This Policy Brief is based on BIS Working Papers No 1213. The views expressed in this article are those of the authors and do not necessarily reflect those of the BIS, the IMF, or the SNB.

Abstract

While Chinese banks have become the top cross-border lender to emerging market and developing economies (EMDEs), their expansion has slowed recently. The strong correlation of China’s bilateral trade and its banks’ cross-border lending has weakened, while lending during 2020-22 has become more positively correlated with FDI. We analyse these patterns, the role of borrower risk variables, and foreign policies. First, we show the average risk profile of Chinese banks’ borrowers. Then, we document that, although the shifting correlation from trade to FDI is a general EMDE phenomenon, China’s Belt and Road Initiative reinforces it. By contrast, borrowers that potentially benefit from geoeconomic fragmentation do not display stronger FDI-lending relationships. We also find that Chinese banks exhibit different levels of risk tolerance relative to other bank nationalities as borrower country risk variables are positively correlated with Chinese banks’ market shares, but not with their amounts of cross-border lending.

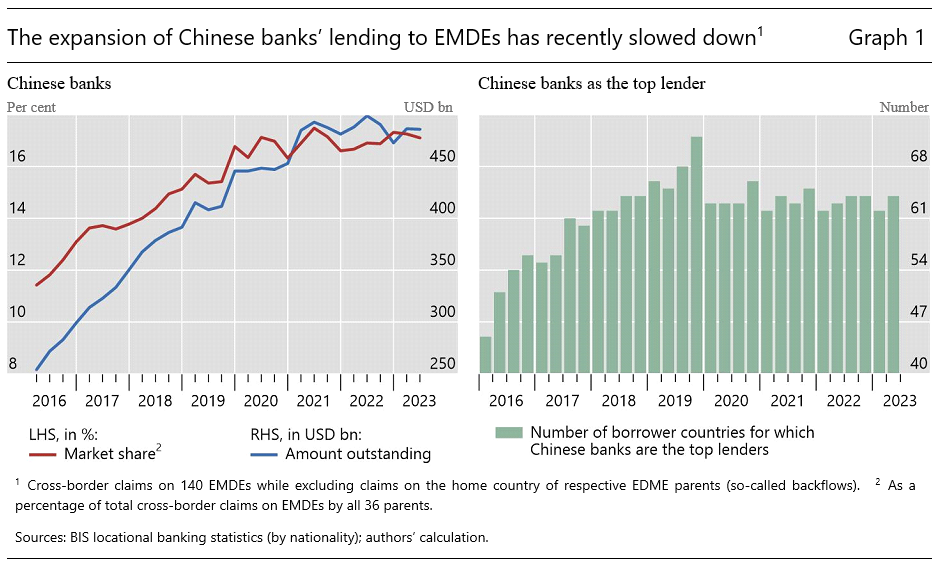

Although Chinese banks still stand out as the top cross-border lender to most emerging market and developing economies (EMDEs), their global expansion has recently slowed. Overall, the market share of Chinese cross-border bank lending increased by 5 percentage points over the 2016-2019 period (Graph 1, left-hand panel)#f1 . In 2016, Chinese banks made up about 11 percent of all outstanding loans on borrowers in EMDEs. This market share increased during the pre-pandemic years, reaching 17 percent in 2019. This increase in Chinese banks’ market share was mostly at the expense of European and Japanese banks, but not US banks. From the perspective of individual borrowers, the number of countries for which China is the most important lender slightly decreased. As of end 2019, for 72 EMDEs, Chinese banks were the most important lender among all bank nationalities extending cross-border loans to them (right-hand panel of Graph 1). That number of most dependent borrowers fell during the pandemic, stabilizing at around 65 out of a total of 140 EMDE borrowers.

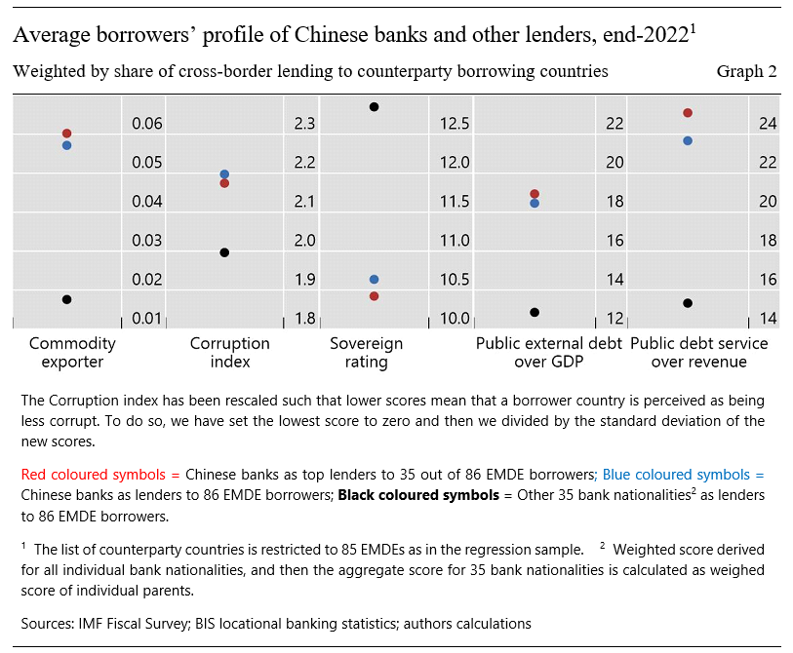

The average borrower country of Chinese banks differs from that of other bank nationalities. We focus on five different measures to capture the creditworthiness or risk profile of the different EMDE borrower countries in our sample (Graph 2). First of all, we resort to two measures on whether or not a country is a commodity and/or fuel exporter and, second, an index on how corrupt a borrower country is perceived to be. Further, we use the average rating of the sovereign across a range of public rating agencies to reflect the markets’ perception of a country’s creditworthiness. Finally, to assess a country’s debt burden, we use two alternative measures: i) external public debt over GDP, and ii) total debt service relative to government revenues.

