Disclaimer: This Policy Brief represents the authors’ personal opinions and does not necessarily reflect the views of the Deutsche Bundesbank or the Eurosystem.

This policy brief presents the findings of the paper Kaldorf and Röttger (2023), in which we propose a quantitative model to understand the interaction between convenience yield, sovereign risk and the supply of government bonds. In the model, convenience yield arises because investors are able to pledge government bonds as collateral on financial markets. Convenience yield depends on the valuation of collateral, which declines with the supply of government bonds, and also declines with collateral haircuts that increase with sovereign risk. Calibrated to Italian data, convenience yield contributes substantially to the public debt-to-GDP ratio and can rationalise prolonged periods of negative bond spreads, even in the presence of default risk. We show that the debt elasticity of convenience yield is the most important driver of our results. Decomposing it into the debt elasticity of a collateral valuation and a haircut component, we find that, under empirically relevant conditions, a higher debt elasticity of haircuts can reduce fiscal discipline.

Investors value government bonds for the extraordinary safety and liquidity that they offer relative to other asset classes. It is these properties that make them the most frequently pledged collateral asset on short-term funding (repo) markets or in margin accounts. The associated price markup that investors are willing to pay for such bonds relative to similar assets, such as corporate bonds, is usually referred to as convenience yield and has been studied extensively in recent years (see Canzoneri et al., 2016, and Jiang et al., 2022, among others). Typically, the focus of the literature is on the United States as the global provider of safe assets (Du et al., 2018). In this context, it is a well-established regularity that convenience yield tends to decline if the amount of outstanding bonds goes up (Krishnamurthy and Vissing-Jorgensen, 2012). Thus, the convenience yield of a bond is high if it is in short relative supply.

While government bonds issued by euro area countries are arguably not free of default risk, they also exhibit convenience yield. For example, investors can pledge them with the Eurosystem and on the repo market to obtain funding at favourable conditions. However, when pledging risky assets as collateral, lenders typically apply collateral haircuts that increase with the default risk of the pledged asset, usually proxied through credit ratings. All else being equal, the convenience yield of a risky bond is largest when its default risk is small and its credit rating is high.

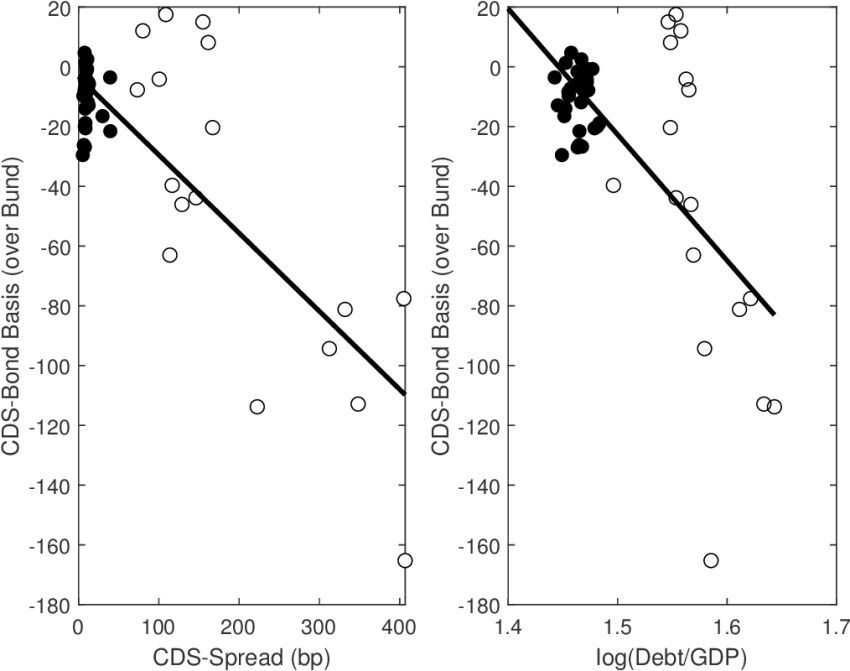

We illustrate these empirical regularities for the case of Italy in the left panel of Figure 1, plotting convenience yield against a measure of sovereign risk. We measure convenience yield by the CDS-bond basis relative to the German Bund. This measure adjusts the funding disadvantage of maturity-matched Italian government bonds relative to Germany, given by the yield spread over German Bunds, for the default risk compensation required by investors, which is measured via credit default swap (CDS) spreads for Italy. In the data, there is no funding disadvantage if the CDS spread is low. However, default risk disproportionally increases the sovereign’s borrowing cost, since Italian bonds also lose their convenience yield. The right panel of Figure 1 suggests that this empirical regularity can also be observed for Italy.

