This Policy Note is based on the publication “Climate stress tests: Are banks fit for the green transition?” by Ursula Walther (Editor: Jan Schildbach), Deutsche Bank Research, January 2023.

Beyond that, there is an ongoing discussion about whether and how to include climate risks in the prudential framework. Ideas range from adjusting the Pillar 1 framework to introducing macroprudential climate buffers.18 Such measures are only conceivable in the medium term. Due to the limitations in data availability and methodological challenges, the results of climate stress tests do not yet provide a robust basis for prudential measures.19 Most importantly, although such measures may help mitigate the impact of climate risks on financial stability, the risks themselves can only be addressed with timely and ambitious action to combat climate change itself.

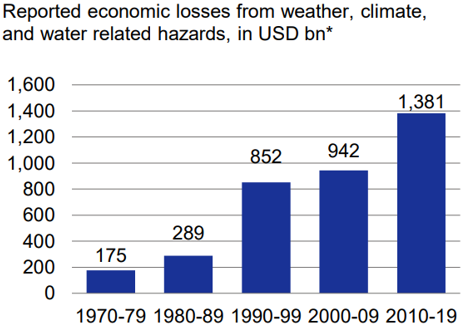

World Meteorological Organization (2021). WMO atlas of mortality and economic losses from weather, climate and water extremes (1970-2019). WMO-No. 1267.

FSB/NGFS (2022). Climate scenario analysis by jurisdictions. Initial findings and lessons. November.

For an investor view on sustainability considerations for European banks, including takeaways from the 2022 ECB CST, see Deutsche Bank Research (2022). ESG for European Banking. Financing the future. November.

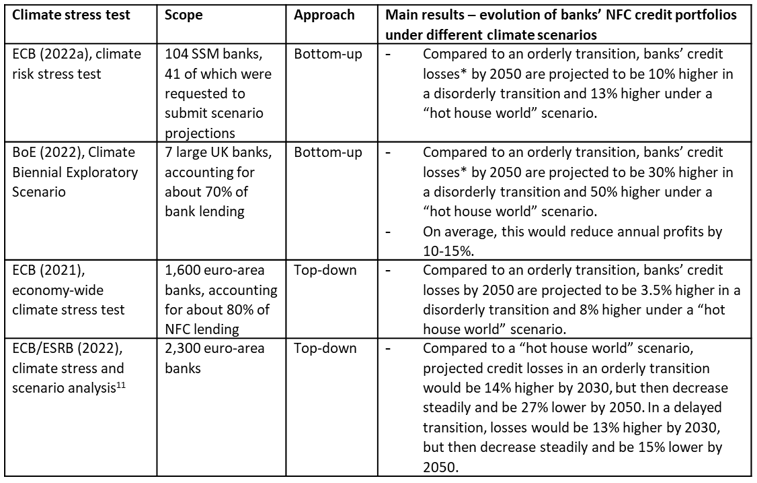

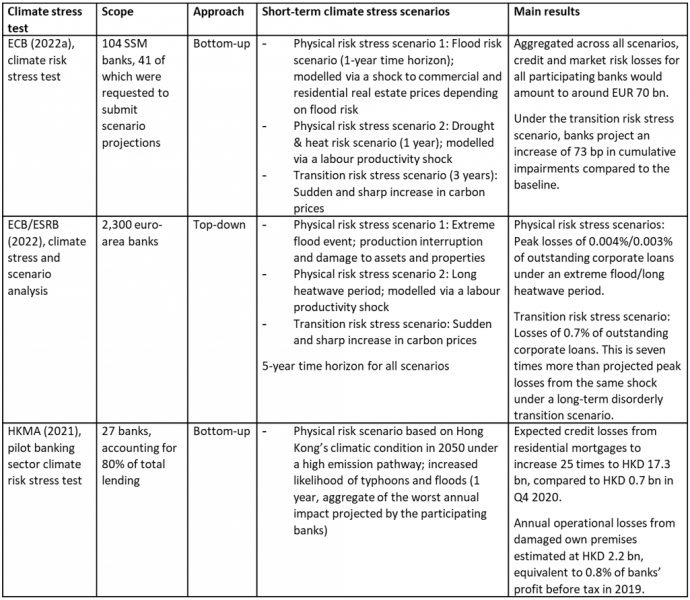

This top-down exercise analysed the resilience of 1,600 euro-area banks towards climate risks, using a comprehensive dataset pulled together from different statistics. For more details, see Alogoskoufis et al. (2021). ECB economy-wide climate stress test. ECB Occasional Paper 281. September.

EIOPA (2022). European insurers’ exposure to physical climate change risk. Potential implications for non-life business. May.

