Covid-19 policy response and the role of the EIB

A global, unprecedented crisis

What started as a local outbreak in China is now a pandemic and a global economic crisis. By the end of April 2020, countries representing some 70% of world GDP were in a form of lockdown, to slow the spread of Covid-19 contagion. The sudden supply and demand shocks, exacerbated by uncertainty, disruptions to mobility, trade and global value chains, are creating an almost unprecedented economic situation.

In the short run, travel, tourism, consumer services and retail have been hit immediately, as have those sectors closely dependent on global value chains and trade, like automotive and machinery and equipment manufacturing. But the effects of the lockdown and the associated collapse of demand and trade have been quickly spreading to the rest of the economy. The IMF is now forecasting -3% world GDP growth in the baseline scenario and some -7% growth in the EU in 2020. This will be a much more serious recession than the one induced by the global financial and sovereign debt crisis. With uncertainty remaining high (with regard to the future trajectory of the pandemic, the consequences of the lifting of lockdown measures and ultimately the timing of possible vaccine availability) the economic policy response needs to be swift and strong, targeting short-term liquidity, but also medium to long-term challenges.

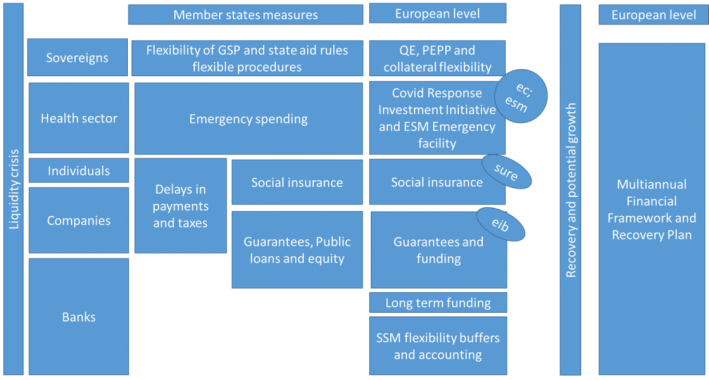

The economic policy response so far has been rapid and multi-faceted. In the EU, measures have included:

− Long-term financing for banks, by the ECB and other central banks, with substantially eased collateral requirements.

− The use of banks’ capital and liquidity buffers allowed by regulators, with supervisors signalling a through-the-cycle interpretation of IFRS9 and milder approaches to accounting for forbearance initiatives. This has been accompanied by strict rules in monitoring credit quality developments and a request that banks temporarily suspend dividend payments and share buy-backs.

− Substantially enhanced offer of guarantee schemes.

In addition, a European package is in the making, one that will complement existing national initiatives, internalising the strong cross-border spill-overs of policy action by Member States.

Figure 1: Covid 19 response package in the EU

The EIB response is an integral part of the package, dealing with corporate and SMEs liquidity and funding issues.

For the corporate sector, the immediate challenge is a liquidity crisis. Social distancing, population confinement and mandatory closures of commercial activities lead to a sharp contraction in economic activity. Despite reduced cash inflows, corporations still need to honour their obligations towards employees, lenders, providers of intermediate goods and other services. As the crisis extends, companies increasingly deplete their cash hoarding, face liquidity shortfalls and ultimately fall into bankruptcy if not supported by public intervention.

EIB economists have been assessing the liquidity shortfall for the European non-financial corporations, using a comprehensive dataset of EU non-financial corporates balance sheet from all size classes (EIB computations based on ORBIS). First estimates suggest a rather dramatic impact on liquidity. In a lockdown scenario, with no policy intervention, some 70% of EU firms would enter into liquidity shortfalls in three months. Policy interventions, including partial support for salary and social contributions and grace periods on debt, might reduce the share of firms facing liquidity constraints after three months to some 50%.

Action to contain bankruptcies due to short-term liquidity problems immediately appeared as a necessary condition for the economy to rebound after the crisis. As experienced during the sovereign debt crisis, liquidity-driven bankruptcies damage production capacities and lead to persistent activity weakness. Moreover, liquidity is not the only concern. Non-financial corporations in Europe face long-standing needs for increased investment: in innovation, in new firms and dynamic sectors, to accelerate the adoption of digital technologies and to adapt to new climate change related targets.

The EIB Group, as the bank of the European Union, with European Member States as its shareholders, has been acting swiftly under its remits to react to the crisis and inject liquidity into the system. Immediate action has been focused on speeding up the disbursement of signed operations and topping up the financing of projects which had already been assessed, by expanding the share of eligible assets and the EIB co-financing share. The EIB has also been quick in further deployment of dedicated liquidity lines, guarantees and ABS purchase programs. On top of that, the EIB group has been assessing options for bridging loans, credit holidays and other measures designed to alleviate liquidity and working capital constraints for SMEs and mid-caps. The immediate financing package consisted of some EUR 28 bn support for SMEs.

However, the shock on the economy and the urgency of easing the liquidity crisis for the corporate sector, particularly SMEs, has made further action imperative. As a second step, on April 9, the EU Finance Ministers have endorsed the EIB proposal to create a EUR 25 billion Guarantee Fund, which will enable the EIB Group to mobilise up to EUR 200 billion in funding for viable firms affected by the crisis. EU Member States will contribute to the guarantee fund pro-rata. The Fund is intended to be temporarily, focusing on addressing the Covid-19 shock, but could form a bridge between the crisis and the recovery periods.

Leveraging on this additional firepower, the EIB Group will unlock financing to the real economy by ramping up guarantees to local lenders, national promotional institutions and other financial intermediaries. The EIB and EIF have years of experience in these products. Through an existing network of hundreds of counterparts, they can quickly channel financing to the markets and sectors most in need. The products to be rolled out will likely be dominated by capped (first loss) and uncapped guarantees on portfolios of SME loans originated by local lenders and other forms of risk-sharing on new and existing corporate loan portfolios. Some of these will provide regulatory capital relief. Other products will also be considered, including participations in Asset Backed Securitisations to free up lending capacity, as well as equity investments in venture capital and private equity funds supporting innovative firms. This fund should also allow the EIB to counter-guarantee some national guarantee schemes, thus increasing their firepower and diversifying risk across the EU.

The EIB response, complementing national initiatives, is crucial to ensure a level playing field at the European level and to internalise spill-overs. With the European economy being strongly integrated, positive and negative spill-over effects are important. The EIB’s own data suggests that 40% of the long-term impact on growth and jobs from the operations we finance comes from cross-border spill-overs. Europe’s venture capital and innovation ecosystems are trans-national by nature – no individual Member State has adequate incentives to fully protect them – calling for a pan-European perspective and policy instrument. Also, diversification naturally matters in a guarantee product. By pooling credit risk across all of the European Union, the overall average cost of the fund could be reduced, in comparison to national schemes.

Short-term efforts must be focused on tackling the direct impacts of the crisis. However, as we look to longer-term recovery, we must switch focus to creating a more competitive, sustainable and resilient European economy, addressing structural failings that were already there, and are only becoming more urgent. Three key challenges facing Europe, in our view, are:

As awful as the pandemic is, we must hope that in the end, it provides an opportunity to restart in a better way. Returning to the status quo would be a failure.

The views expressed are those of the author and do not necessarily reflect those of the European Investment Bank.