What does the average borrower of Chinese banks look like? The average borrower country of Chinese banks is more likely to be a commodity exporter, less creditworthy and/or riskier than the comparison profile revealed by other lending bank nationalities. While blue dots in Graph 2 show the average borrower across all EMDEs that Chinese banks lend to, the red dots isolate the subset of borrowers for which Chinese banks are the most important lenders and which are thus most dependent on Chinese banks. Black dots reflect the comparison profile of an average borrower that all other bank nationalities typically lend to. Blue and red dots tend to be close, while black dots show some distance to them. This suggests that the average borrower from Chinese banks differs from the comparison group in that it is more likely to be a commodity exporter, is perceived as more corrupt, carries a lower sovereign rating and reports higher debt burdens in terms of public external debt and debt service both scaled, respectively.

Our empirical analysis—considering both lending amounts and market shares—provides further insight. We found that borrower country risk variables are positively correlated with Chinese banks’ market shares, but not with their amounts of cross-border lending. For example, while higher corruption perceptions do not themselves translate into larger amounts of Chinese cross-border lending, the market share of Chinese banks was clearly positively correlated with this variable, capturing a different level of risk tolerances relative to other bank nationalities during the entire period 2017-2022. Although to a lesser degree, something similar happened with EMDE debt burden capacity in terms of total debt service payments to government revenues. Chinese banks increased their market shares, on average, vis-à-vis other bank nationalities in countries with higher debt burden. While all other bank nationalities were more inclined to lend to EMDE commodity exporters across both periods, Chinese banks lent even more to those countries, but only pre-pandemic. That latter finding equally applies to both the outstanding amounts and market shares of cross-border lending.

Our empirical analysis also shows that the correlation patterns of cross-border lending and bilateral economic ties have changed significantly since the pandemic. Before the pandemic, bilateral trade was strongly correlated with the amount of cross-border bank lending by Chinese banks.#f2 This relationship has significantly weakened. During the 2020-22 period, it is bilateral FDI that has turned out to be much more positively correlated with both outstanding amounts and market shares of Chinese banks’ cross-border lending. By contrast, portfolio investment mostly displays a negative correlation, which, as highlighted in Cerutti, Casanova, and Pradhan (2023), is explained by the bias in Chinese investment of debt and equity towards Advance Economies (AEs).

How does this shift in correlation lending patterns relate to various foreign policies and geopolitical considerations? While BRI participation of the borrower country and the presence of PBOC swap lines with the borrower’s central bank generally increased the amounts of Chinese banks’ cross-border lending, higher market shares were only associated with BRI participation, especially post-pandemic. Also, we find that BRI membership augments the correlation between cross-border lending and FDI, especially during 2020-22. By contrast, we do not find a reinforcing of the correlation between cross-border lending and FDI in the case of EMDE borrowers that could potentially benefit from geoeconomic fragmentation, such as connector countries (displaying already in our sample simultaneous increases in export shares to the US as well as imports and FDI from China) or countries voting closer with the US at the UN (capturing potential present and/or future access to the US markets). Regarding sanctions, on average, there is no evidence that Chinese banks have systematically taken advantage of Western countries military, financial, and trade sanctions on specific borrower countries and increased lending to those countries.

A better understanding of Chinese banks’ evolving behavior is key for assessing potential risks and spillovers during challenging times with increasing levels of geoeconomic fragmentation. Despite the post-pandemic slowdown of cross-border bank lending, the role of Chinese banks has remained central to EMDEs. More than half of all EMDEs continue to have Chinese banks as top lenders. While Chinese banks’ cross-border lending resemble that of banks from AEs along several dimensions (e.g., relationship with most economic linkages, geographical distance, etc.), there are not only intrinsic differences due to China-specific policies (e.g., BRI), but also different borrower risk tolerances vis-à-vis other bank lenders. These differences could be important in the presence of global and local shocks, possibly reinforced by geoeconomic fragmentation trends. For example, while Chinese banks’ cross-border lending is small in relation to their domestic lending, a further domestic slowdown in China could affect their foreign borrowers, especially those joining policy initiatives and those with certain borrower characteristics that make it hard to find alternative sources of credit. All these factors could play an important role for the evolution of global cross-border bank lending in a world with increasing economic geo-fragmentation.

For a more detailed analysis see Casanova, C, Cerutti, E and SK Pradhan (2024): “Chinese Banks and their EMDE Borrowers: Have Their Relationships Changed in Times of Geoeconomic Fragmentation?”, BIS Working Paper No. 1213 and also IMF WP 24/205.

See Cerutti, E, C Koch, and S K Pradhan, 2023, “Banking across borders: Are Chinese banks different?”, Journal of Banking and Finance; Volume 154.