Understanding the effects of house price booms on firm behaviour and the aggregate economy is a key concern for policy makers. Data on listed U.S. firms show that firms holding real estate are persistently less productive than non-holders. Rising real estate values hence relax collateral constraints for inefficient firms, which allows them to expand production. The ensuing reallocation of resources towards low-productivity firms has negative consequences for aggregate industry productivity. Industries with a stronger relative increase in real estate values see a significant decline in total factor productivity and the within-industry covariance between firm size and productivity declines. Since interest rates are a key driver of real estate prices, the results suggest that low interest rates could have unintended consequences for productivity growth through their effects on real estate prices.

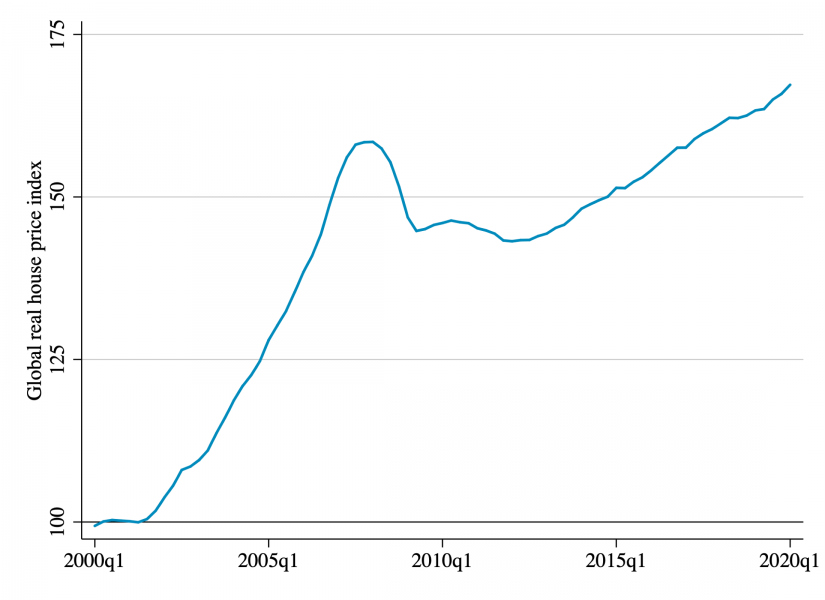

Supported by low interest rates, global real estate prices have reached staggering heights. Many housing markets around the world have even surpassed their peaks during the boom years of the 2000s (Figure 1). Rising real estate prices can spur economic activity: they allow firms to borrow against higher collateral values; easier access to credit boosts employment and firms’ capital expenditure.

Despite these positive effects on businesses, higher asset values and credit booms can have negative consequences for aggregate productivity (Schularick and Taylor 2012; Borio et al 2016). What could explain the apparent disconnect between the positive effects of higher real estate prices on individual firms and their detrimental effects on the aggregate economy?

Figure 1: Global house prices are on the rise

Source: International Monetary Fund, Global Housing Watch Data.

