We provide evidence suggesting that – even in Germany – particularly weak banks used the European Central Bank’s very long-term refinancing operations (VLTROs) to evergreen exposures to zombie firms, which in turn elevated banks’ credit risk. Second, we show that zombie firms, which obtained additional funding from those banks that rely to a larger extent on VLTRO funding, also received more trade credit. And third, zombie firms that obtained further bank funding and trade credit after the VLTROs had an elevated expected default probability even compared to average zombie firms. This suggests that suppliers relying on banks’ lending decisions as a signal about borrowers’ credit quality might be misled by banks’ zombie lending to extend more trade credit to zombie firms exposing suppliers to elevated contagion risk.

As a measure to combat the macroeconomic consequences of the emerging sovereign debt crisis in some euro area Member States, the Eurosystem announced on 8 December 2011 two very long-term refinancing operations (VLTRO) with a maturity of three years. These two VLTROs were allotted on 21 December 2011 and 29 February 2012, respectively. Both VLTROs were conducted as repurchase agreements with a maturity of three years. Interest payments on these VLTROs are set equivalent to the average interest rate of the main refinancing operation (MRO) over the tenure of the VLTRO. The VLTROs provided banks with the option to repay the borrowed amount in parts or completely at their discretion at any time one year after the allotment. Thus, the VLTROs did not provide banks with cheaper access to central bank funding than the continuously rolled over MROs. But they alleviated banks’ concern about future access to funding.

Undoubtedly, German macroeconomic conditions were not severely impaired by the sovereign debt crisis. On the contrary, due to the weak euro and the ECB’s low main refinancing rates, Germany’s gross domestic product grew by 3.7% in 2011, far outstripping the ten-year average of 1.2%.2 Still almost half of the banks in our sample (425 banks) make use of the three-year VLTRO funding from the European Central Bank. Also, among the banks participating in the VLTROs, there is a large heterogeneity in terms of the credit volume they demanded in the VLTROs. But for almost all banks the VLTRO funding equals the total central bank funding.

Zombie lending is widely perceived as undermining market discipline: Rather than making efficient use of their private information and restricting the supply of credit to unproductive firms forcing those firms to downscale or even leave the market, banks implicitly subsidize unproductive borrowers and delay their market exit. There is evidence that this evergreening of loans impairs competitors of zombie firms (Caballero et al., 2008), which seems to have been also an issue in the euro area during the sovereign debt crisis (Acharya et al., 2019; Storz et al., 2017, and Schivardi et al., 2017). However, identifying zombie firms is difficult in an adverse macroeconomic environment which might make otherwise viable firms appear to be non-viable.

Zombie lending might also affect upstream and downstream firms in the supply chain of the zombie firm. A supplier of a bank’s non-financial borrower might interpret the extension of bank credit to the borrower as a positive signal about the borrower’s solvency, which in turn also increases the supplier’s willingness to provide trade credit to that borrower (Biais et al., 1997). At the same time, being less cash constrained, zombie firms might need less trade credit from upstream and grant more trade credit to downstream firms (Petersen et al., 1997).3 In any case, zombie lending is likely to have an impact on trade credit provision, which is one of the main sources of finance for non-financial firms (Demirguc-Kunt et al., 2001), and on the systemic risks inherent in the network of trade credit relations within the corporate sector (Boissay et al., 2013 and Jacobsen et al., 2015).

We match quarterly data from the German credit register on bank firm credit provision to bank and firm balance sheet data. The detailed firm level data permits us to identify any non-viable firms: Firms exhibiting a negative interest coverage ratio over the past three years are deemed to be zombie firms. Given the positive macroeconomic environment in Germany at that time this seems like a rather reliable identification. The dataset further enables us to examine then the impact of the ECB’s long-term refinancing operations on bank lending to non-viable firms, as well as the take-up and granting of trade credits at firm level.

In Bittner et al., 2021 we find that those banks obtaining more funding in the ECB’s VLTROs engage more extensively in evergreening credit exposures to a zombie firm, especially if they have a large concentration risk of their loan portfolio on that firm, which is in line with the view that banks do so in order to avoid writing those exposures off. We also find monetary policy-induced zombie lending to be particularly pronounced at banks with a relatively low raw- as well as risk-weighted equity ratio and at large, internationally active banks, whose equity ratio is presumably more closely monitored by investors. Furthermore banks are more inclined to use ECB funding to engage in zombie lending with smaller, non-listed firms, which do not issue debt claims but rather are dependent on bank funding. This supports the notion that evergreening is only feasible with relatively opaque borrowers and only worthwhile if free riding of other creditors is limited.

