The views expressed in this article are those of the authors and do not necessarily represent the views of Banca d’Italia or the Eurosystem. The note is based on the Banca d’Italia Occasional paper “Credit strikes back: the macroeconomic impact of the 2022-23 ECB monetary tightening and the role of lending rates”.

Abstract

The sustained rise in euro area inflation, which started in the summer of 2021, required a strong and exceptionally rapid monetary policy response by the European Central Bank. The unprecedented sequence of policy rate hikes in 2022-23 was strongly transmitted to the cost of credit. Banks’ risk perception was a key driver of the policy transmission. The tightening of monetary policy is continuing to exert a negative impact on euro area real GDP growth and inflation in 2024, with a significant contribution from the bank lending channel.

A recent paper (Conti, Neri, Notarpietro, 2024; hereafter CNN) provides a comparative analysis of the ECB tightening cycles of 2005-07 and of 2022-23, with a focus on the cost of credit to non-financial corporations (NFCs), and assesses quantitatively the transmission of the ECB tightening in 2022-23 to the euro area economy.

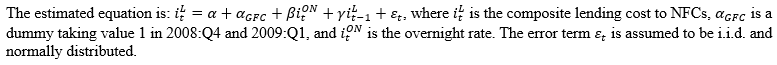

A simple linear regression of the composite cost of lending to NFCs on the overnight rate produces out-of-sample forecast errors that are very small in the 2005-07 tightening cycle compared to the 2022-23 cycle (Figure 1).#f1 The unprecedented pace and magnitude of policy rate hikes in 2022-23 make comparisons with previous tightening cycles particularly difficult. Nevertheless, the differences in out-of-sample forecast errors from a simple linear regression of lending rates on the overnight rate suggest that additional factors beyond monetary policy may have been at play during the 2022-23 tightening cycle.

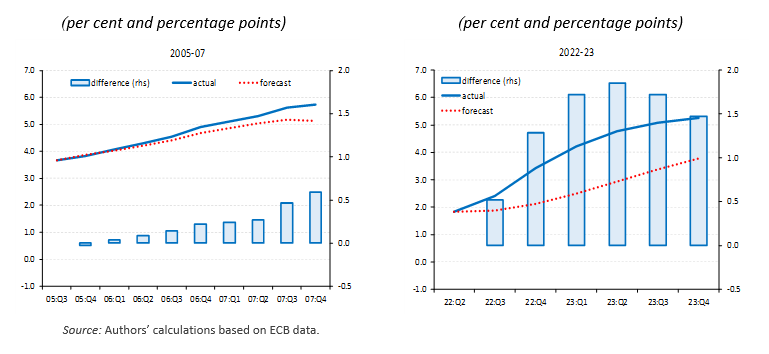

Banks’ assessment of firms’ riskiness as borrowers emerges as a key difference when comparing the economy at the start of the 2005-07 and the 2022-23 tightening episodes. During the latter tightening cycle, banks’ risk perception evolved dramatically as policy rate hikes unfolded and rapidly became the main driver of banks’ lending decisions. This is in stark contrast to the 2005-07 episode. CNN conducts a counterfactual exercise using a Bayesian Vector Auto Regressive (BVAR) model. The estimated BVAR includes the cost of credit to NFCs, short- and long-term interest rates and the Bank Lending Survey (BLS) risk perception factor. The model is used to produce a conditional forecast of lending rates. The results show an almost perfect fit of the realized pattern of lending rates (Figure 2, panel a; red line). Forecast errors would be much larger in a BVAR model that excludes risk perception from the conditioning set (Figure 2, panel b; blue bars).

Figure 1. Lending rates to NFCs in the 2005-07 and 2022-23 tightening cycles: out-of-sample forecasts

The results suggest that banks’ risk perception was a major driver of lending rates in 2022-23, which helps to rationalize the stronger transmission of monetary policy to the cost of credit to NFCs compared with previous historical episodes (see Lane, 2023).

