The policy brief is based on Accetturo, A., Barboni, G., Cascarano, M., Garcia-Appendini, E., & Tomasi, M. (2024).“Credit supply and green Investment” Bank of Italy Working Papers, No. 1456. This policy brief should not be reported as representing the views of the Bank of Italy and of Norges Bank. The views expressed are those of the authors and do not necessarily reflect those of the Bank of Italy and of the Norges Bank.

Abstract

Firms’ investments in sustainable technologies are crucial as the world rushes to transition to a low-carbon economy. However, the impact of credit constraints on firms’ green technology investments is not well-understood. This article leverages data from a national registry of about 30,000 Italian companies to explore this issue. The findings indicate that greater credit availability tends to enhance green investments, particularly for older, financially stable firms, in environmentally conscious regions, and when aligned with government subsidies that support green initiatives.

The 2021 Intergovernmental Panel on Climate Change’s report states that to keep the global temperature rise under 1.5°C, we must cut global emissions by half by 2030 and achieve net zero by 2050. This requires substantial investments in renewable and ‘green’ technologies to phase out those that heavily emit carbon. Yet, credit limitations could impede this green shift, a concern echoed by the European Investment Bank’s Investment Survey.

While extensive literature confirms that credit supply influences capital expenditure investments, this may not directly translate to green investments. Some theories argue that without government interventions like carbon taxes or research grants, firms might not be motivated to invest in green technologies, despite the availability of credit (Acemoglu et al. 2012, Acemoglu et al. 2016). On the flip side, there’s growing evidence that investors are factoring in environmental and social considerations into their investment choices, and institutional investors are finding value in socially responsible investments (Benabou and Tirole 2006, Hart and Zingales 2017, Oehmke and Opp 2020, Pastor et al. 2021, Krueger et al. 2020, Ceccarelli et al. 2021). If business leaders and innovators also take these externalities to heart, they might leverage increased credit availability to invest more in green technologies, even without governmental nudges.

In the study “Accetturo et al. (2024),” the authors investigate whether increased credit availability influences firms’ inclination to invest in green technologies. Utilizing data on roughly 30,000 Italian firms from 2015 to 2019, the research begins with detailed loan-level data from the Italian Credit Register. This data is cleansed of demand-side effects using an instrumental variables approach. The amount of credit supplied to each firm is then correlated with the likelihood of the firm investing in green technology, determined from financial statements.

Our methodology for pinpointing green investments is innovative because it relies on actual investments made by firms, as reported in the textual comments accompanying their financial statements. We’ve developed a ‘dictionary’ of green terms from various sources, including the EU taxonomy for environmentally sustainable activities, green keywords from Sautner et al. (2020), and mandatory sustainability reports from Italian public firms. We then employ text algorithms on the comments in the investment sections of firms’ financial statements. A firm is categorized as making green investments if any identified keywords from our ‘dictionary’ appear in their financial statements. This method’s advantage is that it doesn’t depend on self-reported greenness measures, which are more susceptible to greenwashing.