Figure 1: Relationship between convenience yield and default risk

Note: The debt-to-GDP ratio is defined with respect to real GDP. Convenience yield is measured by the CDS-bond basis relative to the German bund (yieldItaly – yieldGermany – cdsItaly) and is expressed, like the CDS spread, in basis points.

The scarcity and riskiness of a sovereign bond are, however, not exogenously given but reflect the borrowing behaviour and willingness to repay of the issuing government. These decisions, in turn, depend on the price of government bonds, which is affected by investor demand for them.

These interactions between the supply of and demand for government bonds can be illustrated by considering the intertemporal problem of a government that receives tax revenues and decides on the amount of public spending. To increase public spending beyond tax revenues, the government has to run a budget deficit and issue new bonds. Ceteris paribus, these additional bonds tend to increase the risk of default, since they reduce the government’s ability or willingness to repay its debt out of future tax revenues in case the country is hit by a bad shock. Investors are thus only willing to hold these bonds if they are compensated for the additional default risk. The government bond yield then increases due to the associated default risk premium.

Nevertheless, it is still worthwhile for the government to issue these additional bonds if the negative consequences of a higher debt-to-GDP ratio — either a larger tax burden or the potential cost of future default — are considered less important to the current government than the increase in public spending. This can, for instance, be the case if future costs of a higher debt-to-GDP ratio are potentially born by a different government. However, bond markets provide incentives for fiscal discipline to the current government. The government bond yield increases to unattractive levels if the debt-to-GDP ratio approaches the government’s fiscal capacity.1

How does convenience yield affect sovereign borrowing and fiscal discipline? If government bonds can be used as collateral, investors are willing to pay a higher price for them (i.e. they require a lower yield), all else being equal. If convenience yield was independent of the amount of government debt outstanding, the bond would permanently trade at a lower yield than what can be attributed to sovereign risk. The government could then finance more public spending by issuing the same amount of government bonds, making debt issuance more attractive. Empirically, however, investors’ willingness to sacrifice on bond yields in return for their collateral services declines with the amount of collateral available. Consequently, additional debt issuance makes government bonds less scarce and the usage of government bonds as collateral becomes less valuable at the margin. Convenience yield declines as a result. Compared to the hypothetical case of a constant and hence debt-inelastic convenience yield, the relative attractiveness of debt issuance declines as well. The collateral valuation component of convenience yield hence provides incentives for fiscal discipline.

For risky bonds, the collateral value of government bonds outstanding also depends on collateral haircuts that are applied to them on financial markets. Without the collateral valuation component, a sensitive haircut schedule would provide incentives for fiscal discipline, see e.g. Nyborg (2017) for a thorough discussion. New debt issuance decreases the haircut-adjusted collateral value of government bonds, while at the same time increasing the default risk premium. The government bond yield increases by more than it would in the absence of convenience yield, making new debt issuance less attractive.

In the presence of a debt-elastic collateral valuation, the disciplining effect of stringent haircut schedules can be reversed. If the haircut component of convenience yield is sufficiently sensitive to default risk, the collateral value of all government bonds outstanding can even increase when new bonds are issued. Convenience yield increases in this case, since the larger haircut makes the collateral services of government bonds more valuable. The government then finds itself in a situation in which additional debt issuance decreases bond yields and financial markets fail to provide incentives for fiscal discipline. Such puzzling behaviour could be observed in 2011, when rating agencies set the rating outlook for US government bonds to negative. Contrary to conventional wisdom, this event was accompanied by a decrease in US government bond yields. Note that the ambiguous effect of the haircut component of convenience yield depends not only on its own debt elasticity, but also on the debt elasticity of the collateral valuation component. Ultimately, whether debt issuance raises or lowers convenience yield and whether convenience yield incentivises fiscal discipline are quantitative questions.

