This policy brief summarizes the main findings of a recently published paper: D’Orazio (2023), “Navigating financial stability through the dual challenges of climate change and pandemics”, Current Opinion in Environmental Sustainability, Volume 65, December 2023, 101386, https://doi.org/10.1016/j.cosust.2023.101386.

The paper discusses the impact of the COVID-19 pandemic on the strategic focus of financial institutions regarding climate risks. Before the COVID-19 pandemic, some financial institutions worldwide integrated climate considerations into their operations and promoted sustainable finance through green policies. However, the onset of the pandemic led to a shift in focus towards immediate crisis management, inadvertently reducing the priority of climate risk management and fostering a ‘carbon bias’ by increasing investments in high-carbon sectors. The paper highlights research that stresses the need for a joint strategy addressing climate change and the pandemic’s impact on financial markets. It argues for a coordinated response to these interconnected challenges, emphasizing the importance of aligning crisis management with long-term environmental sustainability for the resilience of the global financial system.

Recent studies highlight that intertwining climate risks and pandemics pose significant challenges for credit markets and the financial sector (Karydas and Xepapadeas, 2022; Pagnottoni et al., 2022).

These risks disrupt economic activities and threaten financial stability, placing central banks and financial supervisors at the forefront of maintaining price stability and safeguarding financial systems (Le Quang and Scialom, 2022). Pre-COVID-19, a growing awareness of climate risks among financial institutions and central banks led to proactive measures, such as climate-related disclosures and sustainable finance initiatives (D’Orazio and Thole, 2022; D’Orazio, 2022, 2023c). These efforts marked a shift towards integrating climate considerations into financial decision-making.

However, the pandemic’s onset and the subsequent policy focus on immediate crisis management overshadowed climate risks, potentially increasing investments in carbon-intensive sectors and hindering environmental sustainability (Feyen et al., 2021; Le Billon et al., 2021; D’Orazio, 2021). The reviews proposed in D’Orazio 2023d surveys recent studies, mainly from the last two years, analyzing the financial risks associated with climate change and pandemics. It investigates their effects on monetary policy and financial stability, along with the global policy responses to these challenges, particularly in the context of COVID-19. The review also highlights a tendency to overlook climate risks in these discussions. It concludes by underlining the need for ongoing research that combines financial, climate, and pandemic risks to guide future policy and practice developments.

Climate change influences monetary policy and financial stability, presenting physical and transition risks, crucial for central banks and regulators (D’Orazio, 2023b). While some nations, especially developing ones, adopted climate-related financial policies (D’Orazio, 2022), many central banks hesitated to embrace green policies (Boneva et al., 2022), because of market neutrality and central bank independence concerns (D’Orazio and Popoyan, 2022; Rossi, 2022; Qanas and Sawyer, 2023). Countries vary in their approaches, with China implementing a dedicated green policy and others like Brazil, India, and Japan using credit measures to support eco-friendly sectors. However, global commitment to climate-related financial policies remains limited, with the G20 focusing on green finance principles and guidelines (D’Orazio and Thole, 2022). The current financial policy framework is inadequate for managing climate risks and promoting sustainable investments, affecting financial system protection (D’Orazio, 2023a).

The COVID-19 pandemic triggered economic downturns, marked by recessions and financial market volatility (Mzoughi et al., 2022). Lockdowns deepened these impacts, particularly affecting high-risk banks (Borri and Di Giorgio, 2022) and global banking stability (Elnahass et al., 2021). Developing countries struggled with healthcare and fiscal challenges, exacerbating economic distress (Gubareva and Umar, 2023), while developed nations responded with fiscal stimulus and central bank interventions (Feyen et al., 2021). This crisis led to innovative monetary policies (Wei and Han, 2021) and underscored the role of pre-pandemic banking regulations (Berger et al., 2021) in bolstering financial resilience.

