All opinions expressed here in this policy brief are our own and do not necessarily reflect those of Bank of Italy. For a comprehensive analysis, refer to the full paper: “Commercial Real Estate Loans in Europe: Does Loan-to-Value at Origination Predict Default Risk?” by Federica Ciocchetta, Raffaella Pico, and Ivan Quaglia, Banca d’Italia, Occasional Papers No. 905, February 2025.

Abstract

This paper analyzes bank financing of the commercial real estate sector (CRE) in Italy and compares it with a sample of other euro area countries. The analysis, based on the European AnaCredit database, examines loan characteristics, their riskiness and the relationship between loan-to-value at origination (LTV-O) and the probability of default, providing insights into the potential effectiveness of LTV-O limits as a macroprudential tool. Results show notable differences across countries in terms of CRE exposure, lending practices and credit risk. Italy exhibits limited CRE exposure, a high reliance on non-residential property as collateral and significant use of additional guarantees for high LTV-O loans. An econometric analysis confirms a positive correlation between the level of the LTV-O and the default probability of CRE loans in Italy and Spain.

The interconnections between the real estate sector and the broader financial system can have important financial stability implications (Crowe et al., 2013, Hartmann, 2015). Indeed, in advanced economies financial crises often begin with a serious overvaluation of real estate markets. In particular, the commercial real estate (CRE) market tends to be more cyclical than other economic sectors (Baum, 2001). A downturn in the CRE market can be exacerbated by poor lending practices and excessive credit growth (Gaudencio et al., 2019), making it essential to monitor loan quality and implement macroprudential measures. One key instrument to mitigate risks stemming from the CRE sector is the imposition of limits (‘caps’) to the loan-to-value ratio at contract origination (LTV-O). Those caps tighten lending conditions, thereby helping to moderate the financial cycle (Ampudia et al., 2021) and contain bank losses. Furthermore, LTV-O caps are shown to reduce credit risk for residential real estate loans (Otero-González et al., 2016, Kelly et al., 2019, Gaudêncio et al., 2019, Ampudia et al., 2021); fewer analyses have investigated the relationship between LTV-O and loans risk for CRE loans (Mokas and Nijskens, 2019).

The purpose of the note is twofold. First, it provides a descriptive analysis of banks’ CRE loan portfolios in eight euro area countries (Italy, France, Germany, Spain, Austria, Belgium, the Netherlands, and Greece) using AnaCredit data from March 2019 to June 2023. Second, it contributes to the literature by presenting a country-level regression analysis exploring the empirical relationship between the LTV-O of loans and their default probability (i.e. the probability of transitioning to a non-performing status), controlling for borrower and loan characteristics at origination, with a focus on the four largest euro area economies (France, Germany, Italy, and Spain).

The findings reveal significant differences across countries. The proportion of bank loan portfolios accounted for by CRE loans varies, ranging from 20% in Italy and Spain to 60% in Austria. Regarding credit risk, the share of non-performing loans over total loans (gross of loan loss provisions, NPL ratio) for CRE exposures is generally higher than for other corporate loans, with Italy, Spain, and Greece showing the highest levels. Both descriptive statistics and the regression analysis show that the relationship between LTV-O and default probability varies by country. In Italy and Spain, higher LTV-O loans are significantly associated with greater default risk, with loans over 100% LTV-O showing the highest default probability. In contrast, no such significant relationship is found in Germany and France. Additionally, high LTV-O loans in Italy and Spain are more likely to feature variable interest rates and long maturities, but they often include additional protection, such as financial guarantees, which can mitigate risks.

