This policy brief reflects the opinions of the authors and does not necessarily express the views of the Banque de France or Eurosystem.

Several metals will play a critical role in the transition to a zero-carbon economy. Imbalances between supply and a growing demand for these metals could arise. In order to assess these imbalances, Miller et al (2023) estimate the demand for metals induced by the NGFS climate scenarios and outline the potential implications in terms of macro-financial vulnerabilities.

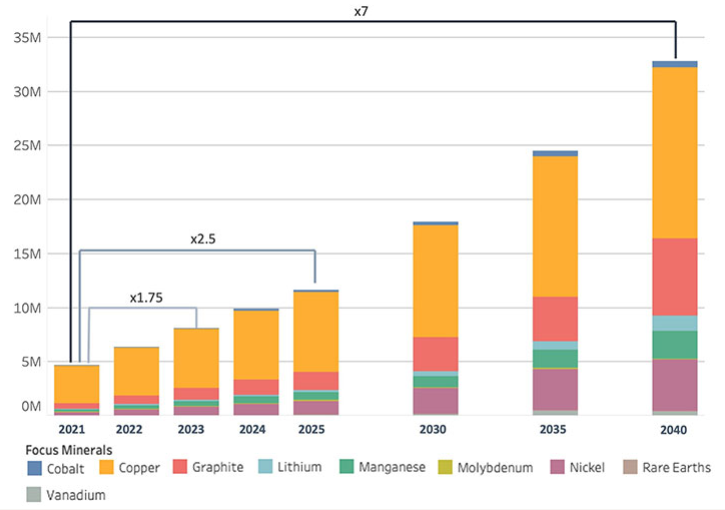

Chart 1: Change in demand for critical metals (in Mt) induced by the NGFS “Net Zero by 2050” scenario

Source: Miller et al. (2023).

Limiting average global warming to 1.5°C (or less than 2°C), as set out in the Paris Agreement signed in 2015, requires a massive and rapid deployment of renewable energies and associated technologies. This implies, for example, developing and installing numerous solar photovoltaic power plants, wind turbines, electric vehicle engines and new electricity networks.

It is well known that this transition to a low-carbon economy will lead to a sharp decline in demand for fossil resources, but less well known that it will also generate a strong rise in demand for a range of metals and minerals such as lithium, copper, nickel and cobalt, which can be described as “transition critical metals” (TCMs). For example, the global demand for lithium (needed in particular to produce electric car batteries) could increase by a factor of around 40 by 2040 (International Energy Agency, 2021). In France, the “Varin report” submitted to the government in January 2022 stresses the importance of securing TCM supply.

In a recent paper, Miller et al. (2023) seek to gain a better understanding of potential future imbalances between TCM supply and demand. On the basis of various databases (on the TCM intensity of different technologies, the geographical distribution of production and known reserves, estimates of recycling rates and substitutability, etc.), the authors estimate the TCM requirements induced by the transition scenarios developed by the Network for Greening the Financial System (NGFS).

Thus, as shown in Chart 1, under the NGFS “Net Zero by 2050” scenario, the induced annual demand for all targeted materials rises from 4.7 million tonnes (Mt) in 2021 to 32.8 Mt in 2040, which corresponds to a 7-fold increase. In the “Delayed transition” scenario, total demand increases from 1.7 Mt to 42.9 Mt (including electric vehicles) and from 0.94 Mt to 32.1 Mt (excluding electric vehicles) between 2021 and 2040. The metal recording the largest increase in demand is copper, followed by other TCMs such as graphite and nickel.

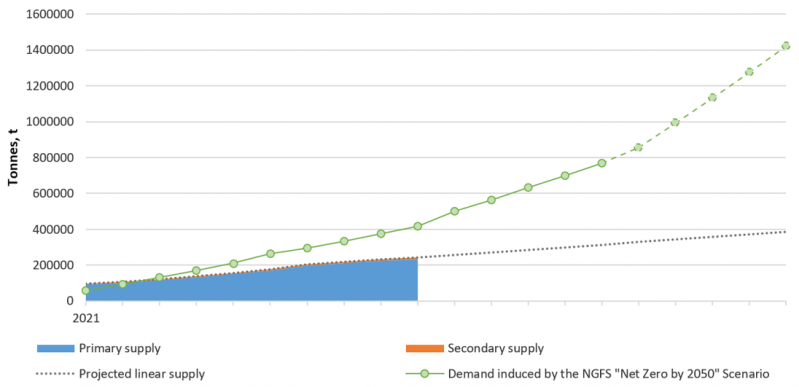

These results suggest that the demand for some TCMs could rapidly outstrip their availability, based on variables such as existing production, new projects underway, existing reserves, recycling rates and the substitutability of each metal. Chart 2 below provides an example for lithium. The imbalances between supply and demand for TCMs could be even greater as the results of Miller et al. (2023) only take into account the demand induced by the low-carbon transition and not by other sectors and uses which are also growing rapidly (such as the IT sector).

Chart 2: Lithium supply projections (in tonnes) vs. demand induced by an NGFS scenario

Source: Miller et al. (2023). Note: the lithium supply projected on the basis of different variables (current production, reserves, new projects, etc.) could be lower than the demand induced by the NGFS “Net Zero by 2050” scenario. Secondary supply is broadly defined as recycled lithium.

Of course, these projections are subject to certain uncertainties. Indeed, many factors that could attenuate or, on the contrary, exacerbate imbalances between the supply and demand for TCMs must be taken into account. In particular:

These potential imbalances between supply and demand for TCMs could be a source of macro-financial vulnerabilities.

First, they could generate major disruptions in global value chains. The recent high volatility of some raw material prices may be a preview of more structural tensions to come (Boer et al., 2021). These could have particularly negative impacts on economies such as those in the EU, which do not have a dominant position, neither in the extraction and refining of these raw materials, nor in their integration into the new transition technologies.

Ultimately, these impacts could threaten both price and financial stability, which central banks and financial supervisors are responsible for ensuring. Despite a recent awareness of the importance of the subject (for example, it is discussed in section 1.4 of the Assessment of Risks to the French financial system), the issue of TCMs should be further integrated into the work agenda on so-called “transition risks”. Miller et al (2023) suggest several avenues: