I would like to thank Friderike Kuik and Eliza Lis for their contributions, and Oscar Arce, Irene Heemskerk and Carolin Nerlich for their helpful comments on this conference paper. The views expressed in this policy brief do not necessarily reflect those of the ECB.

The European Central Bank (ECB) has committed to taking the impact of climate change into consideration in its monetary policy framework. Both climate change and its mitigation can impact relative prices and inflation. Headline inflation increased considerably in recent months, mainly reflecting the surge in energy prices. To date, climate policies have played only a limited role for inflation dynamics. Looking ahead, the energy transition may add inflationary pressures, but there is uncertainty about the magnitude and timing. In the longer run, these pressures could potentially ease or even reverse. To live up to its commitments, the ECB has been working on capturing the impact of climate change policies in the Eurosystem/ECB macroeconomic projections and with that in the medium-term inflation outlook.

Addressing climate change is a global challenge and a policy priority for the European Union. While governments and parliaments have the primary responsibility to act on climate change, the Governing Council of the European Central Bank (ECB) has committed, in its strategy review concluded last year, “to further incorporating climate considerations into its policy framework” (ECB, 2021a). This is particularly important, as climate change and climate policies affect the outlook for price stability through their impact on macroeconomic indicators, financial stability, and the transmission of monetary policy (ECB, 2021b).

Both climate change and its mitigation can impact relative prices and inflation (ECB, 2021c). On the one hand, climate change shocks – especially if materializing in form of simultaneous extreme events and compound risks – may prove increasingly challenging to react to. On the other hand, the transition may add pressure on prices, but there is uncertainty about the magnitude and the timing. In addition, these pressures could potentially ease or even reverse in the longer run, as the economy is expected to advance with the green transition.

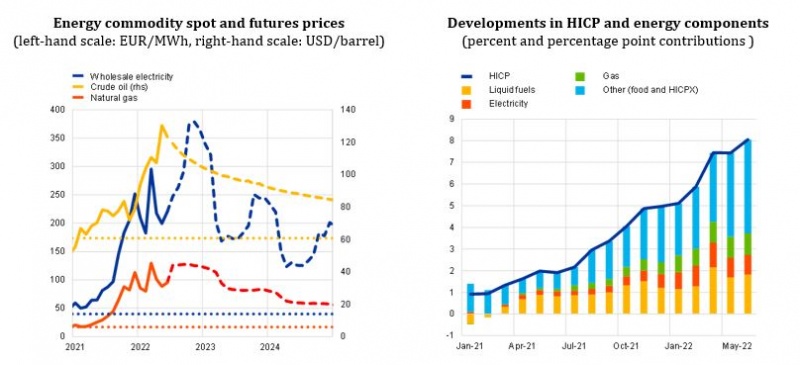

Pressures on energy commodity prices resulted from a rebound in demand after the pandemic, coupled with supply constraints and the impact of the Russian invasion. Energy commodity prices have increased to levels far beyond their long-term averages and are expected to stay at elevated levels for the foreseeable future (chart 1, left-hand panel). In particular, European natural gas prices reached an all-time high, contributing in turn to record-high wholesale electricity prices (ECB, 2022a,b).

Rising energy commodity prices had a large impact on consumer prices in the euro area, with strong contributions of energy inflation to headline inflation (chart 1, right-hand panel). The current energy price shock is unprecedented in terms of magnitude and breadth in the euro area: While increases in crude oil prices had reached similar magnitudes in the past, consumers today face not only an oil price shock but also a considerable rise in gas and electricity prices, which has not been observed before in this dimension. Government compensatory measures eased some of the upward pressure on consumer prices, yet price levels continue to be elevated.

Chart 1: Energy markets are already under pressure from the pandemic and war in Ukraine

Sources: Refinitiv, Eurostat and ECB calculations

Notes: LHS – Futures price curves as of 21 June 2022. Future prices are dashed. Futures data include the TTF Dutch Gas Futures and for electricity a weighted average (weighted by net electricity generation) of prices in the five biggest euro area economies. Averages from 2014 to 2020 are denoted by dotted lines. RHS – latest observation from May 2022.

The role of the energy transition and climate change mitigation policies, including carbon taxes, for inflation is subject to large uncertainties in terms of sign, size and timing. To consider potential effects and impact channels of the green transition on inflation, it is useful to distinguish between different periods. The recent past and near-term is characterized by large global shocks including the pandemic recovery and impacts of the Russian invasion of Ukraine, which largely overshadow any potential impacts of climate policies. In the medium-term, price pressures might become largest as the transition picks up in speed, but with decreasing costs of sustainable alternatives it is possible that price pressures ease or even reverse in the medium- to long-run.

