Beraja, Martin and Christian Wolf (2021), “Demand Composition and the Strength of Recoveries”. URL: https://scholar.princeton.edu/sites/default/files/ckwolf/files/pentup_demand.pdf.

Chenarides, Lauren, Carola Grebitus, Jayson L. Lusk, and Iryna Printezis (2021), “Food consumption behavior during the COVID-19 pandemic.” Agribusiness 37 (1):44{81. URL: https://onlinelibrary.wiley.com/doi/abs/10.1002/agr.21679.

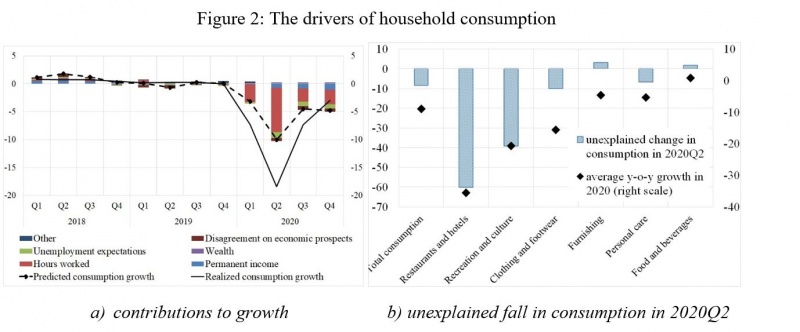

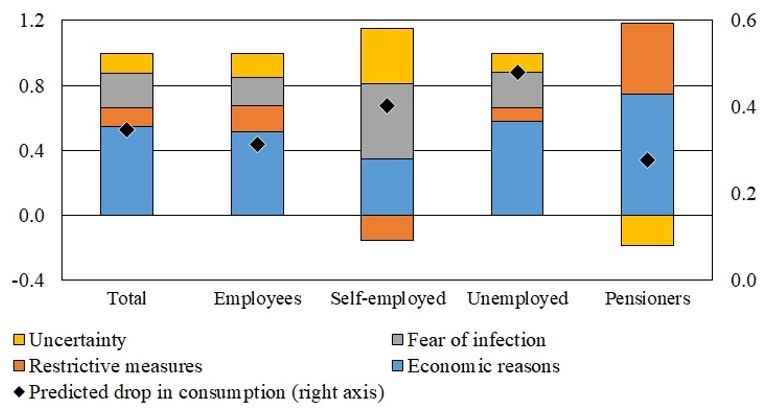

Ercolani, Valerio, Elisa Guglielminetti, and Concetta Rondinelli (2021), “Fears for the future: saving dynamics after the COVID-19 outbreak”, COVID-19 note, Bank of Italy.

Guglielminetti, Elisa and Concetta Rondinelli (2021), “Consumption and saving patterns in Italy during COVID-19”, Questioni di Economia e Finanza (Occasional Paper), Bank of Italy.