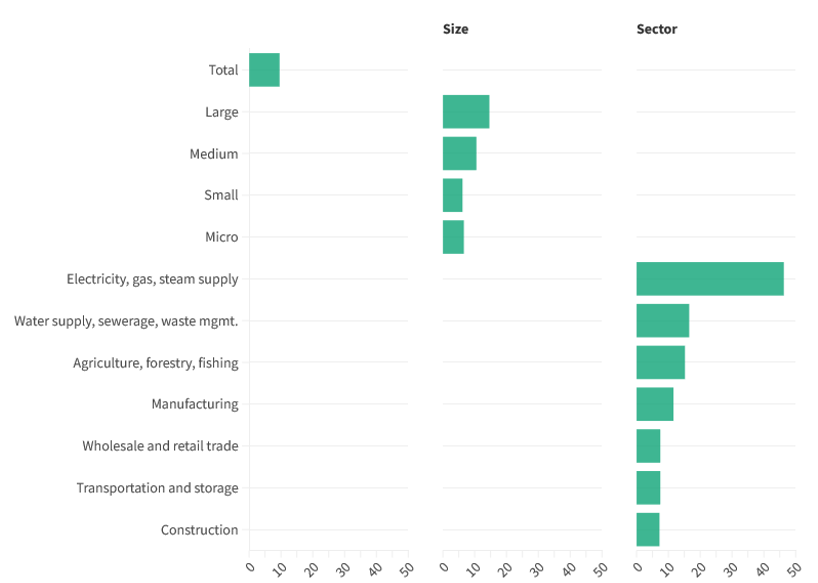

Our study reveals that between 2015 and 2019, almost 10% of firms engaged in at least one green investment. The annual variation in the number of firms making such investments was relatively stable, at around 6%. Notably, medium and large firms were more likely to make green investments compared to micro and small firms, as shown in Figure 1. Sector-wise differences were also observed; unsurprisingly, the electricity, gas, and steam supply sector had the highest proportion of firms investing in green technology, followed by the water supply and waste management sector.

Figure 1. Share of firms that undertook green investments at least once over 2015-19 in Italy

Source: Authors’ calculations on Cerved data.

Source: Authors’ calculations on Cerved data.

In the paper our aim was to relate the probability of a firm in doing green investments to the amount of available credit. To address endogeneity issues, we used an instrumental variable approach, with our instrument being the weighted average of bank-specific credit supply shocks, estimated from nationwide credit data and adjusted for local, industry, and time-varying demand factors.

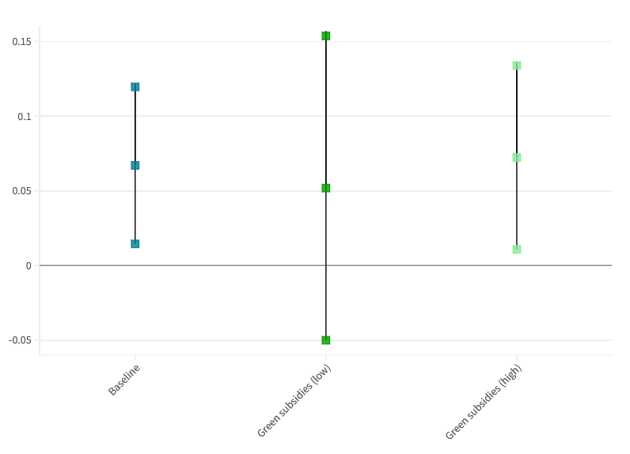

We discovered that a one standard deviation increase in credit supply raises the likelihood of firms investing in green technology by 1.9 to 3.4 percentage points, which is about 15% of its standard deviation (Figure 2). This effect was not observed for general investments, aligning with evidence that bank credit mainly affects the external margin of investments during recessions. During growth periods, like Italy experienced from 2015 to 2019, firms can offset bank credit shortages with internal funds or trade credit (Gaiotti 2013).

Delving into the details of our main finding, we observe that the significant responsiveness of green investments to credit supply is predominantly seen in firms that are more profitable, liquid, solvent, larger, and older—essentially, firms with more financial resources. This pattern suggests that green investments, compared to other investment types, demand substantial financial resources, which need to be supplemented by internal funds. The high capital requirements of green investments could be the reason why they are particularly sensitive to the availability of credit.

Figure 2.

Source: Authors’ calculations on Cerved, Central Credit Register, Italian permanent census of enterprises, 2019, ISTAT. The Figure represents the elasticity of sustainable investments to the provision of credit for the baseline analysis and for different subsets according to total number of regional green subsidies in the region of the firm headquarter locations are lower or higher than the median. Error lines report 95 % confidence intervals.

We investigate the impact of government subsidies on green investments. Public support could either replace or supplement bank credit for such investments. By applying our ‘dictionary’ to the 2018 Italian census of regional subsidies, we count the number of green subsidies in each region. Our findings show that green investments are more responsive to credit supply in regions with a higher number of government subsidies available at the firm’s headquarters. This suggests that green investments require substantial financial resources, and public financial is essential for credit supply to impact on investments in sustainable technologies. The elasticity is particularly pronounced in regions with heightened environmental awareness, indicating that government subsidies, coupled with policies that raise environmental consciousness, can effectively aid credit to push firms to pursue green investments.

