What is the impact of the pandemic on international capital flows? Analyzing highly disaggregated monthly data from the German balance of payments statistics over the period from January 2019 through January 2021, we find that bilateral financial interactions are negatively affected by stricter containment and closure policies as well as health system policies of a partner country, while German capital flows benefit from a partner’s economic support policies.

The macroeconomic consequences of the pandemic have been dramatic. The impact of the pandemic on international capital flows, in contrast, is much less evident. At the beginning of the crisis, at a time of financial market turbulences, some countries experienced substantial capital outflows. In perspective, however, net outflows have been of a magnitude comparable to those seen in previous stress events (Batini, 2020). Moreover, the flight-to-safety episode was remarkably short-lived, partly due to massive central bank intervention (Lane, 2020).1 In this note, we examine empirically the effect of policy responses by foreign governments to the Covid-19 pandemic on German international capital flows.

We combine information from two datasets. Data on German cross-border financial activities are obtained from the Deutsche Bundesbank’s “Statistics on International Financial and Capital Transactions (SIFCT)”.2 We merge the German balance of payments data with information on how governments in the partner country respond to the Covid-19 pandemic, using data from the Oxford Covid-19 Government Response Tracker (OxCGRT).3

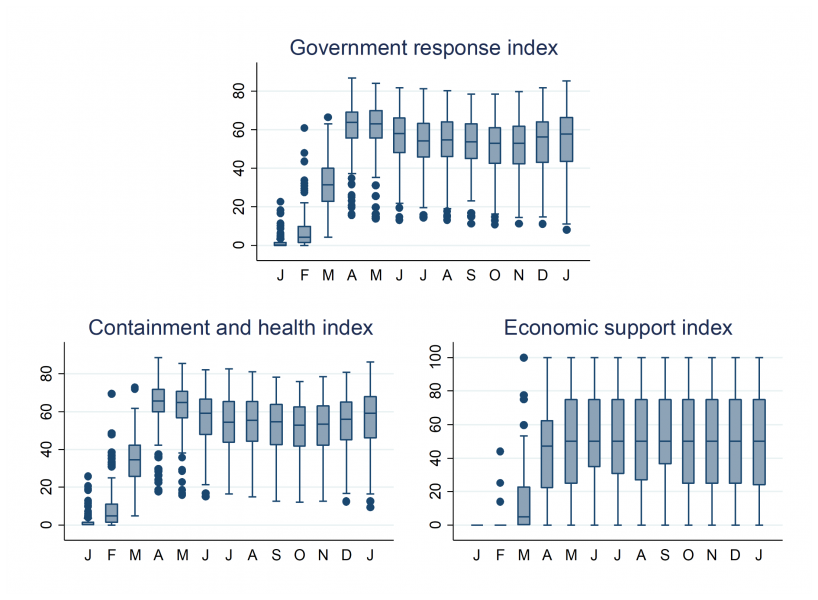

Figure 1 presents monthly box plots of the OxCGRT indicators of government responses to Covid-19 across the 186 countries in our sample. The upper panel of Figure 1 contains a box plot of the overall government response index, which summarizes the information from all (16) ordinal government response measures in a single index for each country; the two box plots in the lower panel present analogous composite indices for two types of government policies, effectively sorting each ordinal government response measure into one of two categories. Unsurprisingly, there is, in line with the spread of the coronavirus, a general tendency towards more and tighter government measures over the course of the year. However, many box plots – especially those with individual measures ‑ are wide, indicating considerable cross-country variation in the implementation of these measures; there is also variation, when measures are adopted and (eventually) abandoned. For instance, many lockdown policies, such as school closures, were temporary and haven been lifted quickly as the number of Covid-19 cases declined, while other interventions, such as public information campaigns, are still widely in place. Overall, the box plots indicate considerable dispersion in government responses to Covid-19, both across countries and over time.

Figure 1: Composite Indicators of Government Response Measures to Covid-19

Notes: Data are monthly averages of daily values, January 2020 – January 2021. Raw data (last update: March 24, 2021) taken from the Oxford Covid-19 Government Response Tracker (OxCGRT).

Our empirical analysis uses a conventional difference-in-difference estimator at the most aggregate level with the OxCGRT summary indicators to quantify the government responses to Covid-19 in countries abroad. Table 1 (see Goldbach and Nitsch, 2021) reports the results. Our default estimate is recorded in the first column of the upper panel of the table. The estimate is small and statistically indifferent from zero at any confidence level, indicating that German capital flows are insensitive to policies implemented abroad to fight the pandemic. Moreover, this (non-)finding turns out to be robust when we sequentially include, at the cost of a substantially reduced sample size, additional regressors to capture the effects of a partner country’s monetary and macroeconomic conditions on capital flows. As shown in columns (2) to (4), the coefficient remains insignificant in these extended specifications (but increases in magnitude). For a composite indicator of government responses to Covid-19, therefore, which aggregates the information from 16 different indicators of government measures into a single index, there is no evidence that the pattern of bilateral capital flows is sizably affected by policy measures taken in response to Covid-19.