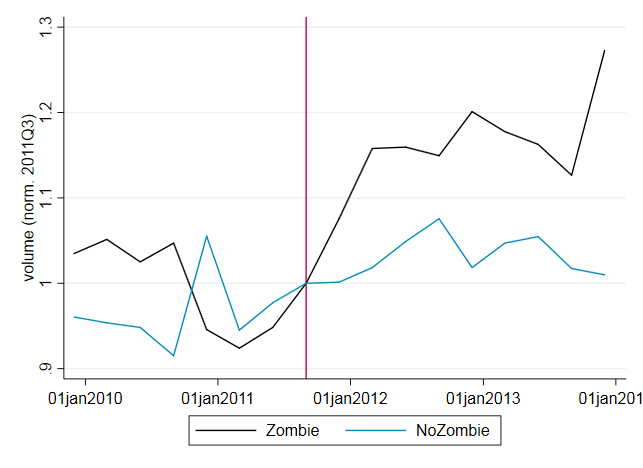

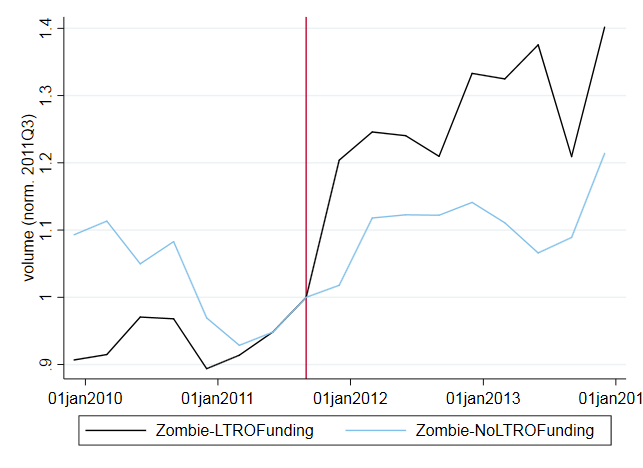

Figure 1: Bank lending development to zombie- and non-zombie firms (lhs) and lending development to zombie firms by banks with and without LTRO funding (rhs).

|

|

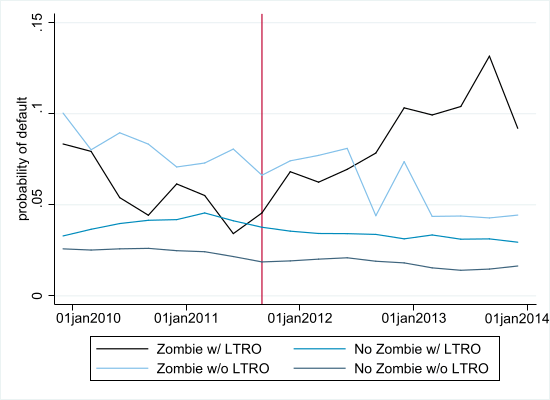

Prior to the ECB’s VLTROs, banks extend new and more credit to those zombie firms that subsequently had a relatively low default probability. However, after the introduction of the VLTROs, zombie firms obtaining new and larger loans from banks using VLTRO funding subsequently had a higher expected default probability even compared to average zombie firms. They also experienced a larger increase in their average expected default probability after the loan was granted. Thus, while in normal times banks might have used private information to cherry pick those zombie firms that might eventually recover, with unconventional monetary policy measures in place, banks no longer engaged in zombie lending based on such private information. Using our rich credit register data which also report the collateralization ratio at the exposure level, we find that banks using VLTRO funding to grant more and new loans to zombie firms did not increase the collateral they required from those borrowers. Thus, the zombie lending induced by unconventional monetary policy not only increased the likelihood of a subsequent loss of the credit exposure, but was probably also associated with a higher loss given default. In sum, these findings lead us to conclude that the ECB’s unconventional monetary policy measure provided a safe refinancing means of zombie loans which induced banks to evergreen their exposures to those firms increasing banks’ subsequent credit risk.

In a second step, we turn in Bittner et al., 2021 to the implications that zombie lending induced by the ECB’s VLTROs has for trade credit and the credit risk exposures of suppliers to zombie firms. We find that zombie firms obtain less trade credit compared to other firms. However, with the introduction of the VLTROs, zombie firms received more trade credit then their peers. This is due, in particular, to those zombie firms that obtained more credit from their main bank after the VLTROs. They also subsequently received more trade credit. Similarly, zombie firms that maintained credit relationships with banks that drew on the VLTROs and zombie firms that obtained more credit from banks that were borrowing from the ECB’s VLTROs also leveraged both their accounts payable and advance payments received compared to other zombie firms.

Figure 2: Probability of default for zombie and non-zombie firms split for firms receiving lending from banks with and without long-term Central Bank funding.

