This policy brief is based on IMF Working Papers “Industrial Policy in Europe: A Single Market Perspective” (WP/24/249). The views expressed are strictly ours and do not necessarily represent the views of the IMF, its Executive Board, or management.

Abstract

A resurgence of industrial policy is underway worldwide, including in Europe. Model based simulations show that unilateral industrial policy has the potential to increase domestic productivity if well-targeted at market failures. It can nonetheless generate adverse spillovers and spillbacks, particularly for the many small, open economies in the EU. Modeling implies that a coordinated approach to industrial policy can mitigate these harmful effects. Implementing uniform industrial policy at the EU-level, while deepening intra-European trade and financial integration, can generate net gains by facilitating adjustment of firms and workers.

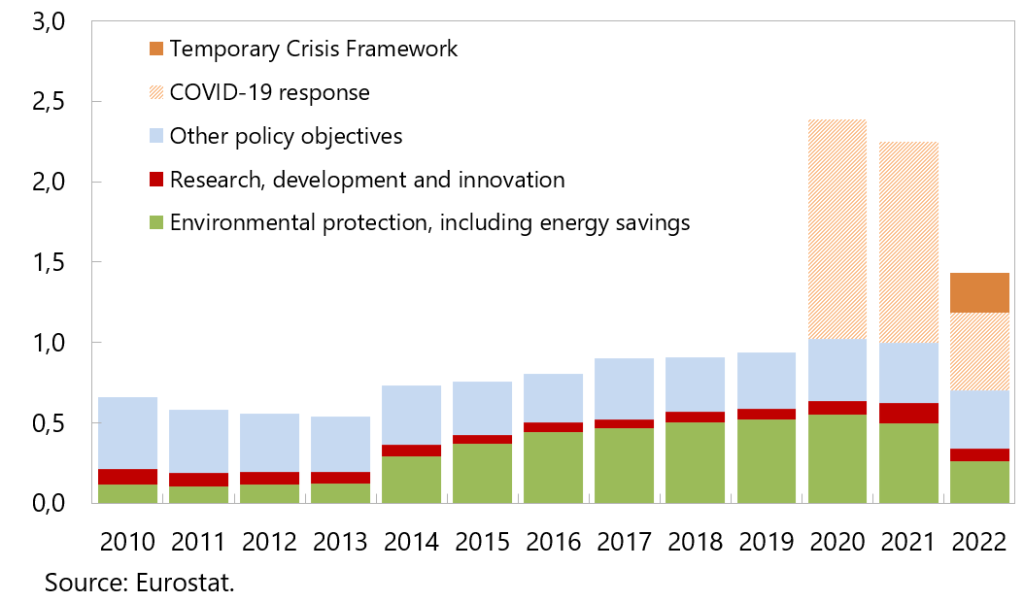

European countries are increasingly turning to sectoral policy interventions to increase economic security, enhance productivity, and accelerate the green transition. State aid spending by European Union (EU) countries has tripled in the last decade, reaching 1.5% of GDP, even after most of the pandemic and energy crisis aid has been unwound.

Much of this aid has flowed into green technologies and energy efficiency, with major economies like France, Germany, Italy, and Spain driving the surge (70 percent of total). For several smaller EU countries, state aid is significantly higher and reaches in some cases up to 2 percent of GDP (e.g., Hungary). Direct subsidy grants and interest rate subsidies are the most-used instruments for non-crisis state aid, accounting for 57.8 percent of total expenditure in 2022. Tax incentives, which account for 30.7 percent of total aid, generate further fiscal costs. As the recent report from Mario Draghi suggests, there is a growing consensus that even more such spending is necessary to spur growth.

