Following the implementation of negative policy rates, in recent years interest rates on bank deposits reached historic lows, with values close or equal to zero. We investigate the implications that such an environment has for currency demand. Based on a 2010-2018 observation period, we find evidence of a structural break in demand for currency when rates on deposits fall below 0.1 per cent. Exploiting time, bank and banknote denomination variations, as well as exogenous reforms that affected currency payments and holdings in Italy, our analysis finds that the increase of currency in circulation appears to be mostly driven by transactions rather than by store-of-value motivations.

After decades of decline following the end of World War II, the recent increase in the demand for currency in many advanced economies is puzzling economists, especially in light of the parallel spread of digital payments.1 One potential explanation is the lowest level ever reached by short-term nominal interest rates, which turned negative in some countries.2 Since currency pays a zero nominal gross return, economists have long assumed that nominal interest rates on other reserves of value have a zero lower bound (ZLB, Hicks, 1937). Taking into account also the costs associated with holding currency, its net return is slightly negative, and instead of talking of ZLB today central banks refer to the effective lower bound (ELB) on nominal interest rates. Indeed, the central banks of Switzerland, Denmark, Sweden and the Eurosystem adopted the negative interest rate policy (NIRP) in recent years, showing that it could be part of the standard toolkit of central banks (Coeure , 2016; Mersch, 2019).3

Despite the relevance of estimating the effect of NIRP on currency demand, formal empirical analysis is still scant. Even though central banks are increasing (or announcing imminent increases of) interest rates to react to new inflationary pressure, policy rates in many of the economies mentioned above are still negative. Evidences on the effects of NIRP introduction can also be informative on the effects of its end. Furthermore, it cannot be excluded that NIRP will be used in the future, as it is now part of monetary policy toolkit. The reason for scarce empirical analysis is twofold. First, there are few monetary systems that adopted negative interest rates in a relatively short observation period. Second, currency demand is difficult to measure at a frequent and disaggregated level.

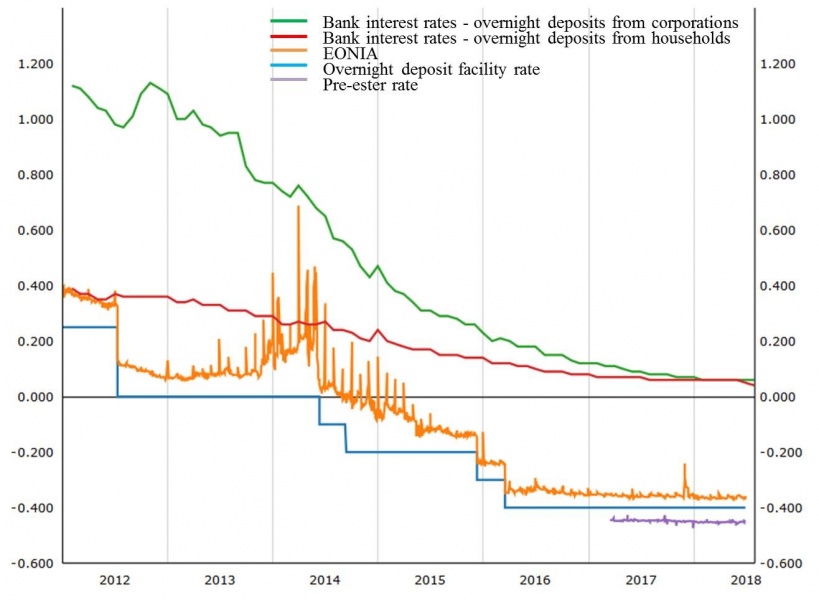

In a recent work, we contribute in this direction by studying how the demand for currency reacts to the introduction of negative policy rates (Rainone, 2022). We study the demand for currency in Italy, a country that is particularly well suited for the task. The use of currency for payments is intense and comparable to other developed countries, like Germany and Japan, and, as part of the Eurosystem, negative policy rates were introduced in 2014 (Figure 1).

