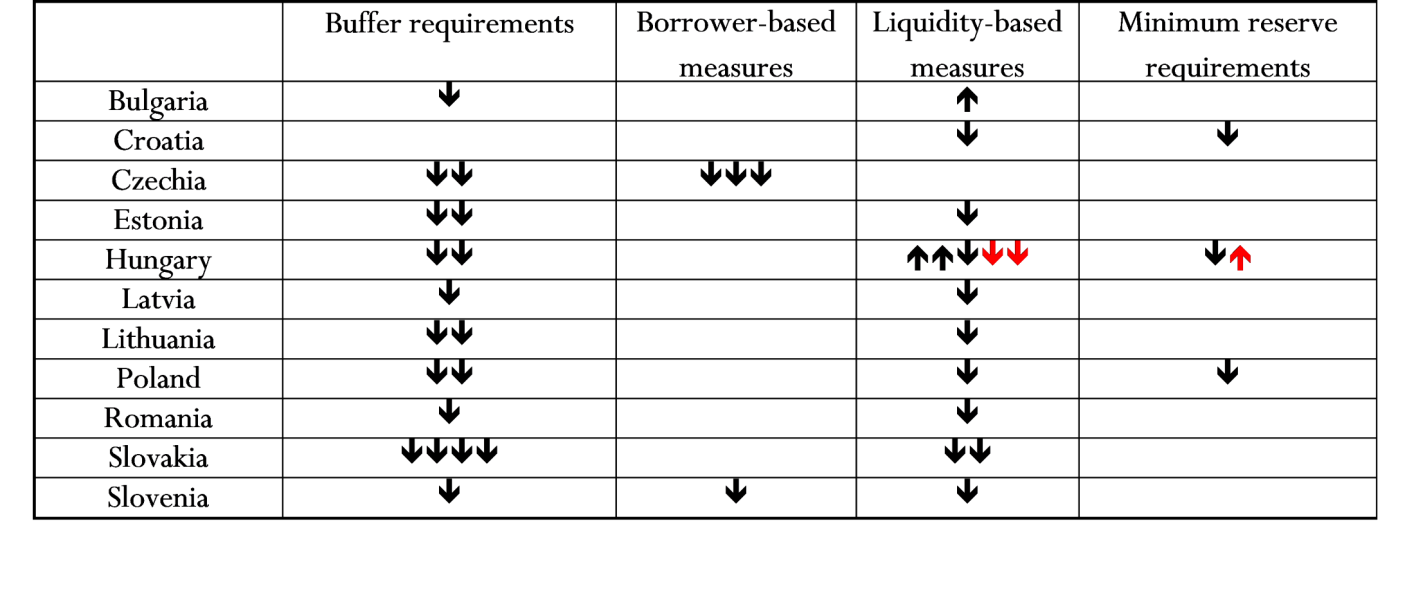

Borrower-based measures were eased only in a few countries, notably in Czechia and, to a lesser extent, Slovenia. Croatia, Poland and Hungary also adjusted their minimum reserve requirements (MRRs).

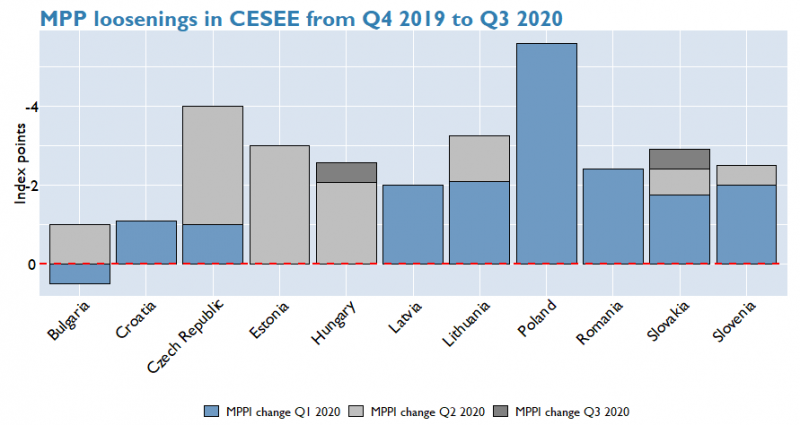

To provide a summary picture of the macroprudential policy response to COVID-19 in the region, Chart 2 depicts the overall strength of macroprudential easing by country. The bulk of the measures were taken at the end of the first and in the second quarter of 2020. Poland and Czechia reacted comparatively strongly. On the other side of the spectrum, Bulgaria and Croatia took far fewer steps to ease their macroprudential policy stance. The rest of the countries fall somewhere in the middle.

