This note is based on the paper: Łyziak T., Pedersen M., Stanisławska E. (2022), Consumer inflation expectations and regional price changes, NBP Working Papers, 347, Narodowy Bank Polski. The views expressed in this study reflect the authors’ opinions and are not necessarily those of Narodowy Bank Polski.

The importance of inflation expectations, including those formed by consumers, in the price setting, makes them an important part of the information set analysed by central banks. In the current context of elevated global inflation rates, analyses of how inflation expectations are formed are especially important. In our recent paper we analyze the extent to which US consumers are affected by regional price swings when reporting their inflation expectations. We find that regional rather than national inflation rates affect consumers’ views on inflation in short- and medium-term forecasting horizons. As a result, regional differences in inflation exert a statistically significant, albeit quantitatively modest, impact on disagreement in inflation expectations among consumers.

Academic researchers and monetary policy makers recognize the important role of inflation expectations, including those formed by consumers (e.g., Coibion and Gorodnichenko, 2015; Friedrich, 2016), in the price setting and in the conduct of monetary policy. Despite this, the knowledge of the formation process driving consumer inflation expectations is still limited.

Recent literature demonstrates that what agents feel in the everyday life matters for their opinions with respect to the future inflation rate. For example, Johannsen (2014) constructs household specific inflation rates by calculating separate consumption bundles with official Bureau of Labor Statistics (BLS) data and shows that demographic groups with higher dispersion in experienced inflation also disagree more about the future rate. D’Acunto et al. (2021) find that consumers rely on grocery shopping experience when forming the inflation expectations. Madeira and Zafar (2015) argue that life-time experience of inflation has impact on one-year-ahead expectations, while public information is more relevant for those of longer horizons. In a recent paper (Łyziak et al., 2022) we build on these observations and argue that consumers form their inflation expectations based on the prices they observe locally rather than on national statistics.

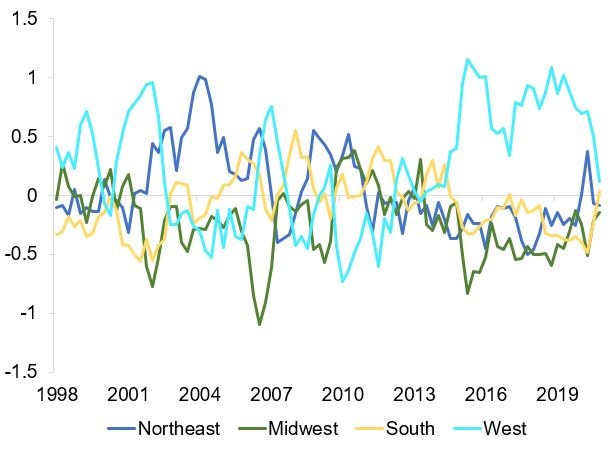

In the analysis we employ two theoretical frameworks of expectations formation: the sticky information/epidemiological framework (Carroll, 2003) and the learning-from-experience framework (Malmendier and Nagel, 2016), as well as two datasets on US consumer inflation expectations: the Survey of Consumer Expectations (SCE) conducted by the Federal Reserve Bank of New York (FRBNY) and the Survey of Consumers made by the University of Michigan (MSC). The data on regional inflation comes from BLS and covers four regions: Northeast, Midwest, South and West. As illustrated in Figure 1, differences in inflation measured at regional level are common and non-negligible. For example, in 2015-2020 inflation in West region exceeded national inflation on average by 0.7 pp which was driven mainly by divergent evolution of energy and shelter inflation.

Figure 1. Deviations of regional CPI inflation from US average inflation

Notes: Figure shows difference (in pp) of regional and national inflation (y/y).

Source: Bureau of Labor Statistics, own calculations.

We start the analysis with testing whether regional differences in inflation rates drive differences in the consumers’ views on future inflation. For this purpose, we refer to the sticky information (epidemiological) framework which explains inflation expectations disagreement with infrequent updating of information by consumers. The version of the epidemiological model applied is based on the generalization of the original model, presented by Łyziak and Sheng (2022). In our application, disagreement among consumers in assessing future inflation rates might come from several sources, including differences in regional inflation and differences in consumers’ propensities to adjust expectations based on current regional inflation.

The model, estimated with Seemingly Unrelated Regression methods, consists of two equations which explain the level of expectations and disagreement. Estimation results based on aggregate MSC data – which covers a relatively long sample – suggest that in a given quarter approx. 52% of the consumers do not modify their previous expectations, 14% follow expert inflation forecasts, and 12% make use of the local inflation rates. The remaining part (approx. 22%) holds expectations constant at 5% on average. The estimations show that the average regional inflation rate and its variance are statistically significant in the model, which suggests that regional differences have impact on disagreement in consumer inflation expectations.

Estimation results of the equation for cross-sectional variance of inflation expectations reveal heterogeneity in the consumers’ propensities to learn from experts and the way they follow either their previous expectations or the regional inflation rate. This heterogeneity seems quantitatively large, especially in the case of the propensity to learn from experts and to follow previous expectations. Hence, not only heterogeneity of regional inflation rates, but also cross-sectional heterogeneity in following regional inflation by individuals seem to constitute relevant drivers of cross-sectional divergences in consumer expectations.

