This policy note analyses recent developments of corporate investments and financing conditions in the European Union (EU) with a view to understanding the pick-up in non-financial firm investment and in financial flows. In the current recovery, part of the EU economy is still following a deleveraging path, be it for firms or banks. This explains the specificity of the current overall modest rebound in investment and financial flows, supported by very accommodative monetary policies, an overall slightly supportive fiscal policy, and specific policies to target investment, such as the European Fund for Strategic Investments. Although access to finance is not a major concern overall, as financial costs are low and liquidity available, clear bottlenecks remain, particularly in some countries and for certain segments of firms. The European Investment Bank Investment Survey (EIBIS 2017) provides a picture at the micro level of firms of the impediments to investment arising from financial factors. Taking account of both, access to external finance and the tendency to be content to rely on internal financing capacity, some economies, mostly in the periphery and cohesion groups, still face challenging conditions. These are mostly linked to costs and the availability of collateral. In addition, some specific types of firms, such as young, innovative and/or small businesses, are confronted with a more adverse financial environment.

1. The macro-financial environment

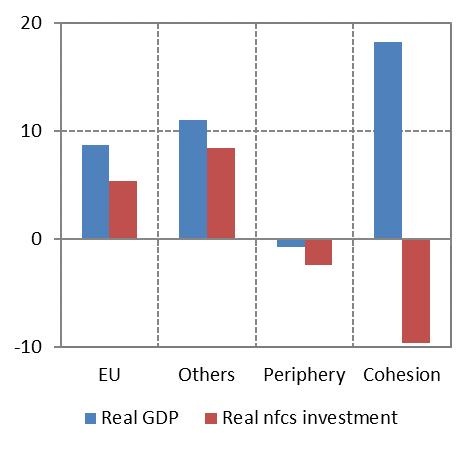

The pre-crisis versus post-crisis gap in GDP has closed, and the recovery in Europe has become broadly based. In 2017, nine years after the bankruptcy of Lehman Brothers in the United States, GDP in the European Union was, above its 2008 level by around 9% in real terms (Figure 1). As of date, real GDP stands 18% above pre-crisis levels in the cohesion economies, 1% below pre-crisis levels in the countries of the periphery, and 11% above pre-crisis levels in the other economies (comprising primarily of the Euro core countries).1 For the periphery countries, there is wide diversity in terms of macro-economic performance in recent years, with the gap vis-à-vis pre-crisis levels being substantial in Greece and, to a lesser extent, Italy and Cyprus whereas, the gap is closed in Portugal and Spain. Ireland’s GDP is well above its pre-crisis level. Overall, a large majority of countries in the EU now have a level of activity above the pre-crisis level.

Figure 1 – GDP and corporate investment in 2017 versus 2008 (change %)

Source: ECON calculations based on Eurostat

Note: Change in real terms compiled using GDP deflator. Owing to data limitations, the cohesion category consists of the Czech Republic, Estonia, Poland and Romania only. NFCS: non-financial corporate sector.

Corporate investment is recovering

Corporate investment lags behind GDP growth in this recovery, most likely due to a long debt-deflation episode. While the corporate sector has been the first to positively contribute to investment recovery, corporate investment still lags behind GDP (Figure 1). It has increased compared to the pre-crisis level in the other economies category, but by less than overall GDP. Conversely, in the cases of the EU as a whole and the periphery and cohesion economies, corporate investment is still below the pre-crisis level. Two main paradigms have been developed to explain the disappointing investment recovery despite low interest rates. First, the muted recovery, after a very severe crisis, is explained by the very strong headwinds resulting from the deleveraging pressure in the context of the burst of the “financial cycle.” The second paradigm reflects structural factors and the adjustment towards “secular stagnation” associated with ageing, a decline in productivity, and the savings glut.

Each analysis has very different implications in terms of the outlook and the policies required. For the latter, the permanent decline in potential output triggers a permanent decline in the neutral rate of interest (Laubach and Williams, 2016). For the former, the adjustment in the financial sector and the deleveraging of banks, firms and households makes the downturn stronger and longer. Until the summer of 2016, views were very much split between secular stagnation and the super-debt-cycle view (EIB, 2016). Following the start of the hiking phase in the US and, more generally, the steepening of the yield curve in most advanced economies, it now seems most likely that the length and severity of the recession was linked to a major debt deflation episode. While some analysts continue to advocate the secular stagnation scenario, most of the fears have vanished (EIB, 2017).