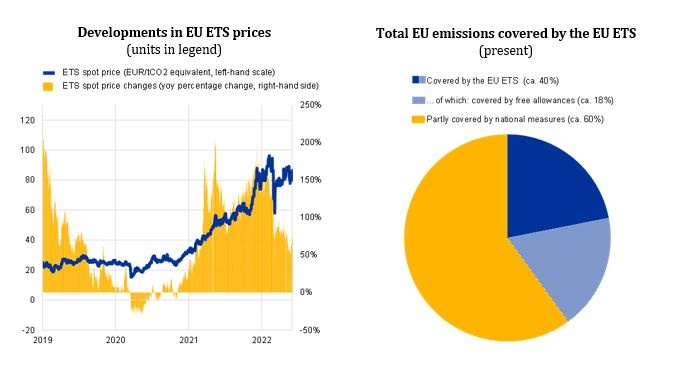

To date, climate policies have played only a very limited role for inflation. Though carbon prices under the EU emissions trading system (ETS) have increased strongly since the beginning of 2021 (chart 2, left-hand panel), their impact on inflation so far was limited. Overall, around 40% of emissions in the EU. Electricity and heat production have so far been the main activities for which emissions had to be covered with allowances purchased on the market. However, the impact of carbon prices on wholesale electricity prices – and consequently also on consumer prices – has been largely overshadowed by the unprecedented increases in natural gas prices. Natural gas prices have in the last months of 2021 and beginning of 2022 been the main driver of wholesale electricity prices (ECB, 2022a). Similarly, national carbon pricing schemes, covering up to 65% of individual countries’ emissions not falling under the EU ETS, have contributed to or are expected in the near term to contribute to a limited extent to price developments in euro area countries (World Bank, 2022; Bundesbank, 2021; Oesterreichische Nationalbank, 2022).

Chart 2: To date climate policies have played only a very limited role for inflation

Sources: Refinitiv, European Environment Agency, European Commission, ECB calculations

Notes: LHS – latest observation on 21 June 2022; RHS – The share of free allowances is based on 2021 data, obtained by the ratio of total free allowances and total emissions under the EU ETS. The share of total emissions covered by the EU ETS is taken from European Commission (2022). The illustration does not consider proposed EU policies under the “Fit for 55” package.

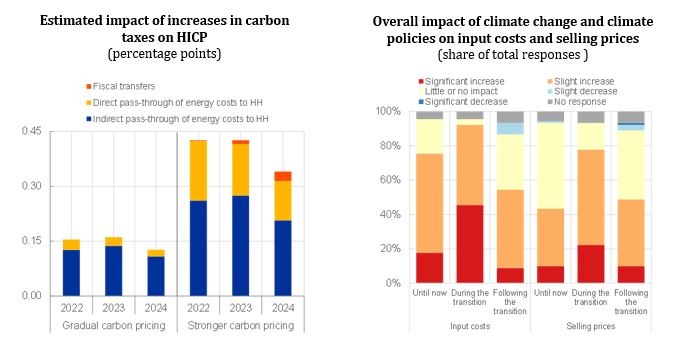

Going forward there is some evidence that the transition may add to some upward pressures on inflation and to heightened price volatility. ECB staff performed a sensitivity analysis of euro area inflation to an increase in effective carbon taxes (chart 3, left-hand panel; ECB, 2022c). The results point to limited but non-negligible effects on inflation in the gradual adjustment scenario until 2024. The scenario assumes a gradual and linear increase in carbon taxes until 2030, consistent with a pathway to reach net zero emissions by 2050. The impacts would be amplified in the case of the strong carbon pricing scenario, where the same increase in carbon prices already takes place by 2024, i.e. in a much shorter time horizon than currently foreseen in EU policy proposals. Therefore, these results can be seen as upper bound estimates. In addition, they are subject to a number of important methodological caveats, which also illustrates the uncertainty surrounding such estimates currently.

Increased cost pressures during the green transition are also anticipated by a recent survey with large non-financial corporations (chart 3, right-hand panel; ECB, 2022d). Among the 90 responding large non-financial firms, a large majority expects slightly or significantly increasing input costs during the transition and resulting pressures on selling prices. However, after the transition only a small share of respondents expects cost and price pressures to remain significantly higher.