The analysis focuses on CRE loans as defined by the European Systemic Risk Board (ESRB recommendation). These include loans to legal entities that are either secured by income-producing real estate (such as rental housing) or business premises or used to acquire real estate. CRE property also includes residential real estate, for example when the related loan has been taken out by a legal entity to finance the construction of property for dwelling purposes. The study relies on AnaCredit, a harmonized and granular database of bank loans granted to legal entities across euro area countries. AnaCredit provides detailed collateral information, which is essential for calculating the LTV ratio, a key risk indicator for CRE loans. The dataset is structured at the loan level, enabling the analysis of loan distribution and characteristics with high borrower coverage due to its low reporting threshold. AnaCredit’ s standardized definitions ensure cross-country comparability. However, as a relatively new dataset, reporting differences across time and institutions may still influence cross-country comparisons. Only a few studies have exploited AnaCredit data in a cross-country analysis (Ryan et al., 2022 and Horan et al., 2022) and, to the best of our knowledge, no published country-level study is available. The analysis focuses on loans granted to non-financial corporations (NFCs) and includes three main types of instruments: finance leases, credit lines other than revolving, and other loans. These categories represent the majority of CRE exposures, although their usage varies by country.

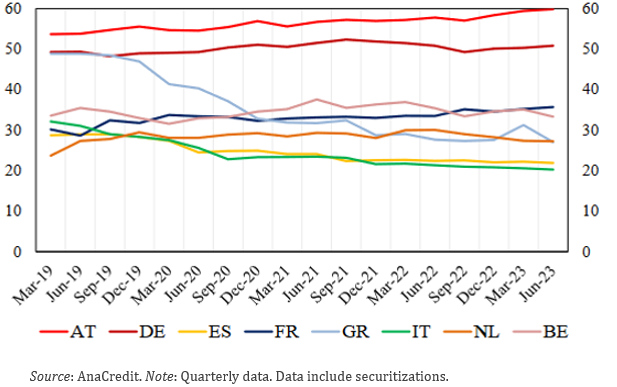

CRE loans represent a significant portion of total loans to non-financial corporations (NFCs) across the eight euro-area countries analyzed. As shown in Figure 1, Germany and Austria have the highest shares, with CRE loans accounting for 50–60% of total NFC loans, while Italy and Spain have the lowest shares, around 20%. Notably, in Italy, Greece, and Spain, this share has been declining steadily over time, reflecting structural changes in lending patterns or shifts in demand for CRE financing.

Figure 1. Share of the commercial real estate loans (CRE) over total loans to non-financial corporations (NFCs) (per cent)

A key feature of CRE loans in Italy is the high proportion collateralized by real estate property, which stands at 85%, like Germany, Austria, and Belgium. Italy also has the lowest share of unsecured CRE loans (2%), indicating a strong reliance on collateralized lending. The composition of collateral varies significantly across countries. In Italy, Greece, and the Netherlands, most collateral is commercial real estate, whereas in Belgium, Germany, and Austria, residential property plays a larger role. This distinction is crucial, as residential-backed loans may carry lower risk due to the relative stability of the housing market. Other loan characteristics further highlight cross-country heterogeneity. In Italy, 80% of CRE loans are variable rate, a pattern also observed in Spain (75%) and Greece (97%). In contrast, fixed-rate CRE loans dominate in Germany and France, making borrowers in those countries less vulnerable to interest rate fluctuations. Additionally, the majority of CRE loans in Italy (75%) have maturities exceeding 10 years, aligning with most euro area countries, though Greece and the Netherlands show lower shares of long-term maturities. Credit quality indicators also reveal important differences. The non-performing loan (NPL) ratio for CRE loans is consistently higher than for other corporate loans across all countries. As of June 2023, Italy and Greece had the highest gross NPL ratios, at 11.2% and 14.1%, respectively. However, in Italy the NPL ratio has been gradually declining from 16% in early 2022, supported by one of the highest loan coverage ratios (47%) among the countries in the sample. This trend suggests an improvement in the management and resolution of distressed loans, despite the sector’s inherent risks.