The risks attached to the monetary policy normalisation

Reflecting the low rate of inflation, interest rates in Europe remain exceptionally low. In contrast, the US Federal Reserve has raised interest rates four times since the end of 2016. Estimates suggest that European financial conditions are supportive (Draghi, 2017). The assessment of the monetary stance is complicated owing to the many instruments currently used and the need to account for the transmission of the various measures to the real economy. The repricing of assets aims to influence the conditions for accessing external finance for the corporate sector. For that matter, the monetary policy stance is one input among others and more encompassing indicators must be elaborated (Darracq-Parries et al., 2014). Overall, the signal shows that in Europe, financing conditions are supportive, an assessment shared by most developed economies (IMF, 2017). Nevertheless, uncertainty is high in the real economy, while its pricing in the financial markets is at historically low levels. This suggests an under-pricing of risk, possibly reflecting the search for yields in a context of very ample liquidity. The normalisation of monetary policy in Europe could be accompanied by large volatility when it happens and a substantial portfolio rebalancing away from equities and into safer bonds.

Improving the policy mix in Europe

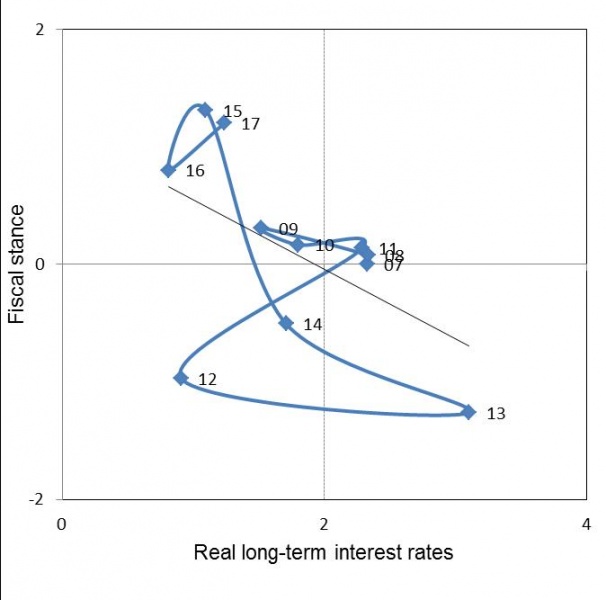

The length of the European crisis suggests that the policy mix in Europe is not efficient and that improved coordination between fiscal and monetary policy is warranted. Indeed, Figure 2 reveals how weakly coordinated the two policies have been since the crisis. A coordinated policy mix should result in synchronised stances, whereby the observations would occur in the lower-left or upper-right quadrant of Figure 2. However, it appears from the figure that most of the time since the crisis, policies in Europe have pulled the economy in opposite directions: the tightened fiscal stance, such as that over the last three years, was accompanied by loose monetary policy.

Figure 2 – The policy mix in Europe

Source: ECON calculations based on AMECO and Thomson Reuters Datastream.

Note: The fiscal stance is measured as the change in the cyclically adjusted net lending or borrowing of the general government as reported in AMECO. Real long-term interest rates are computed by subtracting past annual GDP inflation from the 10-year government bond yield.

2. Corporate balance sheet adjustments and sources of finance

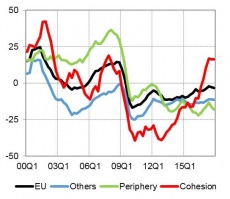

Corporate investment continued accelerating in 2017. A striking feature of the post-crisis period is that, overall in the EU, the corporate sector has become a net saver (Figure 3). This means that the amount of investment is below the financing capacity of the corporate sector as a whole and that this sector now provides savings to the rest of the economy or the rest of the world. In this context, it is interesting to recall that, during the recovery and in a context of moderate cost increases, stronger demand has enabled companies to increase their volume of sales as well as their margins. This has resulted in increased gross entrepreneurial in-come and therefore more internal financing capacity.

Figure 3 – Net borrowing over investment (%; non-financial corporate sector only, nominal)

Source: ECON calculations based on EUROSTAT sectoral accounts.

Note: Four-quarter moving average of non-seasonally adjusted data. Data up to 2017:Q4, Partially estimated.

