We estimate the ex-post short-run (6 months) impact of the Portuguese macroprudential borrower-based measure on new loans for consumption and house purchase, on house prices and on the economic activity. The macroprudential measure introduced a set of recommendations on the criteria used by banks in borrowers’ creditworthiness assessment: i) limits to LTV and DSTI ratios and to maturity and ii) the requirement of regular payments of interest and principal. The effect of the introduction of the measure is assessed by comparing the estimated counterfactual of variables of interest, a no-policy scenario, to the observed post-Recommendation values. Our analysis suggests that the measure contributed to curb the growth of new loans granted to households, both for consumption and house purchase, 4 months after its implementation. We do not find evidence that the macroprudential measure had a significant impact on house prices or on economic activity, in the 6 months following its introduction.

In July 2018 the Banco de Portugal, as the macroprudential authority, implemented a measure in the form of a recommendation, aimed at new credit agreements for consumers. The measure aimed to take pre-emptive action given the evidence of an easing in credit standards for consumers and thus increase the resilience of the financial sector to adverse shocks and promote the sustainable financing of households. In order to do so, the Recommendation sets criteria for assessing the creditworthiness of borrowers when credit is granted, limiting new credit to borrowers with a high risk profile. In particular, the measure covers both loans for consumption and house purchase and introduces limits to the LTV (loan-to-value) and DSTI (debt service-to-income) ratios, to the maturity and a requirement of regular payments of interest and principal.

Even though it does not target the overall lending activity to households, the measure might contribute to curb credit growth. Additionally, it can eventually impact house prices, as a decrease in new loans for house purchase might contribute to reduce the demand for residential real estate, and also economic activity. Therefore, an important question when implementing this type of measures concerns its short-run effects on credit and housing markets and on the overall level economic activity.

To identify the short-run effects of the Recommendation, the observed evolution of new loans granted to households, house prices and economic activity was contrasted with their estimates in a no-policy scenario

In Abreu and Passinhas (2021) a counterfactual analysis is conducted over the six months following the implementation of the Recommendation, i.e. a characterization of the evolution of new loans granted to households, both for consumption and house purchase purposes, house prices and economic activity should the measure not have been introduced.

By considering that the Recommendation was the main regulatory change affecting the consumer credit market over the six months following its implementation, the difference between the observed values and their counterfactual values reflects the potential impact of the Recommendation. This is a plausible assumption, since no other regulation that could have significantly affected credit and housing markets entered into force in Portugal in this period.

The specification of a counterfactual scenario to study the policy impact on macroeconomic and financial variables is a common approach in the literature. Following Price (2014), the model used to build the counterfactual for new loans for consumption and house purchase in Portugal is a BVAR (Bayesian Vector Autoregression) model estimated with observations prior to the introduction of the Recommendation (March 2003 to June 2018). The counterfactual, consisting of a forecast obtained from this model, reflects the likely behavior of the variables based on their historical relations, in a scenario where the Recommendation was not introduced.

The counterfactual scenario considers the interdependence of new loans, house prices and economic activity, producing more realistic estimates of the effects of the Recommendation

The endogenous variables considered are (i) new loans for consumption (ii) new loans for house purchase, (iii) the house price index, and (iv) a proxy for developments in economic activity (coincident indicator). An increase in housing prices may enhance credit growth, given the increase in the value of real estate, which is the main collateral for credit transactions. At the same time, credit growth may contribute to a further increase in house prices. Thus, there is an interdependence between the two variables that must be taken into account. The BVAR methodology is suitable to modelling this relationship, since each endogenous variable is explained by its lags and by the lags of the other endogenous variables.

To improve the accuracy of the counterfactual, the forecasts were conditioned by the evolution of control variables that also affect the credit and housing markets in Portugal, but are not directly influenced by the introduction of the Recommendation in the short term. The selection of control variables was based on the results of previous studies investigating the main determinants of credit granted to households in Portugal, such as Castro and Santos (2010), and real estate market developments, such as Rodrigues and Lourenço (2017). Based on this literature, the following control variables were selected: (i) residential investment by residents (gross fixed capital formation), (ii) residential investment by non-residents (foreign direct investment in housing including house purchase by non-residents), (iii) the 12-month Euribor, to control for bank funding costs, and (iv) the year-on-year rate of change in euro area GDP to control for the international economic environment.