The above results imply that part of the cross-sectional differences in consumers’ inflation expectations is likely to be related to regional inflation differences. However, in quantitative terms the importance of this factor is limited as the differences in regional inflation rates explain approx. only 5% of the cross-sectional variance of inflation expectations.

In the second part of the paper, we take advantage of the micro-level data from SCE to investigate importance of national vs. regional price developments in shaping consumer inflation expectations. SCE covers a shorter period than MSC but is better suited to micro level analyses as consumers participate regularly in the survey, up to twelve consecutive months. SCE also includes information of the region in which the consumer lives (Midwest, Northeast, South, or West), which can be matched with the regional inflation statistics published by BLS.

Firstly, we employ SCE data to estimate a version of the sticky-information model of inflation expectations formation at the micro level. The model allows for regional as well as national inflation rates to affect views on future inflation. Other variables include consensus expert forecasts and a wide set of demographic characteristics, which have been shown empirically to affect consumers’ for inflation expectations.

Estimation results reveal that the regional inflation rate provides an important input to consumers’ expectation formation, while no strong evidence suggests that the national inflation rate does. This holds for both short- and medium-term inflation expectations. Disaggregating overall inflation into core, food, and gasoline inflation we find that regional differences in food inflation play the most important role in affecting short-term expectations. This is different for the medium-term expectations, for which differences in the core inflation is the only regional variable that matters. In both cases, regional gasoline prices do not affect inflation expectations.

Secondly, we take the learning-from-experience model perspective. According to this approach, consumers form inflation expectations based on an autoregressive model of inflation with unknown parameter values, which they try to infer recursively. The important assumption is that more recent data affect expectations stronger than more distant data. Apart from inflation experienced by consumers during their lifetime, other common factors (like professional inflation forecasts) might affect consumers’ inflation expectations. We modify the learning-from-experience model by allowing consumers to learn from national and local inflation rates.

We use grid search to find the length of the inflation history which matters for consumers, and that may be shorter than the entire life-time due to short-memory, as well as the weighting parameter to obtain the best fit to data (similarly to Goldfayn-Frank and Wohlfart, 2020, and Kuchler and Zafar, 2019). Like in the sticky information framework, we find that regional inflation rates affect one-year ahead consumer inflation expectations, while national inflation rates are statistically insignificant. In the case of medium-term inflation expectations, the evidence in favor of the importance of regional inflation rates is weaker, as this variable is only statistically significant in some model specifications.

To what extent do consumers consider regional price developments when forming their inflation expectations? We find that regional differences in inflation rates exert a statistically significant impact on disagreement in inflation expectations among consumers, even though the quantitative importance of this effect is small. Evidence from micro-level analysis suggests that regional differences in inflation rates matter for short- and medium-term inflation expectations. It seems that in the former case it is particularly differences in the food inflation that matter, while it is differences in the core inflation that plays an important role in the latter case. The fact that regional factors influence how consumers form expectations implies that policy makers must pay attention to both national and local news when extracting information from consumers’ economic expectations. This may be particularly important when there are substantial differences across the regions.

Carroll, C. D. (2003). ‘Macroeconomic expectations of households and professional forecasters’, Quarterly Journal of Economics, Vol. 118, No 1, pp. 269-298.

Coibion, O. and Y. Gorodnichenko (2015). ‘Is the Phillips Curve alive and well after all? Inflation expectations and the missing disinflation’, American Economic Journal: Macroeconomics, Vol. 7, No 1, pp. 197-232.

Friedrich, C. (2016). ‘Global inflation dynamics in the post-crisis period: What explains the puzzles?’, Economics Letters, Vol. 142(C), pp. 31-34.

D’Acunto, F., U. Malmendier, J. Ospina and M. Weber (2021), ‘Exposure to daily price changes and inflation expectations’, Journal of Political Economy, Vol. 129, No. 5, pp. 1615-1639.

Goldfayn-Frank, O. and J. Wohlfart (2020). ‘Expectation formation in a new environment: Evidence from the German reunification’, Journal of Monetary Economics, Vol. 115, pp. 301-320.

Johannsen, B. K. (2014). ‘Inflation experience and inflation expectations: Dispersion and disagreement within demographic groups’, Finance and Economic Discussion Series No. 2014-89, Board of Governors of the Federal Reserve System.

Kuchler, T. and B. Zafar (2019). ‘Personal experiences and expectations about aggregate outcomes’, Journal of Finance, Vol. 74, No. 5, pp. 2491-2542.

Łyziak, T. and X. S. Sheng (2022). ‘Disagreement in consumer inflation expectations’, Journal of Money, Credit and Banking, https://doi.org/10.1111/jmcb.12981.

Łyziak T., Pedersen M., Stanisławska E. (2022), Consumer inflation expectations and regional price changes, NBP Working Papers, 347, Narodowy Bank Polski.

Madeira, C. and B. Zafar (2015). ‘Heterogenous inflation expectations and learning’, Journal of Money Credit and Banking, Vol. 47, No. 5, pp. 867-896.

Malmendier, U. and S. Nagel (2016). ‘Learning from inflation experiences’, The Quarterly Journal of Economics, Vol. 131, No. 1, pp. 53-87.