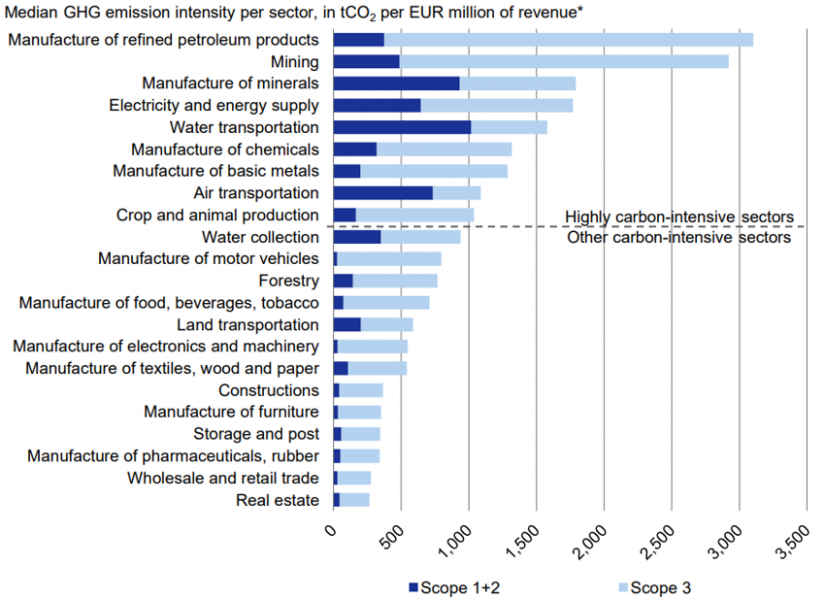

Either absolute level of greenhouse gas (GHG) emissions or emission intensity, i.e. emissions relative to revenues.

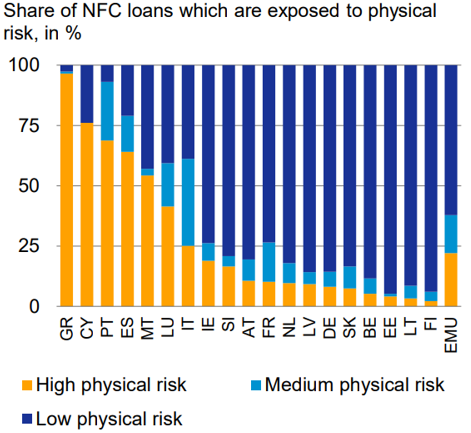

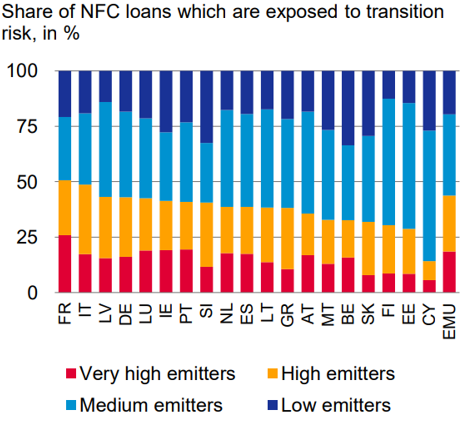

Based on scope 1 and 2 emissions; sectors not identical to those in Chart 4. For more details see ECB/ESRB (2021). Climate-related risk and financial stability. July.

Sectors with a GHG emission intensity above 1,000 tons of CO2 (tCO2) per EUR million of revenue (see Chart 4).

FSB/NGFS (2022) provides an overview of the different modelling approaches.

BoE (2022). Results of the 2021 Climate Biennial Exploratory Scenario. May. Seven large UK banks participated.

ECB/ESRB (2022). The macroprudential challenge of climate change. July.

FSB/NGFS (2022, p. 23).

FSB/NGFS (2022).

For more details, see Walther, Ursula, and Jan Schildbach (2022). Sustainable finance – coming of age. Deutsche Bank Research, EU Monitor. September 2.

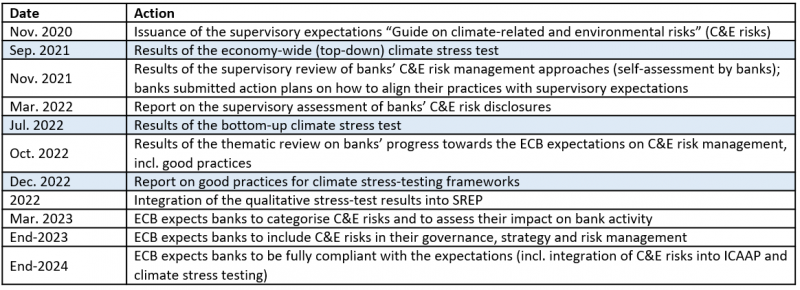

ECB (2022b). Walking the talk. Banks gearing up to manage risks from climate change and environmental degradation. Results of the 2022 thematic review on climate-related and environmental risks. November.

Ibid.

PRA (2021). Climate-related financial risk management and the role of capital requirements. Climate change adaptation report 2021. October.

For an overview, see IIF (2022). Climate and Capital: Views from the Institute of International Finance. July.

See also FSB/NGFS (2022) and Sustainable Fitch (2022). What investors want to know: bank climate stress test and credit. February 8.