Climate change and pandemics, notably impacting macro-financial stability, pose systemic risks to the global economy (McKibbin and Fernando, 2021; Walmsley et al., 2023). These challenges, including extreme weather and pandemics, disrupt economies, affect inflation, and influence creditworthiness (Bloom et al., 2022; Berger et al., 2021). The COVID-19 pandemic’s financial response highlighted vulnerabilities exacerbated by climate change (D’Orazio, 2021). Despite the emergence of an ESG premium in financial markets (Ferriani, 2023), environmentally responsible firms have not seen significant financial benefits (Aristei and Gallo, 2023). Neglecting climate risks in fiscal and financial policies perpetuates carbon-intensive investments (Le Billon et al., 2021). Though evolving, research on concurrent climate and pandemic risks lacks a comprehensive framework (Hoffart et al., 2022).

Global financial markets are heavily affected by climate change and pandemics, leading to fluctuations and challenges in market liquidity. Often analyzed in isolation, these risks are interconnected, as demonstrated by the COVID-19 pandemic. The combined impact of pandemics and climate-related events like extreme weather can significantly escalate risks in various financial sectors. This includes increasing credit and market risks, operational difficulties, higher costs for regulatory compliance, and rising insurance expenses. Recognizing and understanding the interplay between these risks is vital for maintaining financial stability. Therefore, developing a thorough framework to evaluate and mitigate these interconnected risks is essential.