Figure 1. Interest Rates on Overnight Deposits

Notes. Source: ECB statistical data warehouse (SDW). Overnight bank interest rates for Italian corporations (non-financial firms) and households are taken from the MIR.M.IT.B.L21.A.R.A.2250.EUR.N and MIR.M.IT.B.L21.A.R.A.2240.EUR.N series. The deposit facility rate is from the FM.D.U2.EUR.4F.KR.DFR.LEV series. The EONIA overnight interbank rate is from the EON.D.EONIA_TO.RATE series. The pre-ester rate is from MMSR.B.U2._X.U.S12.BO.WT.D76.MA.EUR. Details on the construction of these variables can be found in the SDW website https://sdw.ecb.europa.eu/home.do. Observation period: Jan 2012 – Jun 2018.

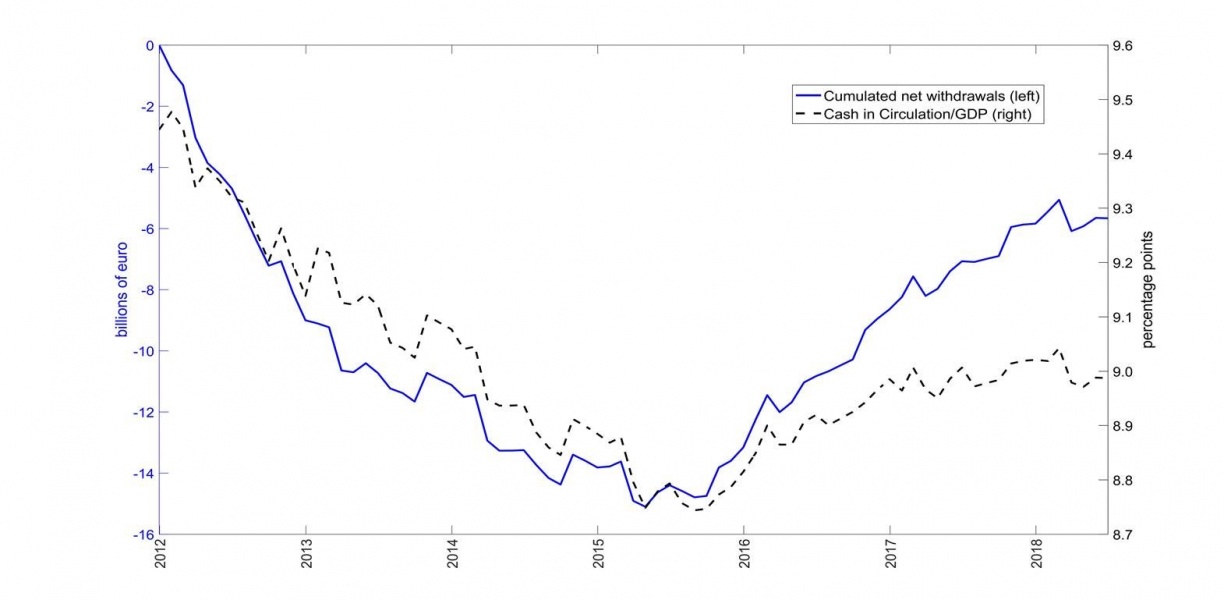

We find evidence of a discontinuity in the relationship between rates and currency holdings when the ELB is approached. More specifically, net withdrawals increase by about ten times when deposit rates fall below 0.10 per cent. Despite the significant increase in the marginal effect, when this threshold is crossed, the amount of additional currency issued remains limited. On average, a reduction of 5 basis points in deposits rates of a bank from 0.15 to 0.10 implies that 0.16 per cent of its deposits are converted in currency. A reduction of 5 basis points from 0.05 to 0 implies a 1.7 per cent conversion. The increasing number of banks setting interest rates below such threshold partially explains the higher number of banknotes issued by the central bank observed after the implementation of NIRP (Figure 2). This threshold may be interpreted as the point after which bank deposits are perceived by the public to pay almost nothing, as currency. It is different from (and higher than) the ELB, which is slightly negative given the storage and other costs related to currency. In addition, the ELB is usually referred to policy rates, while the threshold is estimated for interest rates on deposits. In the sample, the threshold maps with a deposit facility rate equal to -0.4.