Figure 1. State Aid by Policy Objectives, 2010-22

(Percent of EU GDP)

But before rushing ahead, also given the significant fiscal costs, it is appropriate to take stock and re-evaluate good design principles for European industrial policy. A new IMF paper 1 shows that the success of European industrial policy depends not just on how much is spent, but on spending it well: targeting the right priorities and avoiding costly missteps. A critical insight of the paper is that a coordinated approach to industrial policy at the EU-wide level can mitigate its distortions and minimize losses.

Industrial policy gives rise to complex interactions and trade-offs. Under the right circumstances, industrial policy in Europe can deliver tangible economic gains and can strengthen economic resilience. By being laser-focused on addressing market failures—such as by fostering innovation in sectors with knowledge spillovers (think of green technology), enabling regional clustering (think of Silicon Valley), or overcoming coordination failures to build supply chains —it can boost productivity and incomes.

However, even the best-intentioned policies can backfire if poorly coordinated. Powerful interventions, such as subsidies or tax breaks, that expand production and lower costs in a particular sector in one European country will have the opposite effect in another.

Model simulations illustrate this mechanism, building on the multi-country, multi-sector modeling framework of Lashkaripour and Lugovskyy (2023), including every EU country and selected G20 partners. Within each sector, monopolistically competitive firms produce differentiated varieties of goods using only labor. Firms can enter a sector freely, subject to paying a fixed cost. Labor is perfectly mobile across sectors but cannot cross international borders. There are external scale economies in production, which differ by sector and can be interpreted as agglomeration externalities from knowledge spillovers, so that sectoral productivity rises as more firms enter.

In the absence of industrial policy, production in some European sectors can be inefficiently low because firms fail to account for the scale externalities when making entry decisions. This implies a role for industrial production subsidies to correct the market failure and incentivize a level of production that increases sectoral productivity.

While this illustrates a domestic role for unilateral industrial policy in Europe, there are two channels through which it can backfire:

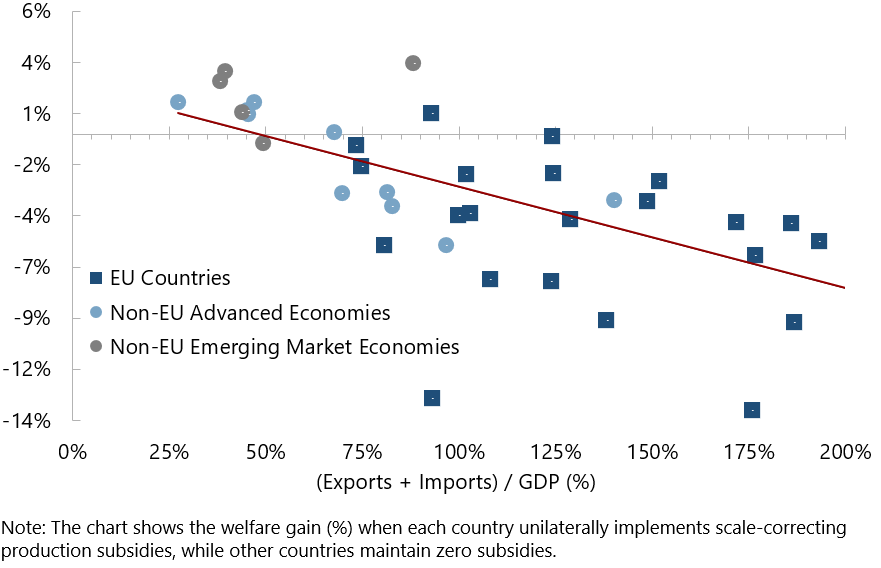

Because of these channels, the model shows that unilateral industrial policies are a losing strategy for most EU countries, given their openness to trade. Without careful design, unilateral policies risk triggering these powerful spillovers and spillbacks across the region that outweigh their benefits.

Figure 2. Welfare Impact of Scale-Correcting Production Subsidies

(Relative to Status Quo of Zero Subsidies, percent)

The central finding of the paper is that a unified, coordinated framework for industrial policy across Europe is a better approach. When countries align their efforts, the benefits of industrial policy can outweigh the costs. Coordinated policies preserve the gains from trade, ensure a level playing field, and make full use of the EU’s single market.

