This policy brief is bason on ECB Working Paper No. 2024/2929 “Decomposing Systemic Risk: The Roles of Contagion and Common Exposures”.

Abstract

Systemic risk is a complex phenomenon, and we ask the question how to decompose it to better understand its driving forces. Inspired by the structural VAR literature we evaluate the effects of contagion and common exposure on banks’ capital by looking at interlinkages between banks’ balance sheets. Contagion can occur through direct exposures, fire sales, and market-based sentiment, while common exposures result from portfolio overlaps. We estimate the model on granular balance sheet and interbank exposure data of the Canadian banking market. First, we document that contagion varies in time, with the highest levels around the Great Financial Crisis and lowest levels during the pandemic. Second, we find that after the introduction of Basel III the relative importance of risks has shifted towards those related to increased similarity in banks’ exposures. Our new framework complements traditional stress-tests focused on single institutions by providing a comprehensive view of systemic risk.

Systemic risk is an inherent feature of the globalized economy, but its prominence has been more and more appreciated as it materialized and rippled through the economy. It was initially associated with interbank linkages. However, the LTCM crisis has shown that pernicious interlinkages go way beyond the banking system (Billio et al., 2012). Nevertheless, only the eruption of the GFC was ultimate evidence that systemic risk can affect global financial and economic activities through complex and opaque links between practically all types of economic agents and financial products.

Notably, inter-bank connections in normal times help to share risk and to provide liquidity but, on the flip side, can spread and amplify adverse shocks. For that, the literature has presented multiple narratives on how interconnections can catalyze cascades of defaults and made theoretical contributions to our understanding of how systemic risk is a complex phenomenon. However, there are only a few empirical findings on contagious distress propagation. Distress propagation is the situation that occurs well in advance of defaults, increasing the likelihood of simultaneous defaults. We focus on systemic risk related to distress propagation and decompose it into three contributing components: contagion, common exposures, and idiosyncratic risk. We derive this decomposition exclusively from banks’ balance sheet accounting identities. First, to decompose the contagion channel, we consider three forms of contagion: (i) investor-sentiment-based contagion, potent to amplify shocks (ii) contagion through exposures, related to contractual obligations and (iii) price-mediated contagion, related to repricing of assets following portfolio decisions of financial agents. Second, we allow risks to affect banks simultaneously through common (or similar) exposures, capturing (iv) the systematic components of systemic risks.

We evaluate the effects of contagion and common exposure on banks’ capital through a regression design inspired by the structural VAR literature. The structural model we propose is derived from the balance sheet identity which is similar to the one considered in network evaluation of financial systems (NEVA) by Barucca et al. (2020). In contrast, we can estimate our model and do not rely on calibrations. That is, we estimate a structural regression based on granular, supervisory balance sheet data and interbank exposures of all large Canadian banks. Thus, our framework augments traditional stress-tests that focus on single institutions by providing a holistic view of systemic risk.

Notably, for the direct interlinkages between banks we use quarterly interbank exposures across different asset classes and interpolate them to monthly frequency to match reporting of other balance sheet characteristics for the Canadian banks. The six reporting banks are: Canadian Imperial Bank of Commerce (CIBC), Royal Bank of Canada (RBC), Bank of Montreal (BMO), Toronto-Dominion Bank (TD), Bank of Nova Scotia (BNS), and National Bank of Canada (NBC). We focus on six broad categories of exposures, which include marked-to-market exposures (i.e., to equity, fixed income, reverse repurchase agreements, and borrowed securities) and assets recognized at book value (i.e., short-term money placements, lending, and derivatives receivables). A visual representation of the multilayer network derived from the data is depicted in Figure 1. The direct exposure channel is then represented by a time series of various interbank exposures.

Figure 1

Note: Multilayer network for Canadian financial institutions (FIs) based on the EB/ET-2A schedule in the supervisory report-ing of the Office of the Superintendent of Financial Institutions (OSFI). Nodes represent FIs, arrows connections, layers asset classes, and colours FIs-categories. The inner circle (in black) represents the reporting banks, and the outer circle represents the outside institutions. Big 6 denotes the biggest six banks in Canada. All other FIs are categorized by residency, where US stands for the United States, UK for United Kingdom, and EU for Europe including Switzerland. CHs denotes clearing houses in-and outside of Canada.