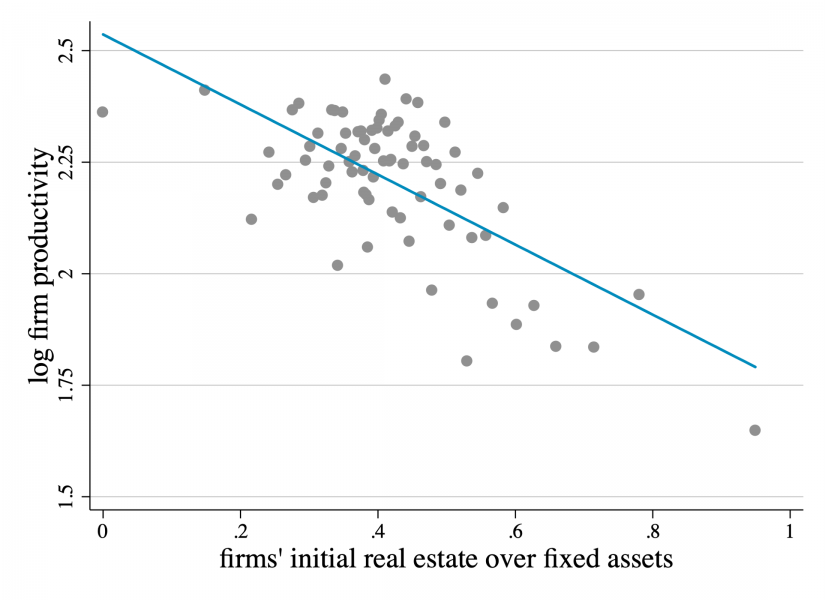

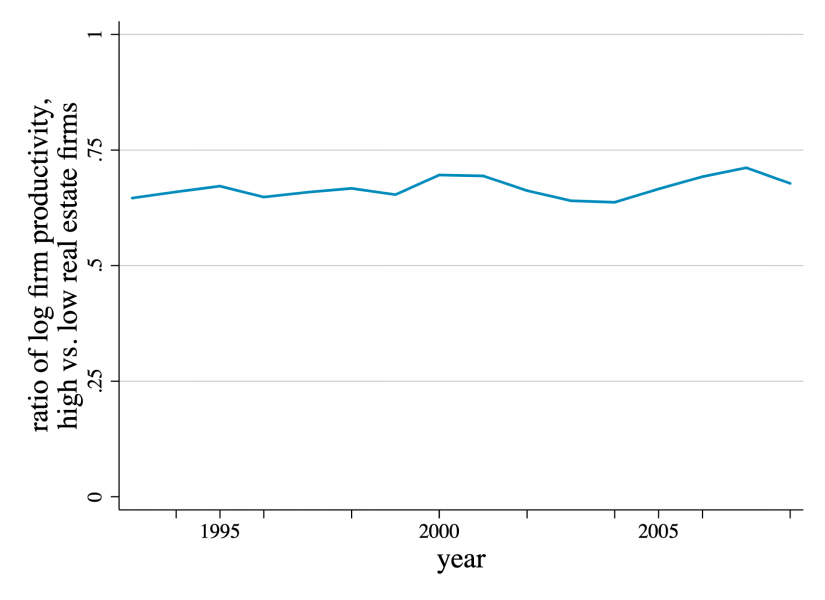

One possible explanation is that real estate booms have unintended side effects on productivity by shifting capital and labour towards inefficient firms. Data on listed companies in the United States shows that firms with a higher share of real estate assets are less productive than firms with a lower share (Figure 2, panel a). During the housing boom preceding the great financial crisis total factor productivity of firms that hold 50% of their fixed assets in the form of real estate is around 20% lower than that of firms that own no real estate. The productivity gap is persistent over time: firms in the top tercile of the distribution of real estate shares are around two-thirds as productive as those in the bottom tercile in each year of the sample period (panel b).

In addition to having lower total factor productivity, firms with a higher share of fixed assets in the form of real estate also have relatively lower labour productivity, investment rates and sales per employee. They also spend significantly less on research and development. The negative relationships between the share of real estate assets and measures of firm efficiency are present even among companies of similar age and size that operate within the same industry and are headquartered in the same city.

Figure 2: Firm Productivity and real estate

| a) The productivity gap | b) Persistence over time |

|

|

| Source: Doerr (2020). |

The combination of high real estate prices and lower productivity of firms with real estate implies that inefficient firms have easier access to funding when collateral values rise. Consequently, extended periods of rising real estate prices allow these firms to grow and make up an ever-increasing fraction of output in each industry. In other words, higher house prices lead to a reallocation of capital and labour towards unproductive firms and depress aggregate productivity, because inefficient firms use larger shares of industry-wide capital and labour.

At the aggregate industry level, regressions show that every 10% increase in average real estate prices leads to a 0.6% relative decline in total factor productivity, based on U.S. data from 1993 to 2008 (Doerr 2020). House prices grew by around 4% per year during the sample period. The housing boom thus shaved off over half a percent of productivity growth every two-and-a-half years. Productivity increased by an average of 1.75% annually, so the effect is economically sizeable.