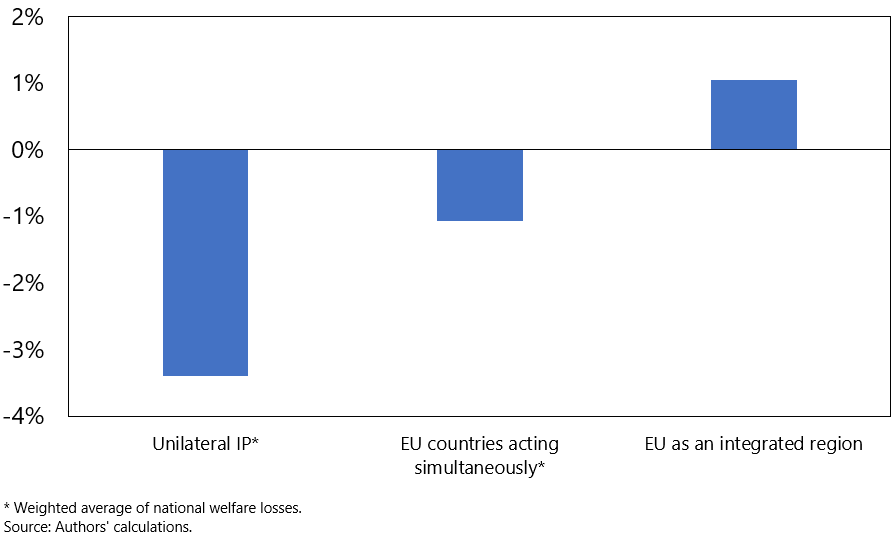

Figure 3. EU Welfare Impact of Production Subsidies

(Change relative to a counterfactual of zero IP subsidies, percent)

Model simulations underscore this point. First, the paper presents a simulation where all EU countries implement industrial subsidies simultaneously, to correct market failures by internalizing scale effects. Simultaneous implementation of subsidies minimizes the production relocation effect and avoids the concentration of production in a country unilaterally implementing subsidies, maintaining the pattern of production implied by underlying comparative advantages. Furthermore, although subsidies may increase production in industries where foreign demand elasticities are smaller, reducing export prices in that industry, all else equal, trading partners’ own subsidies to industries where there are larger scale externalities may lower import prices, overall improving the first country’s terms of trade. Aggregating the welfare impact across all EU countries acting simultaneously indicates a smaller average welfare loss than in the case where each country acts entirely unilaterally (see bar in Figure 3 labeled ‘EU countries acting simultaneously’).

This cooperative scenario nonetheless underestimates the degree of integration between EU countries, since it assumes that labor cannot cross national borders. To illustrate the benefits of full factor mobility within a fully integrated single market, the model is re-calibrated to treat the 27 countries of the EU as a single country. Industrial policy is therefore set at the regional level and both labor and firms are allowed to relocate freely across the EU in response to industrial policy. This maximizes the efficiency gains from implementing subsidies to exploit scale effects. It also minimizes the losses from depressing export prices, since the EU as a whole is less open to trade than many of the individual EU countries, so that the welfare cost of depressing export prices by expanding production in industries where demand elasticities are smaller is less important (see bar in Figure 3 labeled ‘EU as an integrated region’). The result is that industrial policy can achieve net gains for the EU as a whole. Although not explicitly modeled, intra-EU fiscal transfers could be used in this scenario to cushion any adverse impact on regions within the EU that might otherwise lose out, fostering solidarity across the bloc.