Figure 2. The role of risk perception in driving lending rates during the 2022-23 tightening cycle

Source: Authors’ calculation based on ECB and LSEG

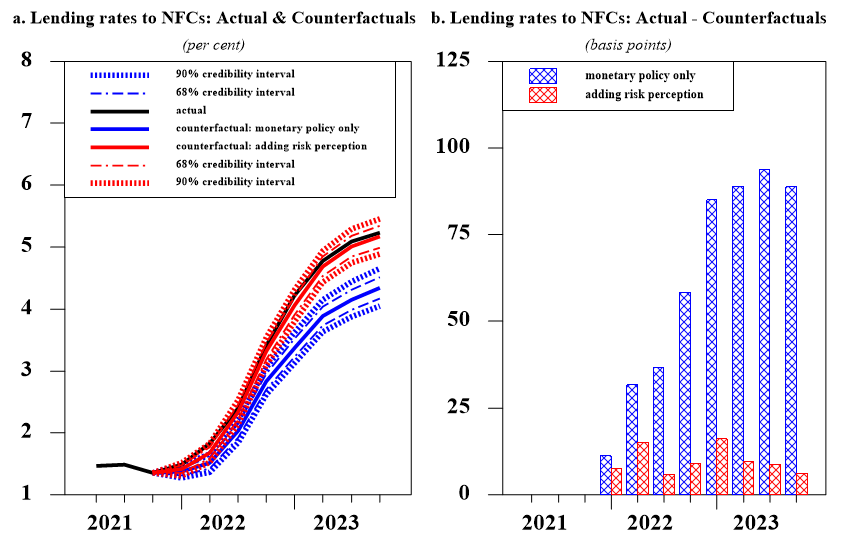

CNN provides a quantitative assessment of the 2022-23 tightening on euro area economic activity and consumer prices using a medium-scale BVAR based on Conti et al. (2023) and Auer and Conti (2024), and an estimated fully-fledged DSGE model with a banking sector (Gerali et al., 2010). The BVAR model includes 8 variables: real GDP, the Harmonized Index of Consumer Prices, short and long-term interest rates, lending rates to NFCs, stock prices, banks’ risk perceptions from the BLS and oil prices. CNN uses a scenario analysis methodology similar to the one employed in Crump et al. (2024) and considers five alternative specifications that modify the benchmark across several dimensions in order to provide robust results.

Figure 3 shows the impact of the monetary policy tightening on year-on-year real GDP growth and inflation. The ECB tightening would have reduced output growth by around 1 pp in 2022, 5 in 2023, and around 2 in 2024, triggering a reduction of inflation of 1.0 pp in 2022, around 4 in 2023, and 3 in 2024. The risk perception channel is estimated to have contributed to a reduction in real GDP growth of over 0.5 pp in 2022, nearly 2 pp in 2023, and 1.5 pp in 2024. Additionally, it is projected to have contributed to a reduction in inflation of approximately 0.4 pp on average in 2023 and 1.5 pp in 2024.