Poor allocation of resources across firms explains the negative effect of real estate values on industry productivity: the within-industry covariance between firm size and productivity declines as house prices rise. The covariance measures whether efficient firms also receive more capital and labour. A decline implies that unproductive firms grow faster than productive firms and increase their relative share of industry output.

To further highlight the reallocation channel, I split industries by their dispersion of initial real estate across firms. For misallocation to play a role, firms’ financial constraints must be relaxed asymmetrically. If each firm has a similar share of real estate out of total assets, there would be no dispersion across firms: rising real estate prices would allow all firms to borrow more, so there would be no change in relative firm size and thus no reallocation. Instead, the data reveal that reallocation reduces productivity by relatively more in industries where initial real estate holdings are more dispersed across firms. Industries with higher dispersion also experience a stronger decline in the covariance term.

Literature has established that financial constraints matter for the allocation of capital across firms and that distortions in the allocation of resources matter for aggregate productivity (Gopinath et al 2017). Yet there exists little evidence on the misallocation of resources during real estate booms, nor on the crucial role of collateral in the process. This novel channel through which real estate booms affect productivity could explain why housing booms are often associated with ‘bad booms’ (Gorton and Ordonez, 2016).

The findings may also have potentially important implications for monetary policy and its effectiveness in stimulating growth. Interest rates are a key driver of real estate prices (Jorda et al 2015). Extended periods of low interest rates – a ‘low-for-long world’ – could hence have unintended side effects: by inflating house prices, low interest rates relax financial constraints for inefficient firms that hold real estate collateral. This reallocation could depress aggregate productivity and dampen the transmission of monetary policy to the real economy.

Of course, monetary policy affects the economy in any number of ways and my results do not imply that low interest rates are detrimental to welfare in general. For example, lower rates and higher home values could stimulate entrepreneurship or relax financial constraints for small firms (Doerr 2019; Bahaj et al 2020). And yet, their potentially negative effects on productivity by reallocating resources across firms need to be considered when evaluating the effectiveness of monetary policy. This is especially relevant in light of the debates on whether unconventional monetary policy could further inflate asset prices (Lowe 2019) and on how big data and machine learning could affect the importance of collateral in the allocation of credit (Gambacorta et al 2020).

Bahaj, Saleem, Angus Foulis and Gabor Pinter (2020): “Home values and firm behaviour”, American Economic Review, 110(7), pp 2225–2270.

Borio, Claudio, Enisse Kharroubi, Christian Upper and Fabrizio Zampolli (2016): “Labour reallocation and productivity dynamics: financial causes, real consequences”, BIS Working Paper No. 534.

Doerr, Sebastian (2019): “Unintended side effects: stress tests, entrepreneurship and innovation”, BIS Working Paper No. 823.

Doerr, Sebastian (2020): “Housing booms, reallocation and productivity”, BIS Working Paper No. 904.

Gambacorta, Leonardo, Yiping Huang, Thenhua Li, Han Qiu and Shu Chen (2020): “Data vs collateral”, BIS Working Paper No. 887.

Gopinath, Gita, Sebnem Kalemli-Ozcan, Loukas Karabarbounis and Carolina Villegas-Sanchez (2017): “Capital allocation and productivity in South Europe”, Quarterly Journal of Economics, 132(4), pp 1915–1967.

Gorton, Gary and Guillermo Ordonez (2016): “Good booms, bad booms”, NBER Working Paper No. 22008.

Jorda, Oscar, Moritz Schularick and Alan M. Taylor (2015):. “Betting the house”, Journal of International Economics, 96(Supplement 1), pp 2–18.

Lowe, Philipp (2019): “Unconventional monetary policy: some lessons from overseas”, Address to Australian Business Economists Dinner, November.

Schularick, Moritz and Alan M. Taylor (2012): “Credit booms gone bust: monetary policy, leverage cycles, and financial crises, 1870-2008”, American Economic Review, 102(2), pp 1029–1061.

This Policy Brief represents the views of the author and not necessarily those of the Bank for International Settlements.