Figure 2. Currency Issued by the Central Bank

Notes. Monthly data. Blue line: moving average (5 observations) of cumulated net withdrawals from January 2012 to June 2018, expressed in billions of euro. Net withdrawals are calculated as the sum of gross currency withdrawals of all Italian commercial banks minus the sum of gross currency deposits. Source: Bank of Italy Currency Management Department. Black line: currency in circulation over GDP. The starting point for currency in circulation is taken from the Italian central bank balance sheet, page 237 of this document https://www.bancaditalia.it/pubblicazioni/relazione-annuale/2011/en_rel_2011.pdf?language_id=1. The other values are derived adding monthly effective net withdrawals, as measured by the blue line. The GDP is taken from ISTAT quarterly estimates at current prices (http://dati.istat.it/Index.aspx?lang=en&SubSessionId=dbf6fee1-a2c2-4893-9f6b-9f5cb93a34ae) and is multiplied by four to have a comparable percentage with year GDP.

To assess the role of store-of-value and transactions demand, we exploit variation in the holdings for different banknote denominations and two reforms that affected in different periods respectively the store-of-value and the transactions demand for currency, after the introduction of NIRP. In the first reform in 2015, the Italian government gave additional tools to the tax revenue agency. It allowed the agency to get detailed data on balances of bank accounts. After the reform, bank deposits thus became less appealing (for example for privacy and tax evasion reasons) than currency. Plausibly, this reform had a more prominent effect on the store-of-value demand. The second reform in 2016 increased the threshold for legal payments in currency from 1000 to 3000 euro. By directly changing the threshold for currency payments, it impacted mainly the transactions demand.4 We find that the higher demand below the estimated threshold is driven mostly by the demand of small banknotes, that are generally used for transactions and less efficient to store value. In addition, currency holdings increased significantly more for clients of banks with lower rates after the second reform, but not after the first. Taken together, our evidences suggest that transactions demand prevails over store-of-value demand, which reconciles with the relatively small increase of currency holdings observed.

The result can be rationalized by the behavior of agents stopping actively minimizing their currency inventory when rates are no longer significantly different from zero (Baumol, 1952; Tobin, 1956). In the Tobin-Baumol model, transactions balances become more interest-elastic when rates increase. It means that when rates are higher agents optimize more intensively their currency inventory, which in turn decreases on average over time, ceteris paribus. On the contrary, when rates are low enough, the loss due to higher non-interest bearing inventory become negligible, eventually disappearing if rates are equal to zero. This mechanism could help explain the so-called paradox of currency whereby, even if the volume of transactions decreases, currency balances increase.

From the policy maker’s perspective, if data on deposits’ rates and currency operations of commercial banks is readily available, the approach proposed here can be used as a tool to evaluate almost in real-time the effects of monetary policy (even in jurisdictions that did not implement NIRP), in particular how much the deposit facility rate can be lowered and its distance from the ELB. Symmetrically, it can also be used to analyze the variation of cash holdings when interest rates rise, as planned recently by many central banks after years of extremely low policy rates.

This study complements the macro finance literature on cash holdings (including currency and deposits) as well as that on the effects of low interest rates on banks’ lending and profitability (in particular for what concerns reversal rates and the retail deposit channel) by providing evidence on the drivers of acceleration of currency conversion. It also adds to the literature related to the ’war on cash’ and the policy debate on potential limitations of currency holdings, in particular the one arguing that the use of cash should be disincentivized so that central banks can set negative interest rates.

Ashworth, J. and Goodhart, C. A. (2020). The surprising recovery of currency usage, 62nd issue (June 2020) of the International Journal of Central Banking.