The propensity of firms to invest in green technologies is significantly influenced by the degree to which managers and shareholders internalize the positive externalities. Our study focuses also on the potential role of environmentalism preference and environmental awareness. We utilize data from the World Values Survey to measure local environmental preferences and Google search data (specifically for “climate change” searches in an area) to gauge awareness. We find that where environmental awareness is high, the elasticity of green investment to credit supply is greater and statistically significant.

Our research highlights that credit availability is crucial for firms to invest in green technologies, indicating that credit constraints could impede the green transition. This issue is particularly pressing as the need for climate action intensifies, possibly coinciding with a global economic downturn and less favorable credit conditions.

Our findings have significant policy implications. First, we demonstrate that green investments are especially sensitive to banking supply shocks, underscoring the economic and social costs of credit crunches, such as slowing the adoption of environmentally-friendly technologies and delaying the green transition. Second, we reveal that public subsidies are essential for leveraging private credit for sustainable investments, emphasizing the importance of policy coordination in accelerating the green transition. Third, we show that environmental preferences are key drivers of the positive response of green investments to increased credit supply: the green transition depends on firms adopting environmental norms and attitudes.

Accetturo, A, G Barboni, M Cascarano, E Garcia-Appendini and M Tomasi (2022), “Credit supply and green investments”, Available at SSRN 4093925.

Acemoglu, D, P Aghion, L Bursztyn and D Hemous (2012), “The environment and directed technical change”, American Economic Review 102(1):131–66.

Acemoglu, D, U Akcigit, D Hanley and W Kerr (2016), “Transition to clean technology”, Journal of Political Economy 124(1):52–104.

Amiti, M and D E Weinstein (2018), “How much do idiosyncratic bank shocks affect investment? Evidence from matched bank-firm loan data”, Journal of Political Economy 126(2):525–587.

Benabou, R and J Tirole (2006), “Incentives and pro-social behavior”, American Economic Review 96(5):1652–1678.

Campello, M, J R Graham and C R Harvey (2010), “The real effects of financial constraints: Evidence from a financial crisis”, Journal of Financial Economics 97(3):470–487.

Ceccarelli, M, S Ramelli and A Wagner (2021), “Low-carbon mutual funds”, Swiss Finance Institute Research Paper 19-13.

Cingano, F, F Manaresi and E Sette (2016), “Does credit crunch investment down? new evidence on the real effects of the bank-lending channel”, The Review of Financial Studies 29(10): 2737–2773.

Duchin, R, O Ozbas and B A Sensoy (2010), “Costly external finance, corporate investment, and the subprime mortgage credit crisis”, Journal of Financial Economics 97(3):418– 435.

Gaiotti, E (2013), “Credit availability and investment: Lessons from the “great recession”, European Economic Review 59: 212–227.

Hart, O and L Zingales (2017), “Companies should maximise shareholder welfare not market value”, Journal of Law, Finance, and Accounting 2(2): 247–275.

Krueger, P, Z Sautner and L T Starks (2020), “The importance of climate risks for institutional investors”, The Review of Financial Studies 33(3): 1067–1111.

Lemmon, M and M R Roberts (2010), “The response of corporate financing and investment to changes in the supply of credit”, Journal of Financial and Quantitative Analysis 45(3): 555–587.

Oehmke, M and M M Opp (2020), “A theory of socially responsible investment”, Swedish House of Finance Research Paper 20-2.

Pastor, L, R F Stambaugh and L A Taylor (2021), “Sustainable investing in equilibrium”, Journal of Financial Economics 142(2): 550–571.

Peek, J and E S Rosengren (2000), “Collateral damage: Effects of the japanese bank crisis on real activity in the United States”, American Economic Review 90(1): 30–45.

Sautner, Z, L van Lent, G Vilkov and R Zhang (2020), “Firm-level climate change exposure”, ECGI Finance Working Paper No. 686/2020.