The measure contributed to curb the growth of new loans granted to households, both for consumption house purchase and, 4 months after its implementation

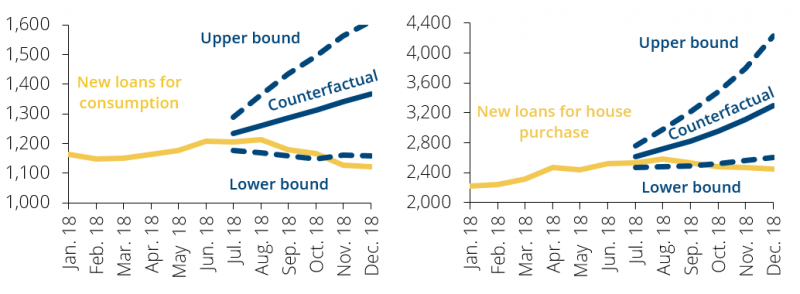

The counterfactual scenario suggests that in a no-policy scenario new loans for consumption and house purchase would continue to increase at a rate similar to the observed prior to the introduction of the measure (Figure 1), reflecting the upward trend of credit prior to the entry into force of the Recommendation in a context of easing of credit granting standards. In contrast, new credit business (consumption and house purchase) slowed down in the second half of 2018, particularly in the consumer credit segment, which recorded negative year-on-year rates of change after October 2018.

Figure 1 – Counterfactual for new loans for consumption and house purchase | € millions

Source: Banco de Portugal. Notes: Counterfactual corresponds to the median of the predicted posterior distribution given by a BVAR(5). Upper and lower bound are the 97.5th and 2.5th percentiles, respectively, of the same distribution. The series of new loans for consumption and house purchase correspond to quarterly flows.

In the 3 months after the introduction of the policy measure, i.e., between July and end-September of 2018, the figures for new loans lie within the upper and lower bounds associated with the estimated counterfactual. In the following months until December 2018, both new loans for consumption and for house purchase lie outside the lower bound, suggesting that the policy introduction curbed the growth of new loans in this period.

According to Banco de Portugal (2019a, 2020), there is an improvement in the risk profile of borrowers associated with new credit agreements that coincides with the introduction of the measure. This suggests that the reduction in the aggregate new credit volume mainly reflected the reduction of credit to borrowers with a high risk profile.

The lag in the response of new loans in relation to the Recommendation’s introduction may reflect the operational adjustment process that banks had to undergo in order to implement the limits imposed by the Recommendation. In addition, according to Banco de Portugal (2019a, 2020), developments in new loans for house purchase in the first few months after the implementation of the Recommendation partly reflected the granting of credit based on a borrowers’ creditworthiness assessment made several months before the Recommendation’s entry into force.

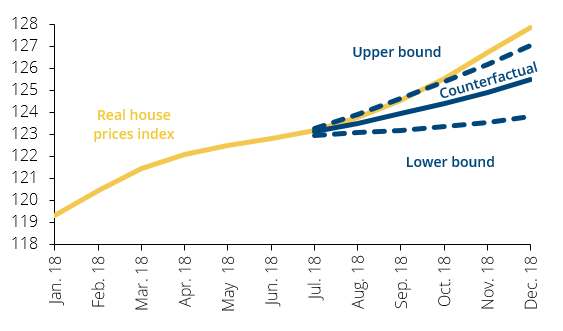

House prices would have stayed on their upward trend in a no-policy scenario and close to the observed path, suggesting no impact from the Recommendation

As for house prices, the counterfactual suggests that in a no-policy change scenario the upward momentum observed in the first half of 2018 would continue through the second half of the year, although at a slower pace (Figure 2). Thus, although the model is not specifically designed to evaluate the deviations of house prices from its fundamentals, the results seem to be consistent with evidence of overvaluation of house prices in Portugal during 2018 as documented in Banco de Portugal (2019b), which seems to be particularly strong in the last quarter of that year. In particular, Banco de Portugal (2019b) presents the results obtained from quantile regressions which suggest that real house prices grew above the estimated 90th percentile of the respective distribution during 2018. This evidence is comparable, to a certain extent, to the result obtained from our counterfactual analysis, as house prices are above the upper bound of the forecast, which corresponds to the 97.5th percentile of the predictive distribution.