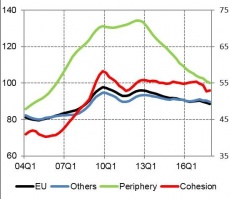

Corporates have stopped increasing their indebtedness

Becoming net savers, European firms have improved their financial position partly by reducing debt, and partly by accumulating financial assets. Indeed, some deleveraging has taken place in the EU, mostly in periphery economies (Figure 4). In this group of countries, the ratio of corporate debt over GDP from 2012 until the end of 2017 declined by around 20 percentage points of GDP. This evolution contributed to a quasi-closure of the gap with the other economies. In order to better understand corporate investment decision in EU economies, the EIB launched in 2016 the EIB Investment Survey (EIBIS). This is an EU-wide survey that gathers qualitative and quantitative information on investment activities by SMEs and larger corporates, their financing requirements and the difficulties they face.2

Figure 4 – Corporate debt over GDP (%)

Sources: ECON computation based on Eurostat sectoral accounts.

Notes: Data up to 2017:Q1. Four-quarter moving average. The debt is comprised of bank loans and debt securities. Italy is not included in the periphery aggregates given data availability.

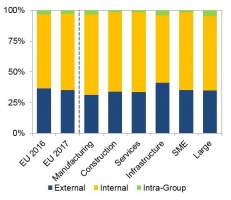

According to the latest EIBIS results, firms across the EU finance most of their investment (62%) via internal financing (Figure 5). Among sectors, infrastructure firms use the lowest proportion of external finance. Across countries, firms in Greece (81%), Cyprus (79%) and Slovenia (78%) are more likely to use a higher share of internal finance, while firms in France (51%), Italy (44%) and Belgium (43%) use the highest share of external finance.

Figure 5 – Source of internal finance (%)

Sources: EIBIS2016 and EIBIS2017.

Note: Base: All firms that invested in the last financial year (excluding don’t know/refused responses). Q: What proportion of your investment was financed by each of the following?

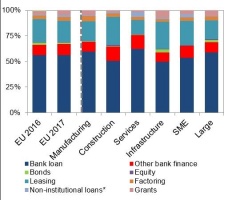

External financing remains mostly bank based

Bank loans accounted for the highest share of external finance (56%), followed by leasing (21%) (Figure 6). This is largely consistent with the previous survey wave of the EIBIS. Across sectors, manufacturing (60%) and service (62%) firms are more likely to use bank loans than other sectors, while construction (27%) and infrastructure (26%) are relatively more reliant on leasing compared to other sectors. In the EU, firms in Malta (82%) and Cyprus (81%) are the most likely among EU countries to use bank loans. During the crisis, leverage exerted a strong and negative effect on the level of investment, and firms with more debt invested less and small firms located in the periphery reduced investment even more. Moreover, firms able to generate internal resources and firms engaged in multiple banking relationships were able to alleviate financial frictions and shield investment(Bruno, D’Onofrio and Marino, 2017).

Figure 6 – Type of external finance used for investment activities (%)

Sources: EIBIS2016 and EIBIS2017.

Note: SME: small and medium-sized enterprises. Base: All firms that used external finance in the last financial year (excluding don’t know/refused responses).

Q: What proportion of your investment was financed by each of the following?

* Loans from family, friends or business partners

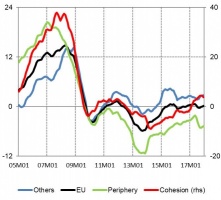

The decline in bank lending rates was associated with the continuation of the very subdued recovery in bank loans. Those are the most important source of external finance for firms in the EU (Figure 6), with outstanding amounts close to 50% of GDP. The recovery in bank loans continues to remain very subdued across the EU apart from in the cohesion economies (Figure 7).

Figure 7 – Bank loans (annual growth rate, %)

Source: ECON estimations based on ECB and Eurostat.

Note: Data up to December 2017.