Additionally, we include less tangible spillover components in the banking market. Specifically, to capture shock transmission through sentiment channels, we incorporate a market-based network that captures funding stress induced by investors’ sentiments and respective actions. These actions are driven by investors’ expectations about the banks’ financial conditions. To understand price-mediate contagion, following the literature on fires sales (e.g., Greenwood et al., 2015), we assume that banks adjust their assets to maintain their capital ratios. We apply a linear price impact of the changes in marketable assets with differing level of liquidity. Combing both effects with the direct exposure channels, we can distinguish risks associated with specific segments of the interbank market or other intangible contagion components. We do so by estimating different degrees of contagion for each type. Lastly, regarding the portfolio overlap channel, we distil variations of bank capital arising from exposures to common risk factors, such as business cycle fluctuations, stock or housing market downturns, or increased funding pressure due to mistrust in banks. We apply a time varying estimation via a kernel-weighted maximum likelihood estimator.

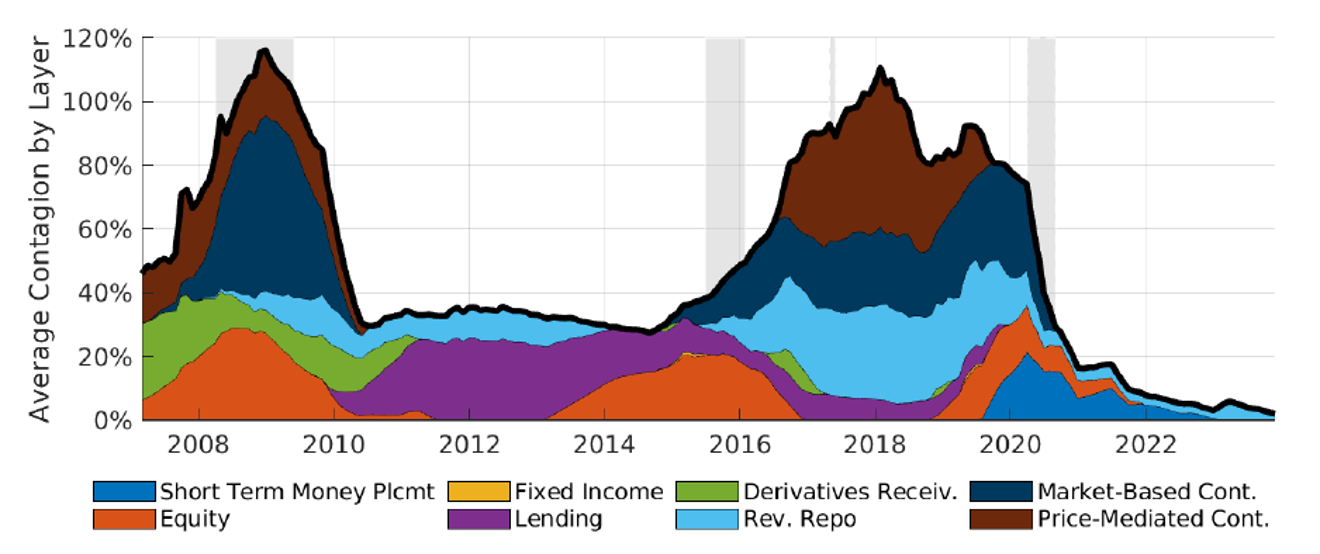

Figure 2

Note: Decomposition of contagion per asset layer (average contagion across banks). A number of 50% implies that an idiosyncratic shock to a bank would be passed on to other banks with 50% of its original size on average.

Time-varying estimates of our model allow us to see how the importance of different contagion components change over time (see Figure 2). First, we document that contagion varies substantially in time, with the highest levels around the Great Financial Crisis and lowest levels after the pandemic. Second, less tangible contagion components, such as investor/market-based contagion (dark blue) or price-mediated contagion (brown) were among the more substantial contributors during times of high contagion. That is, our results suggest that investor sentiment, i.e., investors losing trust to banks and increasing funding pressure, was the main contributor during the GFC, peaking at the end of 2008. Whereas price-mediated contagion played a bigger role in 2017 with the beginning of adverse news at Home Trust, a Canadian bank specialized in mortgage lending. Lastly, at non-stressful times (from 2010 to 2016 and after 2021) contagion was trending relatively low. In particular, at the end of the sample contagion trended at all times low. Lastly, there is a notable increase of short-term money placements around the pandemic period at the beginning of 2020.