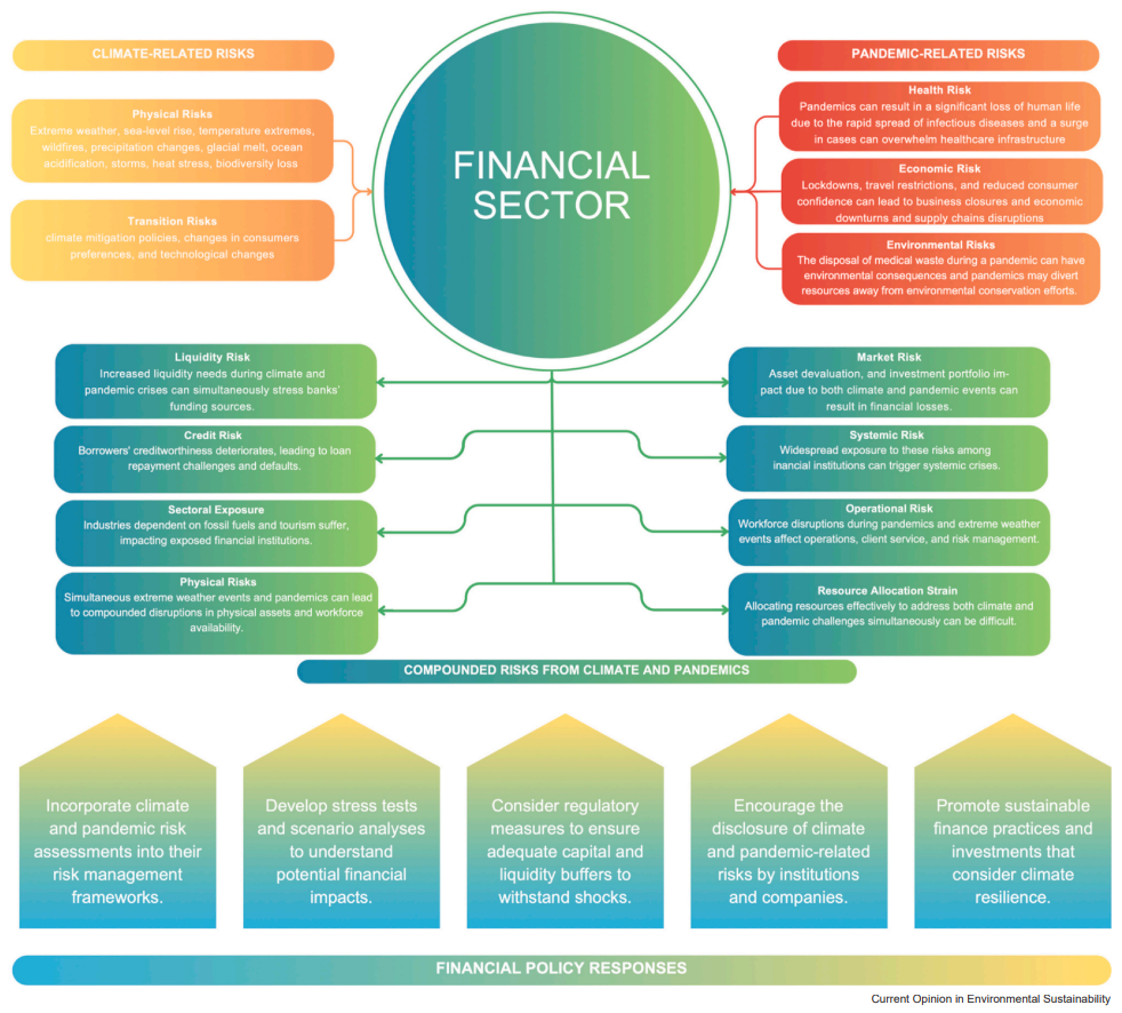

Figure 1 illustrates that climate change introduces immediate physical threats, such as extreme weather, and challenges in shifting towards a climate-resilient economy. Moreover, pandemic-related risks exacerbate these challenges, encompassing direct health impacts and economic strains on businesses and markets. The intersection of these risks, depicted in green, leads to intricate financial issues like liquidity crunches, credit risks, and weaknesses in fossil fuel and tourism-dependent industries.

Emphasizing the need for integrating these risks into financial risk management frameworks, the paper stresses the importance of this approach for sustaining global financial stability. It urges financial entities and regulatory bodies to incorporate these risks into their strategies, advocating for rigorous stress testing and scenario planning to mitigate monetary impacts and strengthen regulatory policies. The paper also calls for transparent risk reporting and adopting sustainability-centered funding practices. A global, coordinated risk management strategy is highlighted as essential to prevent the escalation of local risks into global crises.

The paper also expands on the pivotal role of central banks, which goes beyond mere risk management. It proposes that central banks foster environmentally friendly financial policies, like issuing green bonds, and revise monetary policies to address supply chain disruptions arising from global crises. Additionally, central banks are advised to establish emergency liquidity frameworks to address market instabilities triggered by sudden and severe climate or health events. By implementing these measures, central banks can significantly bolster the financial system’s resilience against climate and pandemic risks, thus fortifying the financial sector against the repercussions of climate change and potential future pandemics.

Figure 1: The diagram maps out how climate and pandemic risks affect the financial sector with a color code: orange for climate threats such as extreme weather, red for pandemics impacting health and economy, and green for their combined effect. It highlights complex challenges (middle of the figure) such as liquidity and credit risks, particularly related to fossil fuel and tourism-dependent sectors. It suggests policy responses (bottom of the figure) such as improved risk management and transparent reporting to ensure financial stability and promote sustainable investments. Source: D’Orazio 2023d.

Aristei, D. and M. Gallo (2023). Green management, access to credit, and firms’ vulnerability to the COVID-19 crisis. Small Business Economics, 1–33.

Berger, A. N., A. Demirgüç-Kunt, F. Moshirian, and A. Saunders (2021). The way forward for banks during the COVID-19 crisis and beyond: Government and central bank responses, threats to the global banking industry.

Bloom, D. E., M. Kuhn, and K. Prettner (2022). Modern infectious diseases: macroeconomic impacts and policy responses. Journal of Economic Literature 60 (1), 85–131.

Boneva, L., G. Ferrucci, and F. P. Mongelli (2022). Climate change and central banks: what role for monetary policy? Climate Policy, 1–18.

Borri, N. and G. Di Giorgio (2022). Systemic risk and the covid challenge in the european banking sector. Journal of Banking & Finance 140, 106073.

D’Orazio, P. (2021). Towards a post-pandemic policy framework to manage climate-related financial risks and resilience. Climate Policy 21(10), 1368–1382.