Baumol, W. J. (1952). The transactions demand for cash: An inventory theoretic approach, The Quarterly Journal of Economics 545-556.

Bech, M. L., Faruqui, U., Ougaard, F. and Picillo, C. (2018). Payments are changing but cash still rules, BIS Quarterly Review, March.

Buiter, W. H. and Panigirtzoglou, N. (2003). Overcoming the zero bound on nominal interest rates with negative interest on currency: Gesell’s solution, The Economic Journal 113(490): 723-746.

Coeuré, B. (2016). Assessing the implications of negative interest rates. speech at the Yale financial crisis forum. URL: https://www.ecb.europa.eu/press/key/date/2016/html/sp160728.en.html

Del Negro, M., Giannone, D., Giannoni, M. P. and Tambalotti, A. (2019). Global trends in interest rates, Journal of International Economics 118: 248-262.

Eggertsson, G. B. and Woodford, M. (2003). Zero bound on interest rates and optimal monetary policy, Brookings papers on economic activity 2003(1): 139-233.

Goodfriend, M. (2000). Overcoming the zero bound on interest rate policy, Journal of Money, Credit and Banking 1007-1035.

Hicks, J. R. (1937). Mr. Keynes and the” classics”; a suggested interpretation, Econometrica 147-159.

Jobst, C. and Stix, H. (2017). Doomed to disappear? the surprising return of cash across time and across countries, Working paper.

Krugman, P. R., Dominquez, K. M. and Rogoff, K. (1998). It’s baaack: Japan’s slump and the return of the liquidity trap, Brookings Papers on Economic Activity 1998(2): 137-205.

Mankiw, N. G. (2009). It may be time for the fed to go negative, New York Times 18: 2009.

Mersch, Y. (2019). Remarks at the “challenges in understanding the monetary transmission mechanism” conference. URL: https://www.ecb.europa.eu/press/key/date/2019/html/ecb.sp190322 58f82e0d4d.en.html

Rainone, E. (2019). Tax evasion policies and the demand for cash, Working paper.

Rainone, E. (2022). Currency demand at negative policy rates. Bank of Italy Temi di Discussione (Working Paper) No, 1359.

Rognlie, M. (2016). What lower bound? monetary policy with negative interest rates, Working paper.

Rogoff, K. (2017). The curse of cash, Princeton University Press.

Tobin, J. (1956). The interest-elasticity of transactions demand for cash, The Review of Economics and Statistics pp. 241-247.

Witmer, J. and Yang, J. (2015). Estimating Canada’s effective lower bound, Working paper.

|

About the author Edoardo Rainone is an Economist at the Financial Stability Department in the DG for Economics, Statistics and Research of the Bank of Italy. Previously he worked as Settlement Manager and Analyst in the DG for Markets and Payment Systems. Before joining the Bank of Italy, he worked in the insurance consulting sector. He earned a PhD in Economics at Sapienza, Rome. His research is focused in the areas of econometrics, networks and banking and has been published in top academic journals. |

See Jobst and Stix (2017) and Ashworth and Goodhart (2020) for studies on the recent trends of currency demand across advanced economies and Bech et al. (2018) for a cross-country comparison of the demand for currency and cashless payments. Remarkable exceptions are Sweden and Norway, where currency in circulation is still declining.

See Del Negro et al. (2019) for a study on the global trends in interest rates.

See Rognlie (2016) for a theoretical model of optimal monetary policy under negative interest rate for currency and Witmer and Yang (2015) for an estimate of the negative rate of currency in Canada. A non-exhaustive list of papers that look at what kind of policies may overcome the lower bound problem include Krugman et al. (1998), Eggertsson and Woodford (2003) Buiter (2009), Goodfriend (2000), Buiter and Panigirtzoglou (2003), Mankiw (2009), Rogoff (2015), Rognlie (2016).

See Rainone (2019) for more details.