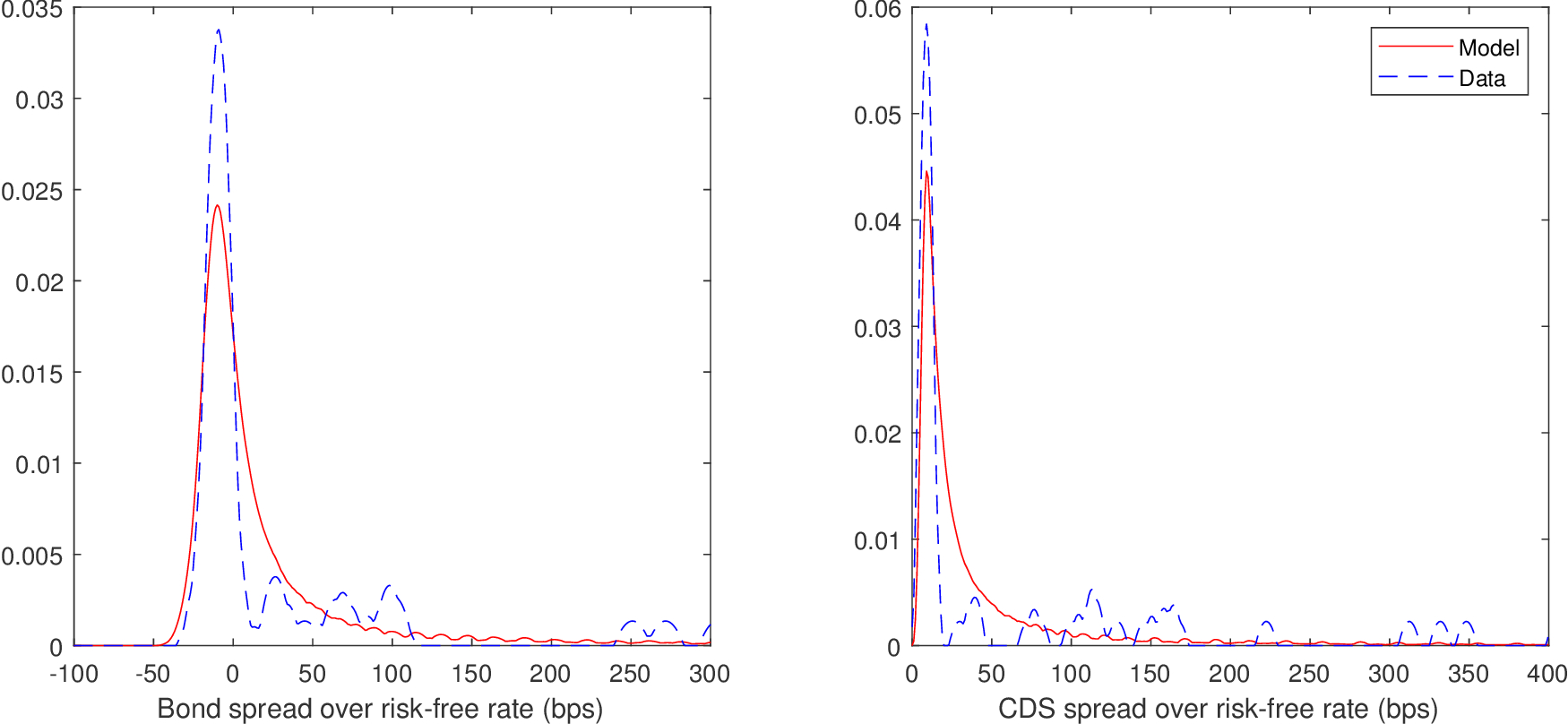

In a recent paper (Kaldorf and Röttger, 2023), we study convenience yield, sovereign risk and the supply of government bonds through the lenses of a quantitative macroeconomic model. A calibration to Italian data around the European debt crisis shows that the model is capable of replicating the joint dynamics of prices and quantities in the Italian government bond market. Specifically, it can match the level and dynamics of Italy’s debt-to-GDP ratio, its default risk, measured by credit default swaps, and its convenience yield, measured by the CDS-bond basis. The CDS-bond basis is defined as the government bond spread over the risk-free rate minus the CDS spread and is usually negative. A CDS-bond basis of zero would indicate that there is no convenience yield associated with holding government bonds. By contrast, if the CDS-bond basis is large in absolute terms, the government pays a considerably smaller spread over the risk-free rate than justified by its default risk.

Figure 2: Distribution of spreads

Note: All values are expressed in basis points and are based on a sample from 2001Q1-2011Q4, prior to the (announcement of the) ECB’s OMT and its asset purchase programmes.

Note: All values are expressed in basis points and are based on a sample from 2001Q1-2011Q4, prior to the (announcement of the) ECB’s OMT and its asset purchase programmes.

As a first step, we show that our model with convenience yield can generate negative government bond spreads over the risk-free rate on average, which is consistent with the data and impossible to reconcile in standard sovereign default models (Arellano, 2008). This means that, on average, convenience yield exceeds default risk premia. On the other hand, the model is also able to generate periods of high sovereign risk, which we define as periods with a positive government bond spread. This is also consistent with the data and cannot be explained in standard models of fiscal policy and convenience yield (Krishnamurthy and Vissing-Jorgensen, 2012). These appealing quantitative properties of our model can be seen by looking at the distribution of bond and CDS spreads over time (see Figure 2).

