This policy brief is based on Álvarez-Román, Laura, Sergio Mayordomo, Carles Vergara-Alert and Xavier Vives. (2024). “Climate risk, soft information and credit supply”. Working Papers 2406, Banco de España. The opinions and analyses in the Working Paper Series are those of the authors and, therefore, do not necessarily coincide with those of the Banco de España or the Eurosystem.

This paper examines the effects of climate-related disasters on bank lending behaviors, emphasizing the role of soft information in credit allocation. Focusing on Spain, a hotspot for wildfires, we analyze the differential lending responses of local versus outsider banks to companies affected by such disasters. Our findings reveal that local banks, equipped with superior soft information, sustain credit flow to opaque but viable firms, mitigating economic repercussions in disaster-stricken areas. This insight underscores the importance of local banks in supporting climate resilience, highlighting the importance of soft information in managing the financial uncertainties of climate change.

Climate-related disasters are significantly increasing in number and severity, escalating the challenges for the financial system. Beyond the transition risks stemming from shifts towards a lower-carbon economy, it is crucial to evaluate how the financial sector is responding to the rising physical risks of climate change. For instance, large and severe wildfires are becoming increasingly commonplace fostered by climate change (Organization for Economic Cooperation and Development, 2023). In fact, Spain is among Europe’s worst-affected countries (see Costa et al., 2020), accounting for around 40% of the EU land ravaged by forest fires in 2022.

The effects of physical climate risks on credit supply are not straightforward. After a climate-related disaster, banks may reduce lending due to factors such as the decline of collateral value or uncertainties in the economic outlook of affected areas (Garmaise and Moskowitz, 2009; Hosono et al., 2016; and Gallagher and Hartley, 2017). Conversely, banks may also increase lending to support recovery efforts in disaster-stricken areas (Chavaz, 2016; Cortés and Strahan, 2017; Koetter, Noth, and Rehbein, 2020). Yet, the factors influencing banks’ credit allocation strategies in response to climate physical risk, particularly under imperfect information, warrant further investigation.

We delve into how the supply of bank credit evolves in response to a climate event, as well as the role of lenders’ access to information about borrowers in a context of informational asymmetries (see the full study in Álvarez-Román et al., 2024). Specifically, we consider a model that incorporates climate impacts and asymmetries in access to information in banking intermediation. We distinguish between local banks, whose credit is geographically concentrated in a specific province, and outsider banks, which are larger and more diversified. Likewise, two categories of companies are considered: transparent and opaque. Transparency allows banks to understand how the company operates and make informed decisions based on reliable information. On the other hand, opaque firms lack transparency and operate with limited disclosure of information. Local banks stand out for their ability to monitor opaque companies more effectively since they have better and greater access to soft information than outsider banks.

The main theoretical predictions from the model are that (1) a climate shock reduces the amount of credit lent to a given firm and that (2) local banks reduce lending to opaque firms to a lower extent as compared to outsider banks because local banks have better access to soft information and a greater monitoring ability. To test these predictions, we use granular information on firms and banks operating in Spain, as well as on the credit relationships between the two, and on wildfires in Spain between 2004 and 2017.