3. Access to finance

Access to external finance not the most pressing concern overall …

Overall, seven per cent of firms are finance constrained, according to the 2017 EIBIS survey.3 The survey also shows that availability of finance is not considered by firms as the main barriers for businesses across the EU.4

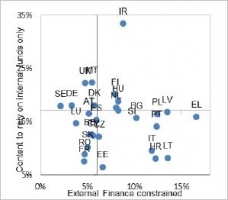

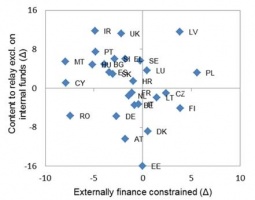

However, looking at the external finance constraints alone can be misleading because, in the first wave of the EIBIS, this indicator is derived from firms investing and using external finance. In the 2017 EIBIS, 16% of firms that did not seek external finance in the EU reported that their main reason for not doing so was because they were content to use internal funds or did not have a need for external finance. SMEs were notably more likely to be content with relying on internal finance than large businesses (19% compared with 12%). herefore, we analyse external finance in relation to internal finance, which is known as the financing cross. Figure 8 plots the share of firms that were constrained in terms of external finance against the share of firms that did not seek external finance because they felt that they had enough internal funds to finance their investment activities. The figure shows significant differences in financing conditions across countries (both in terms of access to external funds and internal-cash-generating capabilities), with as few as 2% of firms constrained in terms of external financing in Sweden and as many as 17% in Greece. Similarly, the highest share of firm’s content to rely exclusively on internal funds to finance their investment activities is 33% in Ireland, which stands in sharp contrast to only 6% of firms in Estonia.

Financing conditions (for investment activities) remain problematic in some countries, particularly Greece, Lithuania, Croatia, Italy and Portugal. These countries are located in the bottom right quadrant of Figure 8, which includes all those instances in which the share of financing-constrained firms is above the EU average. The share of firms content to rely on internal funds to finance their investment activities, in contrast, is below the EU average.

In Ireland, Finland, Hungary and the Netherlands, the financing situation appears polarised. On the one hand, there are relatively large segments of companies that are cash rich and content to fund their investment activities without reverting to external funding. On the other hand, a large group of firms in these countries depends on external finance but struggles to access it, strongly suggesting two polar worlds in terms of firms’ access to finance. Low investment and high profitability make access to finance less of an issue for firms’ investment activities in Germany, Sweden, Luxembourg and Austria. In these countries, the share of firms that are constrained in terms of external finance is below 4%. At the same time, more than 15% of firms in these countries are so cash rich that they do not need external funds to finance their investment activities. Further analyses suggest that the latter phenomenon is driven both by relatively low investment activities and high profit margins.

Figure 8 – Financing cross – level (% of firms)

Sources: EIBIS2016 and EIBIS2017.

Note: Base: All firms. Data derived from the financial constraint indicator and from firms indicating that the main reason for not applying for external finance was that they were “happy to use internal finance/didn’t need finance.” The financial constraint indicator includes firms dissatisfied with the amount of finance obtained (received less), firms that sought external finance but did not receive it (rejected) and firms that did not seek external finance because they thought borrowing costs would be too high (too expensive) or they would be turned down (discouraged).

… Access to external finance is improving

Nonetheless, over the last year, access to external financing improved in most countries. Figure 9 shows how the share of firms that are finance-constrained evolved over the past year. The changes in opposite directions (in terms of access to external finance and reliance on internal sources of finance) can be explained by the general improvement in the economic climate, which helps bring down barriers to accessing external funds and, at the same time, boosts firms’ own capabilities to generate cash.

Figure 9 – Financing cross–Change

Sources: EIBIS2016 and EIBIS2017.

Note: See Figure 8.

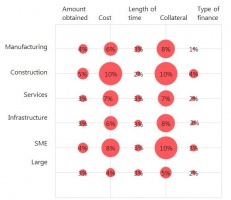

A more detailed understanding of the financial offer is required

When asked in the 2017 EIBIS about the sources of their dissatisfaction with the external finance received, firms cited collaterals as the first source of dissatisfaction, just above the cost (Figure 10). Indeed, a small share of EU firms that used external finance was dissatisfied overall with the amount, cost, maturity, collateral or type of financing received. Looking into details, collateral require-ments and the cost of funding remained the main areas of concern, with EU firms most dissatisfied with the associated collateral (8%) and cost (6%) of securing external finance. The type of finance, its maturity and the amount, on the other hand, mattered much less.

Figure 10 – Dissatisfaction of firms with type of finance offered and received (% of respondents)

Sources: EIBIS2016 and EIBIS2017.