It is important to note that the fiscal cost of subsidies that fully exploit scale externalities can be large. The model is not designed or meant to provide a precise estimate of either the available external economies of scale or the costs of

the fiscal measures that would be needed in practice to realize them. But the model can broadly point to an order of magnitude of their fiscal costs—and they tend to be large. For example, for a European country implementing these subsidies unilaterally, while all other countries maintain the status quo, the fiscal cost is found to be about 13 percent of GDP on average across EU countries, on a GDP-weighted basis. This declines to about 11 percent of GDP if the EU enters the model as a single country, suggesting some degree of cost efficiency under full EU integration, as full labor mobility allows easier reallocation of production across sectors. One of the reasons that these numbers are very high is that they are computed in the model’s steady state and can be interpreted as the cumulative cost of eliminating the market failure by paying annual subsidies over a long period of time. Moreover, the model’s simplifying assumption that taxes are non-distortionary “lump sum” underplays the distortions that a very active industrial policy in the form of subsidies could bring with it. As discussed, these results should be treated as broadly indicative rather than as precise cost estimates—nonetheless, they raise concerns about the fiscal consequences of larger-scale industrial policy at a time when fiscal space is limited in many EU countries.

State aid rules in Europe have helped provide a minimum level of coordination on industrial policy and go some way to providing a level playing field. Supported by data collection and transparency, state aid rules provide guardrails against policy misuse and minimize adverse spillovers across countries, by requiring the review of market failures tackled by state aid, while avoiding competition distortions and welfare losses. However, while a good starting point, EU state aid rules fall short of what is needed to guide strategic industrial policies across Europe. Better data sharing and unified programs could enhance transparency and trust among member states. A centralized decision-making body could streamline priorities and better allocate resources to areas of mutual benefit. Recent initiatives to foster greater flexibility in the approval of state aid in critical areas should be balanced by the need to preserve crucial information sharing and transparency that help to safeguard efficiency and competitiveness.

The creation of the Airbus venture almost half a century ago showed that coordination at scale can work: a collaborative, multi-country initiative combined resources and expertise to create a globally competitive industry. Similar efforts could unlock the potential of Europe’s green and tech transitions.

Deeper integration is also an essential part of the equation. A stronger single market for goods, services, and capital with more labor mobility would amplify the effectiveness of industrial policies, allowing firms to scale up (see also IMF Regional Economic Outlook for Europe, October 2024). This will require efforts to harmonize taxes and subsidies across countries, while developing infrastructure networks, energy grids and interconnectivity (IMF, 2024). Deeper EU integration may also require an EU-wide central fiscal capacity, or a more ambitious EU budget, with centralized projects of mutual interest. This needs to be complemented by efforts to mobilize private sector support for entrepreneurialism across borders, by strengthening the capital market union (or the savings and investment union), which can increase private cross-border risk sharing, lower the cost of finance and improve access to funding. Meanwhile, strengthening public finances and rebuilding fiscal buffers, in line with EU rules, remains an important task to increase resilience against future shocks.

Bagwell, K., and R. W. Staiger. “An economic theory of GATT.” American Economic Review 89, no. 1 (1999): 215-248.

Draghi, M. (2024), EU competitiveness: Looking ahead, European Commission.

Hodge, A., R. Piazza, F. Hasanov, X. Li, M. Vaziri, A. Weller, and Y. C. Wong. Industrial Policy in Europe: A Single Market Perspective. No. 2024/249. International Monetary Fund, 2024.

International Monetary Fund (IMF) (2024), Regional Economic Outlook: Europe. Washington, DC, October.

Lashkaripour, A., and Volodymyr L. “Profits, scale economies, and the gains from trade and industrial policy.” American Economic Review 113, no. 10 (2023): 2759-2808.

Ossa, R. “A “new trade” theory of GATT/WTO negotiations.” Journal of Political Economy 119, no. 1 (2011): 122-152.

Hodge, A., R. Piazza, F. Hasanov, X. Li, M. Vaziri, A. Weller, and Y. C. Wong. Industrial Policy in Europe: A Single Market Perspective. No. 2024/249. International Monetary Fund, 2024.