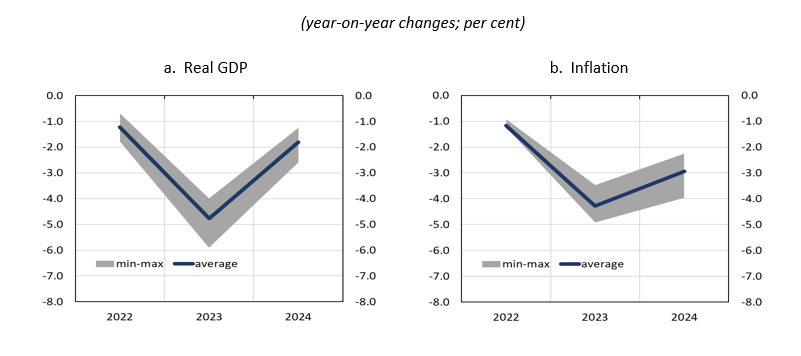

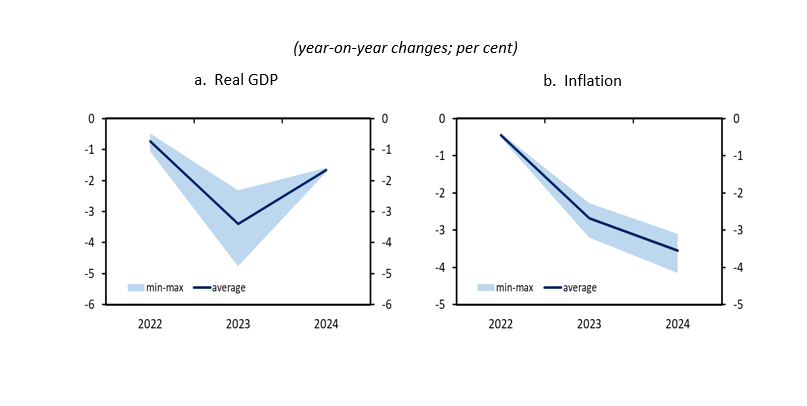

CNN provides a further quantification of the impact of the 2022-23 tightening based on the model developed in Gerali et al. (2010), estimated with data up to, alternatively, 2019:Q4 or 2023:Q4. The model features financial frictions and an imperfectly competitive banking sector. Figure 4 shows that the tightening would have reduced output growth by almost 1 pp in 2022, 3.5 in 2023, and about 2 in 2024. The corresponding reduction in inflation would amount to 0.5 pp in 2022, about 3 pp in 2023, and 3.5 in 2024. The banking channel would contribute to about 0.5 pp of the reduction in output growth in 2022, 1 pp in 2023, and almost 0.5 pp in 2024, and to about 1 pp of the reduction in inflation on average in 2023 and 2024. Overall, the banking channel made a substantial contribution to the macroeconomic impact of the tightening, according to both BVAR and DSGE model-based simulation results.

Figure 3. Macroeconomic effects of the 2022-23 tightening in the BVAR model

Source: authors’ calculations based on the BVAR model. Notes: Simulations based on the posterior mean of the distribution of the parameters. The blue line refers to the average impact across six simulations the baseline and the five alternative specifications); the grey shaded areas represent the intervals defined by the minimum and maximum across simulations.

Figure 4. Macroeconomic effects of the 2022-23 tightening in the DSGE model

Source: Authors’ calculations based on the model in Gerali et al. (2010). Notes: Simulations based on the posterior mean of the distribution of the parameters. The blue line refers to the average impact across the six simulations; the light blue shaded areas to the intervals defined by the minimum and maximum across the simulation.

Since the beginning of 2023, inflation has started to fall after a period of sustained rise, which took it to double-digit levels in October and November 2022. In the context of the unparalleled surge in consumer prices, it is notable that long-term inflation expectations have remained firmly anchored at the 2% target, largely attributable to the ECB’s decisive monetary policy response. The increases in the ECB’s policy rates between July 2022 and September 2023 have exerted a significant negative impact on real GDP growth and inflation, partly due to the response of bank credit supply. These macroeconomic effects are still being felt throughout the euro area economy in 2024 (see Panetta, 2024).

Auer, S., and A. M. Conti (2024). “Bank lending in an unprecedented monetary tightening cycle: evidence from the euro area”, Banca d’Italia, Occasional Paper 856.

Conti, A. M., A. Nobili and F. M. Signoretti (2023). “Bank capital requirements, lending supply and economic activity: A narrative perspective”, European Economic Review, 151, January.

Conti, A. M., S. Neri and A. Notarpietro, “Credit strikes back: the macroeconomic impact of the 2022-23 ECB monetary tightening and the role of lending rates”, Banca d’Italia, Occasional Paper 884.

Crump, R. K., S. Eusepi, D. Giannone, E. Qian and A. Sbordone (2024). “A Large Bayesian VAR of the United States economy”. International Journal of Central Banking, forthcoming.

Gerali, A., S. Neri, L. Sessa and F. M. Signoretti (2010). “Credit and Banking in a DSGE Model of the Euro Area”, Journal of Money, Credit and Banking 42, 107-141.

Lane, P. (2023). “The banking channel of monetary policy tightening in the euro area”, Remarks at the Panel Discussion on Banking Solvency and Monetary Policy, NBER Summer Institute 2023 Macro, Money and Financial Frictions Workshop, Cambridge, 12 July.

Panetta, F. (2024). “Monetary policy in a shifting landscape”, Speech at the Inaugural conference of the ChaMP Research Network, Frankfurt am Main, 25 April.