Base: All firms who used external finance in the last financial year (excluding don’t know/refused responses)

Q. How satisfied or dissatisfied are you with ….?

The figure signifies the share of firms that are dissatisfied (fairly or very) with a particular feature of the finance that they received or were offered.

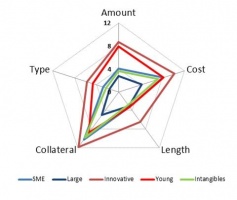

However, 8% of small and medium-sized enterprises (SMEs) were dissatisfied with the cost of external finance, double the percentage of large firms dissatisfied with that cost. Construction firms generally showed higher levels of dissatisfaction compared to other firms. Moreover, SMEs were more likely than larger firms to be dissatisfied with the collateral required to secure external finance. Across economies, there was a relatively larger share of firms unhappy with the cost of obtaining external finance, particularly in Greece, Ireland, the Netherlands, Portugal and Slovakia – economies that mostly stand in the higher part of the distribution of finance-constrained firms across the EU.

Overall, firms are most dissatisfied with the collateral requirements associated with obtaining funding. This is most true for firms in Croatia, Cyprus, Greece and Lithuania (with about one in five companies saying that they are either fairly or very dissatisfied with the collateral require-ments linked to their funding in these countries). Like all the other sources of possible dissatisfaction, however, the proportion of firms dissatisfied with collateral and cost has fallen since the previous wave of the EIBIS.

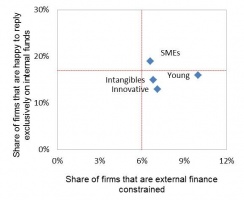

And bottlenecks need to be lifted in order to foster long-term growth

Despite improvements in financing conditions and better access to finance in some parts of Europe, there are segments where access to finance remains difficult. Figure 11 plots the share of finance-constrained firms against the share of firms that are content to rely exclusively on internal sources of finance to fund their investment activities for four different types of corporations. In line with a large body of literature that argues that all of these segments are susceptible to market failures that entail financial frictions, the figure shows that for innovative firms, firms investing relatively more in intangibles, young firms and SMEs, access to external finance tends to be worse than for the average firm in Europe.

In addition, their capacity to generate sufficient internal funds to finance investment activities is poor(er). SMEs are a slight exception to the latter observation, most probably because of generally more modest investment activities in the last financial year.

Figure 11 – Financing cross by type of firms (% of respondents)

Source: EIBIS2017.

Note: The red cross indicates the EU average. SMEs: small and medium-sized enterprises.

Base: All firms who used external finance in the last financial year (excluding don’t know/refused responses)

Q. How satisfied or dissatisfied are you with ….?

INNOVATIVE: firms that allocated more than one third of their investment spent to the development and introduction of new products; processes and services; YOUNG: firms that are younger than 5 years;

INTANGIBLES: firms that allocated a relatively large share (+50%) of their investment spent to intangibles.

While overall access to finance is not among the most prominent impediments to firm investment overall in the EU, clear bottlenecks remain, particularly in some countries and for certain segments of firms, including smaller and younger firms as well as innovative firms and those with a higher investment share in intangibles (Figure 12).

Figure 12 – Dissatisfaction of firms with type of finance offered and received (% of respondents)

Sources: EIBIS2016 and EIBIS2017.

A clear need to diversify sources of finance…

While loan growth has remained subdued, a rebound in equity issuance has been remarked since the beginning of 2014 and continued in 2017. The relatively strong issuance activity is to some extent explained by the higher stock price, which contributes to lowering the cost of equity.

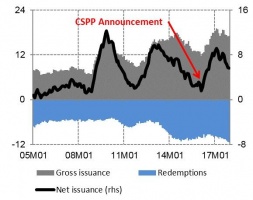

The outstanding amount of non-financial corporate debt securities represents 11.5% of GDP at the end of 2017, a share well below that of corporate bank loans. To some extent, the corporate debt market is catching up in the EU and has been growing faster than GDP for a long time. There is also evidence that the ECB Corporate Sector Purchase Programme (CSPP) launched at the beginning of 2016 has been accompanied by an acceleration of debt issuance activity, as shown in Figure 13.5 Being spread out geographically, the stronger activity was nonetheless focused on large corporations, since, by their nature, they are more inclined to issue debt securities. However, stronger debt market activity can also indirectly benefit SMEs if it is accompanied by stronger market activity fostering the issuance of asset-backed securities. Moreover, by reducing the demand for bank loans, debt issuance liberates resources for the banking sector to lend to SMEs.