Suppliers might have private information on borrowers’ credit risk complementary to banks’ signals. Thus, they might be able to cherry pick and extend only additional trade credit to those zombie firms that were likely to recover. In other words, only zombie firms for which suppliers had a positive credit risk assessment might be able to obtain more trade credit. However, our results show that after the ECB’s unconventional monetary policy, zombie firms that simultaneously obtained more trade credit and larger new loans from a main bank borrowing under the VLTROs displayed a faster subsequent increase in expected default probability than the average zombie firm, and a higher expected default probability at the end of the sample. This suggests that suppliers might have falsely interpreted the bank’s decision to roll over a zombie loan as a positive signal about the bank’s credit risk assessment of the firm inducing the supplier to also extend more trade credit. Thus, banks’ zombie lending seems to mislead suppliers into increasing their trade credit exposure to particularly risky zombie firms, exposing suppliers to greater contagion risks.

Our results suggest that policies that undermine market discipline in bank’s lending decisions might (temporarily) lead to greater trade credit availability to particularly risky zombie firms. Furthermore, we also find that trade credit provision by zombie firms increases after the VLTROs, especially for those zombie firms that obtain more credit from VLTRO banks. Taken together these results suggest that the interconnectedness of zombie firms in the trade credit network due to banks’ evergreening further exacerbates the systemic risks due to knock-on effects.

In this paper we study whether German banks’ zombie lending, induced by the European Central Bank’s Long Term Refinancing Operations, allows zombie firms to leverage their trade credit borrowing. We provide evidence that particularly weak banks use the VLTROs to evergreen their exposures to zombie firms. This poses additional credit risk, because, as we show, zombie firms which obtain more credit from banks that obtained more funding in the VLTROs are themselves more likely to fail. Focussing on a country such as Germany that was not affected by the adverse economic conditions of a sovereign debt crisis makes identifying zombie firms more meaningful. Here zombie firms were not simply non-viable because of the adverse macroeconomic conditions that monetary policy was trying to combat.

We also show that zombie firms that obtain more funding from their main bank are able to increase their accounts payable and advance payments received from downstream and upstream firms. Our findings suggest that zombie lending has a particularly distorting effect on suppliers because they seem to rely on banks’ lending decisions as a signal about borrowers’ credit quality. Therefore, our paper highlights the interplay of bank credit and firm-to-firm credit and in particular the distortionary effects unconventional monetary policy can have on this.

Acharya, V. V., Eisert, T., Eufinger, C. and Hirsch, C. (2019), ‘Whatever It Takes: The Real Effects of Unconventional Monetary Policy’, The Review of Financial Studies 32(9), 3366–3411.

Biais, B. and Gollier, C. (1997), ‘Trade credit and credit rationing’, Review of Financial Studies 10(4), 903–937.

Bittner, C., Fecht F. and Georg C. (2021), ‘Contagious Zombies’, Deutsche Bundesbank Discussion Paper 15.

Boissay, F. and Gropp, R. (2013), ‘Payment defaults and interfirm liquidity provision’, Review of Finance 17(6), 1853–1894.

Caballero, R. J., Hoshi, T. and Kashyap, A. K. (2008), ‘Zombie lending and depressed restructuring in Japan’, American Economic Review 98(5), 1943–77.

Demirgüç-Kunt, A. and Maksimovic, V. (2001), Firms as Financial Intermediaries: Evidence from Trade Credit Data, mimeo.

Deutsche Bundesbank (2012a), ‘German enterprises’ profitability and financing in 2011’, Monthly Report 2012(December), 25–49.

Deutsche Bundesbank (2012b), ‘The performance of German credit institutions in 2011’, Monthly Report 2012(September), 13–45.

Jacobson, T. and von Schedvin, E. (2015), ‘Trade Credit and the Propagation of Corporate Failure: An Empirical Analysis’, Econometrica 83(4), 1315–1371.

Petersen, M. A. and Rajan, R. G. (1997), ‘Trade credit: Theories and evidence’, Review of Financial Studies 10(3), 661–691.

Schivardi, F., Sette, E. and Tabellini, G. (2017), Credit Misallocation During the European Financial Crisis, mimeo.

Storz, M., Koetter, M., Setzer, R. and Westphal, A. (2017), Do we want these two to tango? On zombie firms and stressed banks in Europe, mimeo.

The views expressed are those of the authors and do not necessarily reflect the official views of Deutsche Bundesbank or the Eurosystem. Corresponding author: f.fecht@fs.de.

See Deutsche Bundesbank 2012a and Deutsche Bundesbank 2012b for a discussion of the overall positive stance and outlook of German banks and German non-financial firms in 2011.

Actually, the continuation of operations (i.e. the fact that the borrower is not filing for bankruptcy) might already serve as a positive signal for the supplier.