References

Abildgren, Kim, and Andreas Kuchler, “Do firms behave differently when nominal interest rates are below zero?” Danmarks Nationalbank Working Papers 164 (2020), 1-28.

Altavilla, Carlo, Lorenzo Burlon, Mariassunta Giannetti, and Sarah Holton, “Is there a zero lower bound? The effects of negative policy rates on banks and firms,” Journal of Financial Economics 144:3 (2022), 885-907.

Bailey, Michael, Ruiqing Cao, Theresa Kuchler, and Johannes Stroebel, “The economic effects of social networks: Evidence from the housing market,” Journal of Political Economy 126:6 (2018), 2224-2276.

Bilbiie, Florin O. “Neo-fisherian policies and liquidity traps,” American Economic Journal: Macroeconomics 14:4 (2022), 378-403.

Bloom, Nicholas, “Fluctuations in uncertainty,” Journal of Economic Perspectives 28:2 (2014), 153-76.

Browning, Martin, and Annamaria Lusardi, “Household saving: Micro theories and micro facts,” Journal of Economic literature 34:4 (1996), 1797-1855.

Coibion, Olivier, Yuriy Gorodnichenko, and Rupal Kamdar, “The formation of expectations, inflation, and the phillips curve,” Journal of Economic Literature 56:4 (2018), 1447-91.

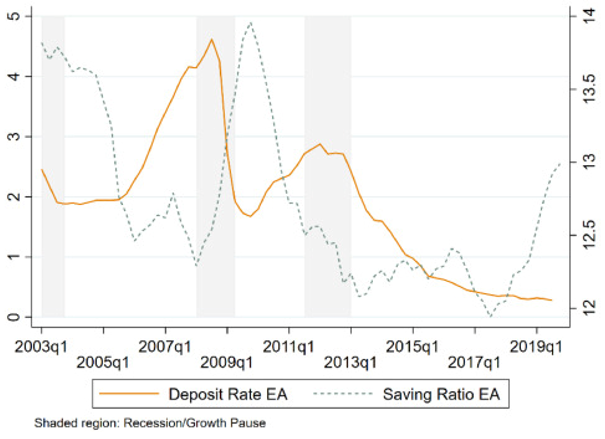

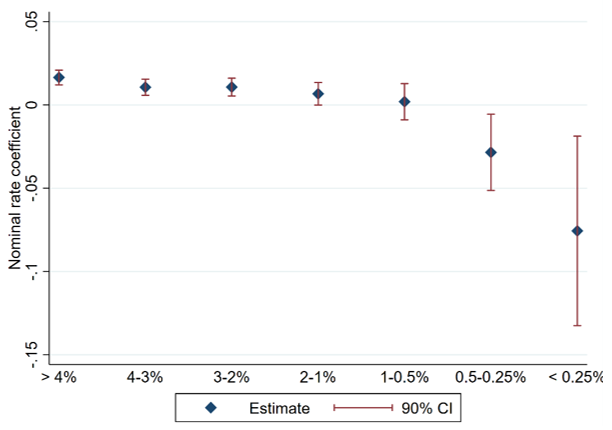

Felici, Marco, Geoff Kenny, and Roberta Friz, “Consumer savings behaviour at low and negative interest rates,” forthcoming, European Economic Review (2023).

Heider, Florian, Farzad Saidi, and Glenn Schepens, “Life below zero: Bank lending under negative policy rates,” The Review of Financial Studies 32:10 (2019), 3728-3761.

Jarociński, Marek, and Peter Karadi, “Deconstructing monetary policy surprises—the role of information shocks,” American Economic Journal: Macroeconomics 12:2 (2020), 1-43.

Kaplan, Greg, Benjamin Moll, and Giovanni L. Violante, “Monetary policy according to HANK,” American Economic Review 108:3 (2018), 697-743.

Lusardi, Annamaria, and Olivia S. Mitchell, “The economic importance of financial literacy: Theory and evidence,” Journal of Economic Literature 52:1 (2014), 5-44.

van den End, Jan Willem, Paul Konietschke, Anna Samarina, and Irina Stanga, “Macroeconomic reversal rate: Evidence from a nonlinear IS-curve,” DNB Working Paper 684 (2020).