Figure 2 – Counterfactual for real house prices index | 2015=100

Source: Statistics Portugal and OECD. Notes: Counterfactual corresponds to the median of the predicted posterior distribution given by a BVAR(5). Upper and lower bound are the 97.5th and 2.5th percentiles, respectively, of the same distribution.

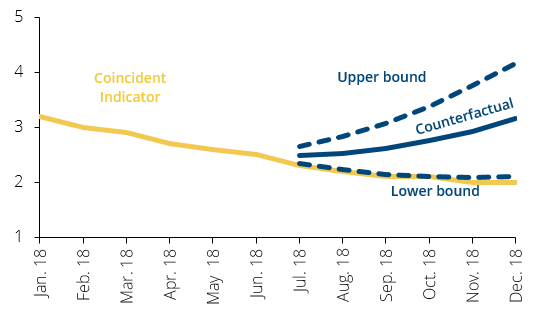

There is no strong evidence that the introduction of the Recommendation had a significant impact on economic activity in the 6 months following its introduction

The counterfactual for the coincident indicator (Figure 3) suggests an acceleration of economic activity during the second half of 2018. In comparison, the coincident indicator has decreased over the same period. The difference between the counterfactual and the coincident indicator increases over time, suggesting that the introduction of the Recommendation might have implied lower economic activity. By introducing stricter criteria for borrowers’ creditworthiness assessment, the Recommendation might have curbed the growth of new loans, which could have had a negative effect on household expenditure and, therefore, on economic activity. The upward trajectory of the counterfactual for the coincident indicator reflects, in part, the growth in new loans in the estimated no-policy scenario, which is amplified by the autoregressive component of the model. However, the observed values of the coincident indicator are very close to the lower bound, meaning that the difference between the coincident indicator and its counterfactual is comparable to the common forecast error of the model. It is worth noting that although BVAR models tend to have good forecast performance over short forecast horizons, our model is not tailored to forecast the evolution of economic activity. This implies that accumulation of forecast errors is especially relevant for this variable since there is a larger uncertainty in comparison to the other endogenous variables.

Figure 3 – Counterfactual for coincident indicator | Percentage

Source: Banco de Portugal. Notes: Counterfactual corresponds to the median of the predicted posterior distribution given by a BVAR(5). Upper and lower bound are the 97.5th and 2.5th percentiles, respectively, of the same distribution.

Abreu, D. and Passinhas, J. (2021). “Curb your enthusiasm: the aggregate short-run effects of a borrower-based measure”. Banco de Portugal Economic Studies, 7 (2), 47-64.

Banco de Portugal (2019a). Macroprudential Recommendation on new credit agreements for consumers – progress report, May 2019.

Banco de Portugal (2019b). Financial Stability Report December 2019, https://www.bportugal.pt/sites/default/files/anexos/pdf-boletim/ref_12_2019_en.pdf.

Banco de Portugal (2020). Macroprudential Recommendation on new credit agreements for consumers – progress report, May 2020.

Castro, G. and Santos, C. (2010). “Bank Interest Rates and Loan Determinants”. Economic Bulletin, Banco de Portugal, 65-86

Price, G. (2014). “How has the LVR restriction affected the housing market: a counterfactual analysis”. Reserve Bank of New Zealand Analytical Note series AN2014/03, May 2014.

Rodrigues, P. and Lourenço, R. (2017). “House prices in Portugal – what happened since the crisis?”, Banco de Portugal Economic Studies, 3(4), 41-57.