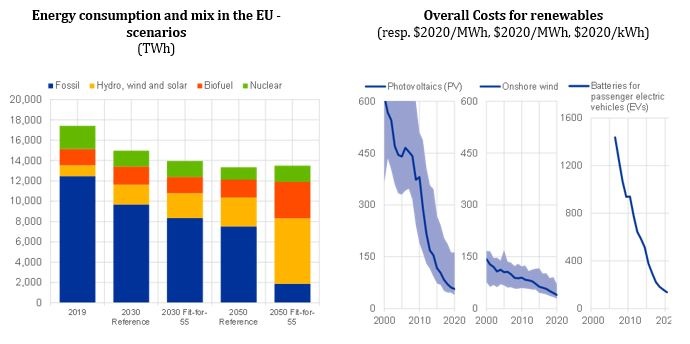

While these survey results suggest that these pressures on prices are likely to ease in the longer run, it may well be possible that they even reverse as clean technology matures. One important example are energy prices: under policy measures proposed by the European Commission – notably the Fit-for-55-package, but more recently also the RePowerEU proposal – it is expected that cheaper renewable sources of energy increasingly contribute to meeting energy demand (chart 4, left-hand panel). It is likely that effects will materialize first for electricity prices, which could decline as electricity demand is increasingly met with cheaper renewable electricity towards the end of this decade. Even though costs increased recently, already today onshore wind and solar photovoltaic ventures are offering long-term contracts that are below the wholesale price averages over the last few months (IEA, 2022; chart 4, right-hand panel). In addition to decreasing costs of solar and wind energy, also the unit costs of batteries used in passenger electric vehicles have fallen, by around 85% between 2010 and 2019 (chart 4, right-hand panel; IPCC, 2022). Furthermore, it is likely that also an increase in energy efficiency can dampen pressures on energy prices. However, fossil fuels are expected to play a role in the energy mix for some decades to come (chart 4, left-hand panel), as will consequently crude oil and natural gas prices for total energy prices.

Chart 3: Going forward the transition may add to pressures on energy prices and inflation

Sources: LHS – ECB, 2022c; RHS – ECB, 2022d

Notes: LHS – The simulations are based on the ECB’s New Multi Countries Model (NMCM). RHS – 90 respondents in total. The respondents consist of large and mostly multinational companies engaged in a wide range of non-financial business sector activities. Firms were asked to compare to a hypothetical baseline without climate change.

Chart 4: A successful transition could lead to downward pressures on prices in the long run

Sources: LHS – ECB staff calculations based on European Commission, 2021; RHS – IPCC, 2022a.

Notes: LHS – Scenarios include a reference with current policies, and the “Fit for 55 mix” scenario. “Fossil” includes gas, oil, coal and waste. RHS – Photovoltaics and onshore wind are costs and Batteries for passenger electric vehicles is Li-Ion battery packs.

There is a lot of uncertainty around the magnitude and timing of the impact of climate change and climate change mitigation on inflation. Nevertheless, it is possible to lay out the possible channels through which the energy transition and carbon taxes could have an effect. Impacts depend on the way the transition progresses, i.e. on whether policy stringency and carbon prices are increased gradually and in a coordinated manner (“orderly transition”; NGFS, 2021), or the transition is further delayed and then implemented in an abrupt and uncoordinated fashion (“disorderly transition”). It also depends on the pace of technological progress and the availability of key technologies to decarbonize the emission-intensive sectors, such as carbon capture and storage technologies (IEA, 2021). Impacts on the macroeconomy and inflation more specifically will depend on the way governments will support more vulnerable households or sectors to weather the transition (ECB, 2022c). Overall, however, there is clear evidence of the catastrophic impacts of unmitigated climate change (IPCC, 2021; IPCC, 2022b), underlining the urgency of forceful action to transition to carbon-neutral economies.

In its 2021 strategy review, the ECB Governing Council has agreed on a roadmap on climate change, which also foresees further work on the above-mentioned questions. In particular, the ECB Governing Council has committed to expanding its analytical capacity in macroeconomic modelling with regard to climate change, including conducting scenario analyses regarding transition policies (ECB, 2021a). The ECB is also working on capturing the impact of climate change policies in the Eurosystem/ ECB macroeconomic projections and with that in the medium-term inflation outlook, which is particularly relevant for monetary policy considerations.