Figure 13 – Issuance of longer-term non-financial corporate debt (% per year)

Source: EIB/ECON calculations based on ECB.

Note: Monthly data up to December 2017. CSPP: Corporate Sector Purchase Programme.

Recent experience shows that strong reliance on debt can negatively affect firms’ resilience in times of crisis. Following the financial crisis, companies in Europe suffered from severe debt overhang that depressed corporate investment. In addition, as investments in intangible goods have become ever more important in the asset mix of firms, a heavy reliance on debt finance is likely to stifle investment activities going forward because of a lack of collateral associated with this type of asset, making access to debt finance more difficult.

To better understand why firms continue to rely so much on debt and so little on external equity for their investment activities, a randomised online experiment has been conducted in the framework of the EIBIS 2017.6 The results suggest that even if we account for the fact that companies have a desire to keep voting rights to themselves and that equity is often more expensive than debt (that is, having a higher required return), firms tend to prefer debt over equity. Part of this may be due to tax codes that favour debt financing over equity financing, as interest rate payments are tax deductible.

Firms with better growth prospects are more likely to accept equity offers than firms with poor growth prospects. However, even for firms with positive growth prospects, loans remain generally more desirable than equity. Large companies are general-ly willing to pay higher interest rates to avoid equity finance than smaller firms. Moreover, firms in countries with a French and socialist legal origin, as well as firms that undertake large investment projects, are less willing to pay to avoid equity financing. The interest rates that make firms indifferent between a loan offer and the benchmark equity offer is, however, in all cases higher than the cost of equity, reflecting a general aversion towards the use of external equity.

…Especially for SMEs

SMEs cannot access corporate debt markets – much less the stock market – and must borrow from banks at more expensive rates. Various actors target SME lending as a policy goal, on the assumption that asymmetric information generates sub-optimal provision of loans to SMEs. Among these are national promotional banks and international financial institutions, including the EIB Group (the EIB and its sub-holding, the European Investment Fund, EIF). Various incentives have been set up to support SMEs’ access to finance, including favourable lending conditions, credit guarantee schemes, guarantees on issuances of mini-bonds, and various forms of incentivised venture capital and private equity funding. Credit guarantees are extensively used by financial institutions in Western Europe, as they provide incentives for banks to lend to SMEs on more favourable terms by insuring part of the credit risk. Those instruments have turned out to be particularly relevant in the aftermath of the crisis, especially when they provide capital relief to the banks (Chatzouz et al., 2017).

Given that SMEs have almost no direct access to the capital markets and that (particularly in Europe) they rely heavily on bank lending, a functioning securitisation market can transform illiquid loans to SMEs into an asset class with adequate market liquidity and can as such provide indirect access to capital markets for SMEs (Kramer-Eis et al, 2015). As more equity finance supports the stability of the system, equity investments should be made more attractive through proper incentives. To spur equity financing governments might, therefore, want to consider equalising the tax treatment of equity and debt. This makes equity more favourable for firms. In addition, governments could consider the treatment of venture capital in a more favourable way. Finally, reconsidering business regulation at the European level (for example, disclosure requirements) might incentivise small and medium-sized enterprises to issue more external equity and thereby boost their investment.

5. Concluding remarks

This policy note has analysed the macro-financial environment of European firms with a view to explaining the financial factors possibly hindering their investments. Since the middle of 2016, the macroeconomic and financial situation has continued to improve in the European Union, and more recently, some indicators have pointed to an acceleration in corporate investment. Financial conditions are supportive, and to a large extent the current recovery still hinges on the very accommodative monetary policy stance that should remain in place for some time.