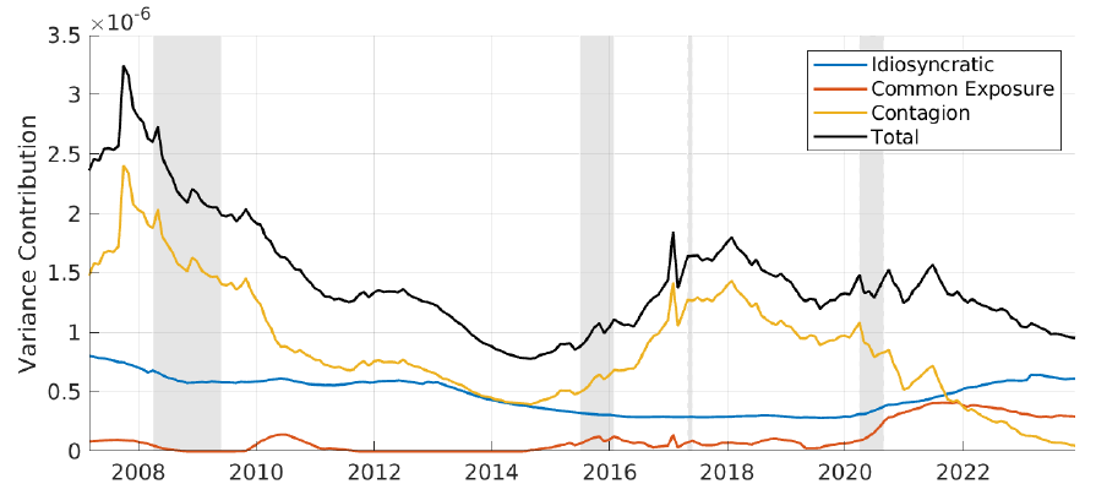

So far, we decomposed contagion based by spillover size on individual bank statistics derived from the model and aggregated as an arithmetic average across banks. To delve deeper into the aggregate stress for the financial system, we aim to understand how much each component — contagion (i.e., shocks getting multiplied by transmission to other banks), systematic (i.e., shocks impacting all banks at once via common exposures), and idiosyncratic risks (i.e., shocks that only impact individual banks)—contributes to the fluctuations in the system’s leverage. Figure 3 illustrates the total variations in capital ratios over the sample, decomposed into its subcomponents. We can see the system’s total variation in capital ratio (in black) peaked during the GFC and lowered after. Further, we can trace the total variation of the system back to contagion (in yellow). Only after the COVID turmoil in 2020, contagion started to trend down substantially with the idiosyncratic contribution (in blue) and the systematic risk due to common exposures (in red) trending up. Interestingly, the idiosyncratic contribution to variance in banks’ capital ratios went down from high levels at the beginning of the sample to the lowest levels in 2016/2017, an observation that aligns with the gradual increase in capital requirements due to the Basel III regulations. Eventually, the period starting with COVID-19 exhibits a reversal of the trend, resulting in a small increase for the idiosyncratic contributions. However, the same regulation may contribute to increased exposures to common risks, resulting in higher systematic risks for the overall financial system. Notably, monitoring changes in these direct and indirect interconnections between banks’ balance sheets over time can provide some early warning signals of potential stress in the financial system.

Figure 3. Impact of contagion channels on financial stability

To conclude, our empirical findings suggest that contagion is a time-varying phenomenon that was heightened during the financial crisis but decreased afterwards. The main drivers of contagion were found to be derivatives, equity, and market-based contagion. Our analysis also revealed that common exposures have increased over time, while idiosyncratic risks have decreased for Canada’s Big Six banks. We conjecture that this change may be due to the introduction of Basel III regulations aimed at enhancing the stability and resilience of the banking sector. Our model gives a tool to monitor trends of various channels of systemic risk combining market-based and balance sheet data for the banking system. Notably, our model is quite data-intensive, requiring some granular information on exposures and bilateral linkages. However, many jurisdictions have started to collect detailed breakdown of exposures, even at the transaction level1, so data accessibility should not be a major issue to implement our framework for other banking systems.

Paolo Barucca, Marco Bardoscia, Fabio Caccioli, Marco D’Errico, Gabriele Visentin, Guido Caldarelli, and Stefano Battiston (2020), Network valuation in financial systems. Mathematical Finance, 30(4):1181

Monica Billio, Mila Getmansky, Andrew W. Lo, Loriana Pelizzon (2012), Econometric measures of connectedness and systemic risk in the finance and insurance sectors, Journal of Financial Economics, vol 104, issue 3, pp 535 535-559.

Robin Greenwood, Augustin Landier, and David Thesmar (2015), Vulnerable banks. Journal of Financial Economics , 115 (3):471 471–485.

See, e.g., Trade Repository reporting in Europe (EMIR Reporting (europa.eu))