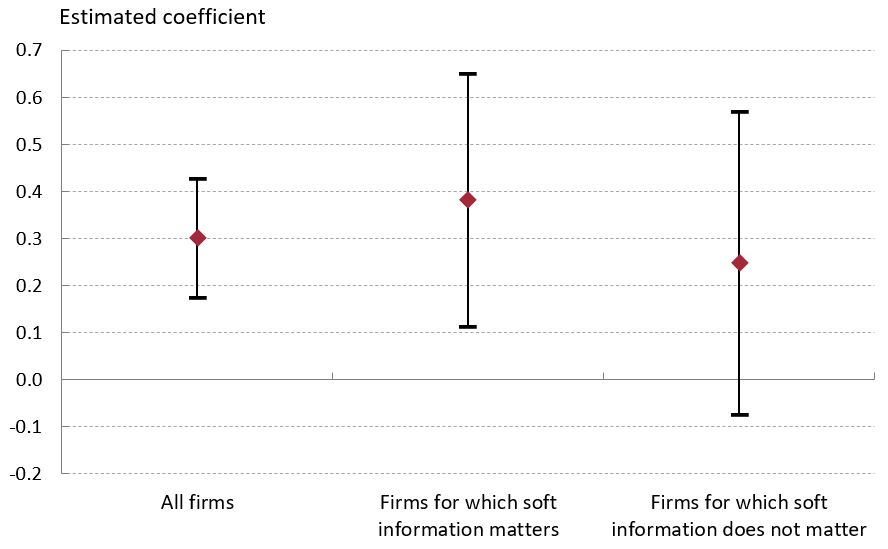

Our empirical results show that disparities in access to soft information between local and external banks play a crucial role in the allocation of bank credit following climate events. In general terms, the amount of credit granted to companies affected by wildfires experiences (within 10km from a wildfire) a decrease of approximately 6%, compared to companies with similar characteristics not affected by the fire (within 20km to 40km from a wildfire). This result is mainly attributed to outsider banks, which, by not being able to accurately assess the impact of the fires on opaque companies, those with low earnings predictability based on accounting information for which soft information matters more, significantly curtail their credit provision. In contrast, local banks, benefiting from access to soft information, reduce their loans to a lesser extent to firms with more opaque accounting information that are affected by the fire (see Figure 1). Importantly, the credit supply of local banks flows to opaque yet non-distressed firms, not inducing credit misallocation through their lending practices.

Figure 1: Change in credit supply by local banks as compared with outsider banks after a wildfire (a)(b)

Notes: (a) Including wildfires with a burned area of 500 hectares or more in Spain between 2004 and 2017. Includes firms located within 10 km and those between 20 km and 40 km from a wildfire. A firm is deemed to be affected if it is less than 10 km from a wildfire. The bands represent the 90% confidence interval.

(b) The explanatory variable is the interaction of a dummy variable that is equal to one if the firm was affected by fire in year t and the fraction of credit of bank b in December of year t − 1 in the province where the firm is located. Firms for which soft information matters are those with poor accounting information. The accounting quality is proxied using the predictability of firms’ earnings. Firms with poor (good) accounting information are those whose earnings predictability is in the top (bottom) quintile of the distribution of the proxy used to measure it.

The validity of the information channel is further supported by showing that local banks exhibit a smaller credit contraction towards opaque firms without incurring greater risks, consistent with their enhanced access to soft information. Additionally, previous research has shown that geographical proximity enables the collection of firms’ soft information by banks (Agarwal and Hauswald, 2010). Aligning with our findings, we observe that local banks extend more credit to affected firms when they are closer to them, but there are no significant differences in the credit supply of local and outsider banks for more distant borrowers. Furthermore, we also discard that the credit supply of local banks to fire-affected firms is driven by bank specialization, relationship lending or the lack of lending opportunities out of the area impacted by the wildfire, which would force them to lend to affected firms.