For the subset of collateralized CRE loans originated since September 2018, it is possible to calculate the loan-to-value ratio at origination (LTV-O) and at a given date (LTV current, or LTV-C). During the analysis period, Italian banks have maintained stable supply conditions for new CRE loans. France exhibits a higher average LTV-O compared to other countries, while a slight downward trend is noticeable in Germany, except for a peak in 2021. In Italy, the weighted mean of the LTV-C is comparable to that of other major euro area countries, at about 47%. Loans with an LTV-C above 80%, typically regarded as riskier, account for around 11% of the total in Italy, representing an exposure of 10 billion euros. This is in line with Germany and Spain but significantly lower than France, where 33% of loans fall into this high-risk category, equating to 97 billion euros.

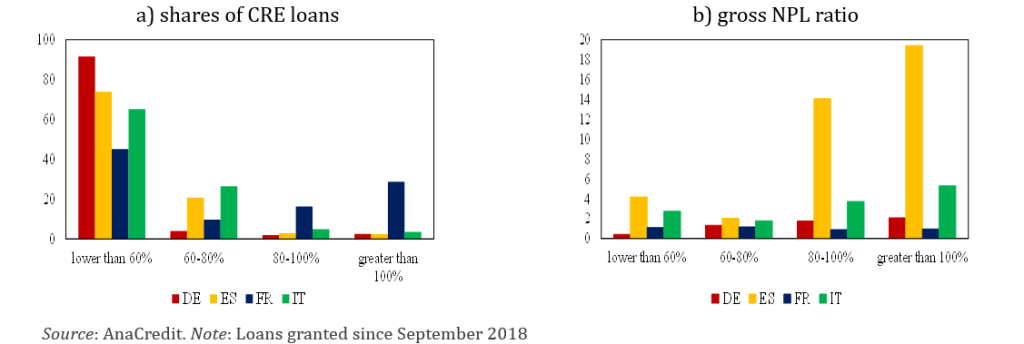

Figure 2 provides empirical evidence on the relationship between LTV-O and default rates. In Italy, the highest share of NPLs is observed for loans with LTV-O exceeding 80% (panel b), although the total amount of the relative CRE loans in is limited (panel a). A similar trend is noted in Spain, where the NPL ratios for higher LTV-O classes surpass those in Italy. Conversely, Germany and France exhibit more stable NPL ratios across different LTV-O classes compared to other countries. The analysis indicates a positive correlation between high LTV-O and non-performing status in Italy and Spain, suggesting that elevated LTV ratios are linked to increased default risks in these markets.

Figure 2. CRE loans and gross NPL Ratio by LTV-O classes (per cent; June 2023)

Furthermore, loans with high LTV-O in both Italy and Spain tend to have more frequently variable interest rates, long maturities, and are larger than other loans. However, additional guarantees, such as financial or state protections, play a crucial role in mitigating potential losses. Notably, over 65% of high LTV-O loans in Italy benefit from such protections, which can reduce the financial losses in case of borrowers’ default.

We perform a multivariate regression analysis to examine the relationship between LTV-O and default, controlling for other loan characteristics at origination, borrower attributes, and bank category. The analysis uses a comprehensive loan-level dataset, comprising collateralized CRE loans that were originated since September 2018 and observed up to June 2023. By focusing on the four largest euro area countries—France, Germany, Italy, and Spain—we capture approximately 80% of the CRE exposures recorded in the AnaCredit database. We employ a logit regression model to estimate the default probability, i.e. the probability that a given loan will have deteriorated by the reference date. The target variable for our analysis is a binary variable equal to 1 if the loan is non-performing as of June 2023, 0 otherwise. Regressors include key loan characteristics: the LTV class at origination (as generally defined in the literature), interest rate type (fixed or variable), loan purpose, and loan size. We control for borrower characteristics, such as total indebtedness, and the probability of default (PD)1 calculated by the lender at loan origination. Our findings indicate that high LTV-O loans have an average higher default probability in both Italy and Spain, controlling for loan and borrower characteristics. Specifically, loans with LTVs between 80% and 100% show a significantly higher probability of transitioning to non-performing status compared to those with LTVs below 60%. In Italy, for example, loans in the 80-100% LTV range exhibit a probability increase of 130 basis points over the baseline default rate (3 per cent of the contracts). Loans exceeding a 100% LTV-O ratio reveal an even greater default probability of 180 basis points. In Spain, the effects are more pronounced, with increases of around 170 basis points for loans with LTVs between 80% and 100%, and 360 basis points for those above 100% (the baseline default rate is 4.8 per cent). In contrast, our analysis reveals no statistically significant relationship between LTV-O classes and default probabilities in the data for Germany and France. This may stem from the limited number of occurrences of non-performing loans in these countries, which are more evenly distributed across the LTV-O classes. Additionally, the results are consistent across various model specifications, reinforcing the robustness of the relationship observed. Overall, this multivariate analysis provides valuable insights into the riskiness of high LTV-O loans. By highlighting the significant relationship between LTV levels and loan performance, particularly in Italy and Spain, we offer critical information that can inform lenders’ risk assessment practices and support policymakers in developing strategies to mitigate potential vulnerabilities within the commercial real estate lending sector.