However, external financing flows such as bank loans remain subdued despite low financial costs, as companies continue deleveraging. Across the EU, firms’ balance sheets are stronger and in many ways they no longer differ between the periphery and the other economies group. While financial conditions have loosened and access to external finance is not a major source of concern for non-financial corporations, some enterprises still have difficulties accessing external finance. This is a source of concern for those firms that do not generate enough internal financing because of their size, age, or innovative profile. In the short-to medium term, it is key to continue accompanying corporations facing more adverse access to external finance for reasons outside of their scope. This becomes even more urgent to prevent possible bottleneck in the distribution of credits as external financing needs expand along the recovery. The European Fund for Strategic Investment is a key element in this regard. The instruments developed under its umbrella enable to address frictions in very pecific segments of the financial markets. In the longer-term, it is important to continue working on the integration of the EU financial system and put in place the conditions for the flows of savings to reach their most efficient use within Europe. It is also important to increase the resilience of the corporate sector to financial shocks, by fostering the diversity of financial sources, not only-bank finance but also market finance. Progress accomplished under the Capital Market Union are key in this regard.

Bruno B., D’Onofrio A. and Marino I. (2017). “Financial Frictions and Corporate Investment in Bad Times. Who Cut Back Most?” CEPR Discussion Paper 12003. Centre for Economic Policy Research, London.

Brutscher, P.B., Heipertz, J. and Hols, C. (2017). “Loan Characteristics, Firm Preferences and Investment: Evidence from a Unique Experiment.” EIB Working Paper 3. European Investment Bank.

Chatzouz, M., Gereben, A., Lang, F. and W. Torfs, (2017). “Credit Guarantee Schemes for SME Lending in Western Europe.” EIB Working Paper 2017/02 and EIF Working Paper 2017/42. European Investment Bank.

Darracq-Parries, M., Maurin L. and Moccero, D. (2014). “Financing Condition Index and Identification of Credit Supply Shock for the Euro Area.” International Finance, 17(3), 297–321.

Draghi, M. (2017). “Accompanying the Economic Recovery.” Introductory speech at the European Central Bank Forum on Central Banking, Sintra, 27 June.

ECB. (2017). “Impact of the ECB’s Non-standard Measures on Financing Conditions: Taking Stock of Recent Evidence.” Economic Bulletin, Issue 2. European Central Bank, Frankfurt.

EIB. (2016). “Investment and Investment Finance Report.” European Investment Bank.

EIB. (2017a). “From recovery to sustained growth.” European Investment Bank.

EIB. (2017b). “EIBIS 2016/2017: Surveying Corporate Investment Activities, Needs and Financing in the EU.” European Investment Bank Economics Department.

IMF. (2017). “Global Financial Stability Report: Measuring Financing Conditions.” Washington, DC: International Monetary Fund, April.

Kraemer-Eis, H., Passaris, G., Tappi, A. and Inglisa, G. (2015). “SME Securitisation – At a Crossroads?” EIF Research & Market Analysis Working Paper 2013/031. European Investment Fund.

Laubach T., and J. C. Williams, (2016), “Measuring the natural rate of interest redux”, Business Economics, April, vol. 51, issue 1, pp. 57-67, December.

The countries in the Cohesion group are all those that joined the EU in 2004 and later. All these countries have embarked on a path of convergence with more advanced EU economies and are recipients of EU Structural and Cohesion Funds. Periphery countries are EU Member States that were affected by the economic and financial crisis more than the other countries. They include Cyprus, Greece, Ireland, Italy, Portugal, and Spain. While some of these economies have become much more dynamic, the similarities in their recent economic histories are still relevant. The group of Other EU members comprises the remaining ten EU Member States: Austria, Belgium, Denmark, Finland, France, Germany, Luxembourg, the Netherlands, Sweden, and the United Kingdom.

http://www.eib.org/about/economic-research/surveys-data/investment-survey.htm

That is, firms that applied for external finance for their investment activities and were rejected; received less than what they asked for; did not take up the offer because they felt that it was too expensive; or did not apply in the first place because they were afraid of getting rejected.

The main barriers are considered to be the lack of staff with the right skills and uncertainty over the future. Business and labour market regulations remain also significant constraints. See EIB (2017b).

The CSPP was announced in March 2016. See ECB (2017) for an overview of the policy reaction to the crisis.

The experiment worked as follows: First, firms had to state which amount they wanted to finance externally (either in euros or their local currency) and which maturity this financing should ideally have. Second, based on the desired amount and maturity as well as the funding situation in the firm’s country, a sequence of pairs of hypothetical loan offers was generated through independent random draws from uniform distributions over the various financing characteristics. One of these characteristics was whether the financing offer was an equity participation or a loan offer. Firms were then asked which offer they preferred. In total, 973 firms participated in the experiment.