Table 1 shows that crisis-related MPP easing was first and foremost based on the loosening of buffer and liquidity requirements, while minimum reserve requirements and borrower-based measures were eased in only three and two countries, respectively, and risk weights for loans in the residential sector were not changed at all. Depending on the country-specific starting positions as shown in Chart 1, loosening borrower-based measures (more strongly) would likely increase lending to more “marginal” borrowers, increasing medium- to long-term risks to financial stability. Moreover, the implementation of borrower-based measures is often politically very difficult making a renewed tightening of such measures after the pandemic politically costly. Hence there are good reasons why most CESEE-11 countries initially refrained from loosening borrower-based measures. Similar considerations apply to risk weights, for example those attached to residential or commercial real estate exposure of banks. Such risk weights are sometimes used as a politically less problematic alternatives to borrower-based measures. Loosening them would also likely increase medium- to long-term risks in real estate markets while providing fewer short-term benefits.

Chart 2: Intensity of MPP loosening in the first quarters of the COVID-19 crisis

Source: Authors’ calculations.

Table 1: Types of macroprudential policy instruments used in the first quarters of the COVID-19 crisis

Note: Arrows indicate the number of measures taken by national authorities for a given set of instruments. An arrow pointing downward indicates a loosening in a given category; arrows pointing upward indicate a tightening. Red arrows indicate that measures that were introduced at the beginning of the crisis were repealed again.

The extent to which MPP measures have been used so far depends on a range of policy considerations, not least including the overall “macroprudential space” that was created ahead of the pandemic, the state of the banking sector and the intensity of responses in other policy areas.

Eller, Martin and Vashold (2021) find tentative evidence that CESEE-11 countries entering the crisis with better capitalized and more profitable banking systems tended to implement relatively less pronounced macroprudential easing. This might be explained by the fact that macroprudential authorities in these countries were less concerned about their banking systems continued ability to supply loans to the real economy. The authors also find very tentative evidence that fiscal support to the economy and macroprudential loosening to support the banking sector were largely complementary. Countries with relatively large fiscal stimulus packages also tended to loosen their macroprudential stance more substantially. Finally, for most countries there appears to be a negative relation between macroprudential loosening and indicators for monetary policy easing, suggesting a substitutive use of these policies by the respective central banks.

Macroprudential authorities in the CESEE-11 countries have loosened a wide range of macroprudential measures in response to Covid-19, most notably capital buffers and liquidity requirements. The extent to which the countries have engaged in macroprudential loosening differs substantially and there is tentative evidence that fiscal and macroprudential policy easing went hand in hand in a complementary manner. At the same time, stronger monetary policy easing was often accompanied by a less pronounced macroprudential loosening.

Depending on the respective countries’ starting positions, there appears to be further scope for macroprudential loosening in the CESEE region if economic and financial developments in the region become even more adverse. At the same time, a further loosening, in particular of borrower-based measures and risk weights, could entail more severe medium- to long-term financial stability risks (e.g. with regard to housing markets) than the measures implemented so far.

ECB. 2020a. ECB Financial Stability Review. May 2020.

ECB. 2020b. ECB Banking Supervision provides temporary capital and operational relief in reaction to coronavirus. Press release of March 12, 2020. https://tinyurl.com/y5qyeuq2

Eller, M., R. Martin, H. Schuberth and L. Vashold. 2020. Macroprudential policies in CESEE – an intensity-adjusted approach. Focus on

European Economic Integration Q2/20. OeNB. 65–81.

Eller, M., R. Martin and L. Vashold. 2021. CESEE’s macroprudential policy response in the wake of the COVID-19 crisis. Focus on European Economic Integration Q1/21. OeNB. 55-69.

IMF. 2020. Regional Economic Outlook: Europe. Whatever It Takes: Europe’s Response to COVID-19. Washington, DC: International Monetary Fund. October 2020.

OeNB. 2020. The impact of the COVID-19 crisis on financial stability in Austria – a first assessment. In: Financial Stability Report 39. OeNB. July 2020. 39–64.

Topcu, M. and O. Gulal. 2020. The impact of COVID-19 on emerging stock markets. Finance Research Letters, vol. 36, 101691.

This policy brief is a shortened version of Markus Eller & Reiner Martin & Lukas Vashold, 2021. “CESEE’s macroprudential policy response in the wake of the COVID-19 crisis,” Focus on European Economic Integration, Oesterreichische Nationalbank (Austrian Central Bank), issue Q1/21, pages 55-69, https://www.oenb.at/feei.

Markus Eller is Principal Advisor at the Oesterreichische Nationalbank, Reiner Martin is Lead Economist at the Joint Vienna Institute and Lukas Vashold is Research and Teaching Associate at the Vienna University of Economics and Business. The views expressed here are those of the authors and do not necessarily reflect those of their respective institutions.

Note that the index shown in Chart 1 is based on announcement dates of measures, i.e. a decrease in the MPPI also reflects the cancelation of announced but not yet implemented tightening measures.

These countries were Bulgaria, Czechia, Lithuania and Slovakia.

Several countries have also eased their stance regarding the fulfilment of bank-specific Pillar 2 requirements and Pillar 2 guidance. However, such bank-specific instruments are not reflected in our index, apart from the O-SII buffer, for which an average of the rates applied to different institutions is included.