Ampudia, M., M. Lo Duca, M. Farkas, G. Pérez-Quirós, M. Pirovano, G. Rünstler, E. Tereanu (2021). On the effectiveness of macroprudential policies, ECB working paper, N. 2559, May 2021.

Baum, A. (2001). Evidence of Cycles in European Commercial Real Estate Markets — and Some Hypotheses. In: Brown, S.J., Liu, C.H. (eds) A Global Perspective on Real Estate Cycles. The New York University Salomon Center Series on Financial Markets and Institutions, Vol 6. Springer, Boston, MA.

Crowe, C. W., G. Dell’Ariccia, D. Igan and P. Rabal (2013). How to Deal with Real Estate Booms: Lessons from Country Experiences. Journal of Financial Stability, Vol. 9: 300–319.

ESRB Recommendation on closing real estate data gaps, ESRB/2016/14, emended by ESRB/2019/03.

Gaudêncio, J, A. Mazany and C. Schwarz (2019). The Impact of Lending Standards on Default Rates of Residential Real-Estate Loans, ECB Occasional Paper N. 220; ISBN 978-92-899-3685-9, Available at SSRN: https://ssrn.com/abstract=3356407

Hartmann, P. (2015). Real Estate Markets and Macroprudential Policy in Europe. Journal of Money, Credit and Banking, Vol. 47 (s1).

Horan, A. B. Jarmulska and E. Ryan (2022). Understanding banks’ response to collateral value shocks – insights from AnaCredit and the COVID-19 shock in commercial real estate (CRE) markets. ECB Macroprudential Bulletin, October 2022.

Kelly, J., J. Le Blanc, and R. Lydon (2019). Pockets of risk in European housing markets: then and now,ECB working paper N. 2277.

Mokas, D. and R. Nijskens (2019). Credit Risk in Commercial Real Estate Bank Loans: The Role of Idiosyncratic versus Macro-Economic Factors. De Nederlandsche Bank Working Paper No. 653, Available at SSRN: https://ssrn.com/abstract=3448455 or http://dx.doi.org/10.2139/ssrn.3448455

Otero-González, L. P.Durán-Santomil, R. Lado-Sestayo and M. Vivel-Búa (2016). The impact of loan-to-value on the default rate of residential mortgage-backed securities. Journal of Credit Risk Vol. 12(3), 1–13.

Ryan, E., A. Horan, A. and B. Jarmulska (2022). Commercial real estate and financial stability – new insights from the euro area credit register, Macroprudential bulletin BCE, issue 19, October 2022.

The PD reported in AnaCredit is the probability of default of the debtor at loan origination, over one year, determined in accordance with the CRR; we use it as a proxy of firm specific characteristics, that are not available in the database and that may have an impact on their riskiness. This information is available only when the bank does have to determine its estimate in accordance with the IRB approach.