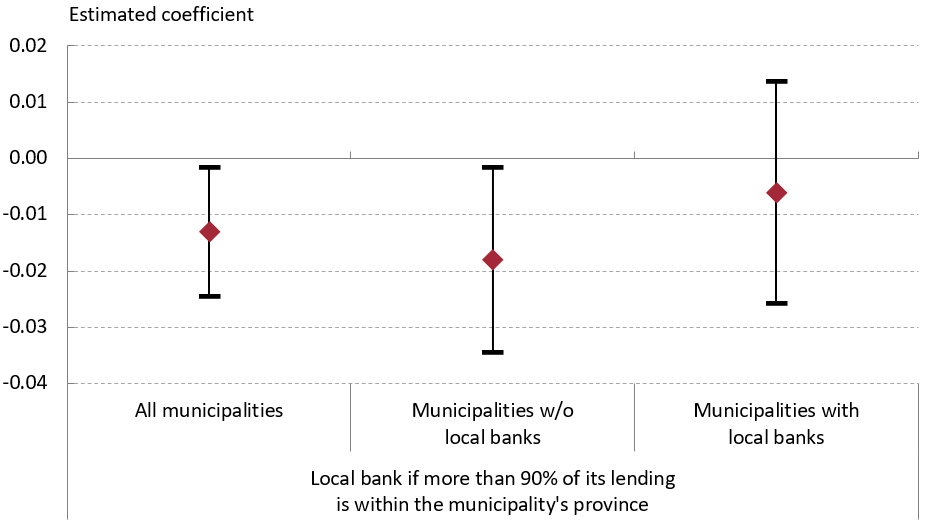

Do local banks facilitate economic stability and recovery in areas affected by climate disasters? Regarding the effects on the real economy, our results show that in the affected areas there is a decrease in employment two years following the fire (see Figure 2). However, the drop in employment after a fire is specific to municipalities where local banks are not active lenders, while there is no significant change in employment when local banks are present in the fire-hit areas. These findings underscore the pivotal role of local banks in mitigating the repercussions of climate shocks on the economy. Thanks to their superior access to soft information, they can extend recovery lending to profitable firms that have been impacted by climate disasters.

Figure 2: Change in firm employment two years after a wildfire (a)

Notes: (a) Including wildfires with a burned area of 500 hectares or more in Spain between 2004 and 2017. Includes firms located within 10 km and those between 20 km and 40 km from a wildfire. A firm is deemed to be affected if it is less than 10 km from a wildfire. The bands represent the 90% confidence interval.

Our research documents the pivotal function of small or local banks in sustaining credit supply after natural disasters by isolating the soft information mechanism through which they operate. Specifically, our findings reveal that the differential use of soft information by local and outsider banks in their lending decisions significantly influences bank credit allocation after climate-related disasters. As a result, our analysis suggests that local banks are better positioned to support firms affected by physical climate risks in the region where their credit activity is concentrated, highlighting their crucial role in mitigating the impact of climate shocks on the real economy.

Agarwal, Sumit, and Robert Hauswald. (2010). “Distance and private information in lending”. The Review of Financial Studies, 23, pp. 2757-2788. https://doi.org/10.1093/rfs/hhq001.

Álvarez-Román, Laura, Sergio Mayordomo, Carles Vergara-Alert and Xavier Vives. (2024). “Climate risk, soft information and credit supply”. Working Papers 2406, Banco de España. https://doi.org/10.53479/36112.

Chavaz, Matthieu. (2016). “Dis-integrating credit markets: diversification, securitization, and lending in a recovery”. Bank of England Working Paper, 617. https://doi.org/10.2139/ssrn.2843683.

Cortés, Kristle Romero, and Philip E. Strahan. (2017). “Tracing out capital flows: How financially integrated banks respond to natural disasters”. Journal of Financial Economics, 125(1), pp. 182-199. https://doi.org/10.1016/j.jfineco.2017.04.011.

Costa, H., D. De Rigo, G. Libertà, T. Houston Durrant and J. San-Miguel-Ayanz. (2020). European wildfire danger and vulnerability in a changing climate: towards integrating risk dimensions: JRC Peseta IV project: Task 9 – forest fires. Publications Office of the European Union. https://data.europa.eu/doi/10.2760/46951.

Gallagher, Justin, and Daniel Hartley. (2017). “Household finance after a natural disaster: The case of hurricane Katrina”. American Economic Journal: Economic Policy, 9(3), pp. 199- 228. https://doi.org/10.1257/pol.20140273.

Garmaise, Mark J., and Tobias J. Moskowitz. (2009). “Catastrophic risk and credit markets”. The Journal of Finance, 64(2), pp. 657-707. https://doi.org/10.1111/j.1540-6261.2009.01446.x.

Hosono, Kaoru, Daisuke Miyakawa, Taisuke Uchino, Makoto Hazama, Arito Ono, Hirofumi Uchida and Iichiro Uesugi. (2016). “Natural disasters, damage to banks, and firm investment”. International Economic Review, 57(4), pp. 1335-1370. https://doi.org/10.1111/iere.12200.

Koetter, Michael, Felix Noth and Oliver Rehbein. (2020). “Borrowers under water! Rare disasters, regional banks, and recovery lending”. Journal of Financial Intermediation, 43, p. 100811. https://doi.org/10.1016/j.jfi.2019.01.003.

Organization for Economic Cooperation and Development. (2023). Taming Wildfires in the Context of Climate Change. OECD Publishing. https://doi.org/10.1787/dd00c367-en.