D’Orazio, P. (2022). Mapping the emergence and diffusion of climate-related financial policies: Evidence from a cluster analysis on G20 countries. International Economics 169, 135–147.

D’Orazio, P. (2023a). Are Current Prudential Frameworks Up to the Challenge of Climate Risks? Intereconomics 58(2), 96–101.

D’Orazio, P. (2023b). Climate change and macro-financial risks: financial policy responses for an orderly low-carbon transition. Environmental Research: Climate 2(1), 013002.

D’Orazio, P. (2023c). A global database for climate-related financial policies. BMC Research Notes 16(1), 1–7.

D’Orazio, P. (2023d). Navigating financial stability through the dual challenges of climate change and pandemics. Current Opinion in Environmental Sustainability, 65, 101386. https://doi.org/10.1016/j.cosust.2023.101386

D’Orazio, P. and L. Popoyan (2022). Realising central banks’ climate ambitions through financial stability mandates. Intereconomics 57(2), 103–111.

D’Orazio, P. and S. Thole (2022). Climate-related financial policy index: a composite index to compare the engagement in green financial policymaking at the global level. Ecological Indicators 141, 109065.

Elnahass, M., V. Q. Trinh, and T. Li (2021). Global banking stability in the shadow of Covid-19 outbreak. Journal of International Financial Markets, Institutions and Money 72, 101322.

Ferriani, F. (2023). Issuing bonds during the covid-19 pandemic: Was there an ESG premium? International Review of Financial Analysis 88, 102653.

Feyen, E., T. A. Gispert, T. Kliatskova, and D. S. Mare (2021). Financial sector policy response to COVID-19 in emerging markets and developing economies. Journal of Banking & Finance 133, 106184.

Gubareva, M. and Z. Umar (2023). Emerging market debt and the COVID-19 pandemic: a time–frequency analysis of spreads and total returns dynamics. International Journal of Finance & Economics 28(1), 112–126.

Hoffart, F. M., P. D’Orazio, and C. Kemfert (2022). Geopolitical and climate risks threaten financial stability and energy transitions. Energy 2004, 2965.

Karydas, C. and A. Xepapadeas (2022). Climate change financial risks: Implications for asset pricing and interest rates. Journal of Financial Stability 63, 101061.

Le Billon, P., P. Lujala, D. Singh, V. Culbert, and B. Kristoffersen (2021). Fossil fuels, climate change, and the covid-19 crisis: pathways for a just and green post-pandemic recovery. Climate Policy 21(10), 1347–1356.

Le Quang, G. and L. Scialom (2022). Better safe than sorry: Macroprudential policy, covid 19 and climate change. International Economics 172, 403–413.

McKibbin, W. and R. Fernando (2021). The global macroeconomic impacts of COVID-19: Seven scenarios. Asian Economic Papers 20(2), 1–30.

Mzoughi, H., A. Ben Amar, F. Belaid, and K. Guesmi (2022). The impact of COVID-19 pandemic on islamic and conventional financial markets: International empirical evidence. The Quarterly Review of Economics and Finance 85, 303–325.

Pagnottoni, P., A. Spelta, A. Flori, and F. Pammolli (2022). Climate change and financial stability: Natural disaster impacts on global stock markets. Physica A: Statistical Mechanics and Its Applications 599, 127514.

Qanas, J. and M. Sawyer (2023). ’independence’ of central banks and the political economy of monetary policy. Review of Political Economy, 1–16.

Rossi, S. (2022). The political benefits of ’unconventional’ monetary policies in times of crisis. Review of Political Economy, 1–13.

Walmsley, T., A. Rose, R. John, D. Wei, J. P. Hl´avka, J. Machado, and K. Byrd (2023). Macroeconomic consequences of the COVID-19 pandemic. Economic Modelling 120, 106147.

Wei, X. and L. Han (2021). The impact of COVID-19 pandemic on transmission of monetary policy to financial markets. International Review of Financial Analysis 74, 101705.