Additionally, convenience yield is able to explain a sizable part of the government debt-to-GDP ratio. All else equal, setting convenience yield to zero would reduce the debt-to-GDP ratio from 113% to 86%, which is a considerably smaller value. Key for this effect is the elasticity of convenience yield with respect to government bonds outstanding. A constant and debt-inelastic convenience yield would imply only a debt-to-GDP ratio of 90%. The importance of a debt-elastic convenience yield is in line with recent work by Mian et al. (2022), who study convenience yield in the absence of sovereign default risk.

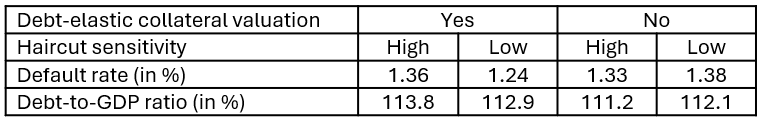

So far, we demonstrated that convenience yield helps to explain government bond market dynamics and large debt-to-GDP ratios. We use the model to show that the decomposition of convenience yield into collateral valuation and haircut components delivers further insights. In Table 1, we distinguish between an empirically plausible debt-elastic collateral valuation component and a debt-inelastic one. Within each case, we compare a haircut regime that is strongly sensitive to default risk to a less sensitive policy. In the baseline case, the highly sensitive haircut regime exhibits both a higher debt-to-GDP ratio and higher default probability. The reverse is true if investors’ valuation of collateral services is (counterfactually) debt-inelastic.

Table 1: Collateral haircut and collateral valuation components

The complementarity between stringent haircut schedules and the elasticity of collateral demand can have important implications for government bond market dynamics and the way haircuts are set on financial markets (Corradin et al. (2017) discuss financial stability implications of collateral and haircuts). We argue that a highly debt-elastic collateral valuation is an empirically relevant situation. In this case, stringent haircut schedules might fail to provide incentives for fiscal discipline. Our model, however, abstracts from other assets that investors could resort to as collateral in case of a debt crisis (see Jiang et al., 2021 for empirical evidence). In this case, the debt elasticity of collateral valuation would be smaller than in our baseline model. Nevertheless, our analysis suggests that endogenous responses by the collateral demand side (investors’ collateral valuation) and the collateral supply side (sovereign debt and default incentives) should be taken into account for haircut schedules on financial markets.

Arellano, C. (2008): “Default Risk and Income Fluctuations in Emerging Economies,” American Economic Review, 98, 690–712.

Canzoneri, M., R. Cumby, and B. Diba (2016): “Optimal Money and Debt Management: Liquidity Provision vs Tax Smoothing,” Journal of Monetary Economics, 83, 39–53.

Corradin, S., F. Heider, and M. Hoereva (2017): “On Collateral: Implications for Financial Stability and Monetary Policy,” ECB Working Paper Series No. 2107.

Du, W., J. Im, and J. Schreger (2018): “The U.S. Treasury Premium,” Journal of International Economics, 112, 167–181.

Jiang, Z., H. Lustig, S. van Nieuwerburgh, and M. Xiaolan (2021): “Bond Convenience Yields in the Eurozone Currency Union,” Working Paper.

Jiang, Z., H. Lustig, S. van Nieuwerburgh, and M. Xiaolan (2022): “Manufacturing Risk-free Government Debt,” Working Paper.

Kaldorf, M. and J. Röttger (2023): “Convenient but Risky Government Bonds,” Bundesbank Discussion Paper 15/2023.

Krishnamurthy, A. and A. Vissing-Jorgensen (2012): “The Aggregate Demand for Treasury Debt,” Journal of Political Economy, 120, 233–267.

Mian, A., L. Straub, and A. Sufi (2022): “A Goldilocks Theory of Fiscal Deficits,” NBER Working Paper 29707.

Nyborg, K. (2017): Collateral Frameworks: The Open Secret of Central Banks, Cambridge University Press.

In models of public debt, a government can typically issue debt to smooth the impact of fiscal shocks over time but also to front-load public spending, leading to a positive debt-to-GDP ratio on average. Discussions about fiscal discipline usually concern the second borrowing motive, which tends to be welfare reducing. Note that most models usually abstract from public investment, which can provide an additional rationale for (temporary) budget deficits in case of welfare-improving investment opportunities.