Bundesbank, 2021. Outlook for the German economy for 2022 to 2024, Deutsche Bundesbank Monthly Report, December 2021. https://www.bundesbank.de/resource/blob/882442/471d6fca1db2062180ea41f3b0321614/mL/2021-12-prognose-data.pdf

ECB, 2021a. ECB presents action plan to include climate change considerations in its monetary policy strategy, ECB press release, 8 July 2021. https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210708_1~f104919225.en.html

ECB, 2021b. Climate change and monetary policy in the euro area, ECB Occasional Paper Series, No. 271/September 2021. https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op271~36775d43c8.sv.pdf

ECB, 2021c. Considerations on the impact of climate change on inflation, Box 9 in the Occasional paper on Understanding low inflation in the euro area from 2013 to 2019: cyclical and structural drivers, Gerrit Koester, Eliza Lis, Christiane Nickel, Chiara Osbat and Frank Smets, ECB Occasional Paper Series, No 280/September 2021.

https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op280~697ef44c1e.en.pdf

ECB, 2021d. EU emissions allowance prices in the context of the ECB’s climate change action plan, Giovanna Bua, Daniel Kapp, Friderike Kuik and Eliza Lis, ECB Economic Bulletin Issue 6/2021. https://www.ecb.europa.eu/pub/economic-bulletin/focus/2021/html/ecb.ebbox202106_05~ef8ce0bc70.en.html

ECB, 2022a. Energy price developments in and out of the Covid-19 pandemic – from commodity prices to consumer price developments, Friderike Kuik, Jakob Adolfsen, Eliza Lis and Aidan Meyler, ECB Economic Bulletin Issue 4/2022. https://www.ecb.europa.eu/pub/economic-bulletin/articles/2022/html/ecb.ebart202204_01~7b32d31b29.en.html

ECB, 2022b. The impact of the war in Ukraine on euro area energy markets, Jakob Feveile Adolfsen, Friderike Kuik, Eliza Magdalena Lis and Tobias Schuler, ECB Economic Bulletin Issue 4/2022. https://www.ecb.europa.eu/pub/economic-bulletin/focus/2022/html/ecb.ebbox202204_01~68ef3c3dc6.en.html

ECB, 2022c. Short-term impact of increasing the euro area effective carbon tax on output and inflation, Marien Ferdinandusse, Friderike Kuik, Georg Müller and Carolin Nerlich, forthcoming (2022).

ECB, 2022d. The impact of climate change on activity and prices, Friderike Kuik, Richard Morris and Yiqiao Sun, ECB Economic Bulletin Issue 4/2022. https://www.ecb.europa.eu/pub/economic-bulletin/focus/2022/html/ecb.ebbox202204_04~1d4c34022a.en.html

European Commission, 2021. Energy Scenarios, interactive tool, https://visitors-centre.jrc.ec.europa.eu/tools/energy_scenarios/ (last access: 22 June 2022).

European Commission, 2022. EU Emissions Trading System (EU ETS), webpage, https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets_en (last access: 22 June 2022).

IEA, 2021. Net Zero by 2050, IEA. https://www.iea.org/reports/net-zero-by-2050

IEA, 2022. Renewable Energy Market Update – May 2022, IEA. https://www.iea.org/reports/renewable-energy-market-update-may-2022

IPCC, 2021. Summary for Policymakers. In: Climate Change 2021: The Physical Science Basis, contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. https://www.ipcc.ch/report/ar6/wg1/downloads/report/IPCC_AR6_WGI_SPM.pdf

IPCC, 2022a. Summary for Policymakers. In: Climate Change 2022: Mitigation of Climate Change, contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. https://www.ipcc.ch/report/ar6/wg3/downloads/report/IPCC_AR6_WGIII_SPM.pdf

IPCC, 2022b. Summary for Policymakers. In: Climate Change 2022: Impacts, Adaptation, and Vulnerability, contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. https://report.ipcc.ch/ar6wg2/pdf/IPCC_AR6_WGII_SummaryForPolicymakers.pdf

NGFS, 2021. NGFS Climate Scenarios for central banks and supervisors, Network for Greening the Financial System. https://www.ngfs.net/sites/default/files/media/2021/08/27/ngfs_climate_scenarios_phase2_june2021.pdf

Oesterreichische Nationalbank, 2022. The inflationary impact of climate policy with a special focus on carbon pricing in Austria, Oesterreichische Nationalbank, forthcoming (2022).

World Bank, 2022. Carbon pricing dashboard, World Bank, data updated on 1 April 2022 (access: 8 June 2022). https://carbonpricingdashboard.worldbank.org/map_data