In the remaining eight columns of the table, we present sets of analogous results for two sub-indices which summarize information on different types of public policies in response to Covid-19. Columns (5) to (8) show the results when the overall government response index is replaced with a summary index of containment and health policies only; this index aggregates the information from 14 (of the 16) indicators in the overall index.4 For this measure, then, the estimated effect on capital flows is not only consistently negative; the effect is also marginally significant at the 10 percent level in two of the four specifications. Consequently, bilateral financial relationships do not seem to be completely unaffected by the pandemic. At least for the group of Germany’s major financial partners (for most of which data on the composite leading indicator is available), capital flows fall sizably when a country implements stricter lockdown policies. While we do not attempt to interpret the point estimates too literally, given the arbitrary construction of the index, a 10 percentage point increase in the containment and health index is associated with a 5 percent decrease in bilateral capital flows.

For a summary index of economic policies, in contrast, which aggregates the information from the two remaining ordinal indicators (that is, indicators dealing with economic policy measures in response to Covid-19), the estimate is always positive and, with one exception, statistically significant at conventional levels. According to these findings, financial relationships benefit from more active policies abroad, policies with which governments provide economic support to reduce the impact of the pandemic. Moreover, it is reassuring to note that the results are remarkably robust.

Next, instead of estimating the average effect over the course of the pandemic, we allow for two separate interaction terms which distinguish between the first (before September 2020) and the second wave (from September 2020 onwards) of the pandemic.5 The results are presented in the lower panel of Table 1, which tabulates estimates for specifications of equation (1) analogous to those that have been reported in the upper panel of the table. Again, the effects of government response measures to Covid-19 on capital flows vary strongly by type of public policies, although many coefficients lack statistical significance at this aggregate level. For containment and health policies, the estimates suggest that stricter measures tend to reduce financial interactions, and this (negative) effect seems to become larger over time. For economic support policies, in contrast, a more active policy stance benefits cross-border financial transactions, with particularly strong effects immediately after the outbreak of the pandemic. One obvious and plausible explanation of this pattern is that the economic costs of Covid-19 increase with the duration of the pandemic.

Reviewing the results using the individual OxCGRT indicators of government response measures, the estimates turn out to be generally in line with our initial findings. German capital flows rarely respond in systematic ways to actions taken by foreign governments in response to the pandemic; the majority of the estimates is statistically indifferent from zero. More importantly, to the extent that an effect of government measures on bilateral financial relationships is identifiable, the results strongly confirm our findings for the composite indices. Hard lockdown policies lead to a reduction in financial interactions, especially the longer the pandemic drags on; also, it seems plausible that the strongest (negative) effects are obtained for ‘workplace closings’. Public interventions providing economic support, in contrast, tend to benefit financial relationships; of the four indicators that track a country’s economic policies, especially the variable recording direct ‘income support’ measures for households enters (mostly) significantly and with a positive sign. Possible explanations are that households and firms have better access to financial resources available for cross-border transfer and that market participants expect the respective economy to better cope with the economic consequences of the pandemic-induced crisis.6

We conclude that cross-border capital flows are sensitive to policies in response to Covid-19. Bilateral financial interactions are negatively affected by stricter lockdown policies abroad, especially the longer the pandemic lasts. Economic support policies, in contrast, tend to benefit capital flows, with the largest effects during the initial phase of the pandemic.

Batini, Nicoletta. 2020. “The COVID-19 Crisis and Capital Flows,” IEO Background Paper BP/20-02/05.

Biewen, Elena and Harald Stahl. 2020. “Statistics on International Financial and Capital Transactions (SIFCT),” Data Report 2020-07 – Metadata Version1. Deutsche Bundesbank, Research Data and Service Centre.

Borgioli, Stefano, Carl-Wolfram Horn, Urszula Kochanska, Philippe Molitor, and Francesco Paolo Mongelli. 2020. “European Financial Integration During the COVID-19 Crisis,” ECB Economic Bulletin. 7/2020: 62-84.

Goldbach, Stefan and Volker Nitsch. 2021. “COVID-19 and Capital Flows: The Responses of Investors to the Responses of Governments”, Deutsche Bundesbank Discussion Paper No. 17/2021.

Lane, Philip R. 2020. “The Macroeconomic Impact of the Pandemic and the Policy Response,” ECB blog post, August 4.

Borgioli, Horn, Kochanska, Molitor, and Mongelli (2020) argue, along similar lines, that, after a short period of systemic stress and fragmentation, there has been a fast rebound of European financial integration which has broadly returned to its pre-crisis levels.

A detailed description of the SIFCT dataset is available in Biewen and Stahl (2020) and at https://www.bundesbank.de/en/bundesbank/research/rdsc/research-data/statistics-on-international-financial-and-capital-transactions-sifct–831698.

The dataset and more detailed information are available at https://www.bsg.ox.ac.uk/research/research-projects/coronavirus-government-response-tracker.

Put differently, this index drops the economic support measures from the overall government response index.

The results remain qualitatively unchanged when we use October 2020 as the start of the second wave.

According to the OxCGRT data description, the variable ‘income support’ records “if the government is providing direct cash payments to people who lose their jobs or cannot work”.