A lot has happened in relation to crisis management of credit institutions since the financial crisis. The main driver in Europe is the Bank Recovery and Resolution Directive which ensures that the authorities have the necessary tools and powers for crisis management of failing credit institutions. With the recent revision of the directive, a maximum limit has been introduced for the so-called subordination requirement. This means that there are limits to how large a share of the minimum requirement for own funds and eligible liabilities the authorities can demand must be met with subordinated liabilities. The new maximum limit for the subordination requirement makes it more likely that senior unsecured creditors of Danish banks – e.g. large corporations with deposits of more than 100,000 euro – will have to contribute to the crisis management. Senior unsecured creditors should be aware of this risk and take it into account in their risk management. This Policy Brief is a summary of an analysis published by Danmarks Nationalbank (link to publication).

A lot has happened in relation to crisis management of credit institutions since the financial crisis. The main driver in Europe is the Bank Recovery and Resolution Directive (BRRD) which ensures that the authorities have the necessary tools and powers for crisis management of failing credit institutions.

The BRRD means that, instead of an institution either entering into liquidation proceedings or being bailed out by the government, the resolution authorities can now let the investors and creditors absorb the losses – a so-called bail-in – while the institution’s critical functions are continued, so that the individual citizens can still conduct their banking transactions. The whole idea is that once the authorities have handled the crisis management of the institution, it can return to the market as a viable institution after investors and creditors have absorbed the losses. This should all be dealt with during a single weekend to avoid significant disruptions to financial markets and society.

To ensure that such crisis management can be implemented in practice, the resolution authorities have been working to develop crisis management plans for the individual institutions since the introduction of the crisis management framework. Today, the authorities are thus far better equipped to handle a crisis in the financial sector than they were during the financial crisis.

The crisis management framework is still being developed and the revised Bank Recovery and Resolution Directive (BRRD2) has just been implemented in Denmark. It is important that both authorities and credit institutions continue to prepare for a crisis situation and improve the possibilities of rapid, flexible and controlled crisis management, so that negative impacts on financial stability and the real economy are avoided.

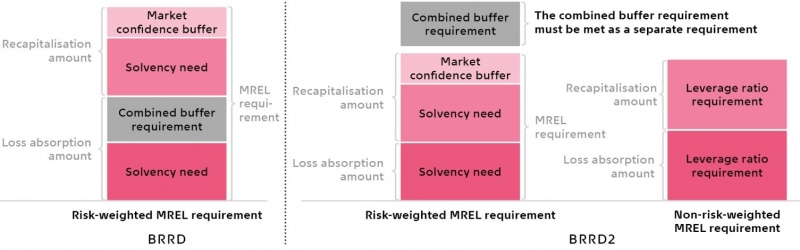

With BRRD2 changes to the MREL requirement has been introduced, see Figure 1. The MREL requirement ensures that the institutions do not compose their liabilities (capital and debts) in a way that means that the bail-in tool cannot be used or becomes less effective. The purpose of the MREL requirement is thus to ensure that the institutions have sufficient liabilities suitable for loss absorption and recapitalisation when facing a crisis management situation.

Figure 1: MREL requirement under BRRD and BRRD2

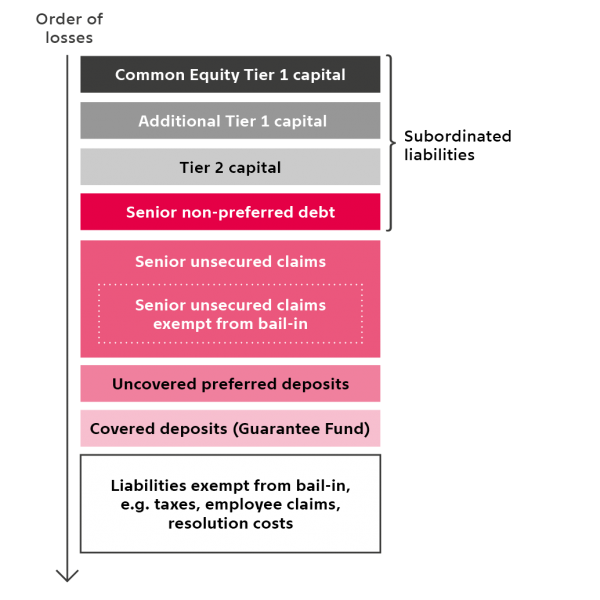

Furthermore, with BRRD2 a maximum limit has been introduced for the so-called subordination requirement. This means that there are limits to how large a share of the MREL requirement the authorities can demand must be met with subordinated liabilities, that is liabilities that bear losses before senior unsecured claims. Subordinated liabilities include capital instruments and senior non-preferred debt, see the hierarchy of creditors in Figure 2.

Subordination of the MREL requirement is an advantage because it helps ensure transparency for the institutions’ investors and creditors about who will bear losses. In addition, it makes the crisis management simpler if bail-in is used only on subordinated liabilities.

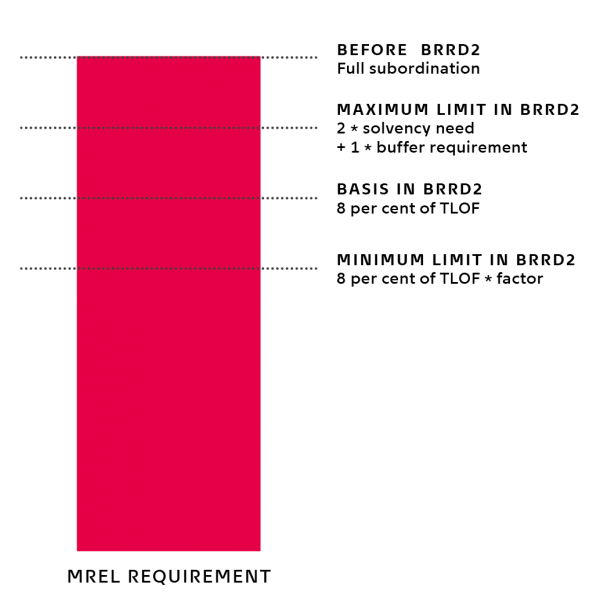

| Figure 2: Order of losses in Danish banks | Figure 3: Subordination requirements for Danish banks |

|

|

In Denmark it has so far been required that the Danish banks must meet their entire MREL requirement with subordinated liabilities. With the maximum limit introduced for the subordination requirement, it is no longer possible for the Danish Financial Supervisory Authority to require full subordination of the MREL requirement for the Danish institutions, as illustrated in Figure 3. In future, part of the MREL requirement can thus be met with liabilities that form part of the creditor class of senior unsecured claims. This means that senior unsecured creditors must now be prepared for the risk of having to make contributions in situations that are regarded as normal loss scenarios from a crisis management perspective. Their claims may either be written down or be converted into shares. It is, however, most likely that the claims will be converted. Senior unsecured creditors, for example large corporations with deposits over 100,000 euro, should be aware of this risk and take it into account in their risk management.

Regardless of whether or not the liabilities used to meet the MREL requirement are subordinated, they can be used for crisis management of the institution. The maximum subordination requirement thus does not mean that there are less funds available for crisis management of the institution. Also, there is no special reason to protect senior unsecured creditors. It should consequently not be considered an impediment to the crisis management of a failing credit institution that senior unsecured might have to make a contribution. However, it may mean that the crisis management becomes more complicated and less transparent.